Stage 2 Breakouts and Significant Bars

Multiple stocks making Stage 2 breakouts to new highs and some in Stage 3 showing a change of behaviour following earnings with Significant Bars.

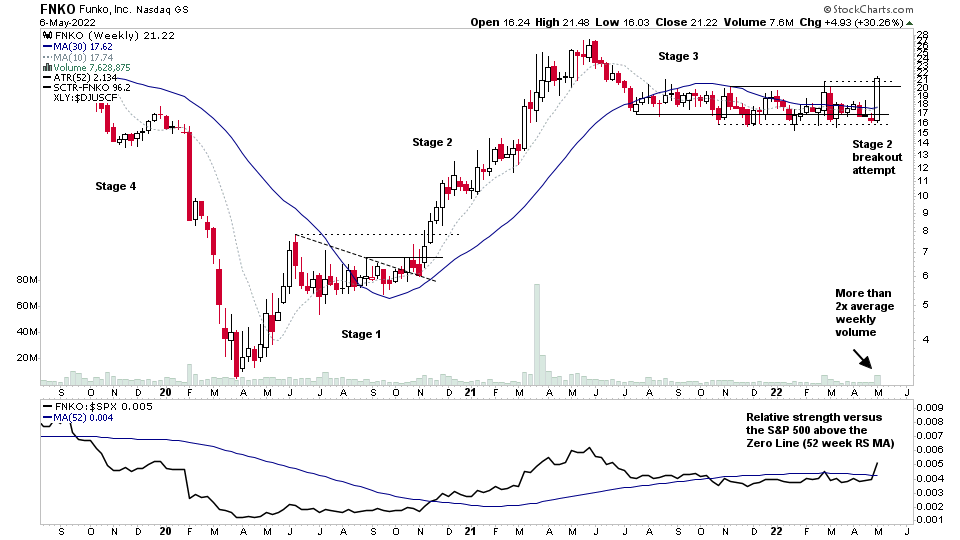

$FNKO Funko stock with a new Stage 2 breakout attempt on Friday with an Earnings Gap Significant Bar and more than 2x the average weekly volume and relative strength versus the S&P 500 moving back above the "Zero Line" (52 week RS MA)

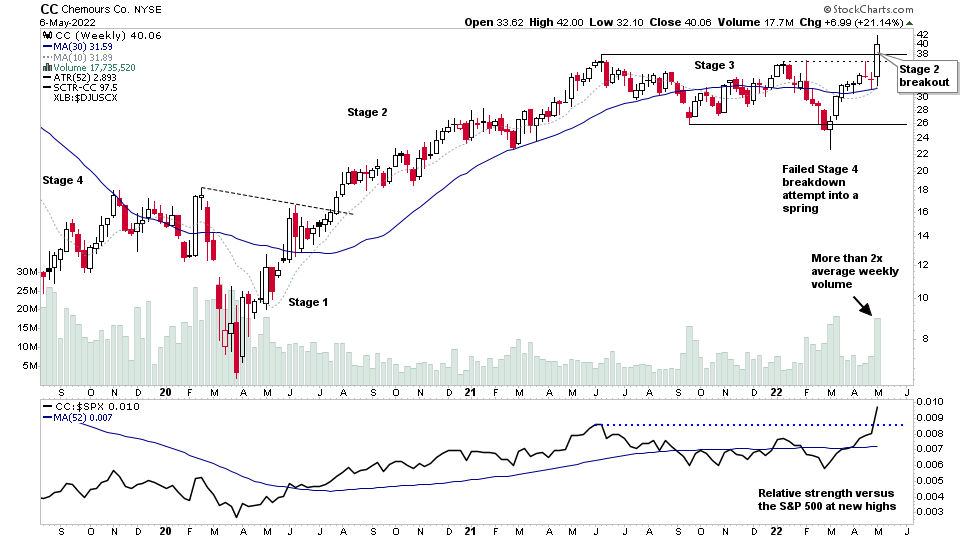

$CC Chemours stock made Stage 2 breakout attempt this week on more than 2x the average weekly volume and relative strength versus the S&P 500 at new highs

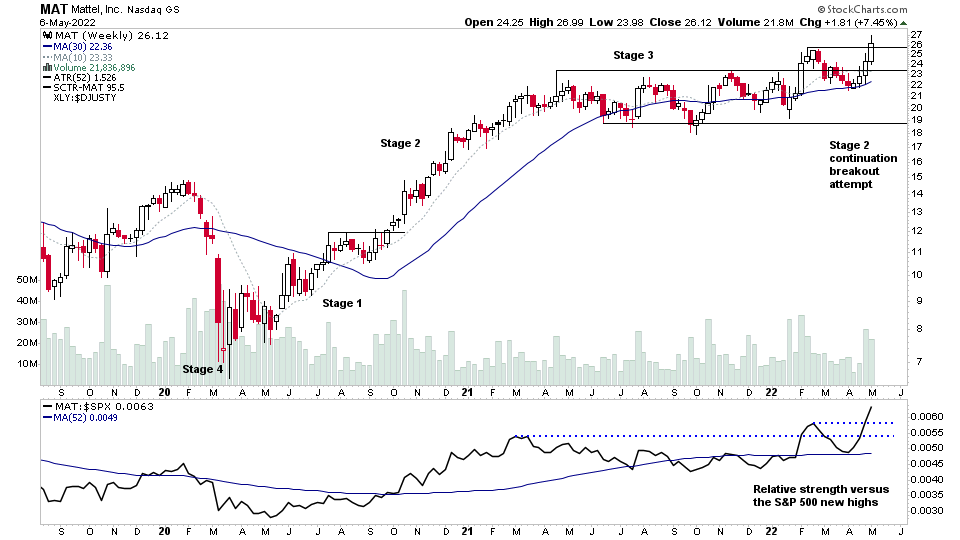

$MAT Mattel stock made a Stage 2 continuation breakout attempt to new highs, with strong relative volume and relative strength versus the S&P 500 at new highs

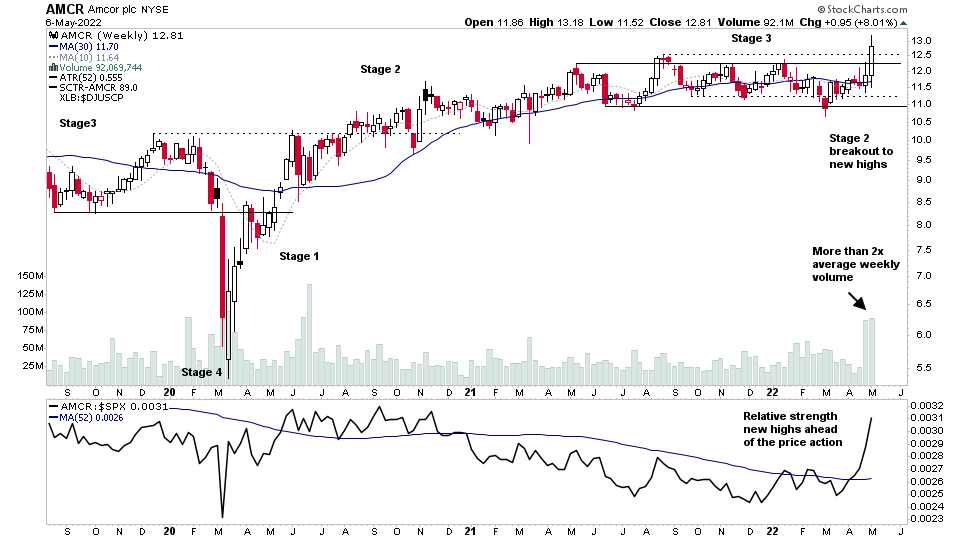

$AMCR Amcor stock with a new Stage 2 breakout attempt from a year long Stage 3 range & failed Stage 4 breakdown attempt into a Spring in early March (Wyckoff method Phase C early entry point).

Strong relative volume & RS versus the S&P 500 at new highs ahead of the price action.

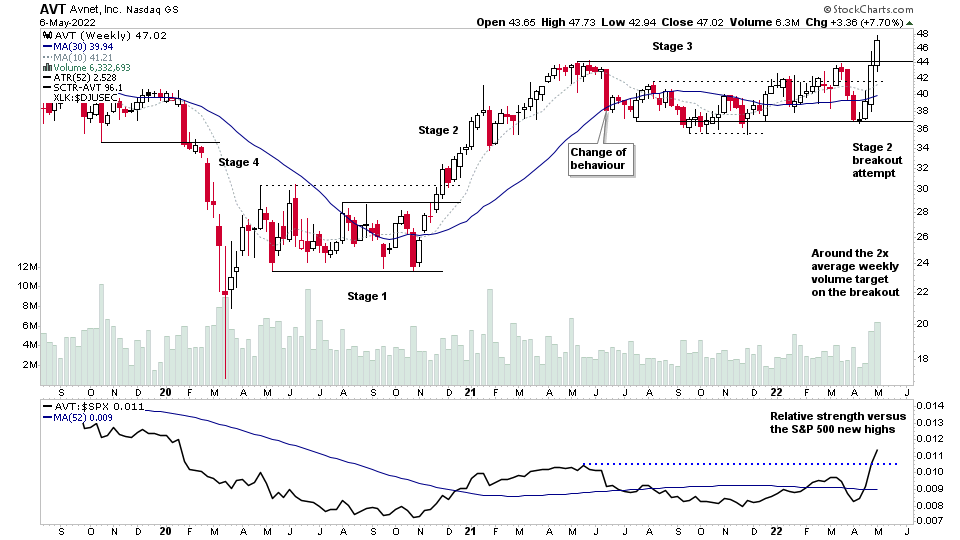

$AVT Avnet Nasdaq stock with a new Stage 2 breakout attempt from a one year Stage 3 range on roughly the 2x average weekly quality target that the Stage Analysis method looks for and relative strength versus the S&P 500 at new highs too.

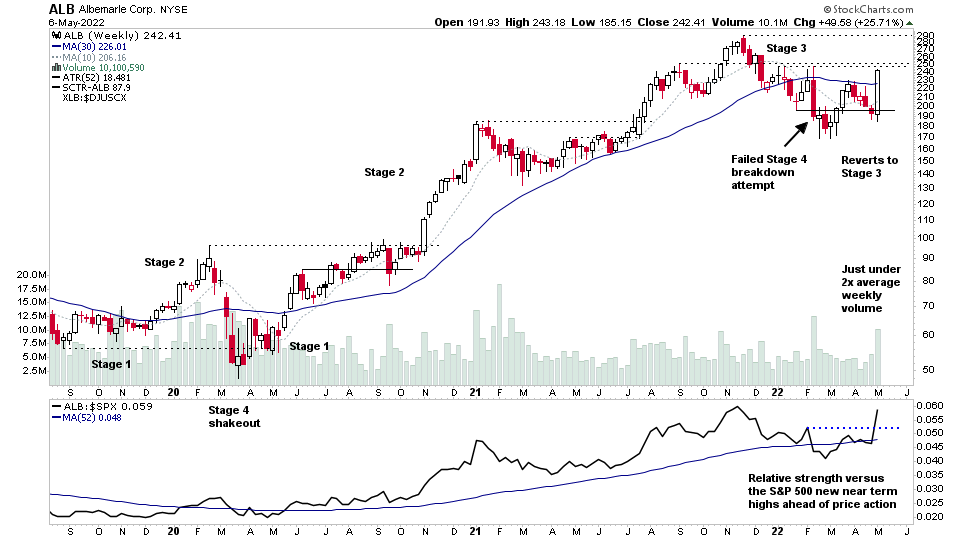

$ALB Albemarle stock was highlighted multiple times this week in watchlist and is showing a Change of Character following its earnings with a significant bar that engulfed 5 weeks price action (PA) on strong relative volume & RS vs the S&P 500 ahead of the PA.

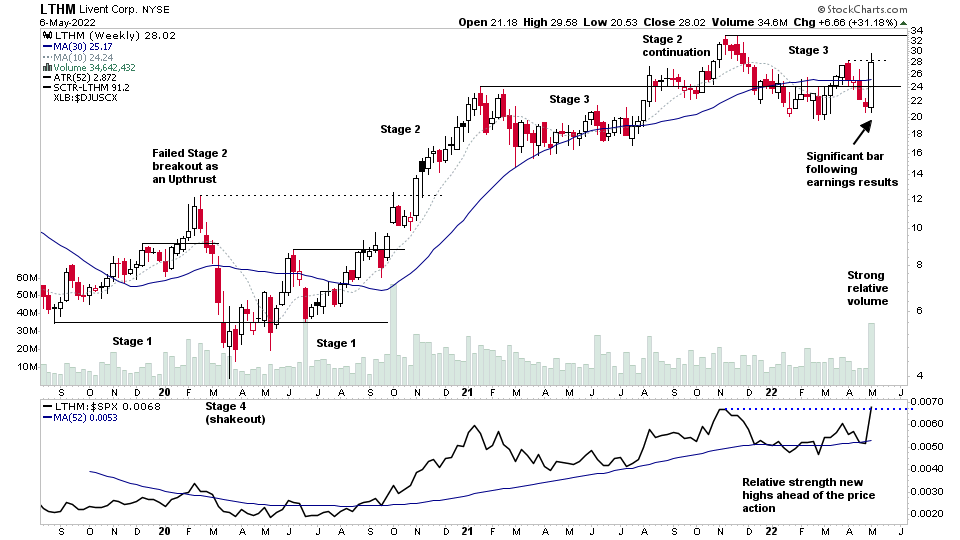

$LTHM Livent NYSE stock with a Significant Bar following earnings results engulfing a whole month of candles and relative strength at new highs ahead of the price action and strong relative volume.

So a potential Change of Behaviour within its Stage 3 range.

Be on the lookout for signs of failure in breakout attempts

There were multiple Stage 2 breakout "attempts" to new highs from large Stage 3 ranges this week, which is a change, as there's been very few over the last month.

However, failure is a key thing to watch for in new Stage 2 breakouts to new highs from Stage 3. As failed breakouts that reverse strongly back into the range become an Upthrust After Distribution (UTAD) – which is a Wyckoff method initial short entry point, and looks like the inverse of Spring on a chart.

So Stage 2 breakout failure that had high quality attributes is a key pattern to watch out for. As if the A+ quality breakouts fail. Then the market conditions tend to be poor, which tells you to get out or to go short.

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.