Major Stock Market Indexes Attempt To Stop the Decline and the US Stocks Watchlist – 25 April 2022

The full post is available to view by members only. For immediate access:

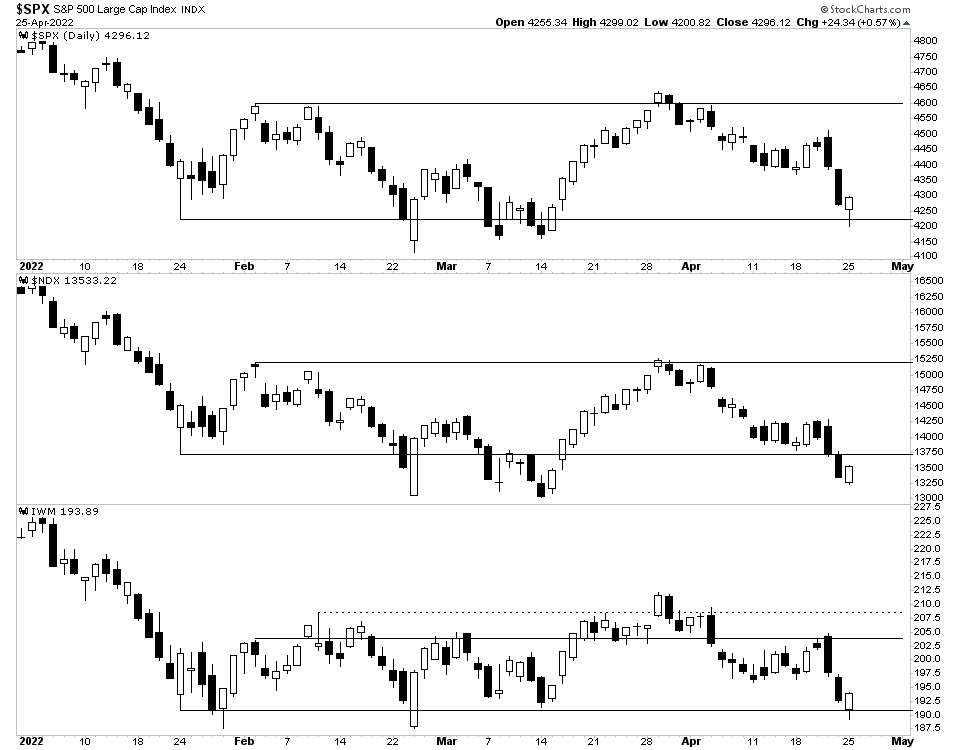

There was an attempt to spring near the lows of the recent ranges in multiple US Indexes today. However, a deeper low that undercuts the base structure would be more useful in order to wash out the weaker hands, and provide the large players (institutional investors) liquidity.

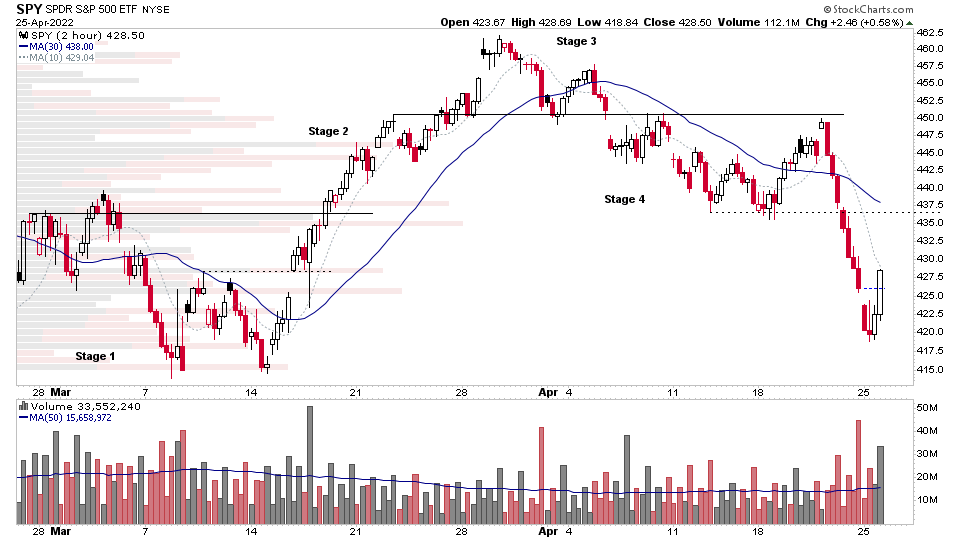

Looking at the intraday chart of the S&P 500 (2 hour timeframe). You can see that it made a climactic move, and hence could be a local Selling Climax (SC) in Stage 4. But there's also a chance that it's just Preliminary Support (PS), and could still test lower after a bounce. As Thursday and Fridays price bars were significant, and so it will likely be key resistance in the near term.

Hence, if we do get a bounce higher from here, they will be the key to overcome. Although I wouldn't expect any bounce to be of A+ quality at this point. As remember, the overall market is in bearish environment currently with the majority of stocks in Stage 3 and Stage 4. So any rally attempts, are guilty until proven innocent. And caution is key.

US Stocks Watchlist – 25 April 2022

There were 36 stocks for the US stocks watchlist today.

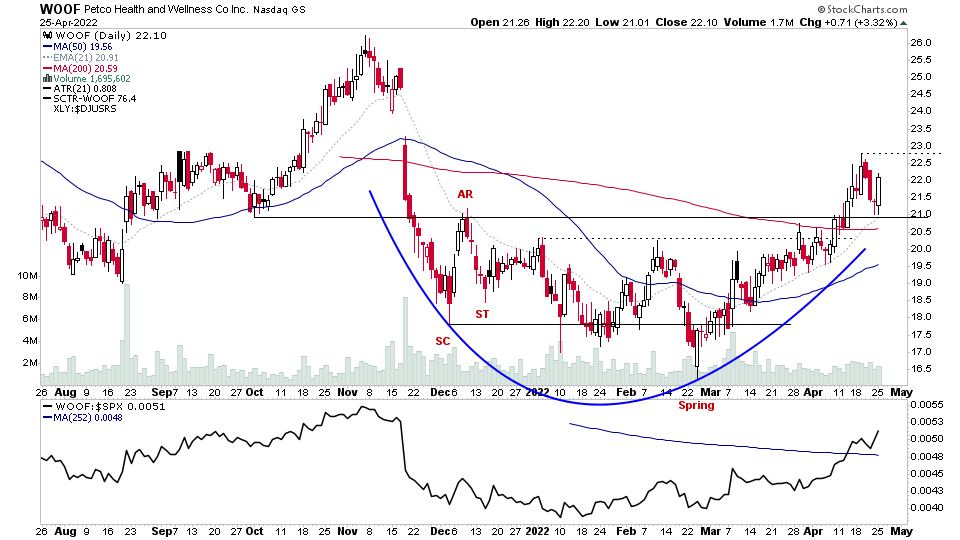

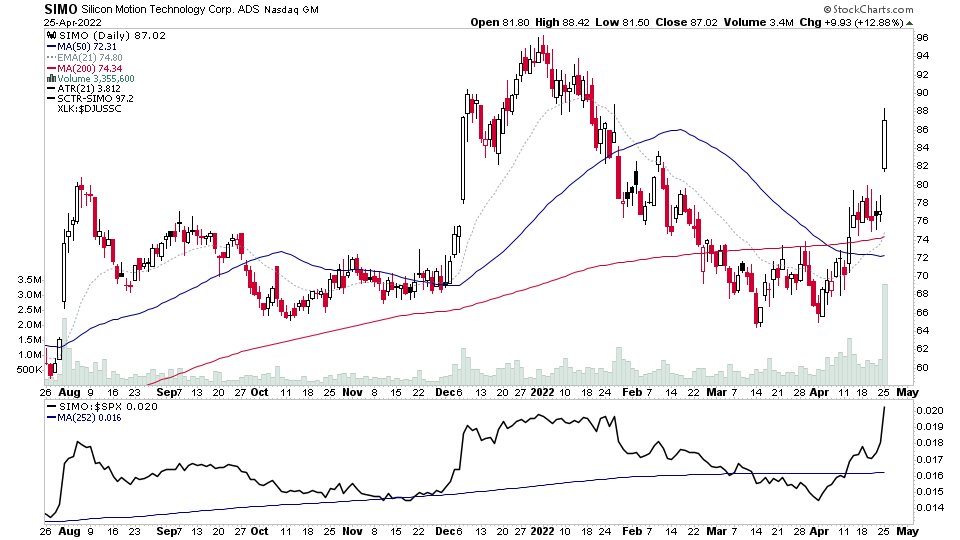

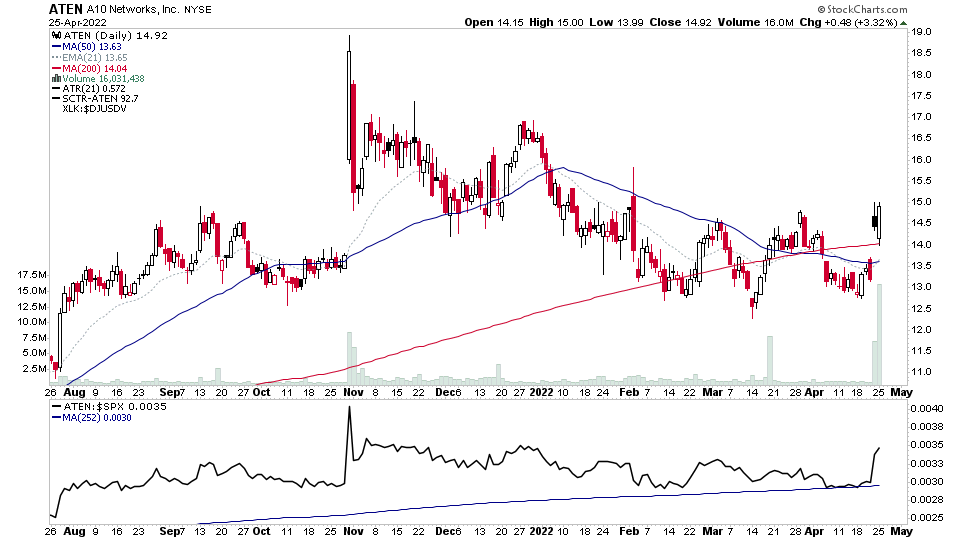

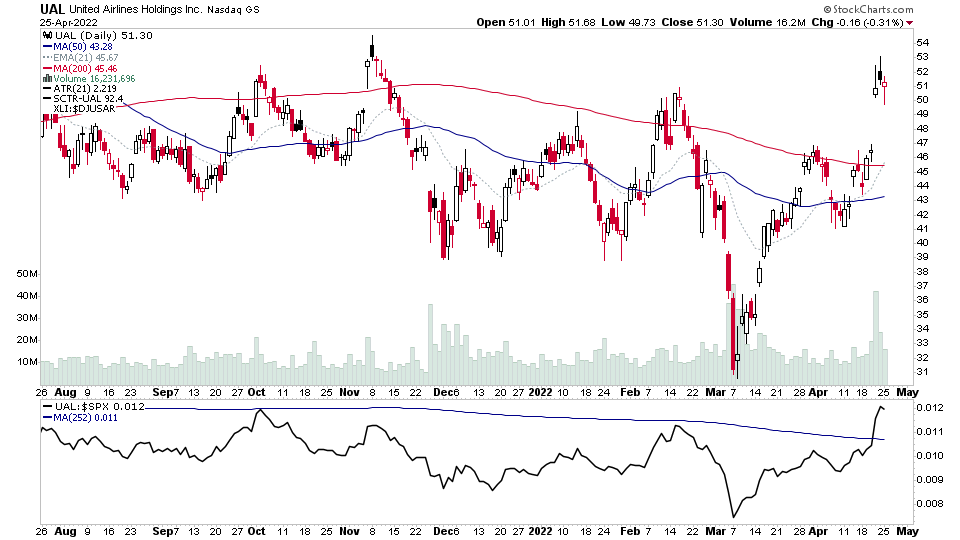

WOOF, SIMO, ATEN, UAL + 32 more...

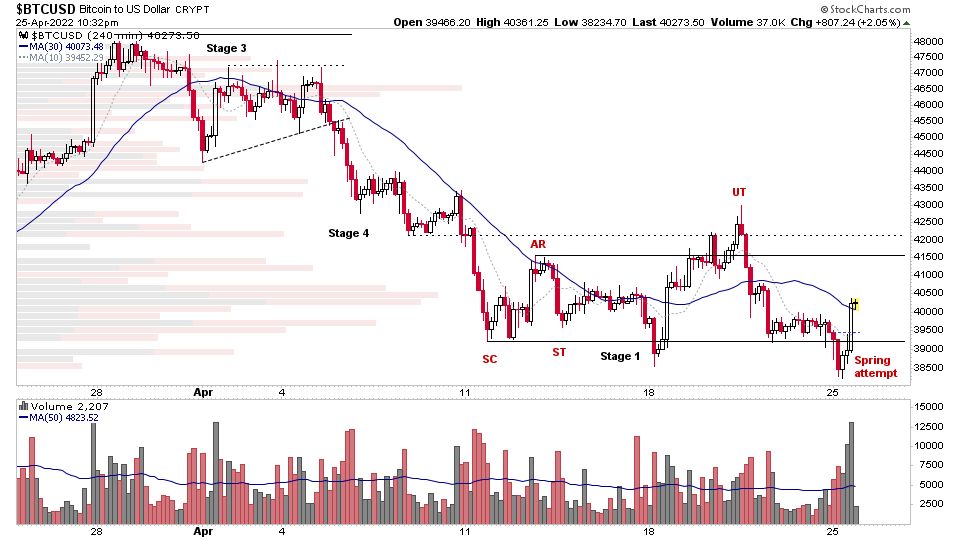

Bitcoin

Also of note today was the Spring attempt in Bitcoin on increased volume on the intraday charts (4 hour shown below). So I'm watching to see if it forms a higher low test – as that's a potential early Wyckoff entry zone that attempts to capture a rally within the base, in Phase D of the structure and potential Sign of Strength (SOS) out of the base.

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.