Major US Stock Indexes Update - NYSE, Nasdaq, S&P 500, Nasdaq 100, DJIA & S&P 600

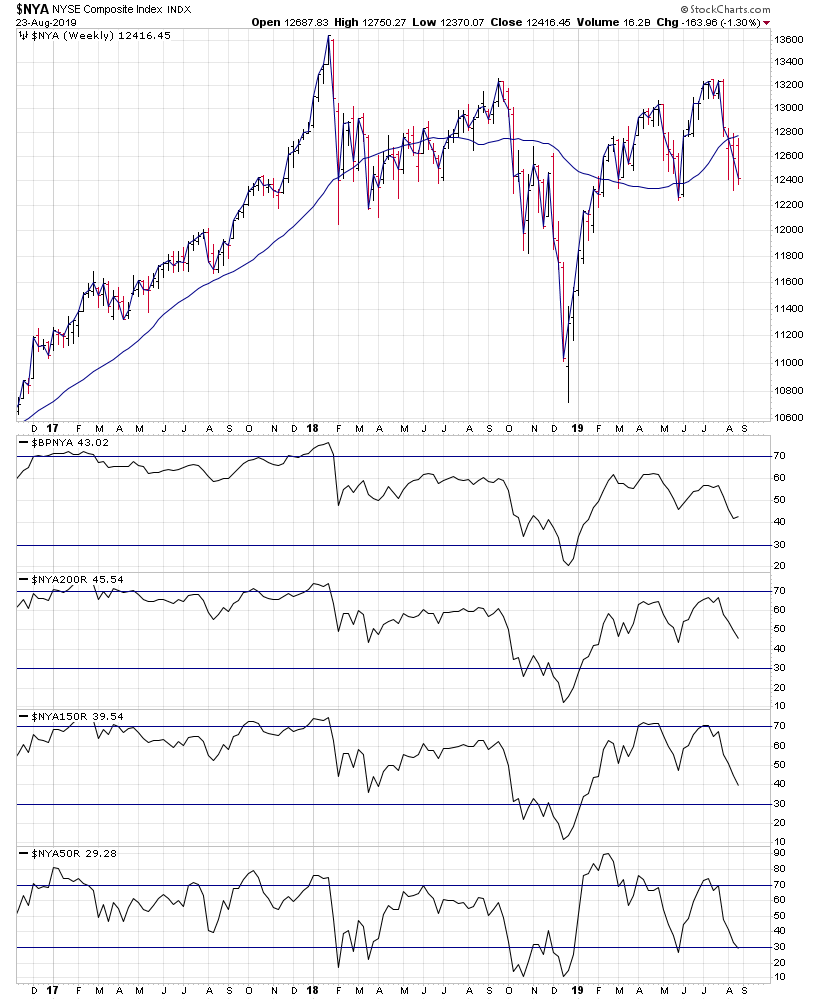

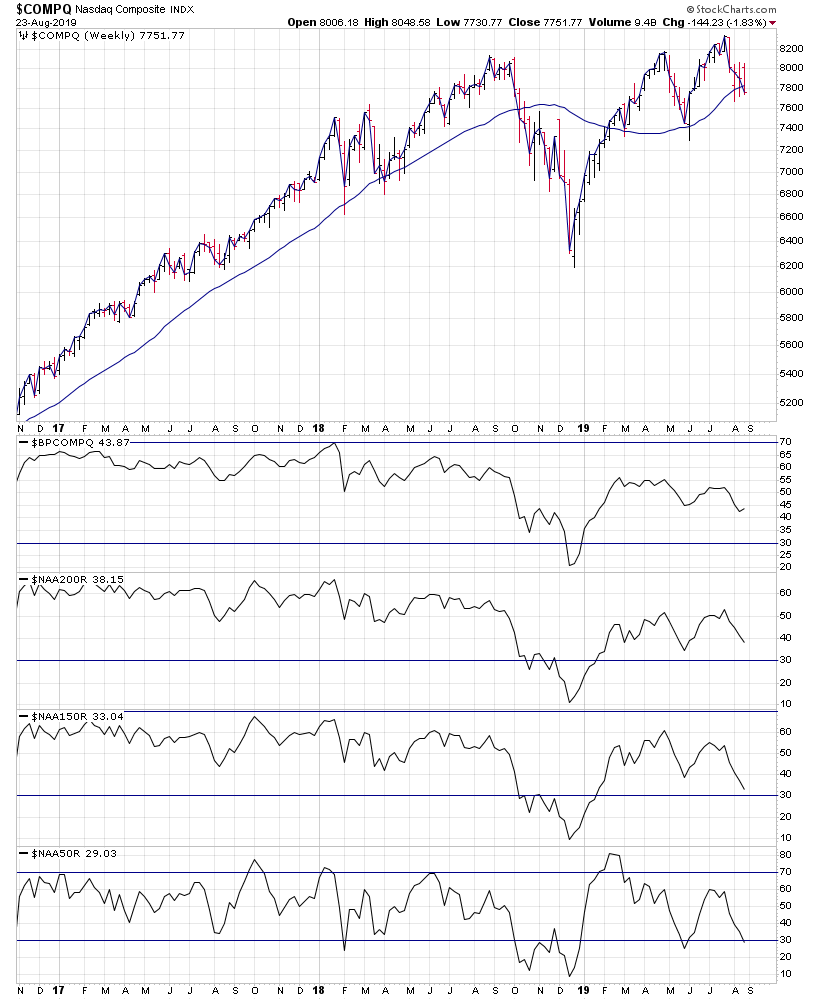

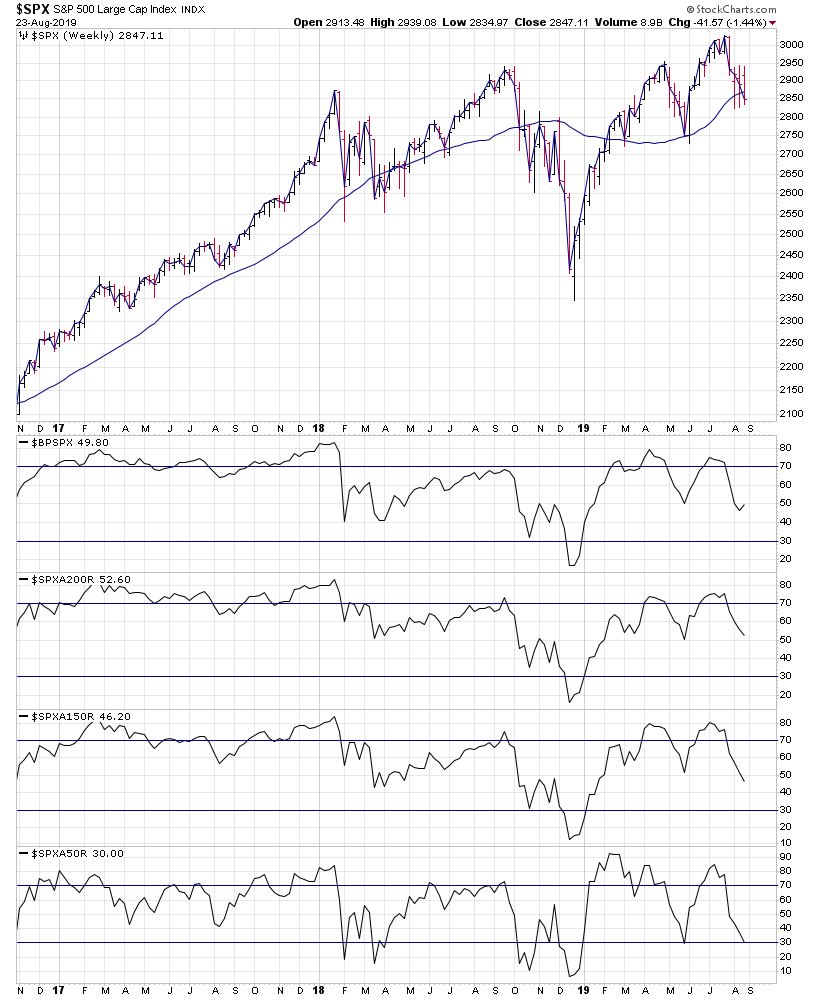

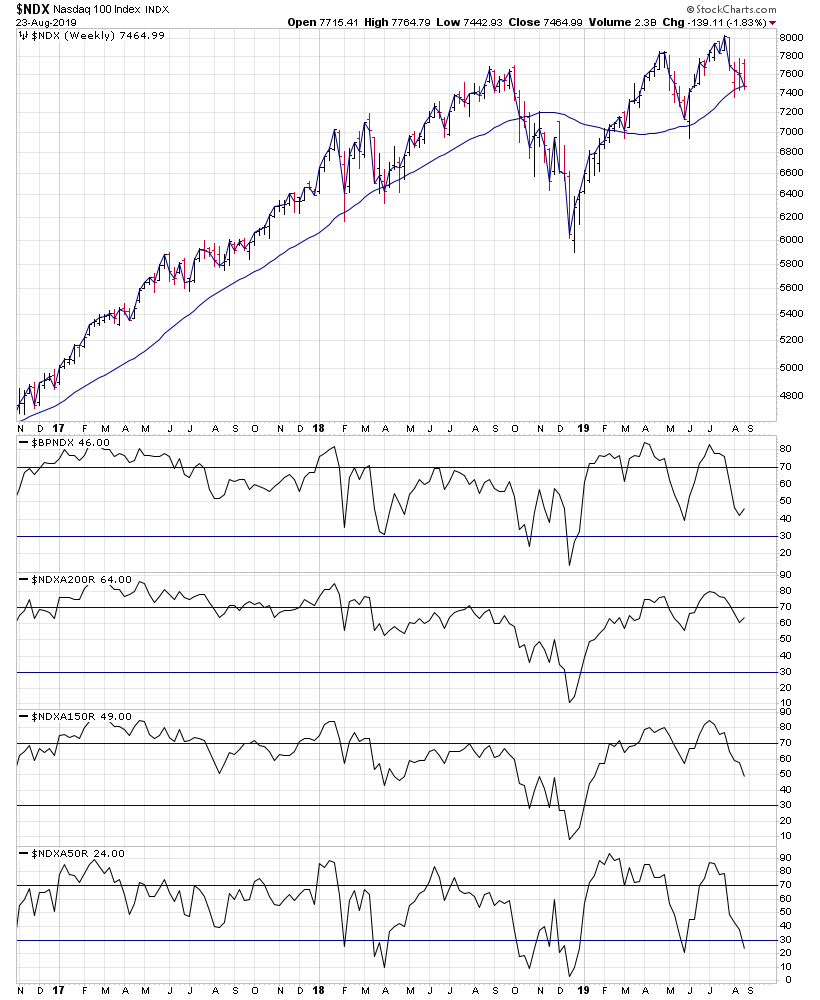

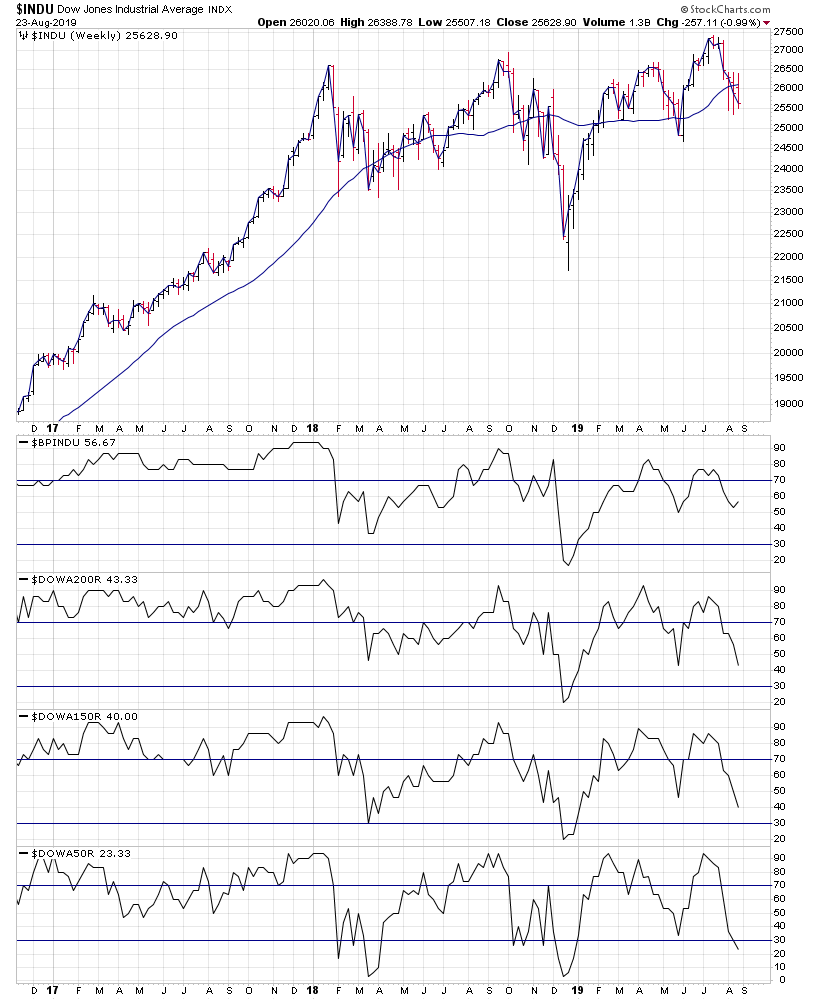

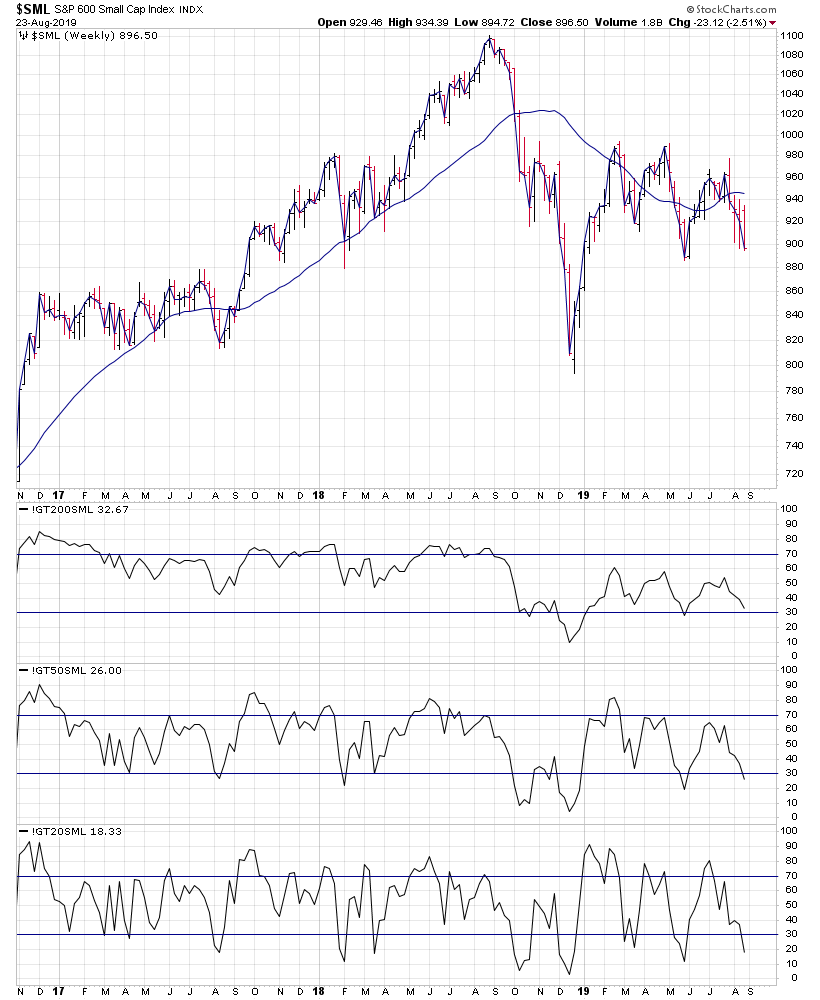

Note: The indexes charts are all showing Stage 3 or Stage 1 consolidation patterns. It's unclear which as we only had a very brief move back to Stage 2 in some, but not others. So either could be argued at this point, but doesn't really matter. As both mean a choppy range, and can breakout in either direction back into Stage 2 or down into Stage 4. However, the bullish percent indexes and moving average breadth data is a mix of Stage 1/3 and now edging into Stage 4 levels in the NYSE and Nasdaq Composite and Small Caps breadth data. But is still in the Stage 1/3 ranges in the S&P 500 and Nasdaq 100 data. So the large caps are still holding up the market from going to full blown Stage 4 again, but the underlying weakness in the majority of stocks suggests continued caution imo, as if the large caps breakdown too, then there could be a sharp down move, as its a bit like the game jenga when the breadth is in this position. So manage your risk carefully here imo.

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.