Pullback Continues in the S&P 500 and the US Stocks Watchlist – 4 January 2024

The full post is available to view by members only. For immediate access:

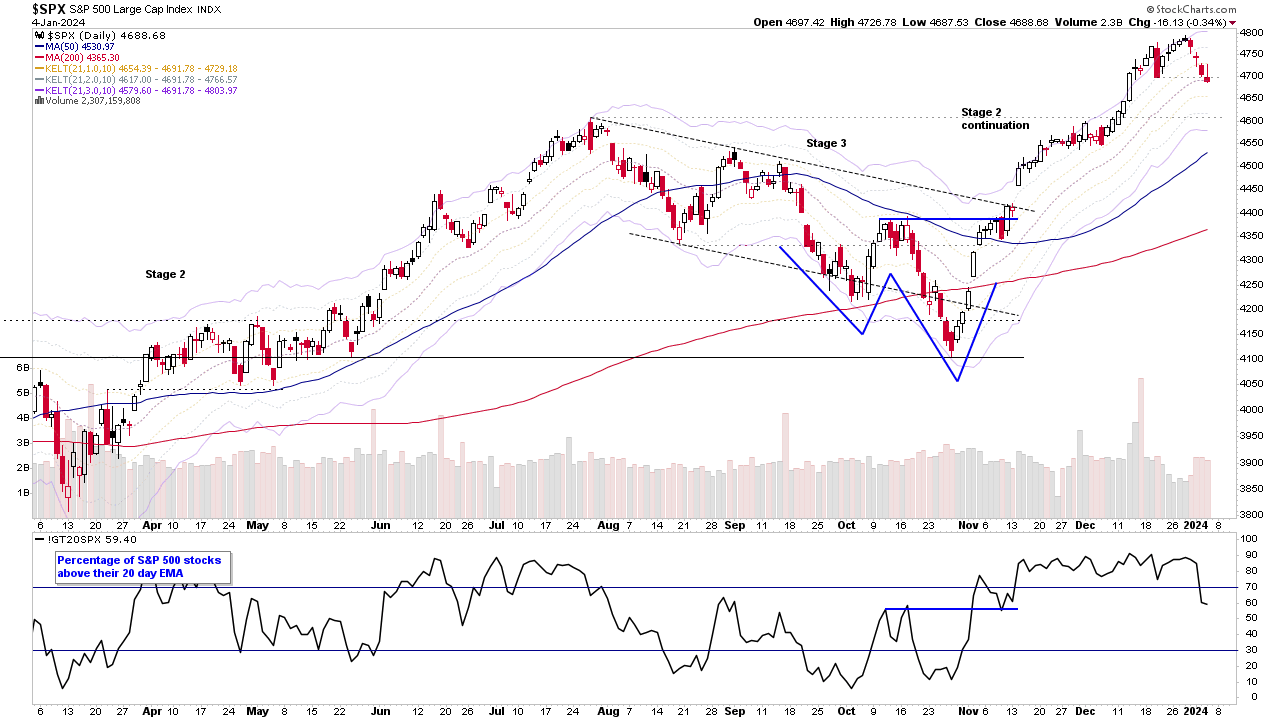

The S&P 500 has continued to pullback since the start of the year, and is currently -2.21% below the high set on the 28th December, and today closed below its 21 day EMA for the first time since the beginning of November. So it's a Change of Behaviour compared to the prior pullbacks since the October low. However, it's not yet a Change of Character, as it's still in the neutral range between the +1x ATR(21 day) level and -1x ATR(21 day) level. But if it starts to close below the -1x ATR level (currently 4654.39), then it would be considered a short-term trend change, and thus a Change of Character.

In term's of other price based metrics to consider if the pullback were to deepen. Then it is still over 3% above the Anchored VWAP from the October low and the 50% Fibonacci retracement is at 4448.54, which would require a further -5% correction. Which, although it drop it significantly back below its 50 day MA, it would still be in the normal correction range from a longer term perspective. So caution seems prudent in the short-term until at least some signs of strength appear.

The defensive team is on the field.

US Watchlist Stocks

There were 21 stocks highlighted from the US stocks watchlist scans today

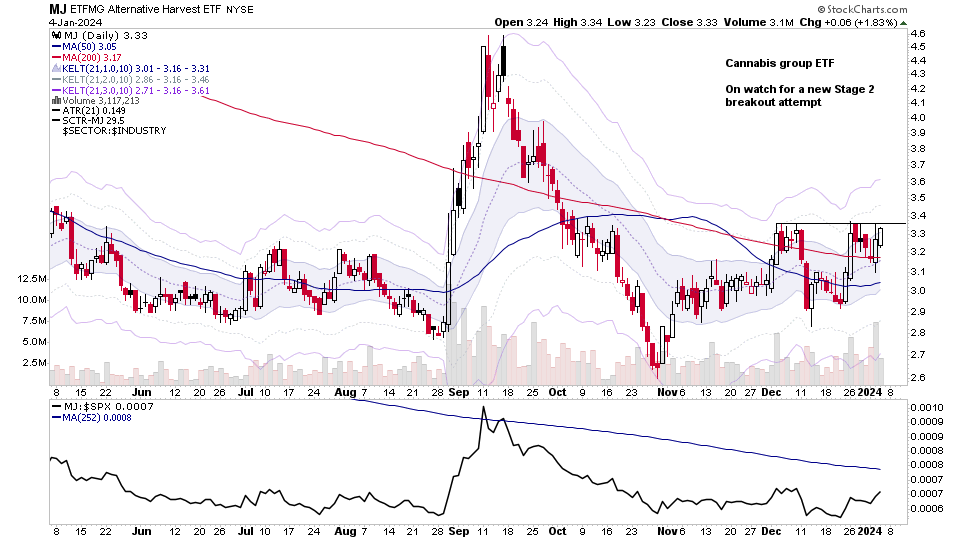

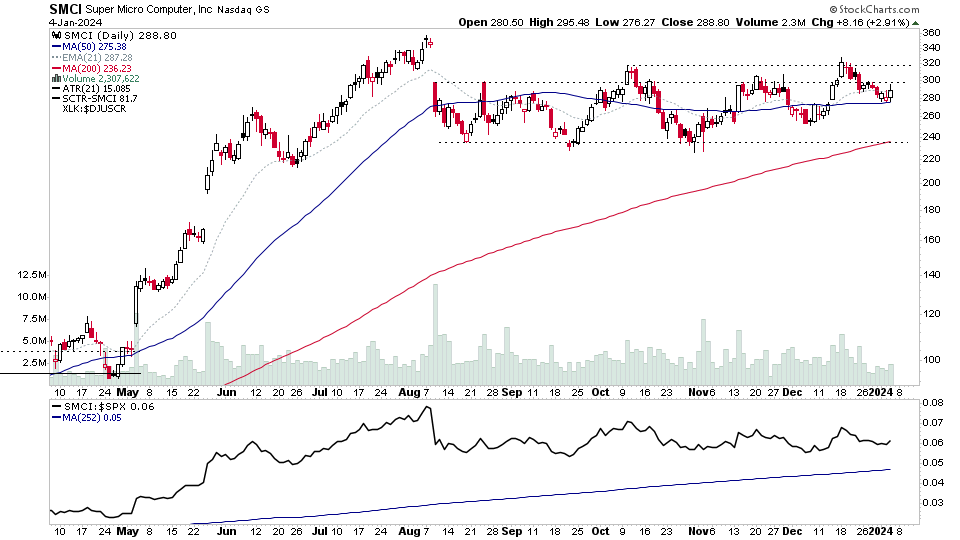

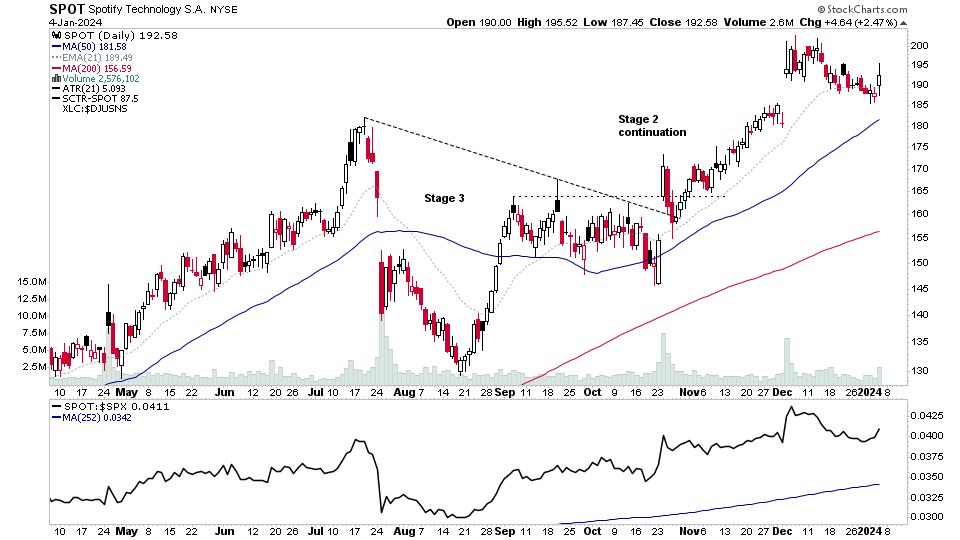

MJ, SMCI, SPOT + 18 more...

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.