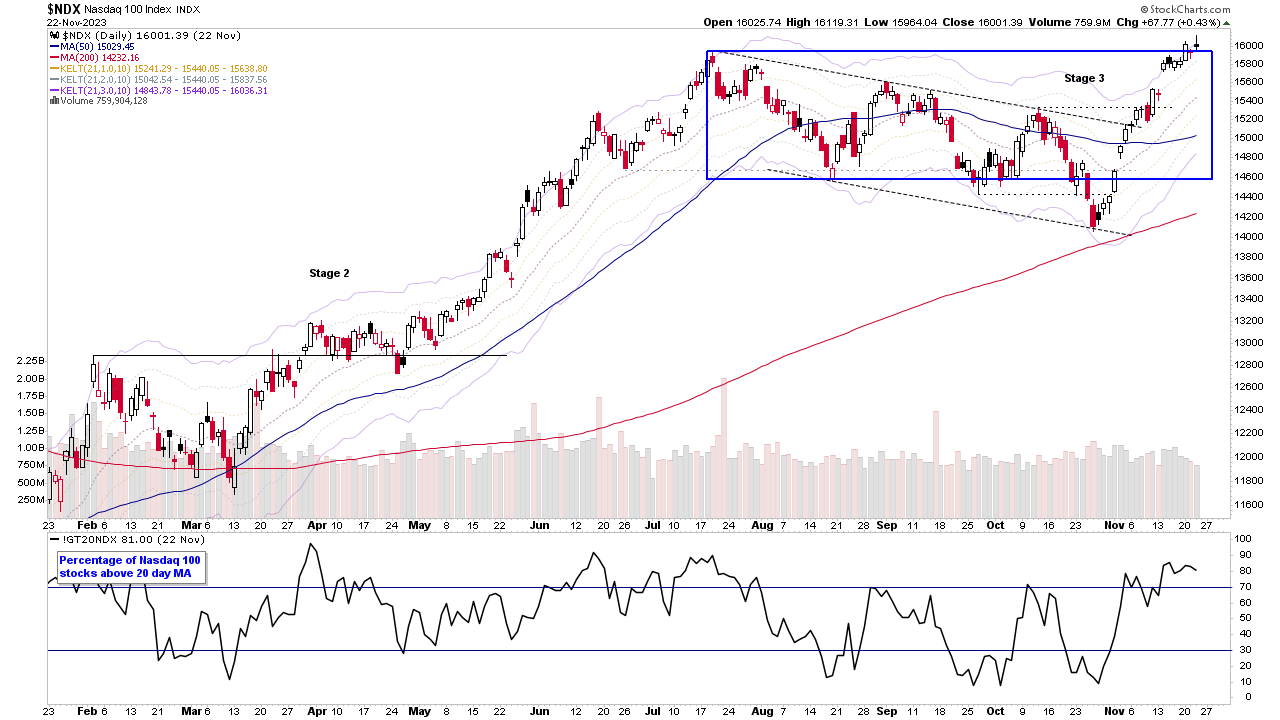

Nasdaq 100 Testing the Top of the Recent Range – Stage 2 Continuation or Developing UTAD?

The full post is available to view by members only. For immediate access:

The Nasdaq 100 has continued to strengthen over the last few weeks with a lockout rally since the Shakeout / Spring and gap at the start of the month. The majority of this price action has occurred in the right hand part of the multi-month base structure so far, clearing two internal swing highs within the range – which is a Change of Character and hence potentially may be Phase D of a re-accumulation base. But it hasn't convincingly broken out of the range yet, and so there remains the possibility that a UTAD (Upthrust After Distribution) – which is the opposite of a Wyckoff Spring – could form, and pull the price action back into Stage 3 again.

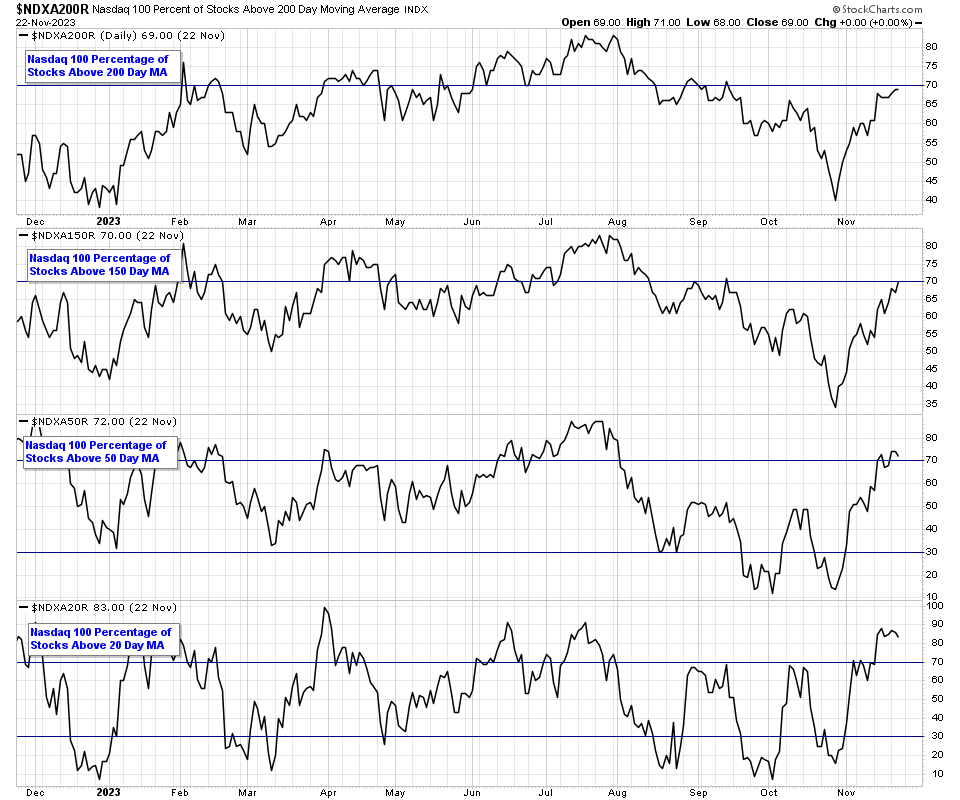

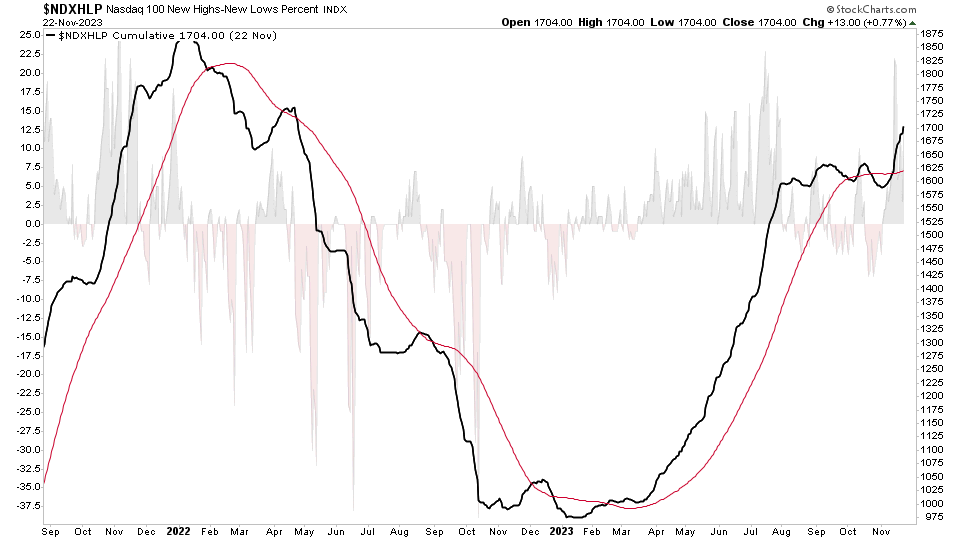

However, for now it's making a Stage 2 continuation breakout attempt, and the Nasdaq 100 market breadth data (see below charts) is so far supportive of that, with the moving average breadth at a combined 73.50% – which is a positive, as 60%+ is considered strong and in the Stage 2 zone. And also the Nasdaq 100 cumulative new highs - news lows chart has recently broken out to new 52 week highs, which is also a positive position.

Nasdaq 100 Moving Average Breadth

- 69.00% > 200 day MA (Long-term)

- 70.00% > 150 day MA (Medium-term)

- 72.00% > 50 day MA (Short-term)

- 83.00% > 20 day MA (Very Short-term)

Combined Average: 73.50% (Strong)

Nasdaq 100 Cumulative New Highs - New Lows

US Watchlist Stocks

There were 33 stocks highlighted from the US stocks watchlist scans today

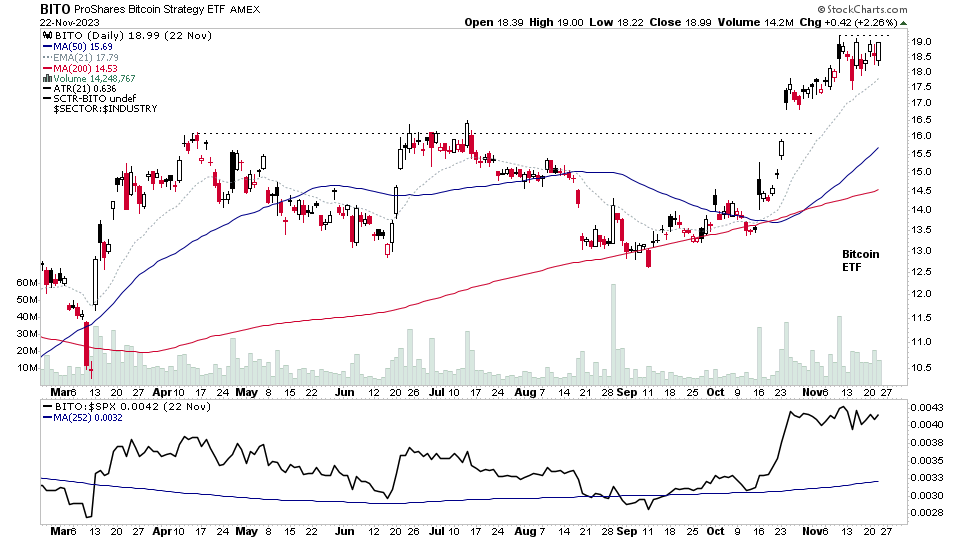

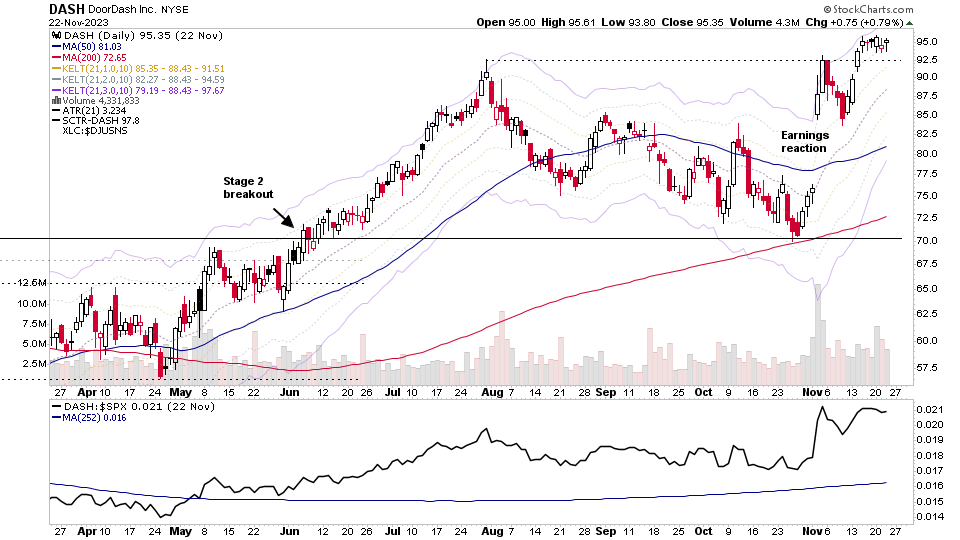

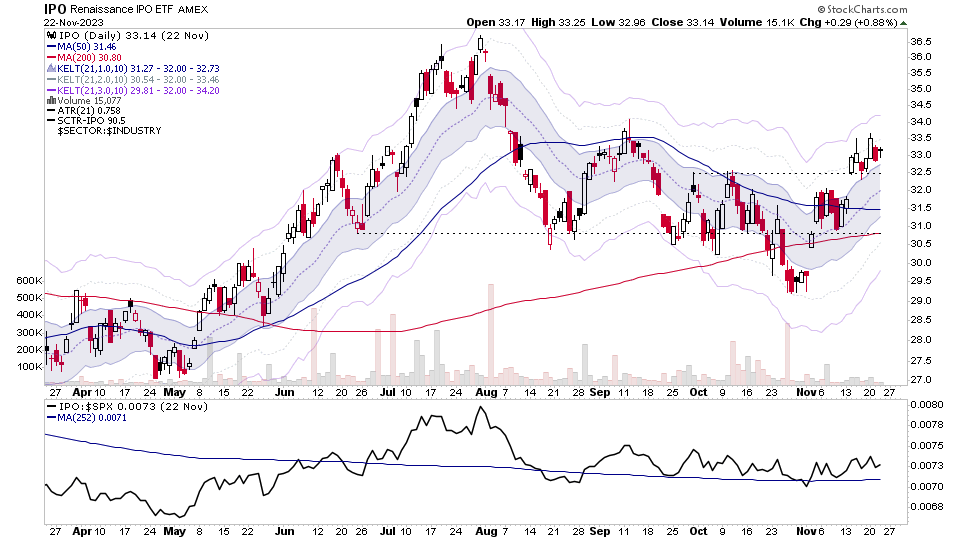

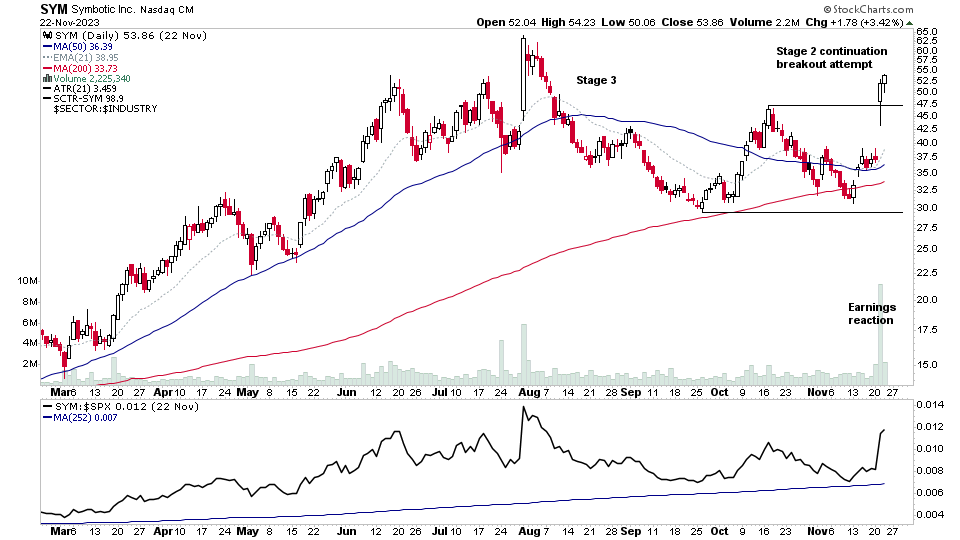

BITO, DASH, IPO, SYM + 29 more...

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.