Part 2 of the regular members weekend video discussing the market, commodities, industry groups and market breadth to determine the weight of evidence.

Read More

Blog

23 October, 2022

Stage Analysis Members Video Part 2 – 23 October 2022 (58 mins)

23 October, 2022

Stage Analysis Members Video Part 1 – 23 October 2022 (43 mins)

Part 1 of the weekend video discussing the watchlist stocks from Thursday and the Weekend watchlist posts.

Read More

23 October, 2022

US Stocks Watchlist – 23 October 2022

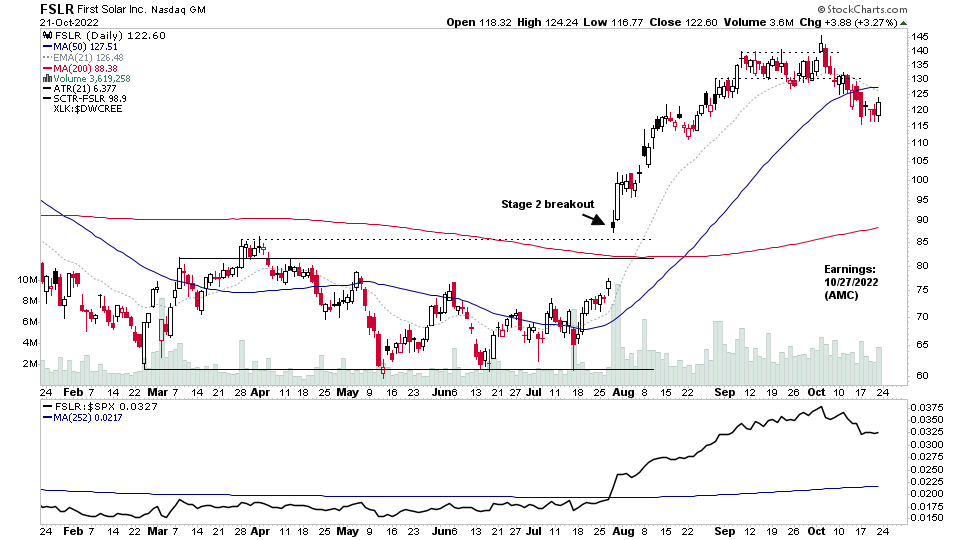

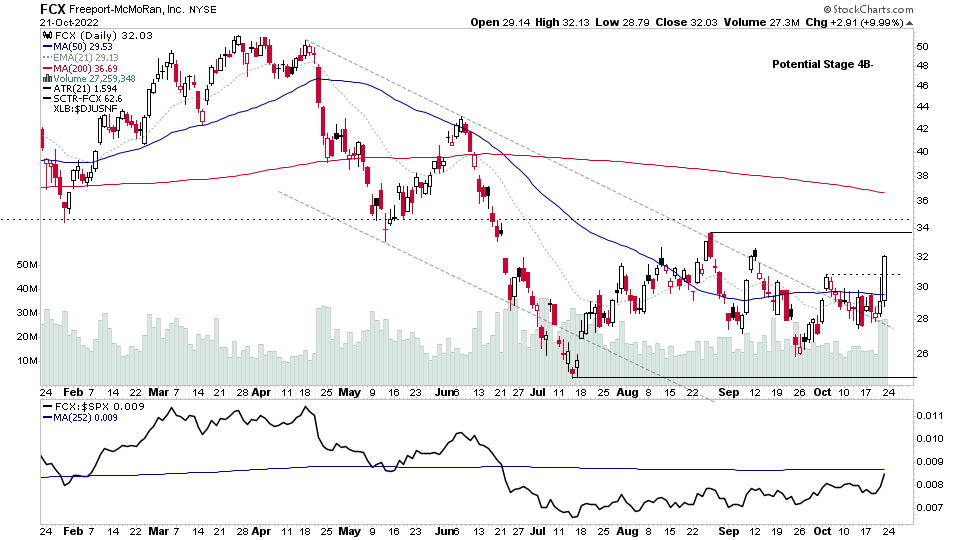

I noted the relative strength in the Nonferrous Metals and Steel groups in the RS rankings blog post on Friday, which have also featured strongly in the watchlist scans this weekend, as well as a number of other areas such as Gold Mining (Gold and Silver stocks) and the strength in some of the Technology groups as money rotated from more defensive groups/sectors into the more speculative areas on Friday...

Read More

20 October, 2022

Stock Market Update and the US Stocks Watchlist – 20 October 2022

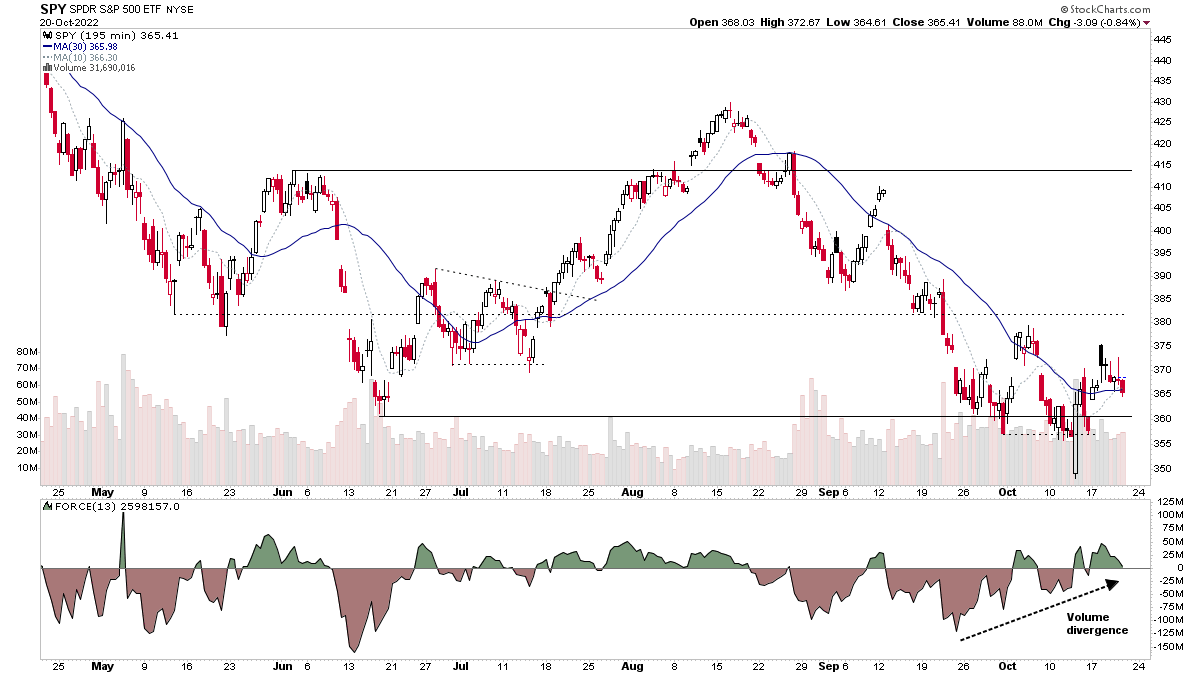

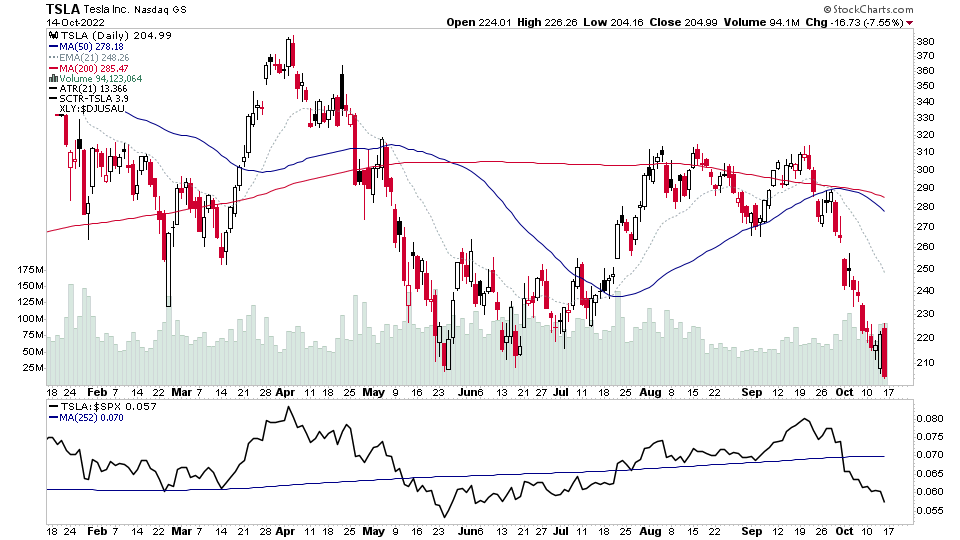

The S&P 500 and other major stock market indexes pulled back for another day, but remains above the swing low that formed a week ago on heavy volume on the 13th October...

Read More

19 October, 2022

Stage Analysis Members Midweek Video – 19 October 2022 (54 mins)

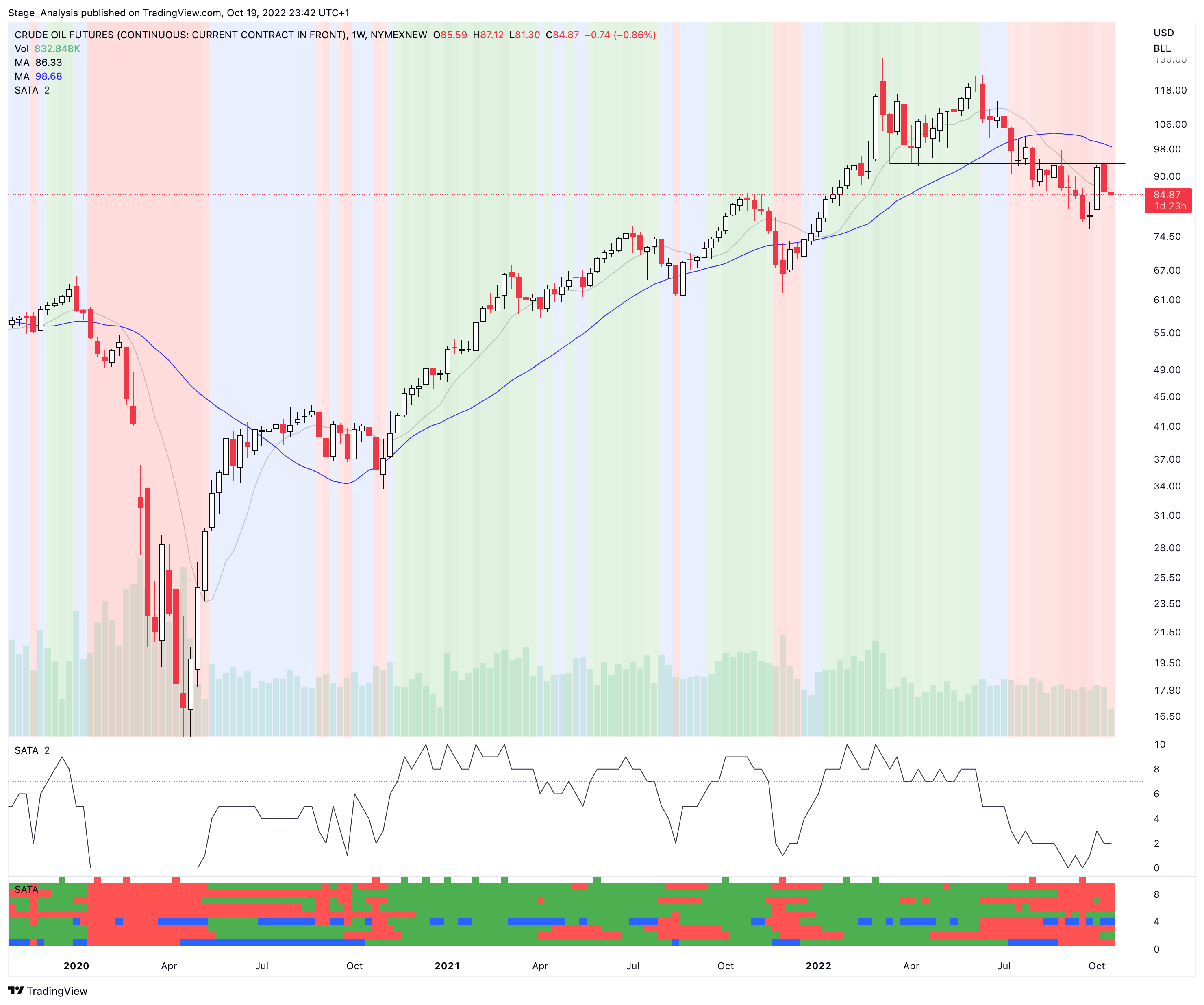

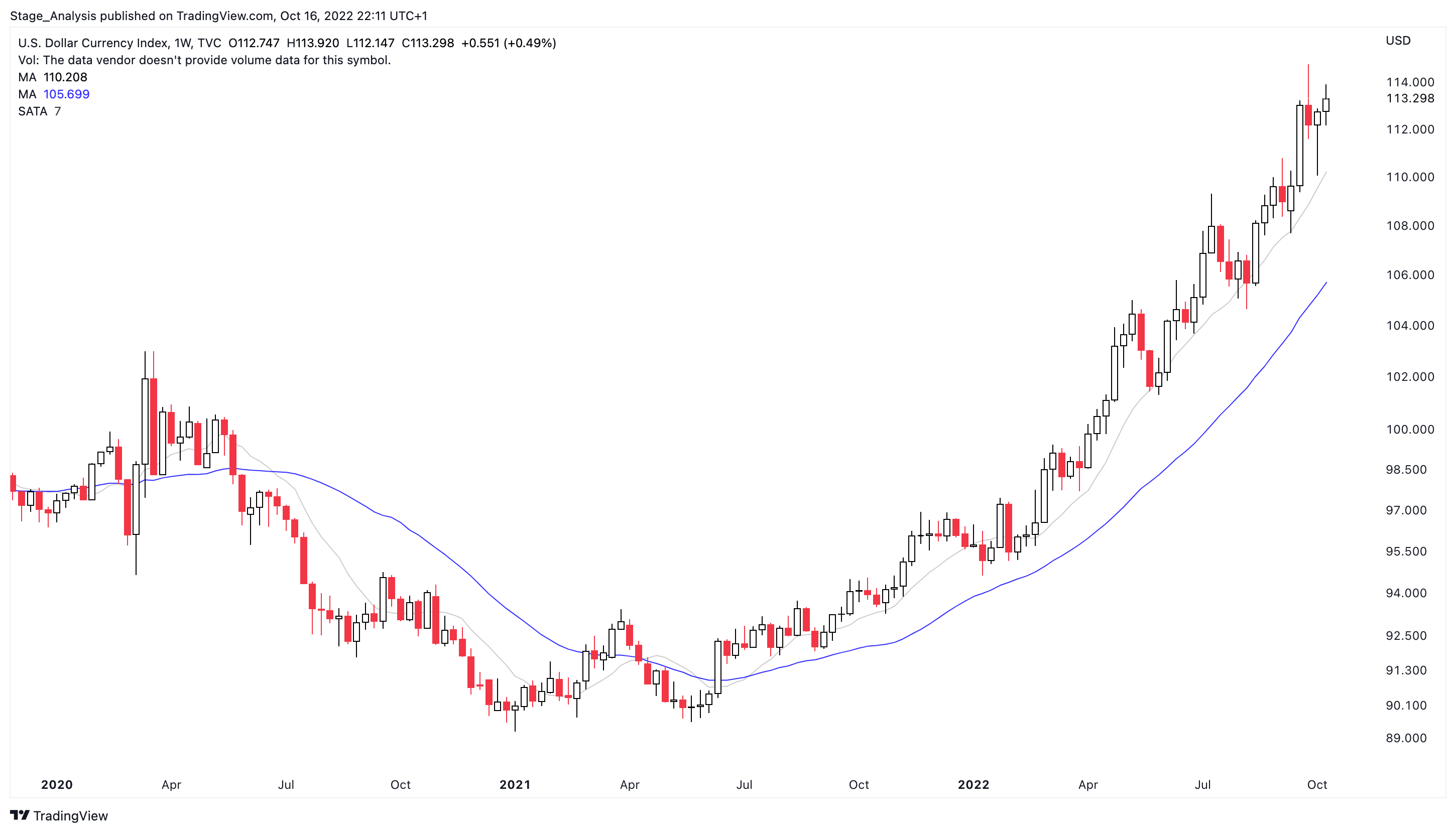

The members midweek video, this week discussing the divergence in Crude Oil Futures and the breakout attempts in the Oil stocks. Then a look at the market indexes, short-term market breadth and Stage Analysis of some of the weeks key earnings results so far...

Read More

18 October, 2022

Earnings Movers and the US Stocks Watchlist – 18 October 2022

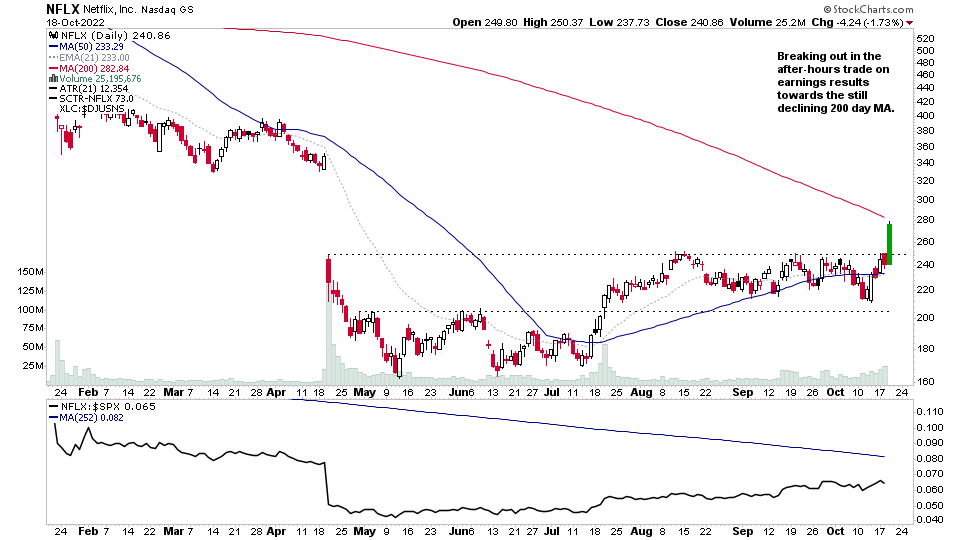

NFLX (Netflix) from the Earnings Watchlist is the strongest mover of todays earnings results, breaking out of its six-month base structure in the after-hours trading and approaching the still declining 200 day MA...

Read More

17 October, 2022

Stock Market Update and the US Stocks Watchlist – 17 October 2022

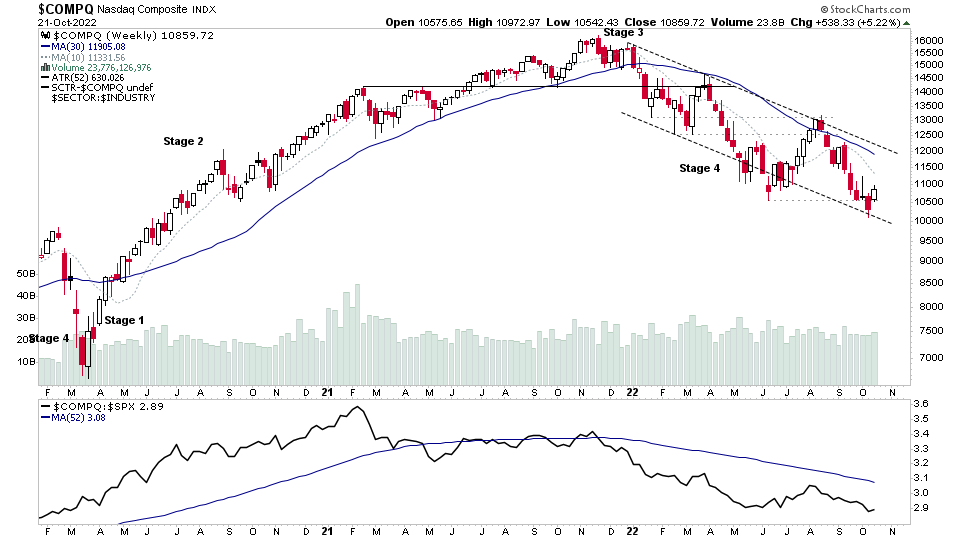

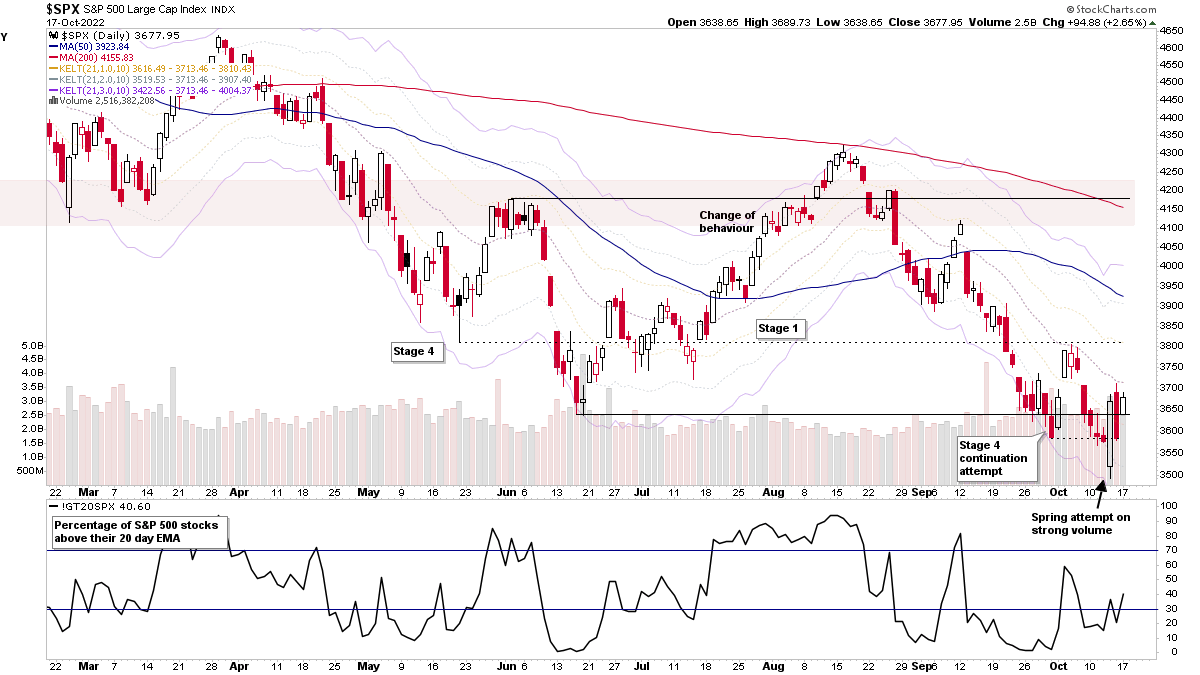

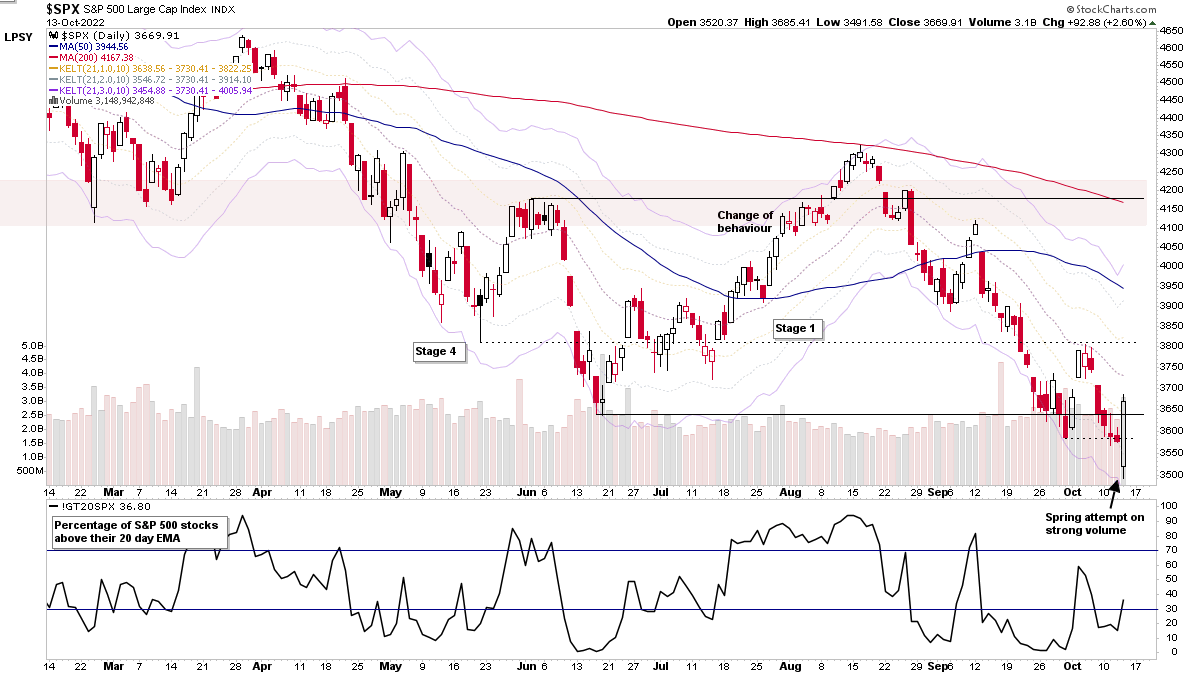

The heavy volume Spring attempt from last Thursday remains in play as a potential swing low, with a further reclaiming of the 5-day MA in the S&P 500 today – which marks Day 3 of a rally attempt from the swing low. So the S&P 500 and Nasdaq are both potentially in position for another CAN SLIM method Follow Through Day (FTD) attempt on Day 4 or later...

Read More

16 October, 2022

Stage Analysis Members Weekend Video – 16 October 2022 (1hr 14mins)

The regular members weekend video discussing the market, industry groups, market breadth and individual stocks from the watchlist in more detail.

Read More

16 October, 2022

Earnings Watchlist – 17-21 October 2022

Earnings season begins to ramp up this coming week with hundreds of stocks reporting earnings, the bulk of which are in the Bank group and Financials sector. In todays post I've cut the list down to 48 of the stocks reporting to give a reasonably broad overview...

Read More

13 October, 2022

Financials Emerging in Developing Stage 1 Bases and the US Stocks Watchlist – 13 October 2022

The major market indexes had a major shakeout today with a greater than 5% range on the daily bar in the S&P 500 for example, as it opened sharply lower with a Stage 4 continuation breakdown attempt in the pre-market / early European session...

Read More