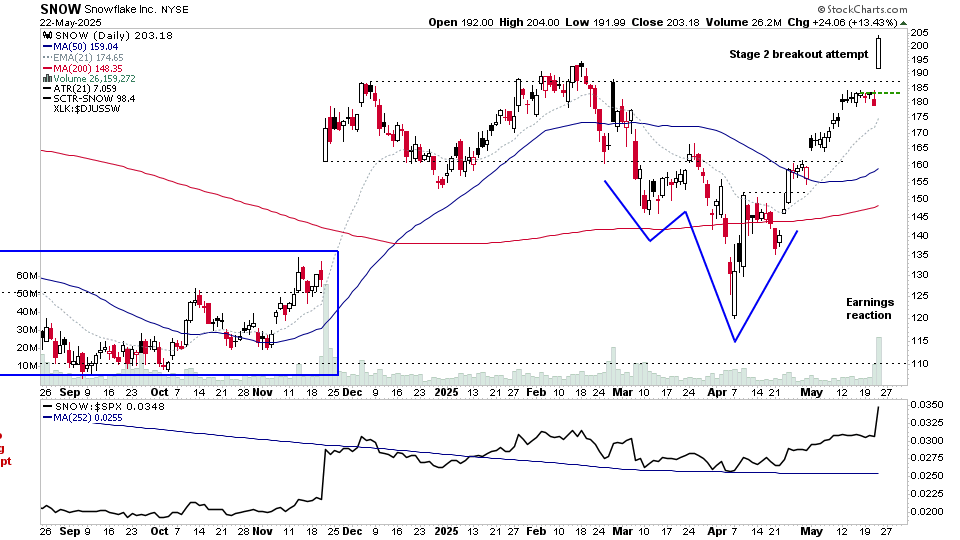

There were 17 stocks highlighted from the US stocks watchlist scans today...

Read More

Blog

22 May, 2025

US Stocks Watchlist – 22 May 2025

20 May, 2025

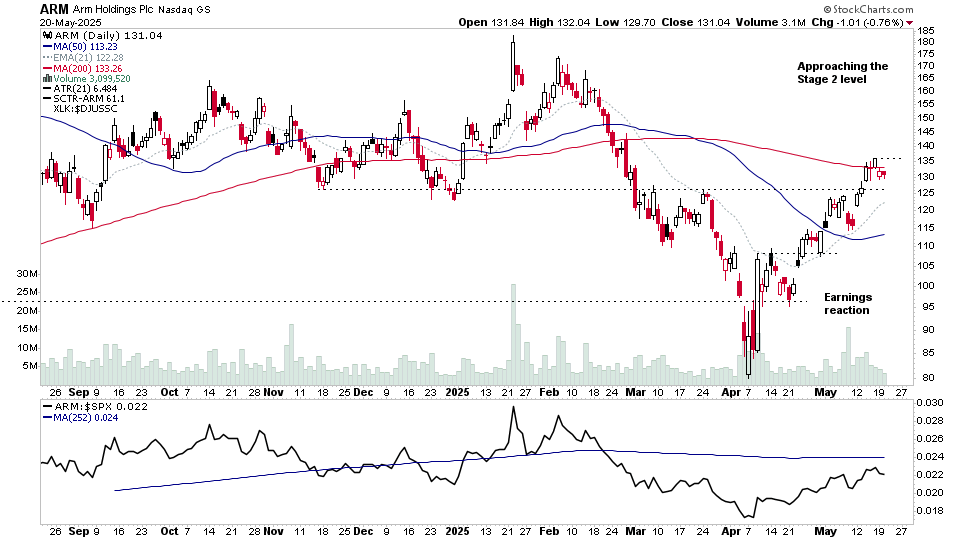

US Stocks Watchlist – 20 May 2025

There were 16 stocks highlighted from the US stocks watchlist scans today...

Read More

18 May, 2025

Stage Analysis Members Video – 18 May 2025 (46mins)

The Stage Analysis members weekend video discussing the US Watchlist Stocks in detail on multiple timeframes, Stage 2 Breakout attempts, Stages Summary, Relative Strength Rankings, the Sector breadth and Sub-industries Bell Curves, the key Market Breadth Charts to determine the Weight of Evidence, Bitcoin & Ethereum and the Major US Stock Market Indexes Update.

Read More

18 May, 2025

US Stocks Watchlist – 18 May 2025

There were 16 stocks highlighted from the US stocks watchlist scans today...

Read More

17 May, 2025

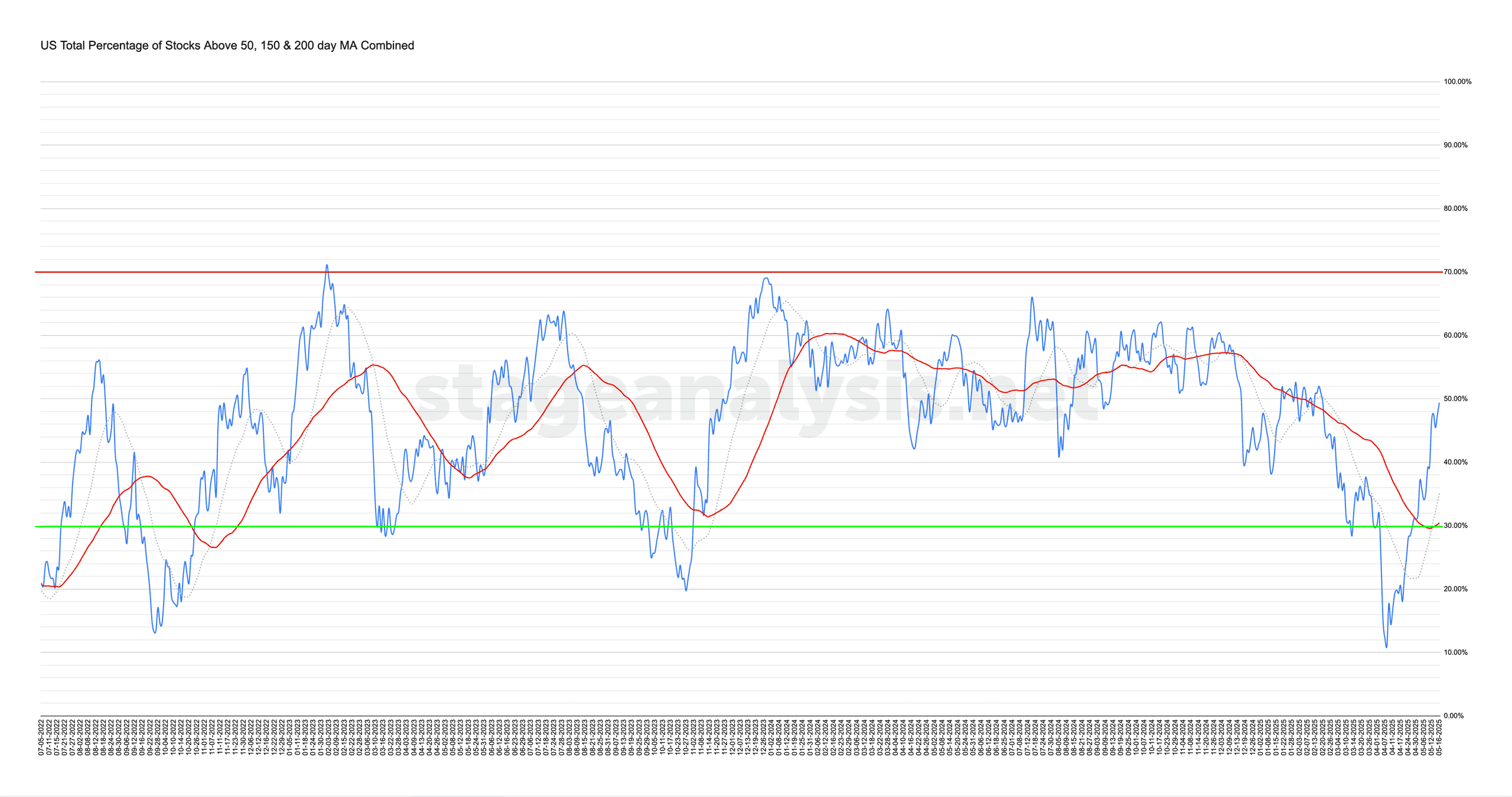

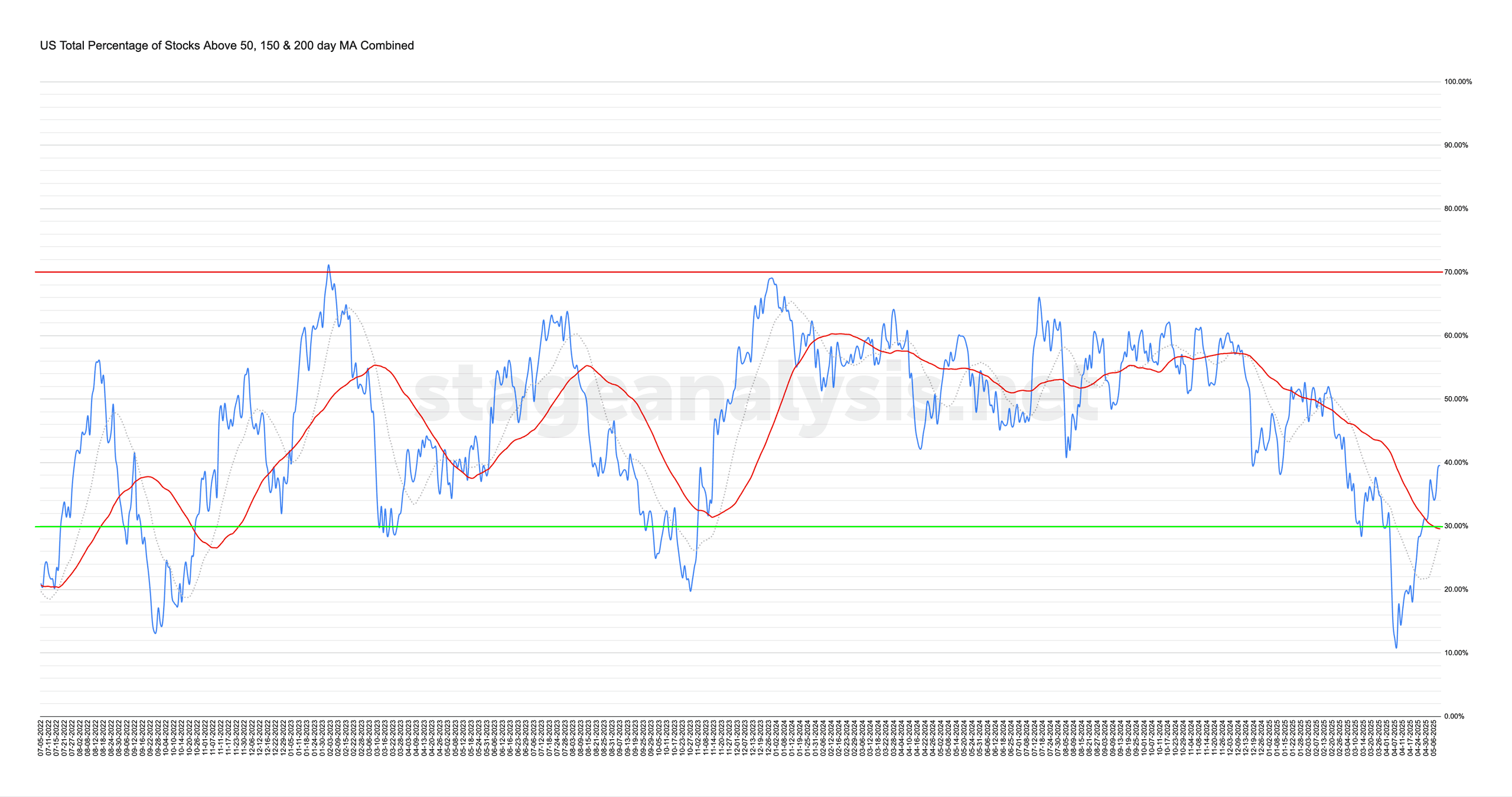

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

The US Total Percentage of Stocks above their 50 Day, 150 Day & 200 Day Moving Averages (shown above) increased by +9.92% this week. Therefore, the overall combined average is at 49.39% in the US market (NYSE and Nasdaq markets combined) above their short, medium and long term moving averages.

Read More

16 May, 2025

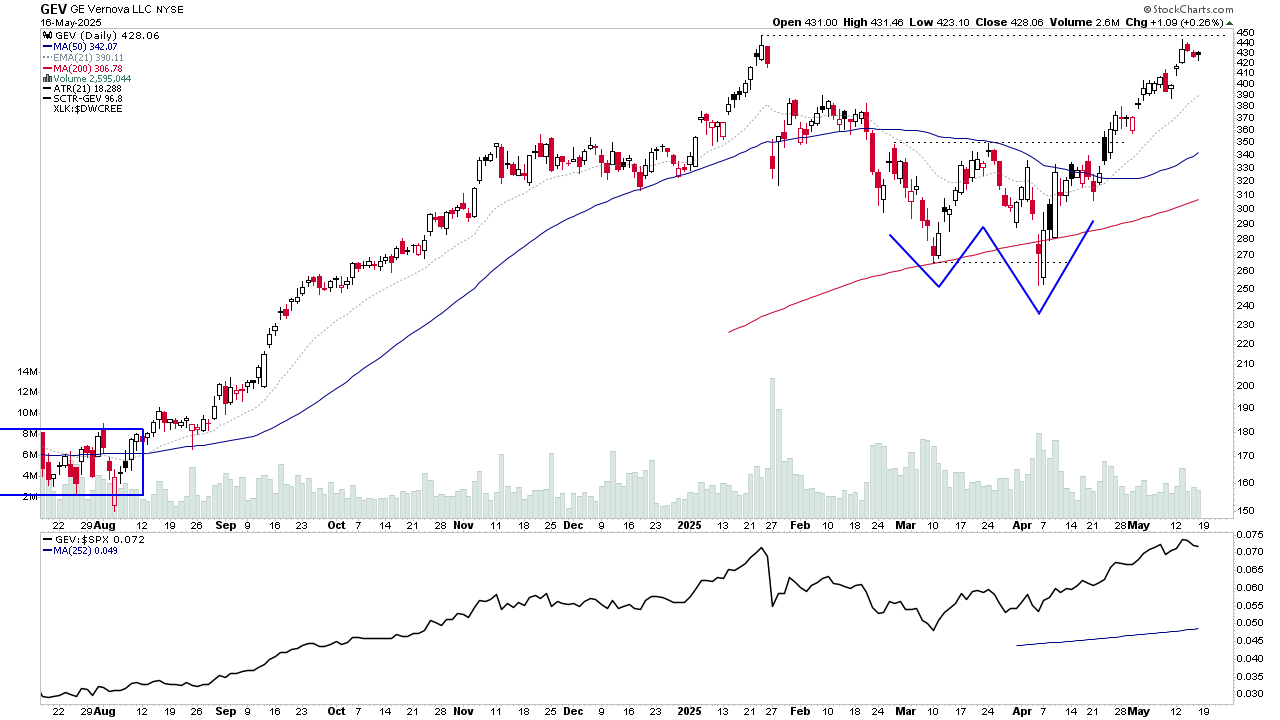

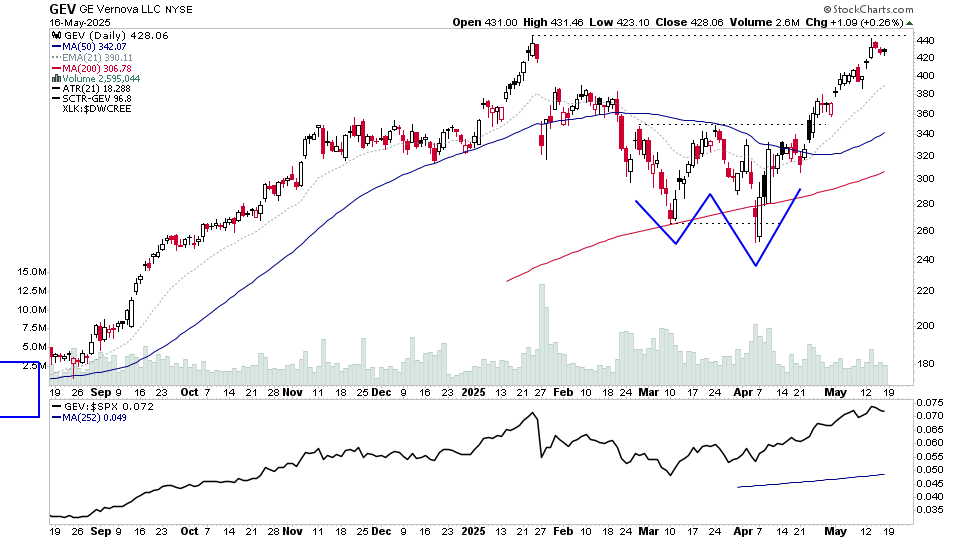

US Stocks Watchlist – 15 May 2025

There were 16 stocks highlighted from the US stocks watchlist scans today...

Read More

13 May, 2025

US Stocks Watchlist – 13 May 2025

There were 18 stocks highlighted from the US stocks watchlist scans today

Read More

11 May, 2025

Stage Analysis Members Video – 11 May 2025 (56mins)

The Stage Analysis members weekend video begins with a discussion of the US Watchlist Stocks in detail on multiple timeframes, Stage 2 Breakout attempts, Stages Summary, Relative Strength Rankings, the Sector breadth and Sub-industries Bell Curves, the key Market Breadth Charts to determine the Weight of Evidence, Bitcoin & Ethereum and the Major US Stock Market Indexes Update.

Read More

11 May, 2025

US Stocks Watchlist – 11 May 2025

There were 22 stocks highlighted from the US stocks watchlist scans today...

Read More

10 May, 2025

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

The US Total Percentage of Stocks above their 50 Day, 150 Day & 200 Day Moving Averages (shown above) increased by +2.32% this week. Therefore, the overall combined average is at 39.46% in the US market (NYSE and Nasdaq markets combined) above their short, medium and long term moving averages.

Read More