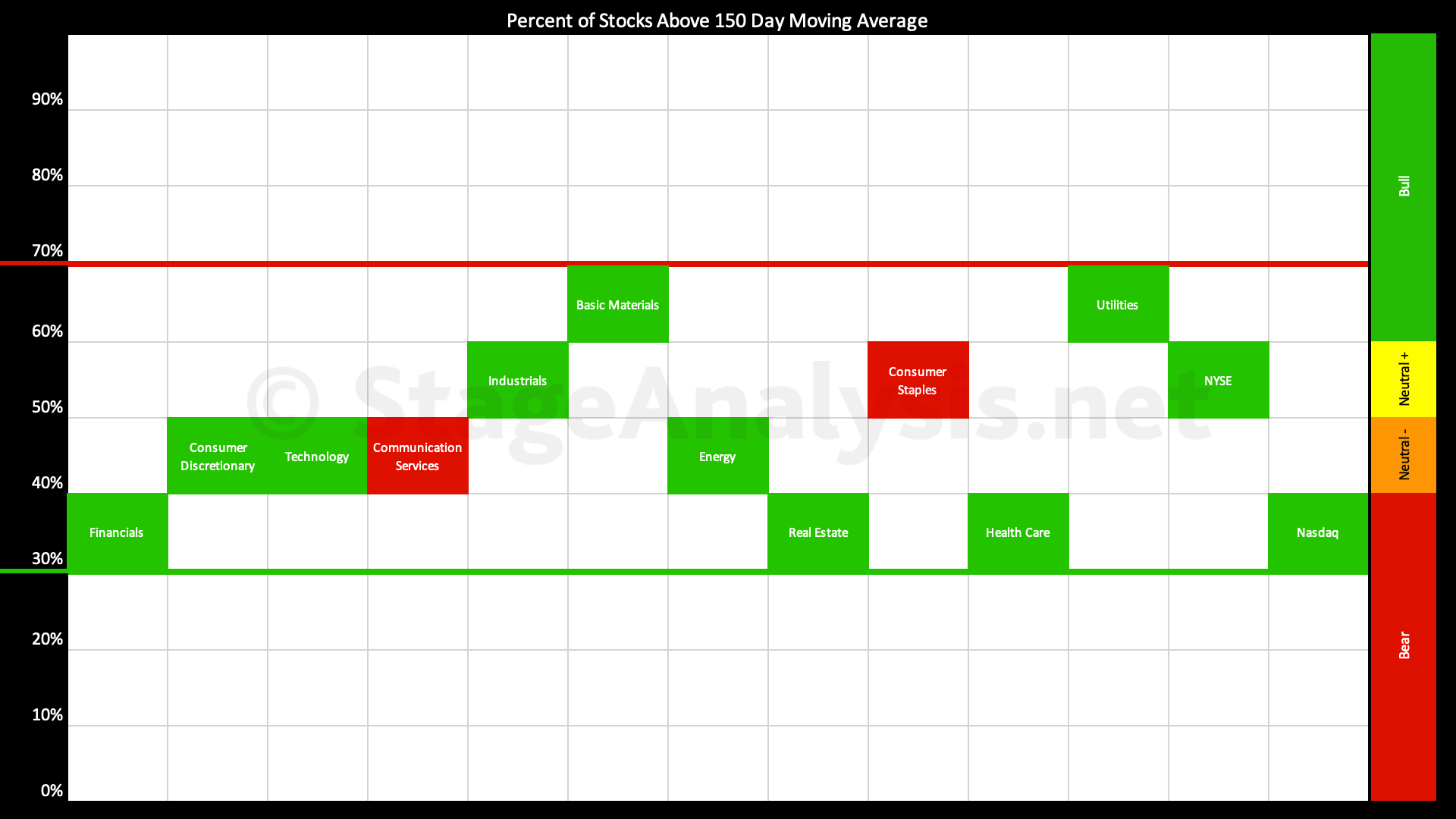

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The full post is available to view by members only. For immediate access:

Average: 48.54% (+1.72% 2wks)

- 2 sectors in Stage 2 zone (Utilities, Basic Materials)

- 6 sectors in Stage 1 / 3 zone (Industrials, Consumer Staples, Technology, Consumer Discretionary, Energy, Communication Services)

- 3 sectors in Stage 4 zone (Financials, Health Care, Real Estate)

Sample Size: 5223 stocks

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors continues to edge to towards the middle of the range, with every sector clustered in the middle range, as can be seen on the visual diagram above.

There has been a gain of +1.72% since the previous post on the 3rd April 2023, which moves the overall average to 48.54%, which is a very Neutral position, and is equivalent to either Stage 1 or Stage 3, which are both non-trending environments (i.e. a range-bound environment would be another way to describe it).

Sector changes: The sectors in the Stage 2 zone (Above 60%) increased from 0 to 2. The sectors in the Stage 1 / 3 zone (40% to 60% range) decreased from 8 to 6, and the number of sectors in the Stage 4 zone (Below 40%) remains the same at 3.

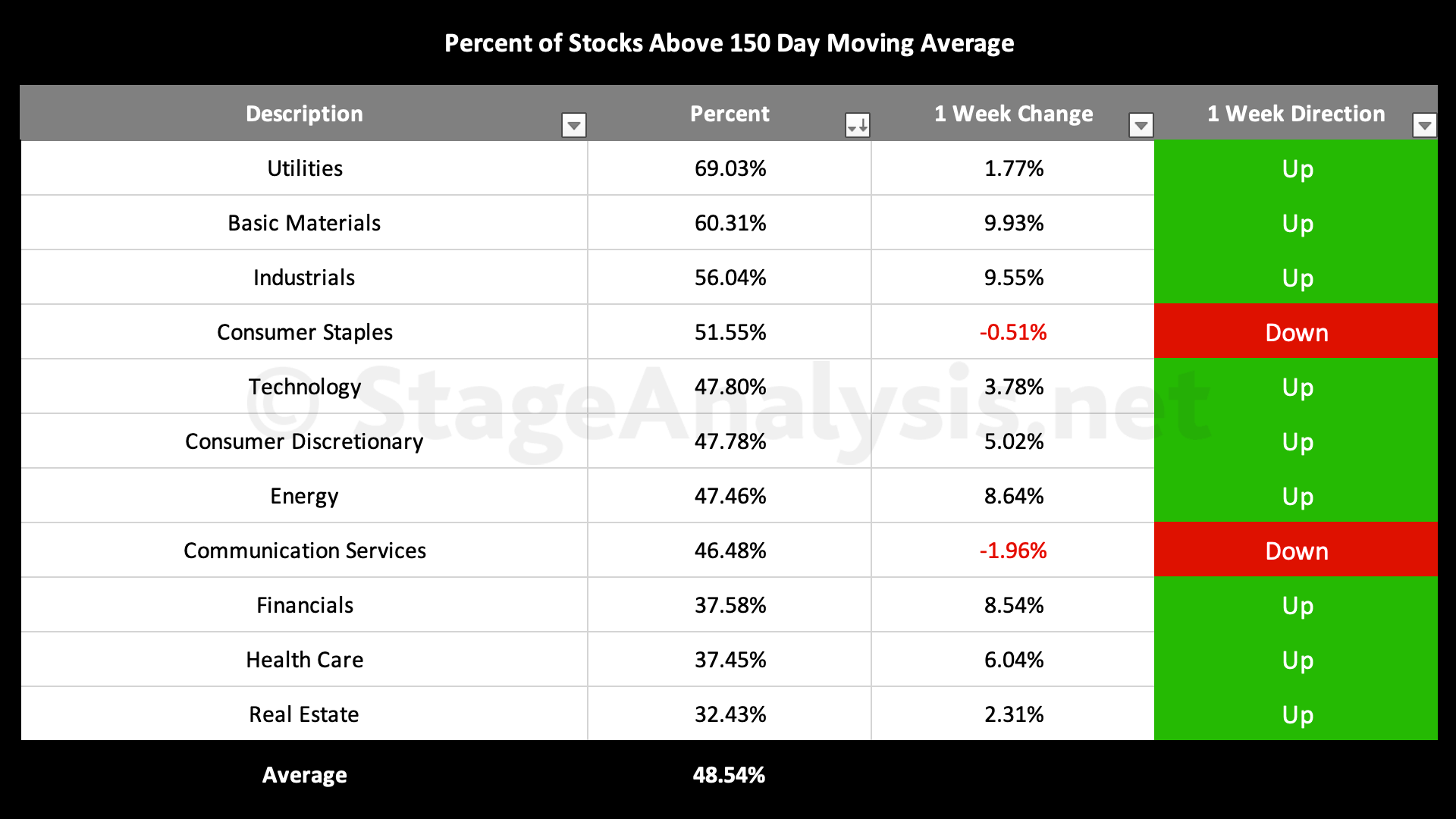

The table below shows the short-term changes since the close on Friday 7th April, with Basic Materials, Industrials, Energy and Financials having the largest moves over the last week or so in the percentage of stocks within each sector moving back above their 150 day MA / 30 week MA.

Sector Breadth Table – Ordered by Relative Strength

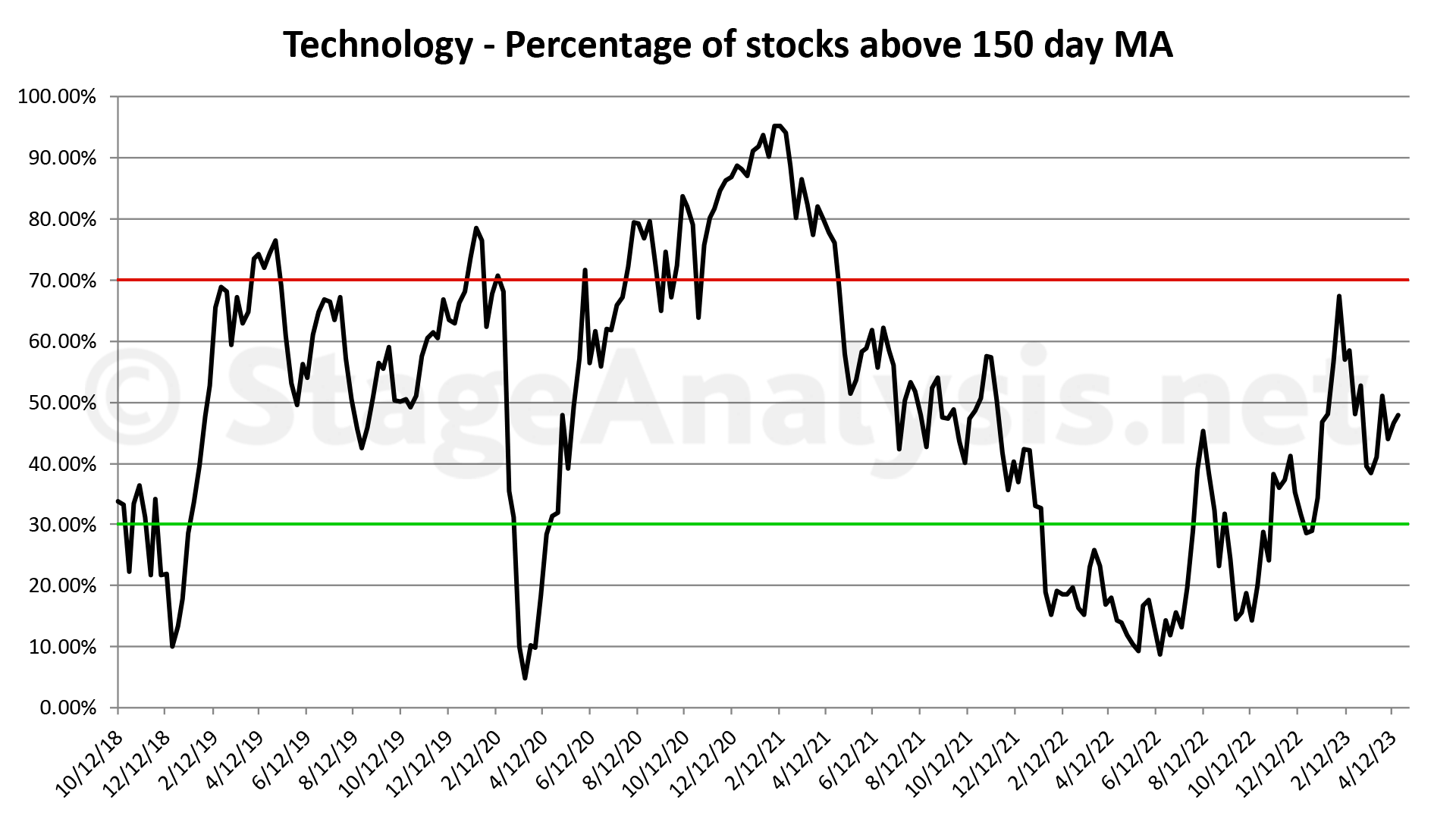

Sector Breadth Charts (Members Only)

Below is the charts for the 11 sectors showing back to late 2018. Which gives a very clear picture of the overall health of each sector and the market as a whole.

(Technology chart shown as an example for non-members – Sample size: 818 stocks from the Technology sector, which is the second largest group)

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.