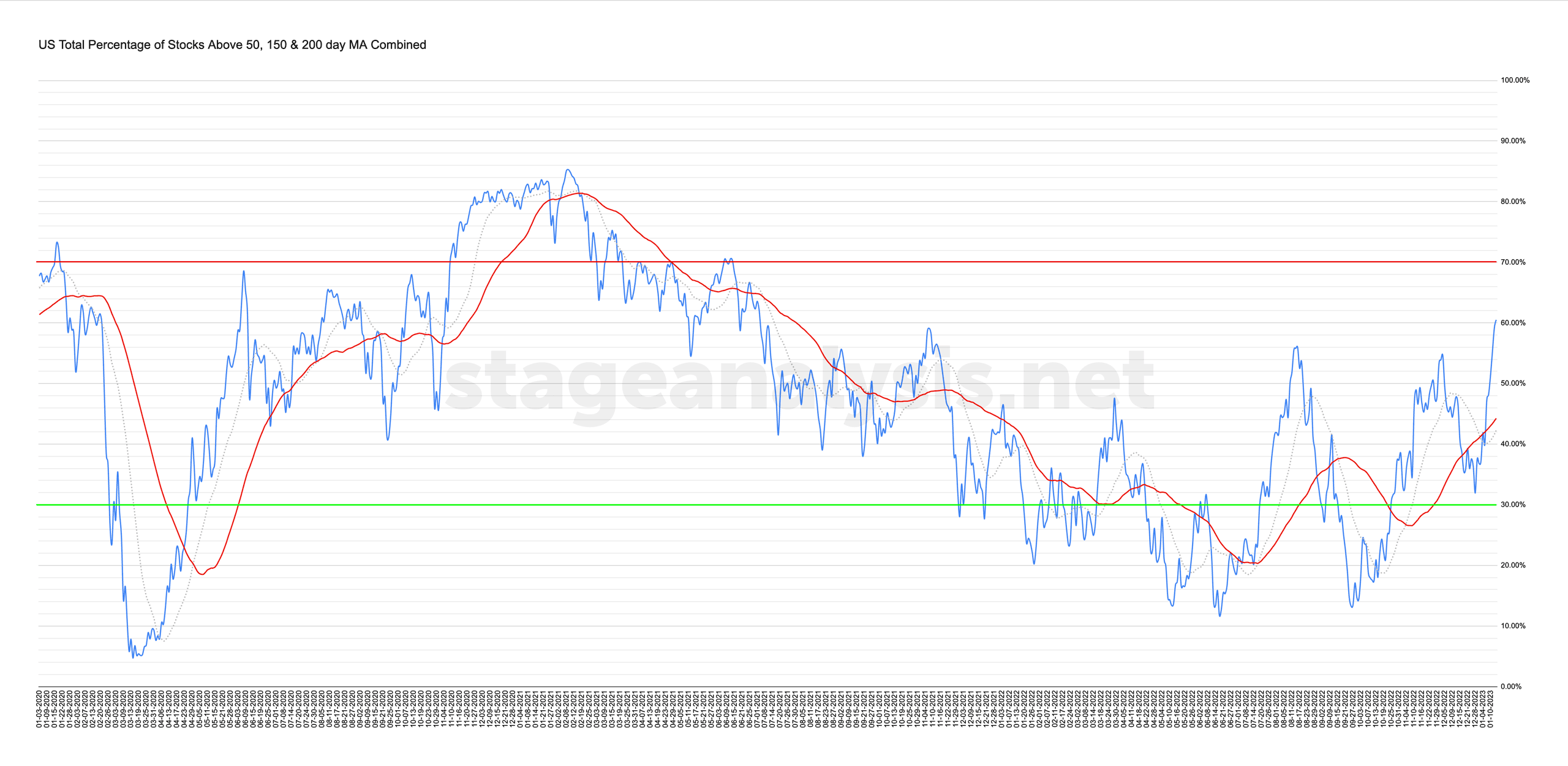

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

The full post is available to view by members only. For immediate access:

60.50% (+13.43% 1wk)

Status: Postive Environment – borderline between the Stage 1 and Stage 2 zones

The US Total Percentage of Stocks above their 50 Day, 150 Day & 200 Day Moving Averages (shown above) continued strongly higher with a further +13.43% move this week, expanding the overall average by +23.71% since the start of 2023.

The overall combined average now stands at 60.50% in the US market (NYSE and Nasdaq markets combined) above their short, medium and long term moving averages, which puts it at +16.24% above its own 50 day MA signal line, and with the move above 60%, it's attempting to move into the Stage 2 zone, but to move to Stage 2 it will require more confirmation. So currently with the combined average above its rising 20 and 50 day MAs and edging above the 60% level, we consider its status as in a Postive Environment, that is borderline between the Stage 1 and Stage 2 zones.

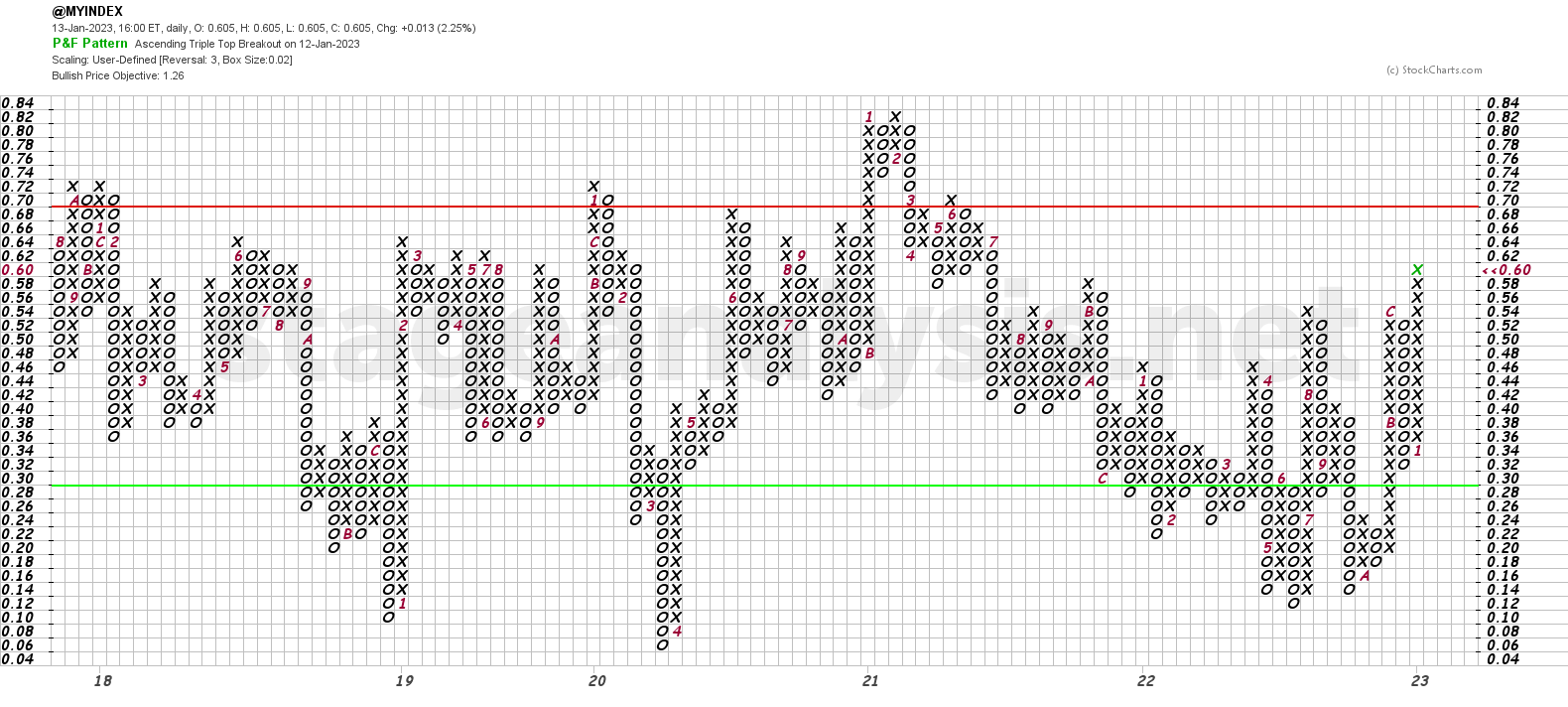

The Point and Figure (P&F) chart (shown above), added a further 7 Xs to the current column of Xs, with a double top breakout at the 56% level. So the P&F status remains on Bull Confirmed status and on Offense (as it's in a column of Xs).

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.