US Breakout Stocks Watchlist - 17 June 2020

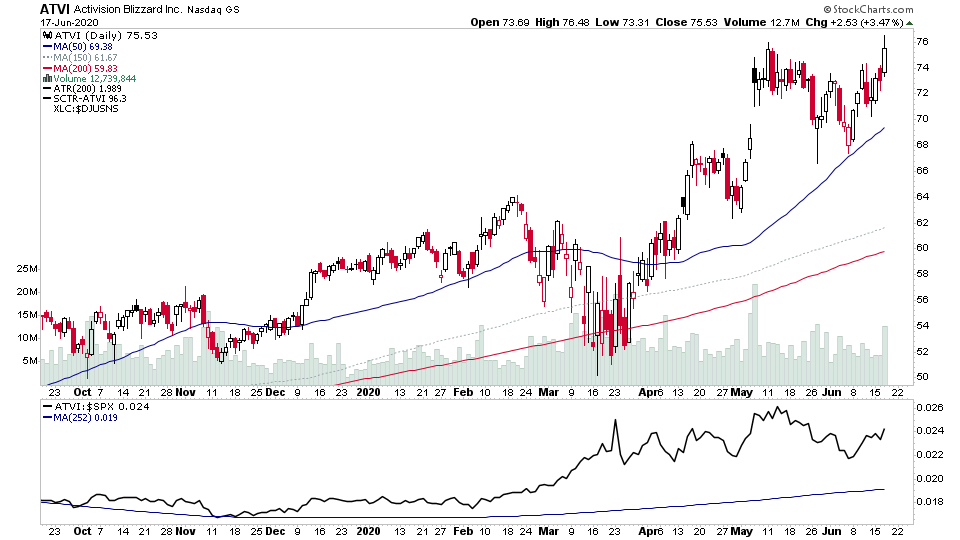

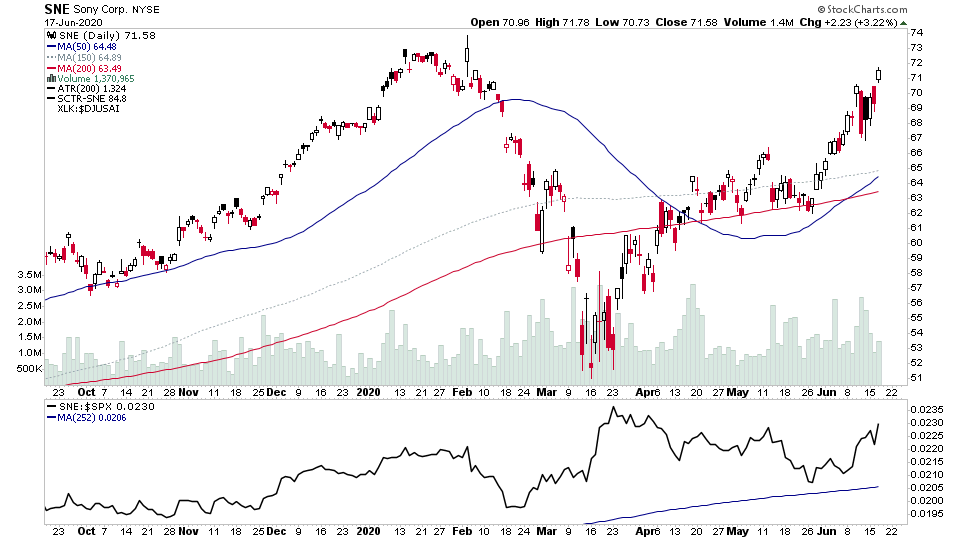

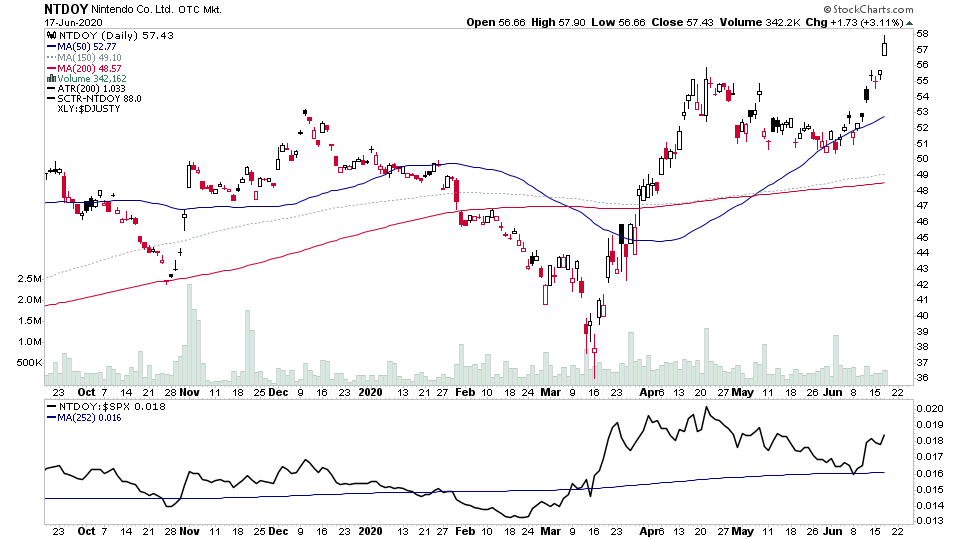

The market was weak, but there was a noticeable sector theme today with multiple computer game stocks breaking out.

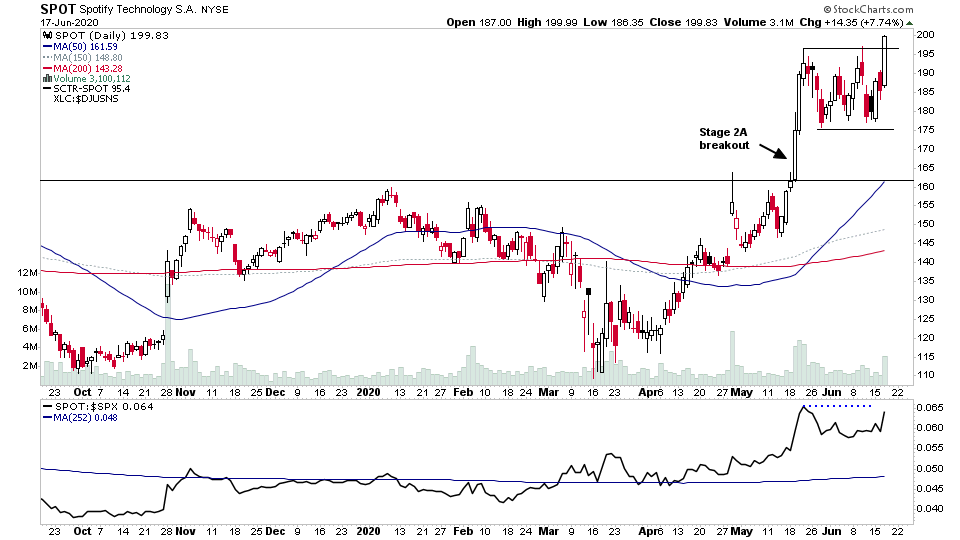

Another stock of note was SPOT, which managed to break above the IPO-AP (IPO Advance Phase) high to new all time highs. This has been a stock that I've highlighted multiple times since before the Stage 2A breakout, and multiple times after as its formed its first base since the Stage 2A breakout. The Stage 1 base was a massive year and a half, and its seen significant accumulation from from the institutions, with over a 103% increase in funds that own it since this time since last year, and so it's gaining support and could well be close to moving into the institutional advance phase in early Stage 2. So definitely one to watch imo, as could become an institutional favourite.

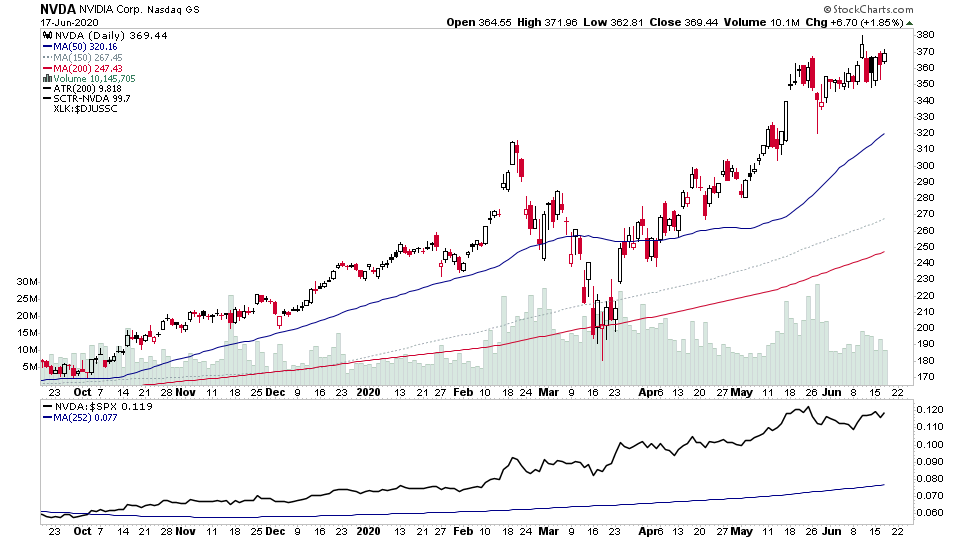

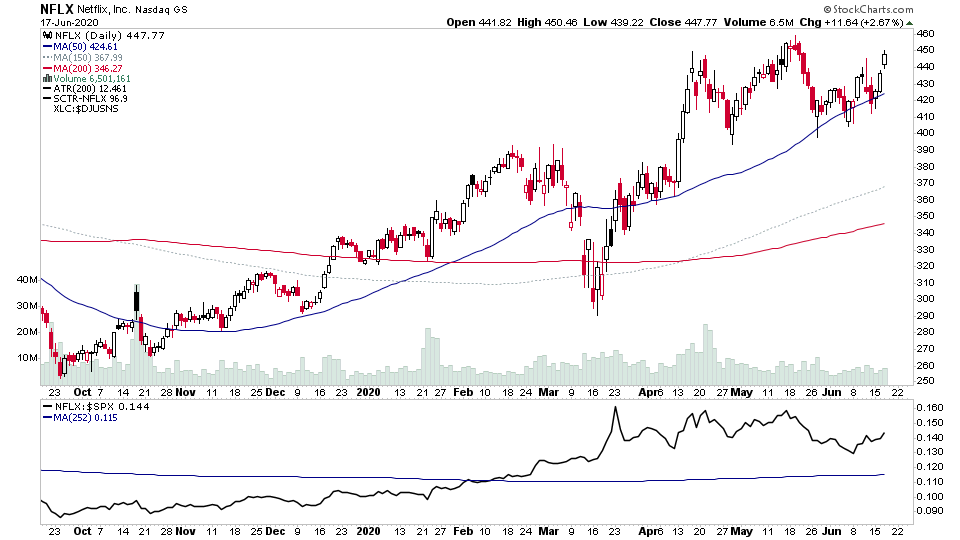

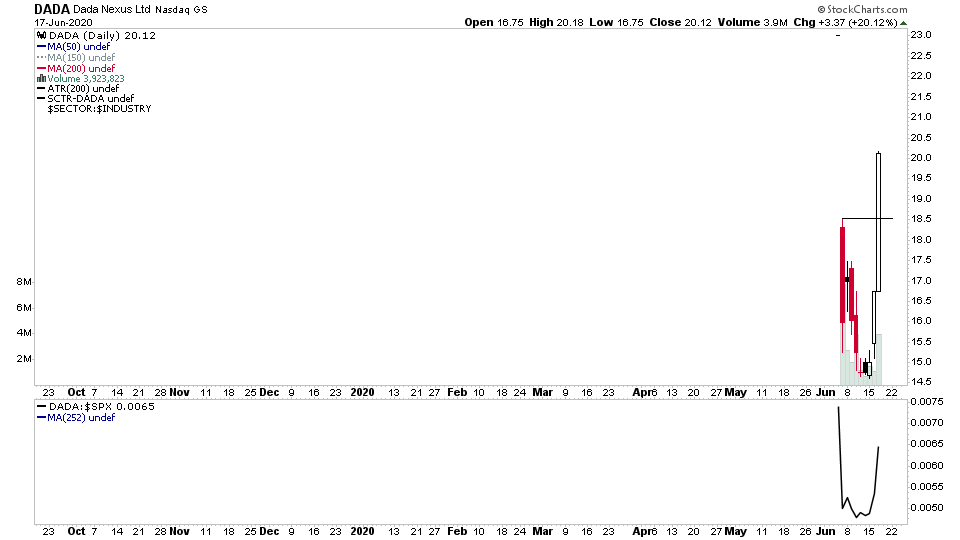

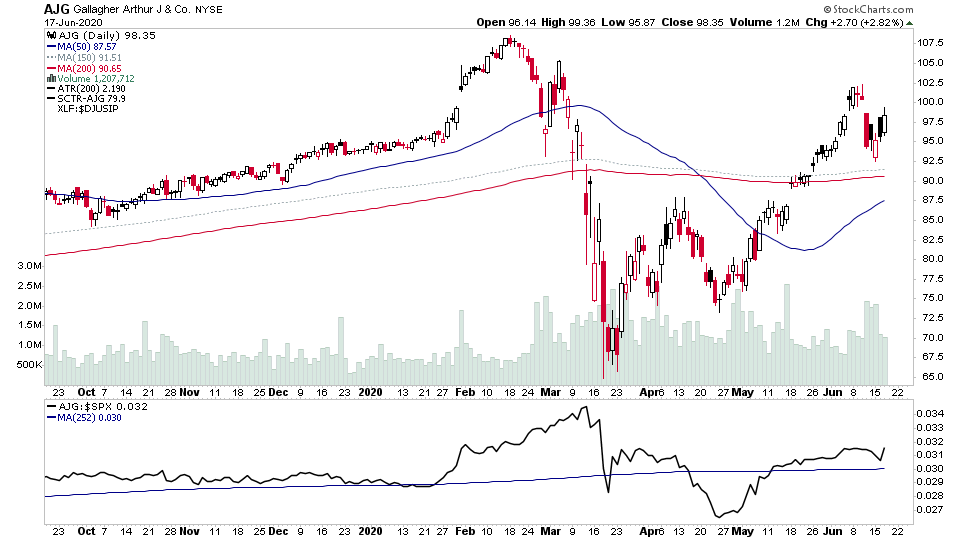

For the watchlist from Wednesdays scans - AJG, ATVI*, DADA, NFLX, NTDOY, NVDA, SNE, SPOT

*I took a 1/3rd size position in ATVI at 74.73

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.