US Breakout Stocks Watchlist - 15 May 2020

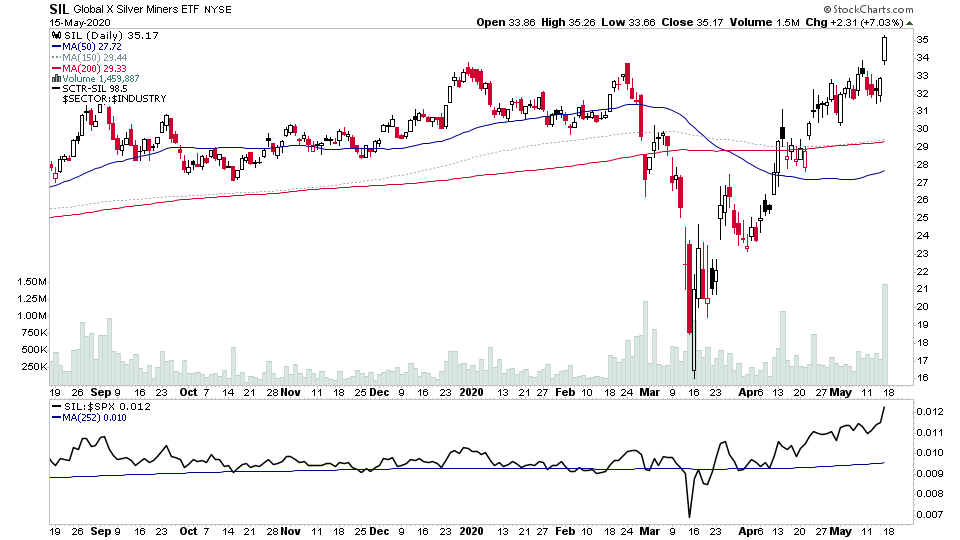

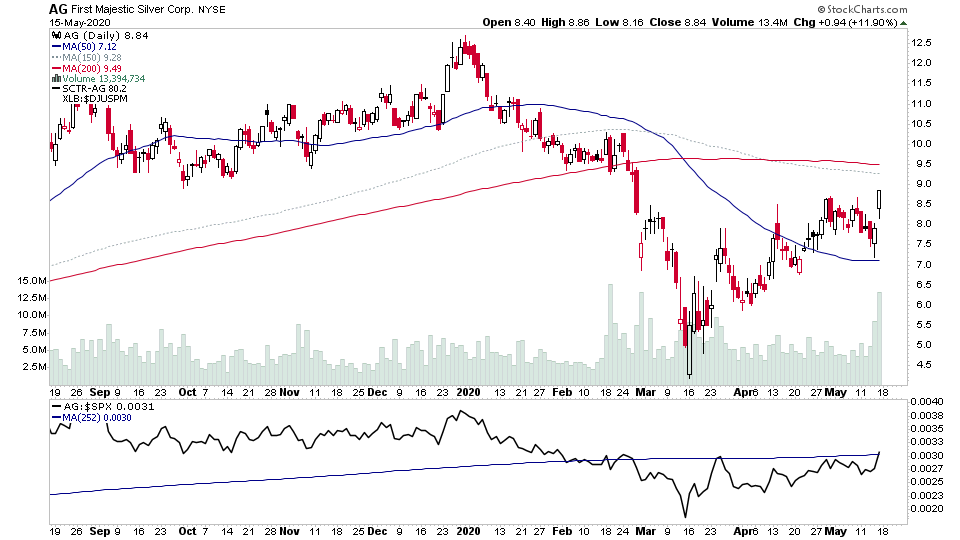

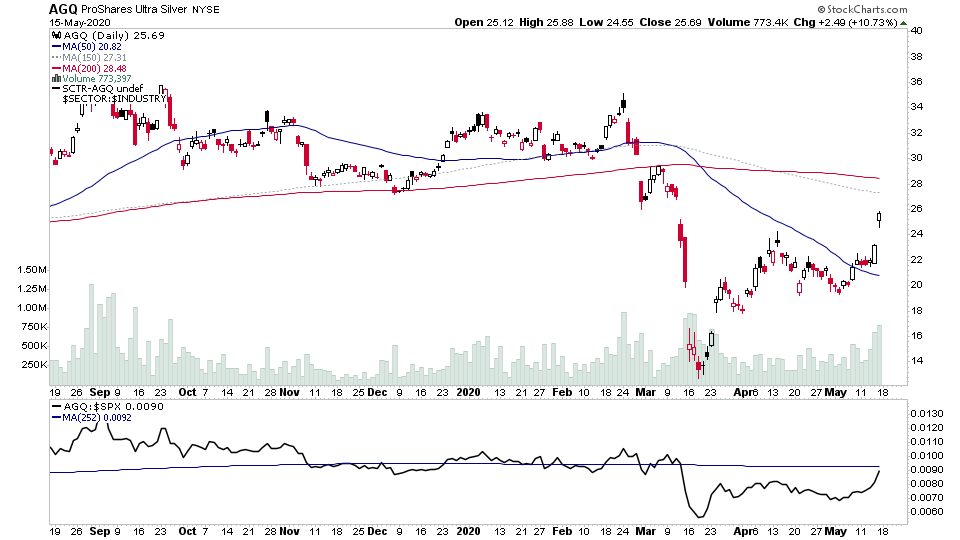

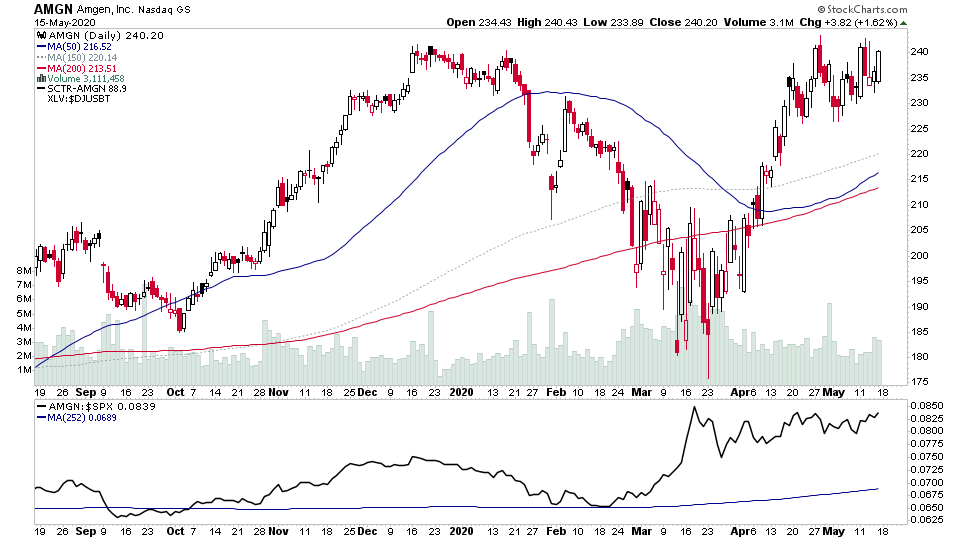

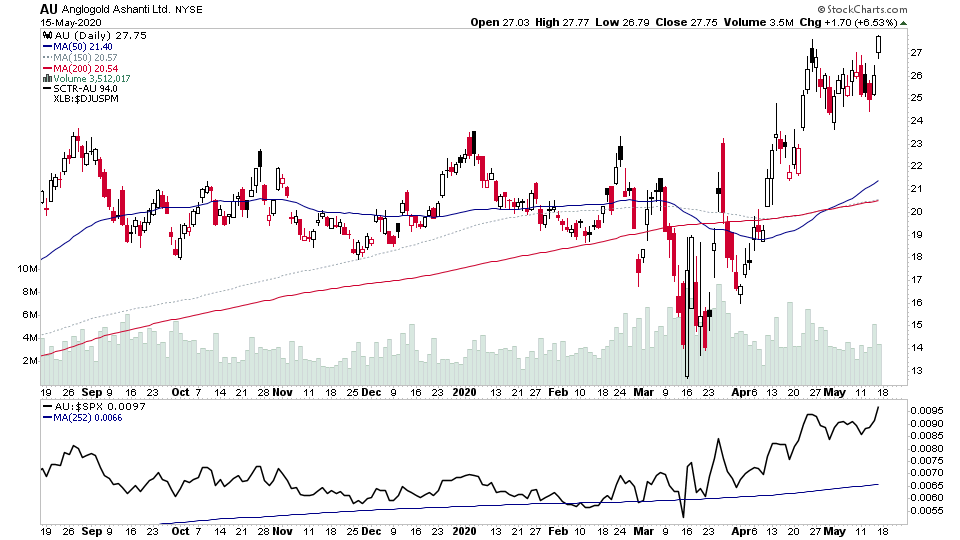

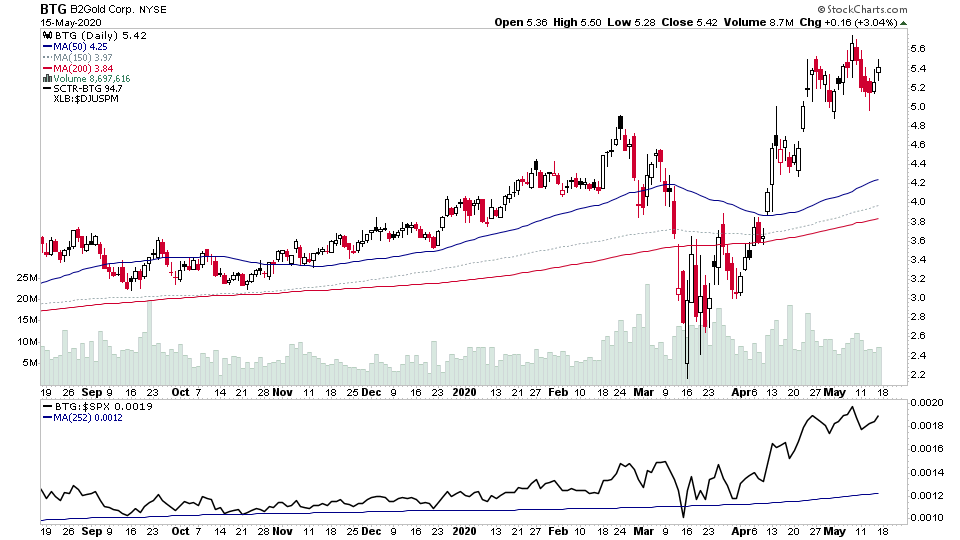

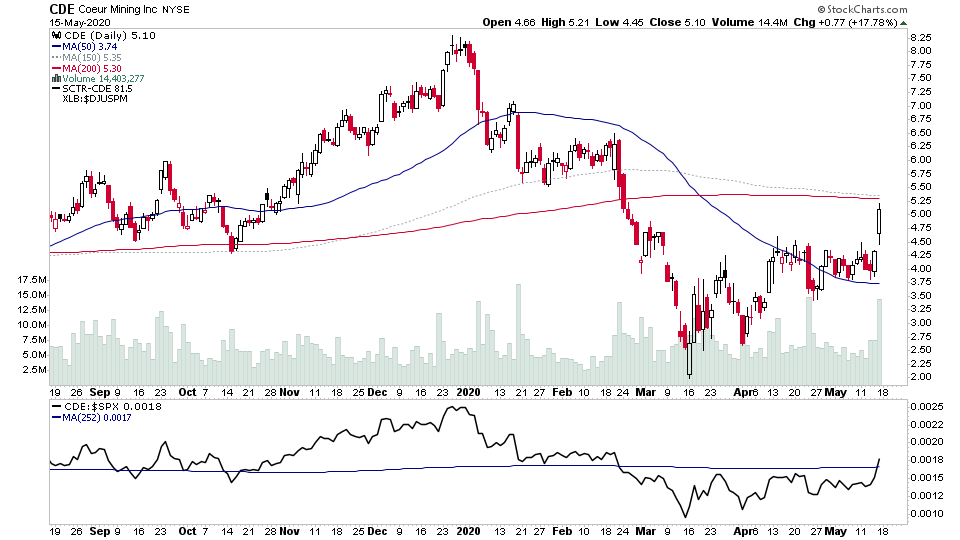

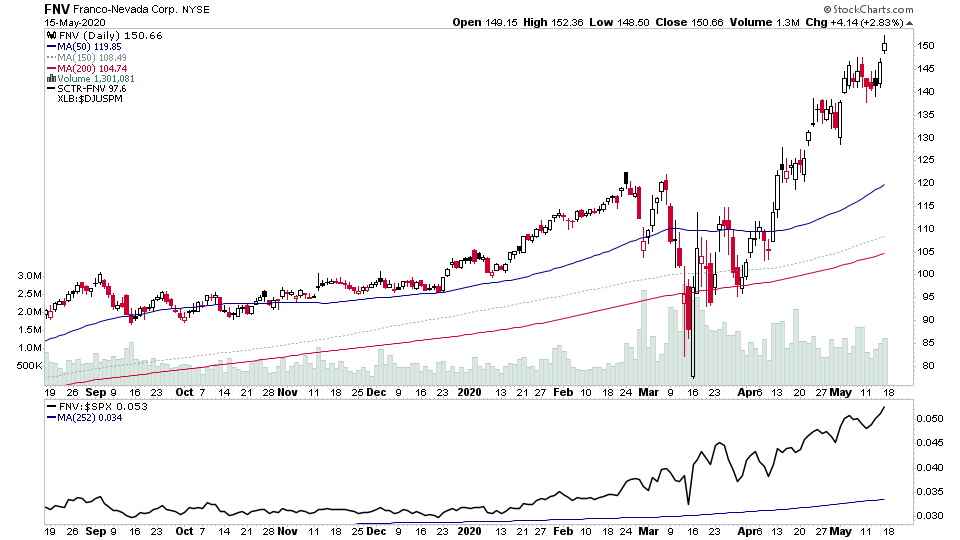

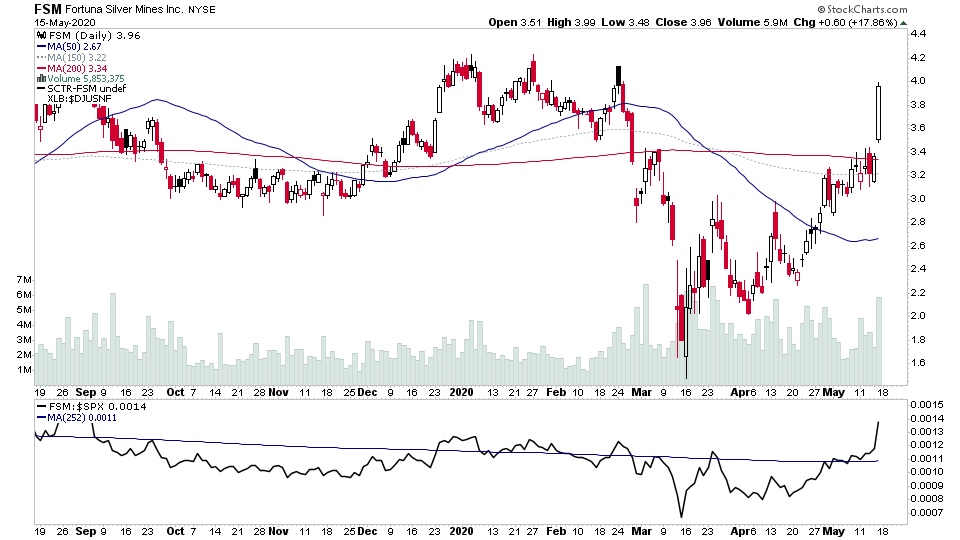

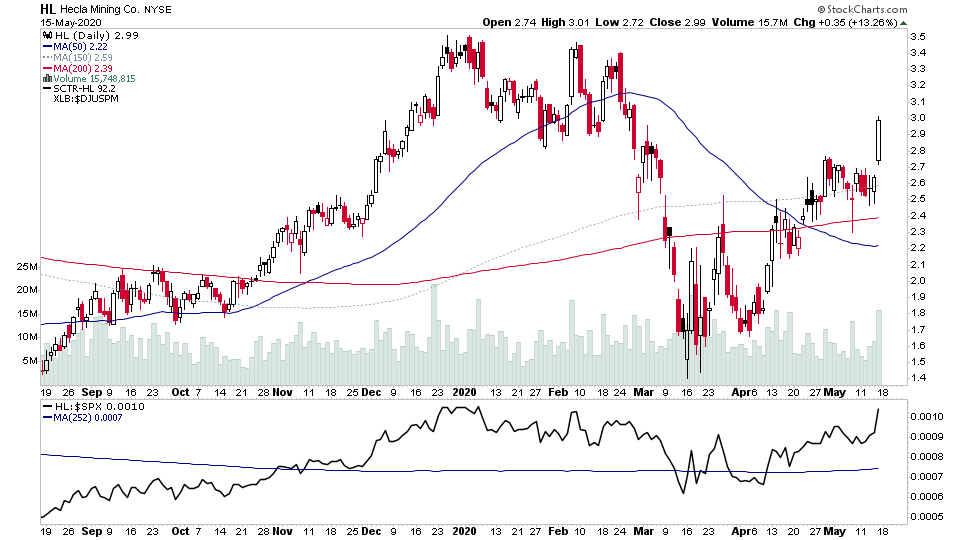

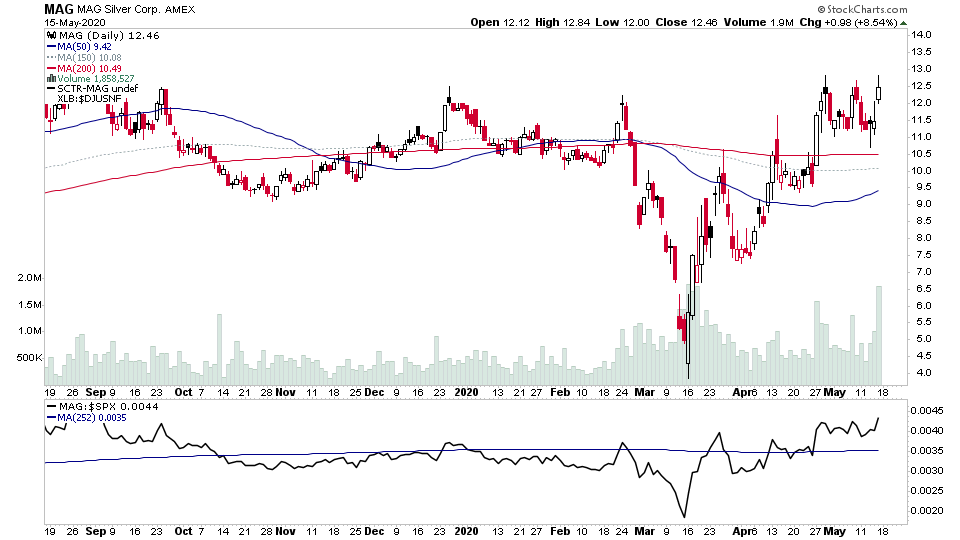

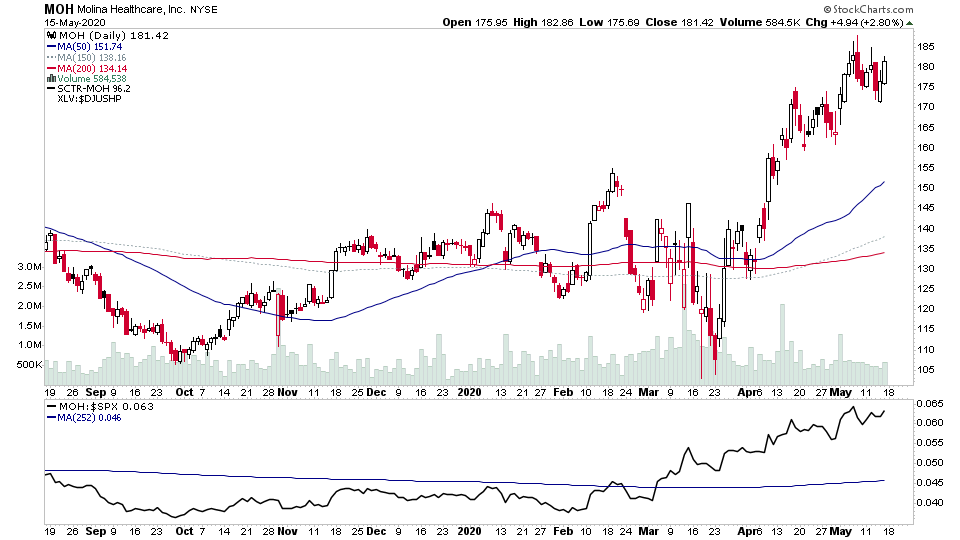

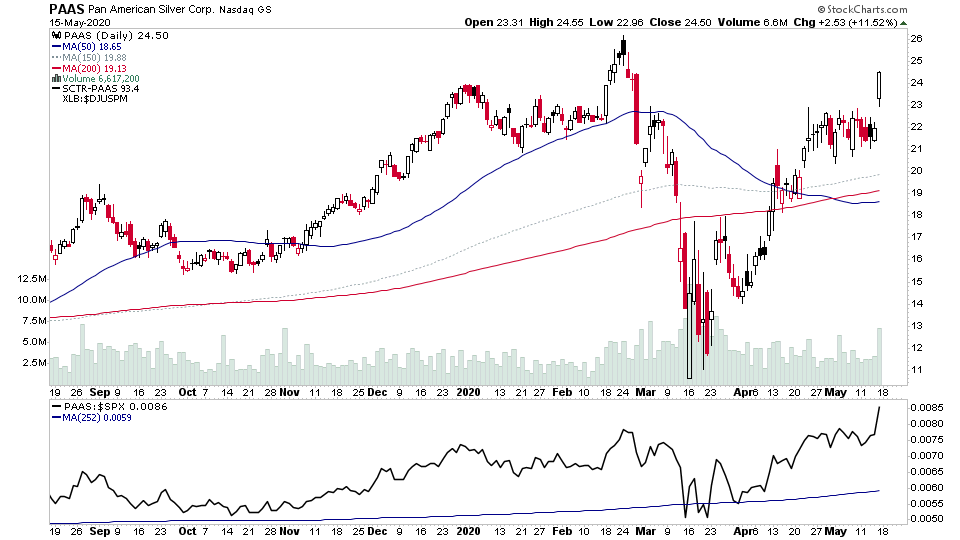

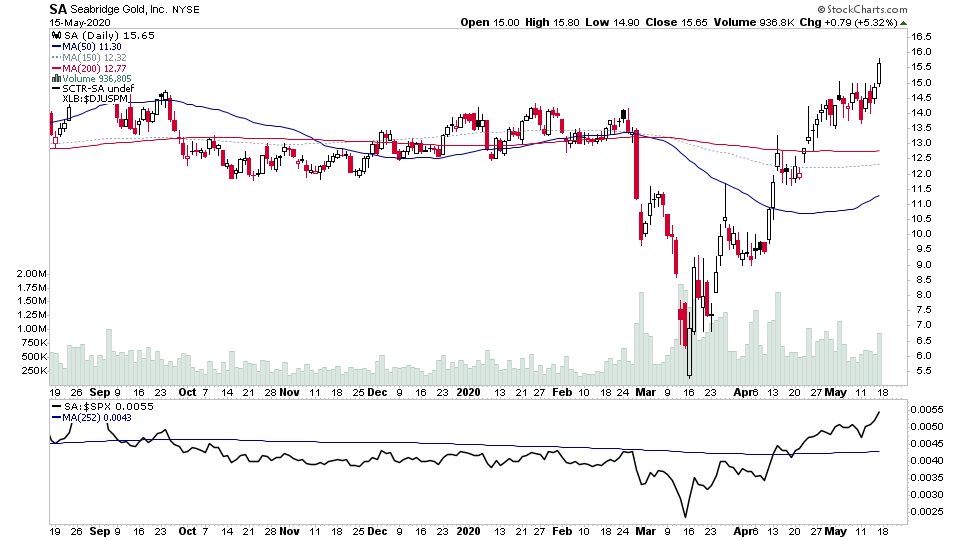

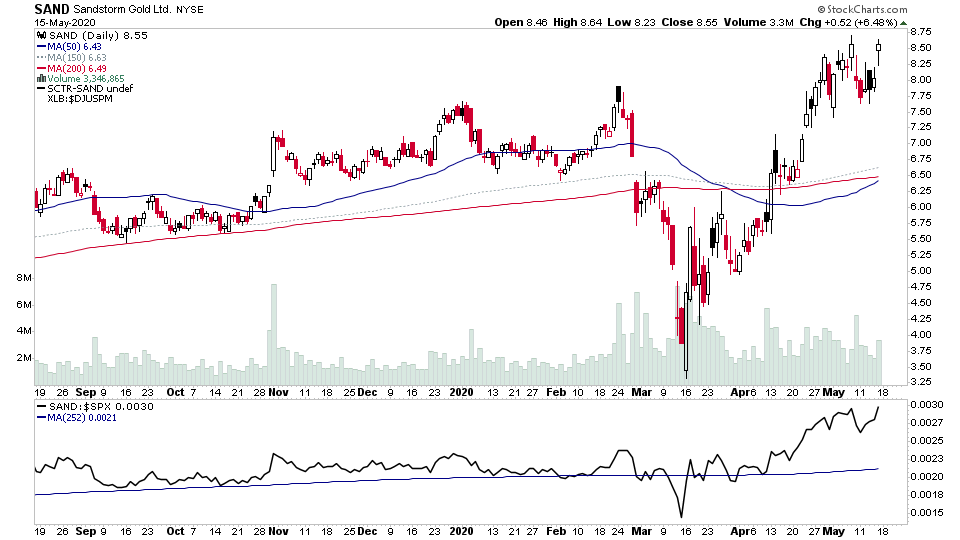

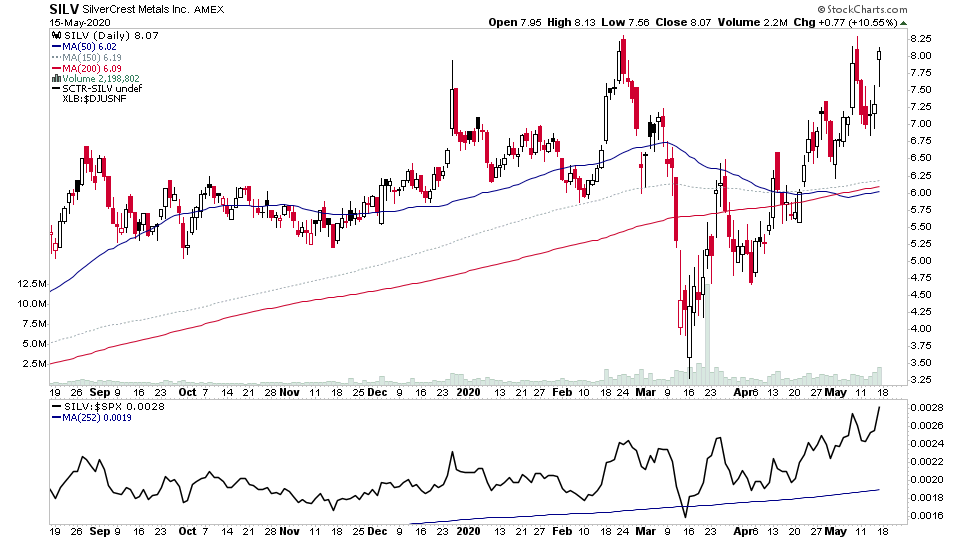

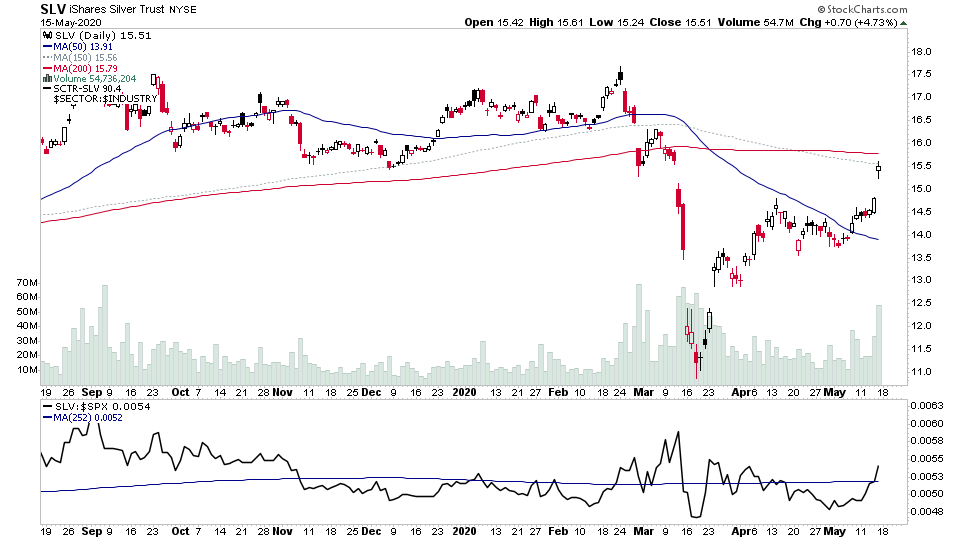

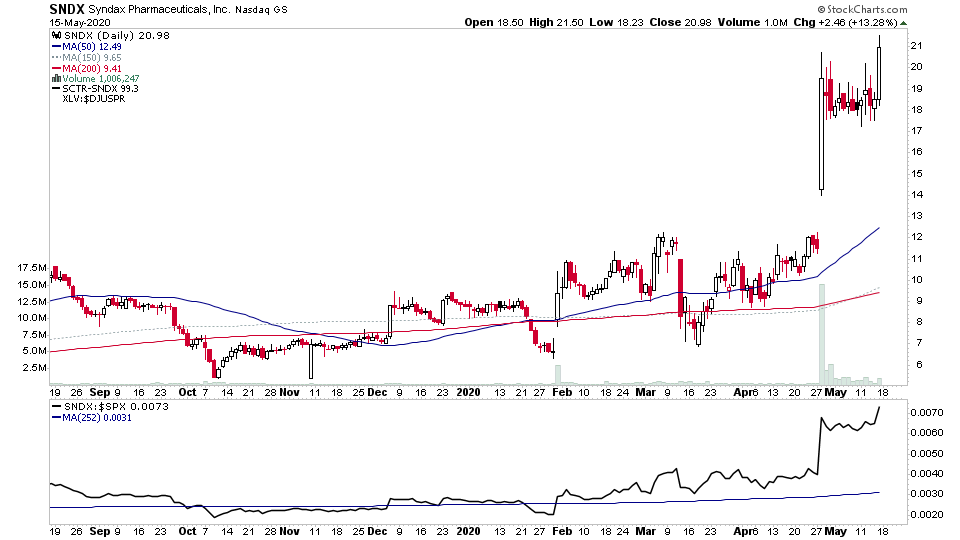

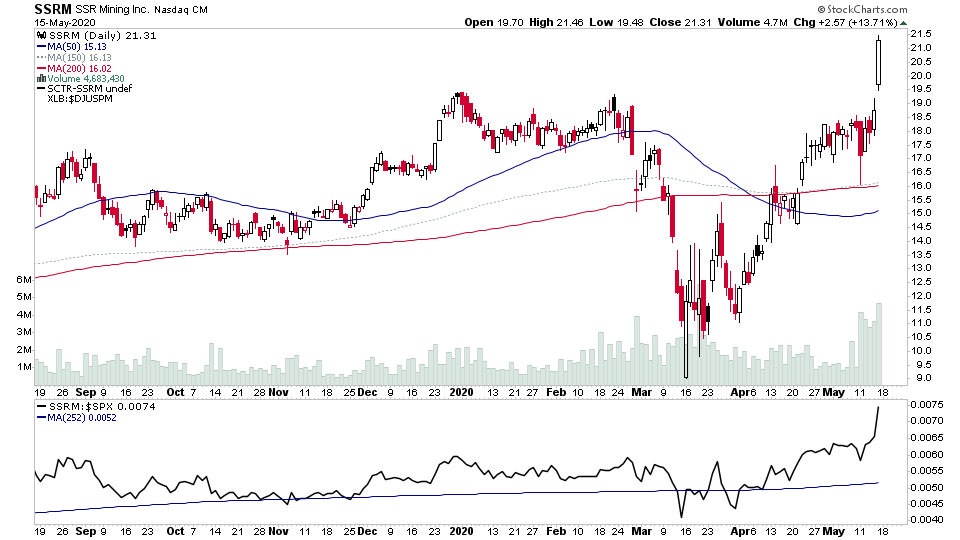

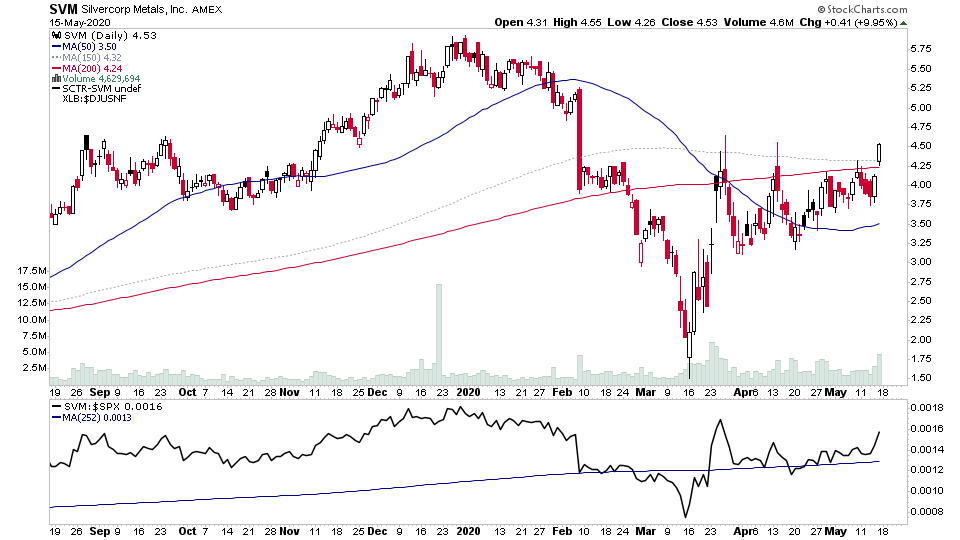

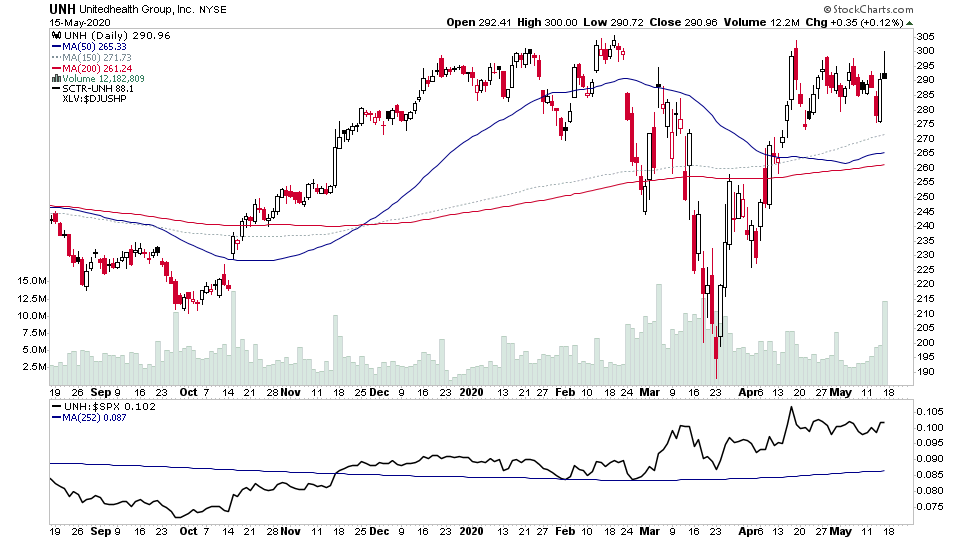

Another day with multiple precious metals miners breaking out, although this time a lot more Silver miners are appearing than before due to spot silver breaking out strongly from its recent consolidation on Friday. So Gold and Silver miners is clearly the strongest group this week.

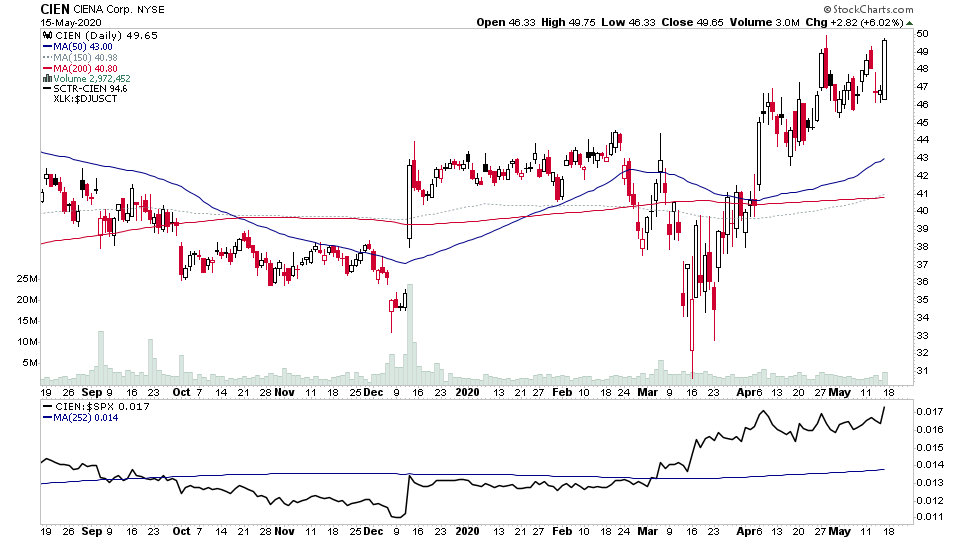

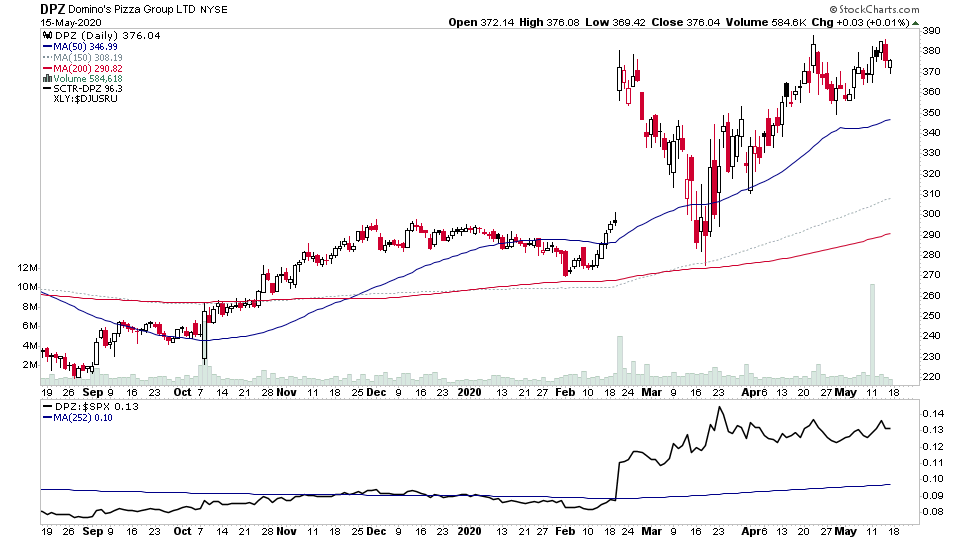

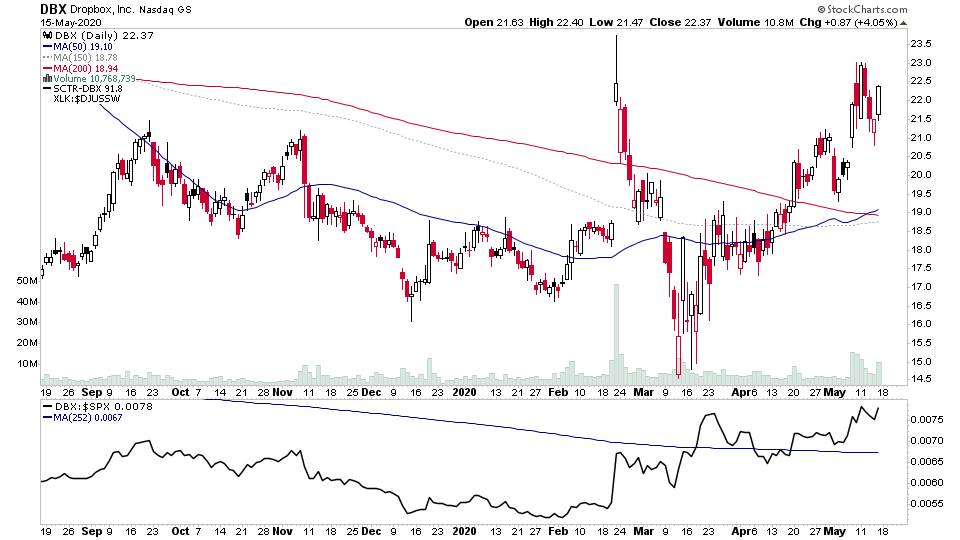

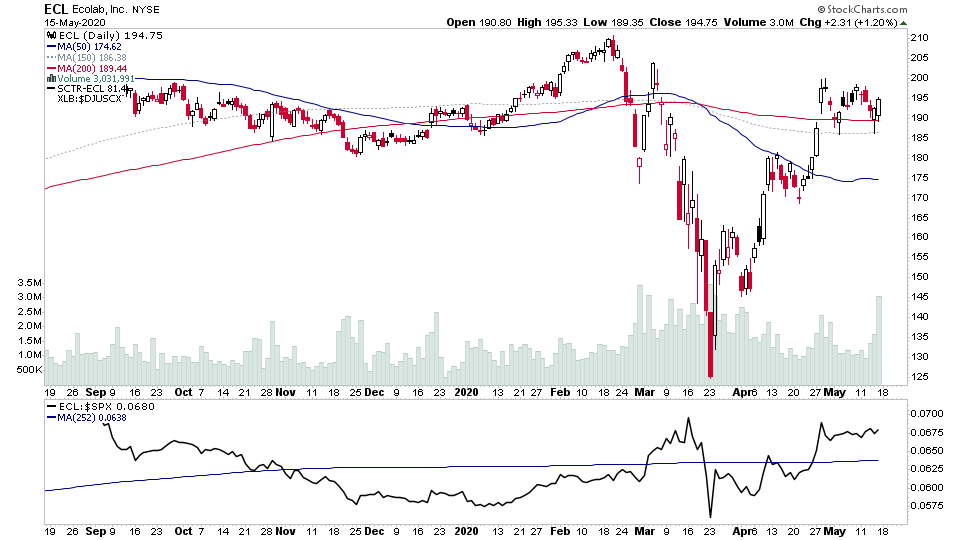

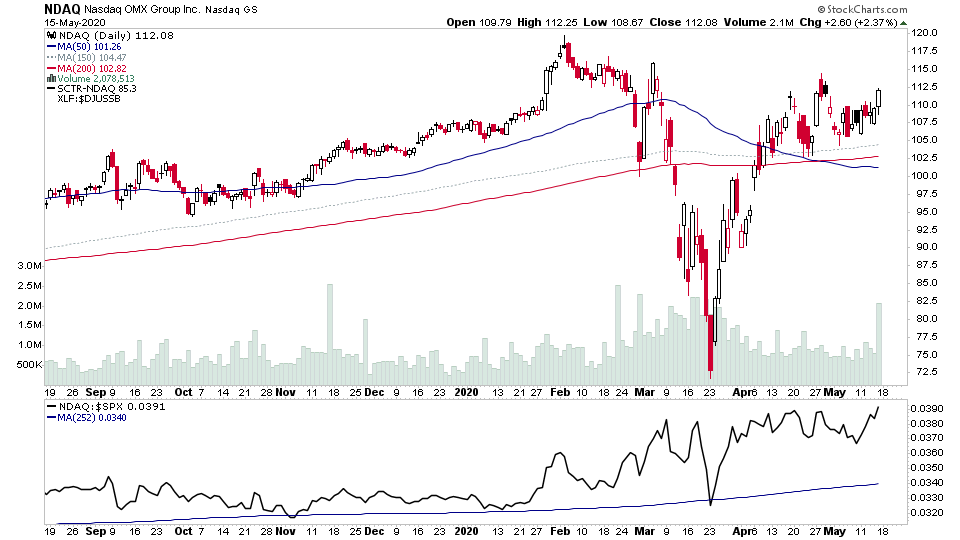

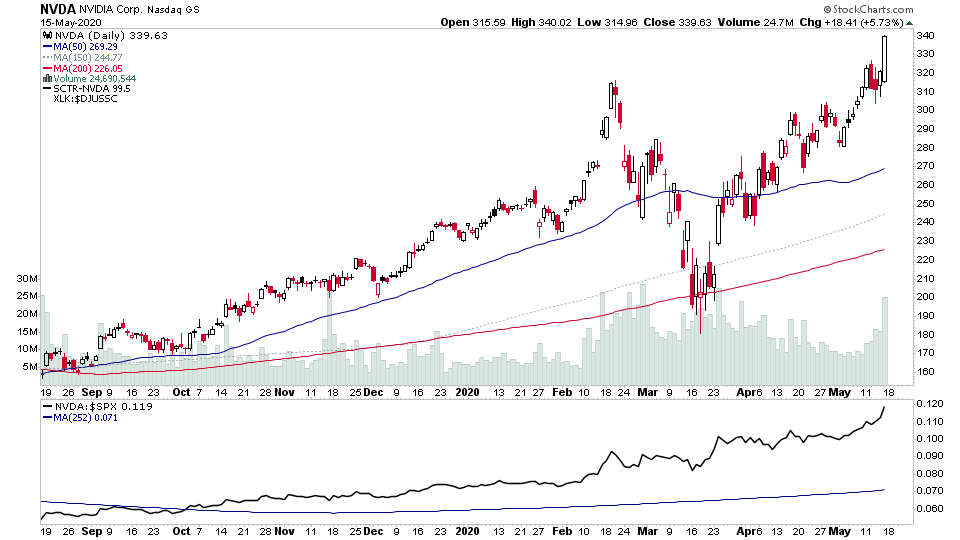

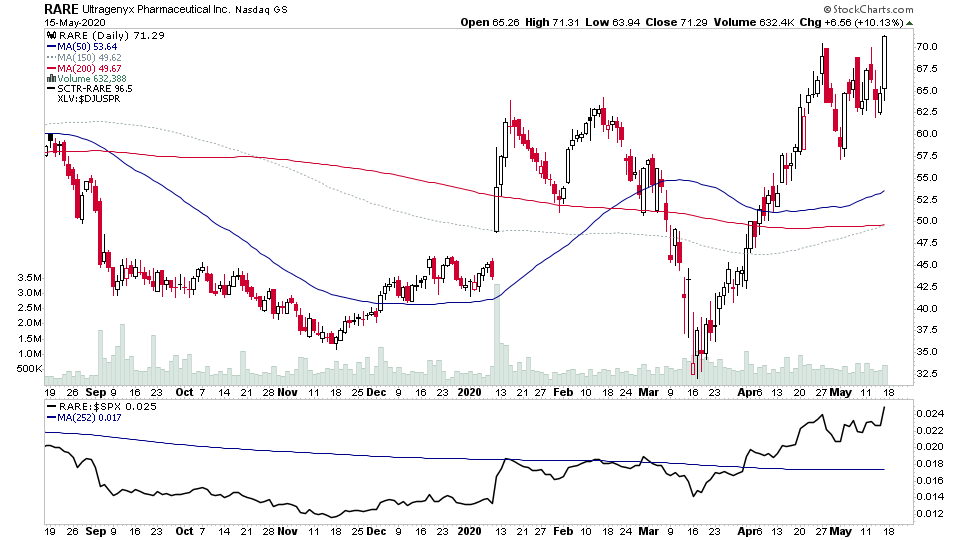

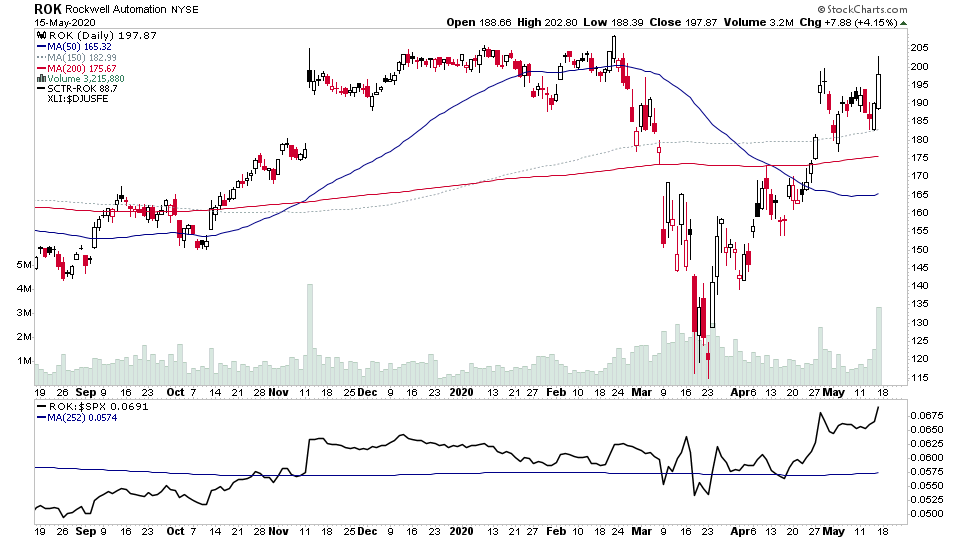

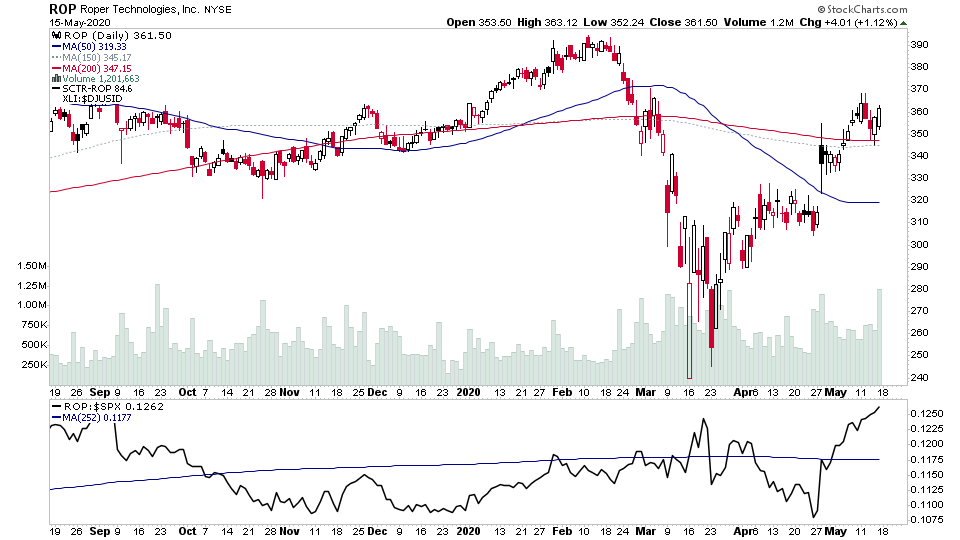

For the watchlist from the Fridays scans - AG, AGQ, AMGN, AU, BTG, CDE, CIEN, DBX, DPZ, ECL, FNV, FSM, HL, MAG, MOH, NDAQ, NVDA, PAAS, RARE, ROK, ROP, SA, SAND, SIL, SILV, SLV, SNDX, SSRM, SVM, UNH, VGZ

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.