Major US Stock Market Indexes Update

S&P 500, Nasdaq 100, Dow Jones Industrial Average, S&P 600 Small Caps, NYSE and Nasdaq Composite,

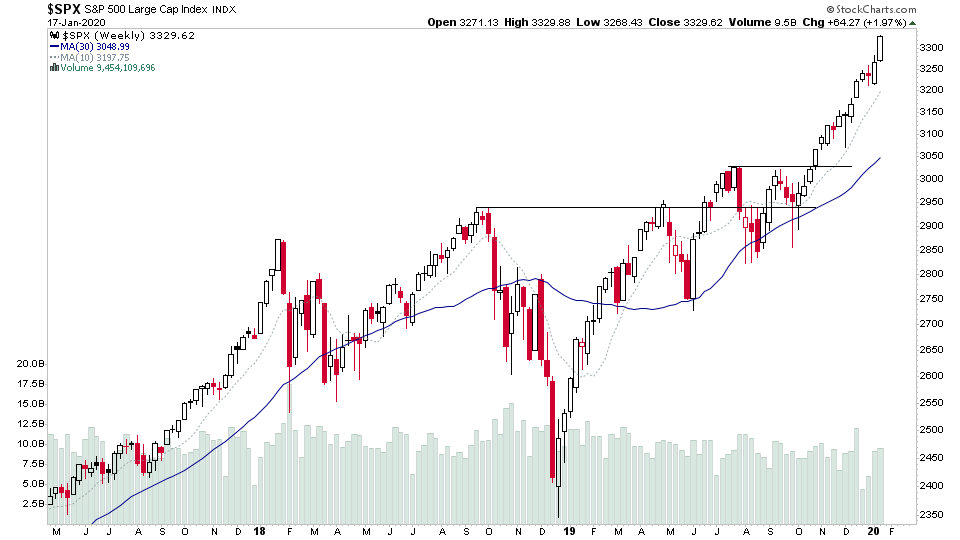

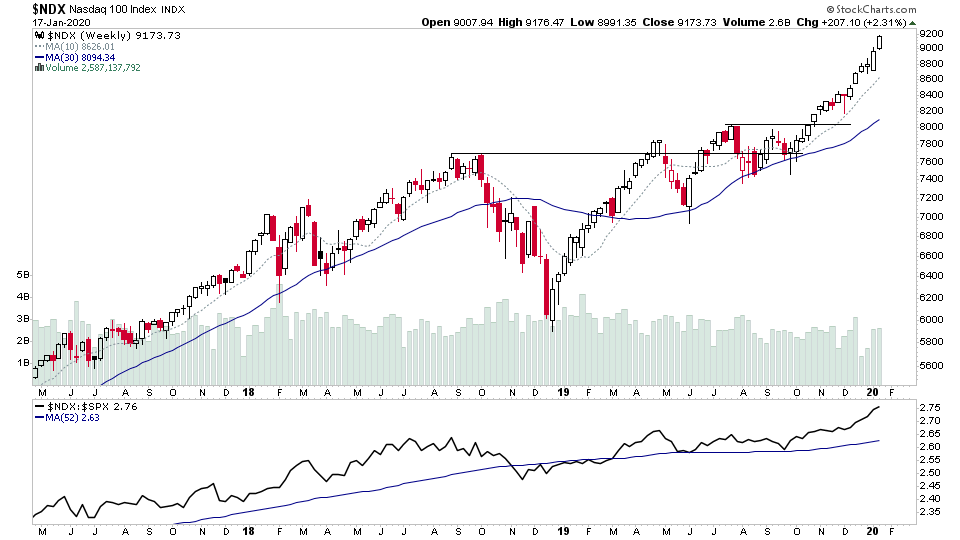

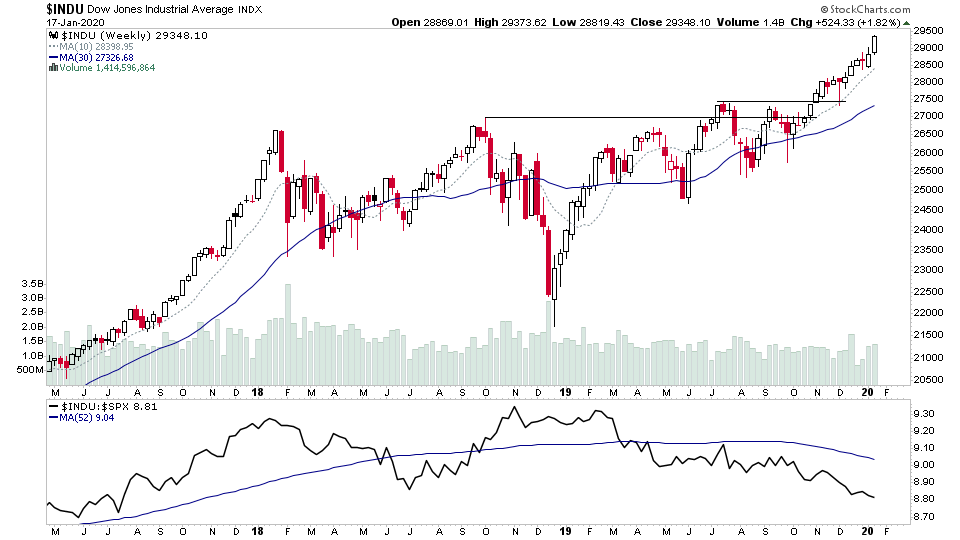

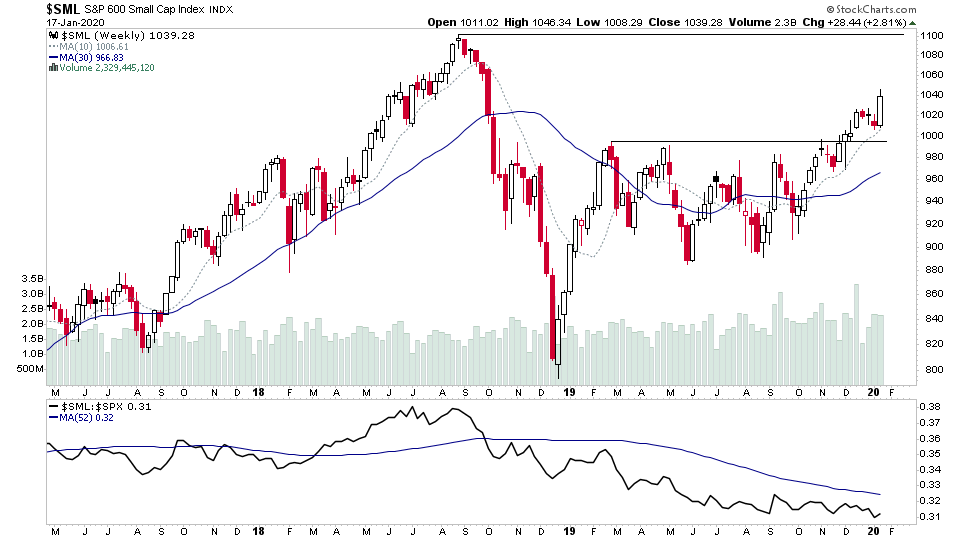

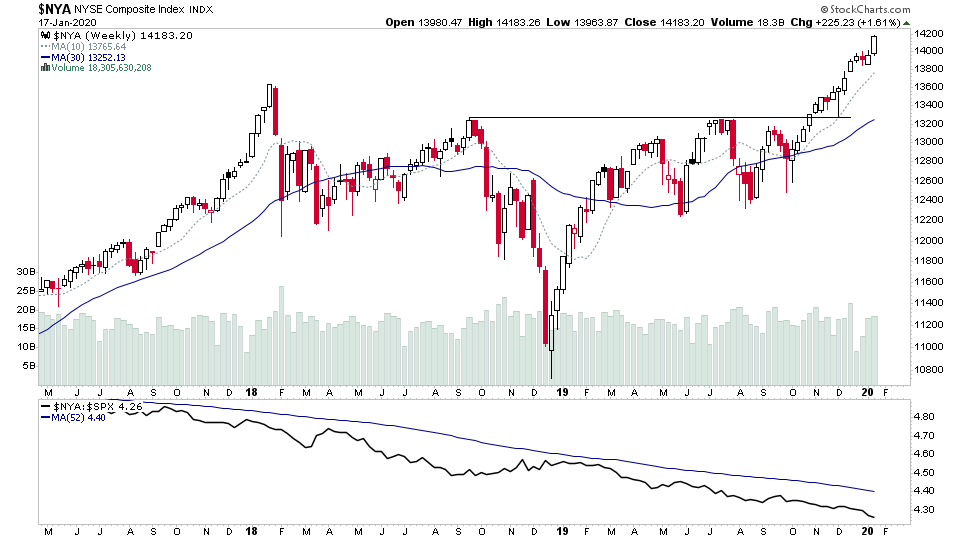

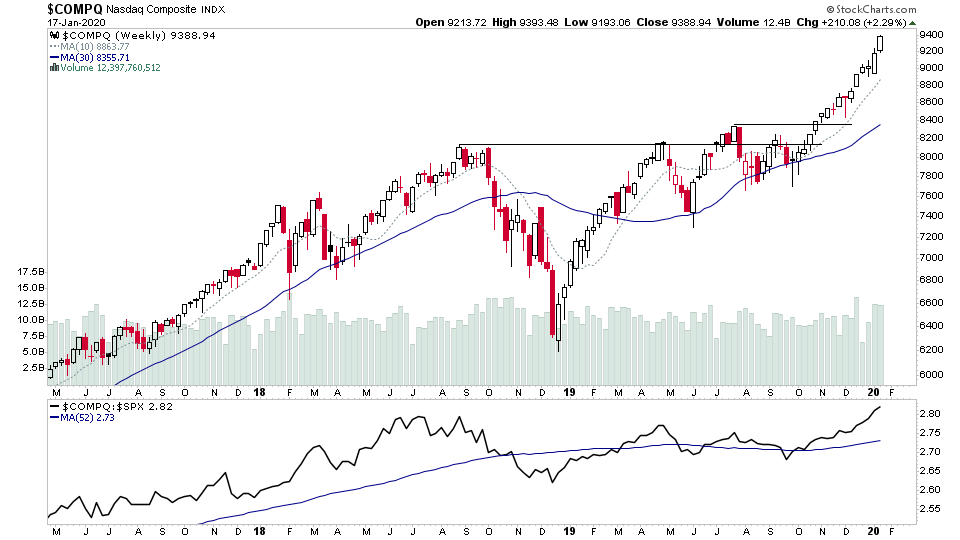

Another week, and more new highs. The major stock indexes. i.e. the S&P 500 and Nasdaq 100 continue to soar to new highs, closing the week strongly. But they are now moving out of their normal weekly range, as some have moved outside of the 3 times their average weekly range Keltner channel - which is quite rare, as around 95% of time or so the price action will trade within that range.

So, it suggests we could be due for some consolidation in due course in stocks and the indexes, as stocks don't often stay extended for long. So it might be wise to exercise some caution here, i.e. take some profits in trades that are big winners, cut weakness in stocks that are underperforming, and tighten stops etc. As the elastic band that is the stock market can only stretch so far before it needs to revert to its normal state.

Gold, Oil and Copper

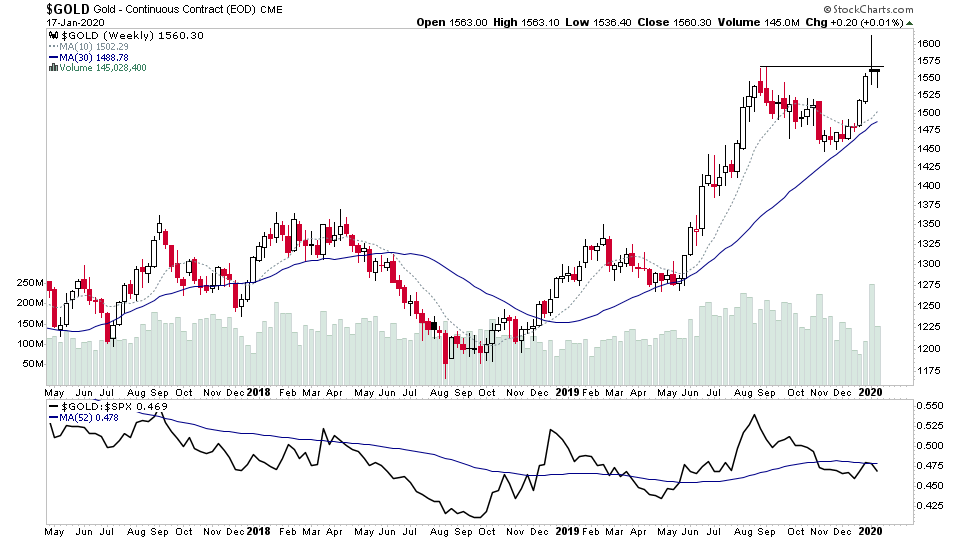

Gold rebounded back a bit this, but it closed the week just under the breakout level again, and so it may try for an early Stage 2 continuation breakout again, but it would be good to see a consolidation for a few weeks yet at least, so that it can form a handle pattern, which would give a lower risk entry point if it did break out again.

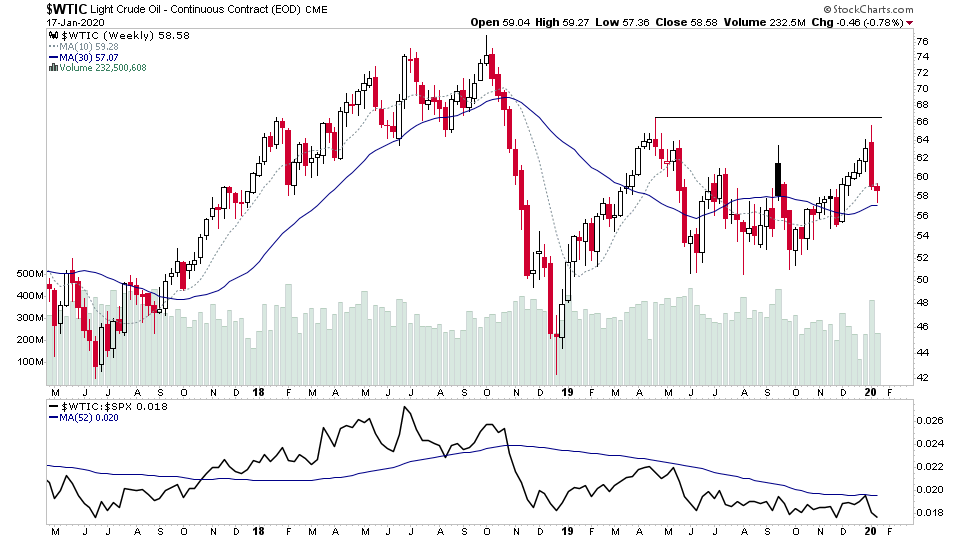

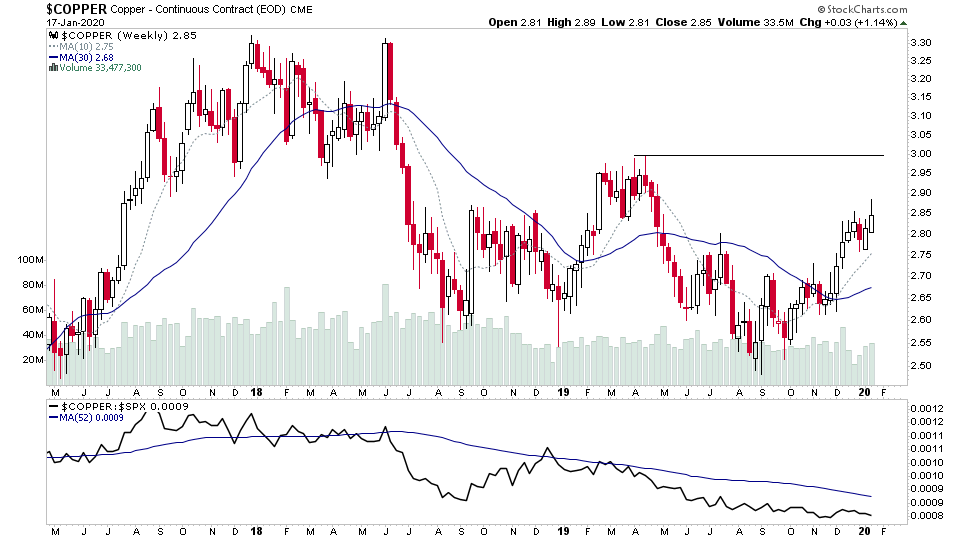

Oil had a quieter week and is just above the 30 week MA in its Stage 1 range, whereas Copper closed just below a minor breakout level within its early Stage 2 phase, as it's still below considerable resistance currently.

Stocks are running hot at the moment, with only a minor pullback in over four months. So exercise caution and focus on higher quality setups with strong relative volume.

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.