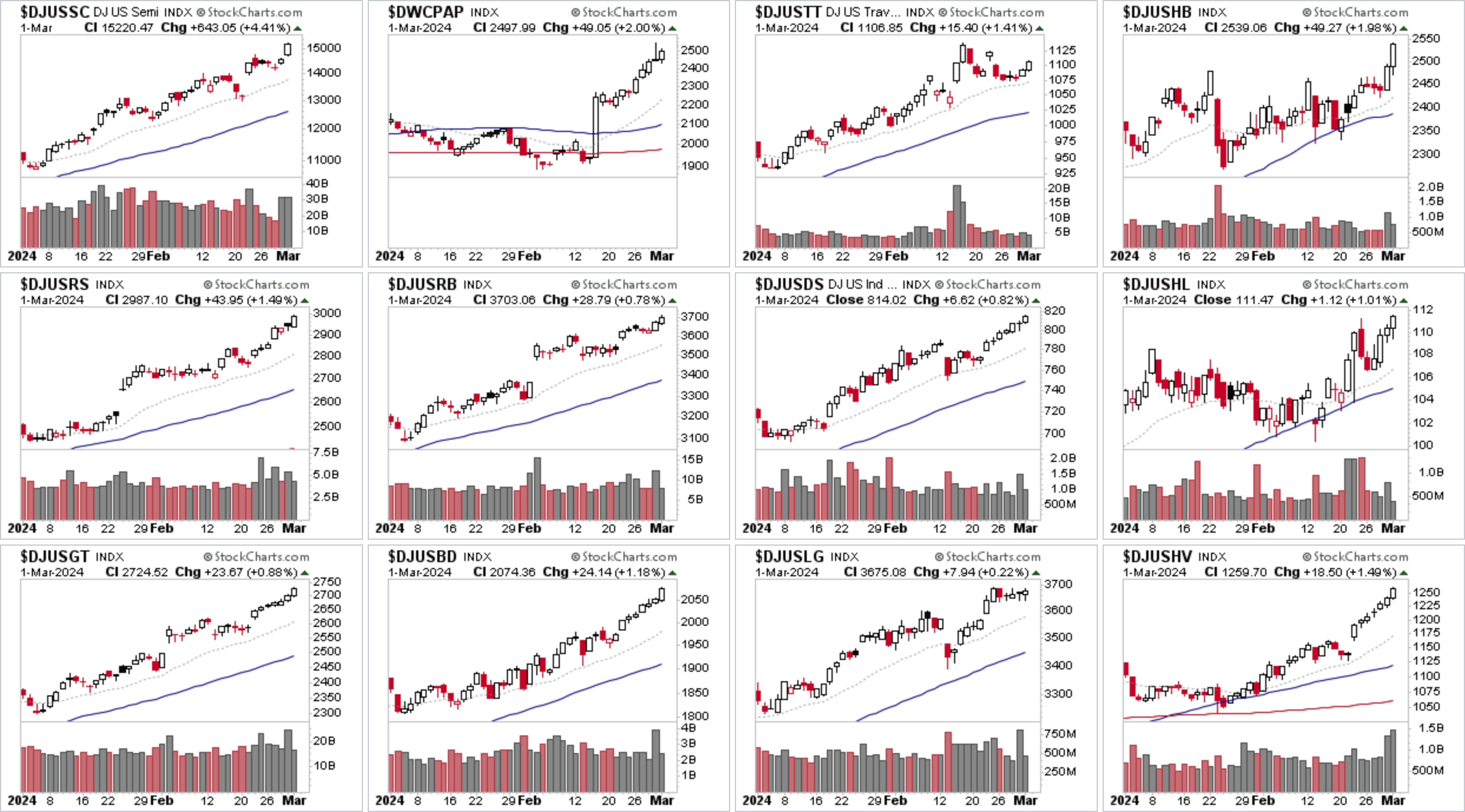

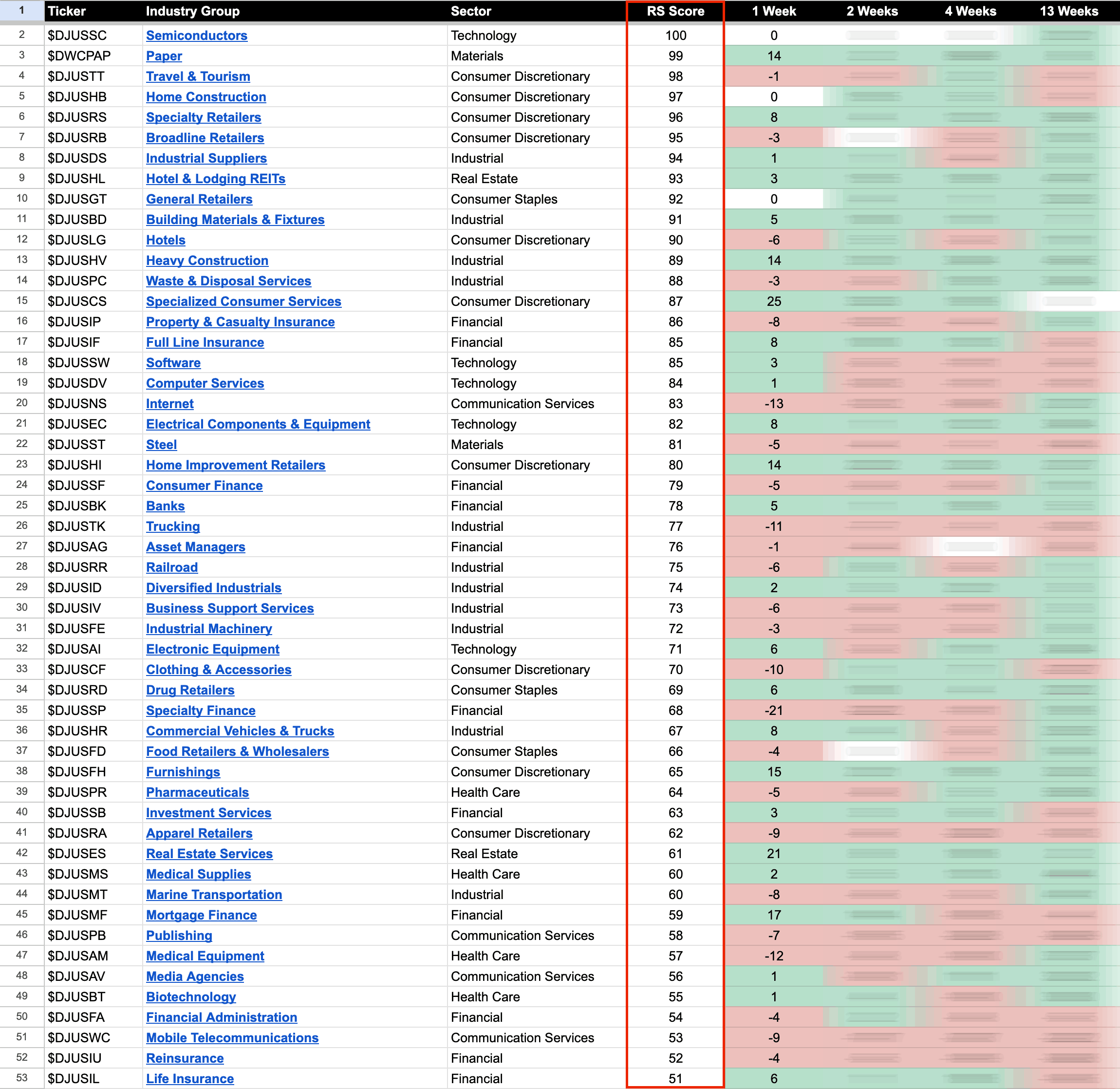

US Stocks Industry Groups Relative Strength Rankings

The full post is available to view by members only. For immediate access:

US Industry Groups by Highest RS Score

Semiconductors ($DJUSSC) continues to dominate the Industry Groups Relative Strength (RS) Rankings, with a seventh week at the top as multiple stocks in the group made continuation breakouts to new 52 week highs, including AMD, AVGO, ASML, AMAT, KLAC, LRCX and more. With group leader NVDA approaching its all time highs once more.

Specialty Retailers ($DJUSRS) was another area on the move, rising +8 RS points to 5th position overall with strong moves from CVNA, RVLV and AZO to name a few.

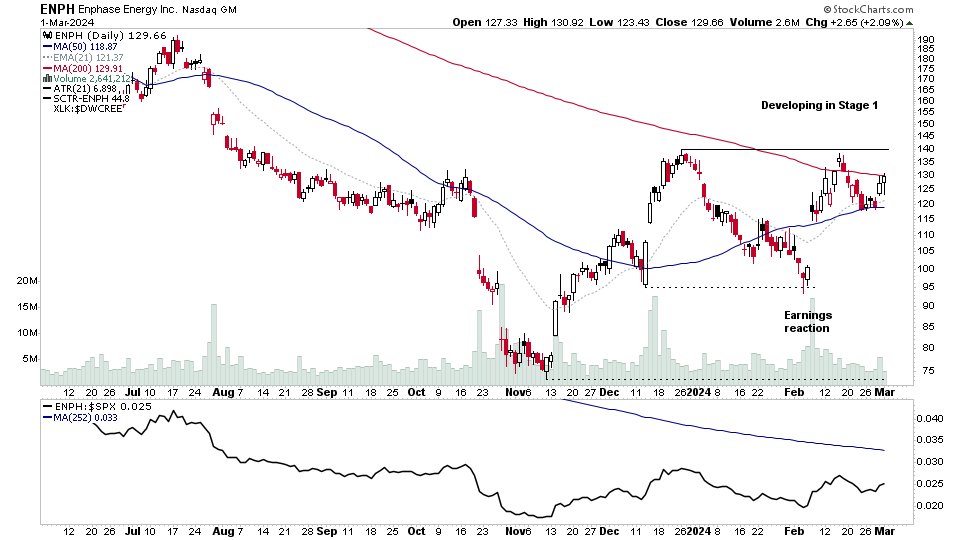

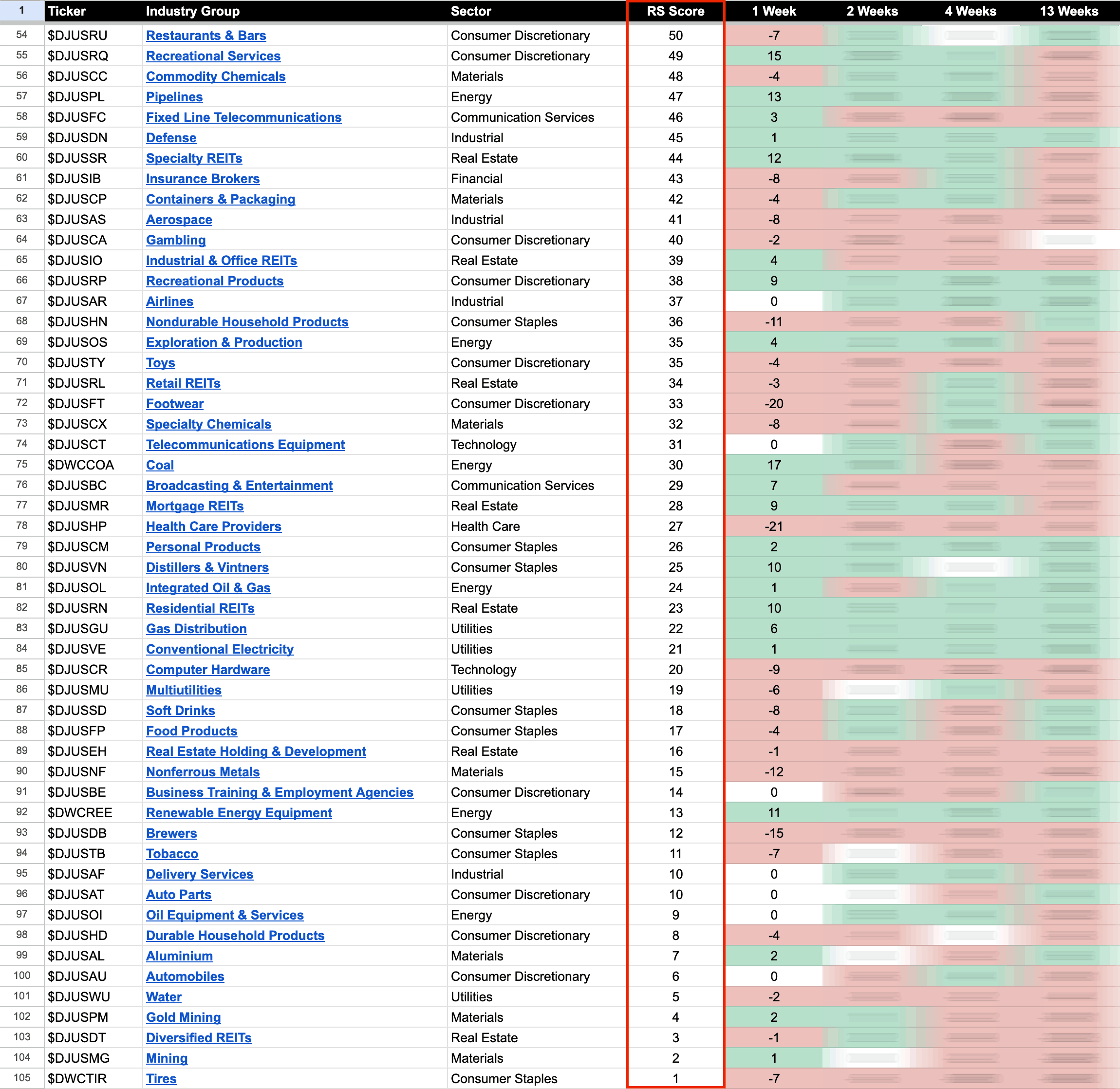

Renewable Energy Equipment ($DWCREE) was once again in focus, moving up +11 RS points from the bottom end of the rankings, as the majority of the Solar, Fuel Cell and Wind stocks had a strong week. With most continuing to develop base structures either still in late Stage 4 or early Stage 1, with a few of the group leaders more progressed in their Stages such as ENPH (Stage 1), which closed the week just under its 200 day MA and within 8% of the Stage 2 level set by the December and February highs. So its on watch for a potential early Stage 2 breakout attempt in the coming month.

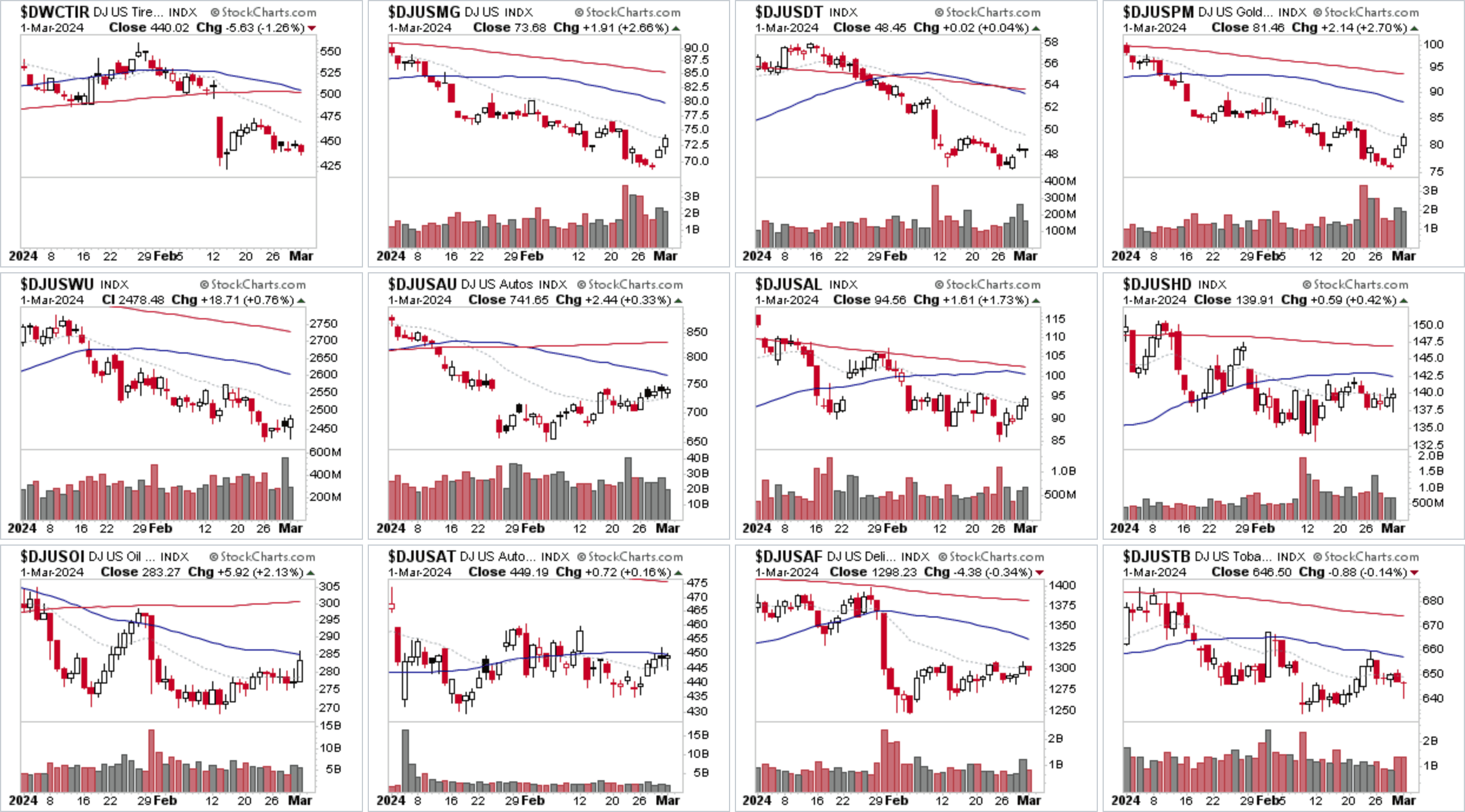

US Industry Groups by Weakest RS Score

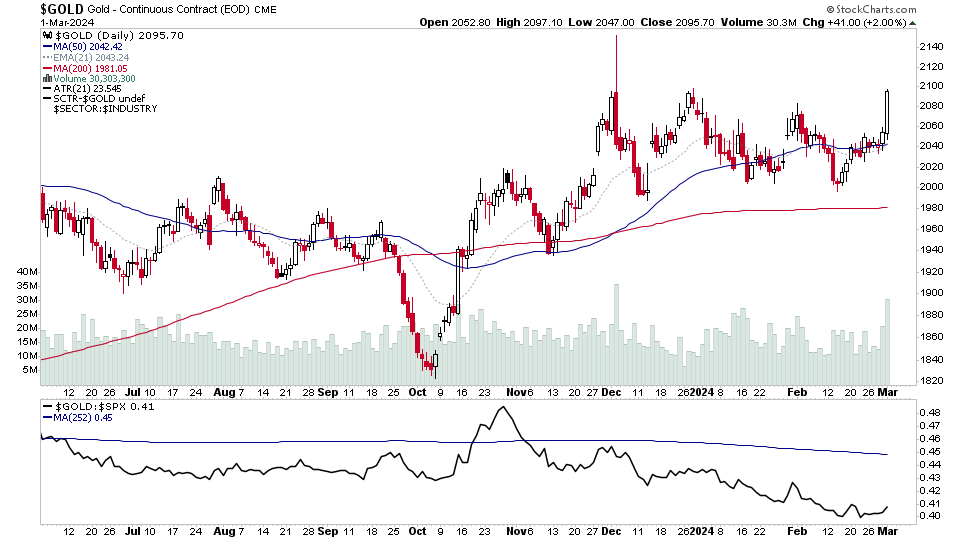

At the bottom end of the RS rankings the Gold Mining ($DJUSPM) group is an area of interest, as physical Gold futures pushes towards it highs, with potential for a new Stage 2 attempt. Whereas, the group has been severely lagging in Stage 4, and this week started to show some signs of life again. Hence, it may be a group to start looking at once more.

US Industry Groups sorted by Relative Strength

The purpose of the Relative Strength (RS) tables is to track the short, medium and long-term RS changes of the individual groups to find the new leadership earlier than the crowd.

RS Score of 100 is the strongest, and 0 is the weakest.

In the Stage Analysis method we are looking to focus on the strongest groups, as what is strong, tends to stay strong for a long time. But we also want to find the improving / up and coming groups that are starting to rise up strongly through the RS table from the lower zone, in order to find the future leading stocks before they break out from a Stage 1 base and move into a Stage 2 advancing phase.

Each week I go through the most interesting groups on the move in more detail during the Stage Analysis Members weekend video – as Industry Group analysis is a key part of Stan Weinstein's Stage Analysis method.

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.