Stage Analysis members weekend video discussing the US watchlist stocks in detail on multiple timeframes, the new Stage Analysis Technical Attributes (SATA) tool added to the site, the Significant Weekly Bars moving on volume, Industry Groups Relative Strength (RS) Rankings, IBD Industry Group Bell Curve – Bullish Percent, the key Market Breadth Charts to determine the Weight of Evidence, and the Major US Stock Market Indexes.

Read More

Blog

03 March, 2024

Stage Analysis Members Video – 3 March 2024 (1hr 13mins)

25 February, 2024

Stage Analysis Members Video – 25 February 2024 (1hr 5mins)

Stage Analysis members weekend video discussing the Significant Weekly Bars moving on volume, the US watchlist stocks in detail on multiple timeframes, Industry Groups Relative Strength (RS) Rankings, IBD Industry Group Bell Curve – Bullish Percent, the key Market Breadth Charts to determine the Weight of Evidence, and the Major US Stock Market Indexes...

Read More

11 February, 2024

Stage Analysis Members Video – 11 February 2024 (1hr 15mins)

Stage Analysis members weekend video discussing the Significant Weekly Bars, the US watchlist stocks in detail on multiple timeframes, Industry Groups Relative Strength (RS) Rankings, IBD Industry Group Bell Curve – Bullish Percent, the key Market Breadth Charts to determine the Weight of Evidence, the Futures charts and finishing with the Stages of the Major US Stock Market Indexes...

Read More

04 February, 2024

Stage Analysis Members Video – 4 February 2024 (1hr 7mins)

Stage Analysis members weekend video discussing the Stages of the Major US Stock Market Indexes, the Futures charts, Industry Groups Relative Strength (RS) Rankings, IBD Industry Group Bell Curve – Bullish Percent, the key Market Breadth Charts to determine the Weight of Evidence, Significant Weekly Bars and the most recent US watchlist stocks in detail on multiple timeframes...

Read More

28 January, 2024

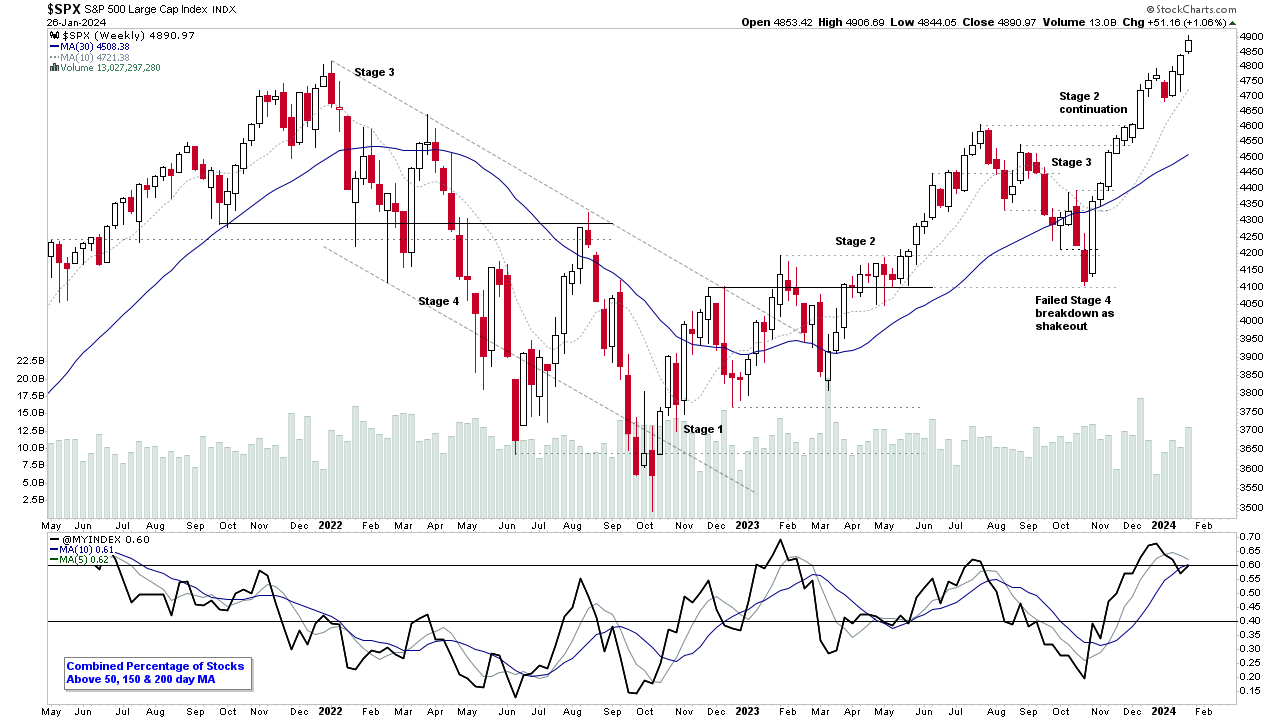

Stage Analysis Members Video – 28 January 2024 (1hr 15mins)

Stage Analysis members video discussing the Major US Stock Market Indexes, the Futures charts, Industry Groups Relative Strength (RS) Rankings, IBD Industry Group Bell Curve – Bullish Percent, the key Market Breadth Charts to determine the Weight of Evidence, Significant Weekly Bars and the most recent US watchlist stocks in detail on multiple timeframes.

Read More

21 January, 2024

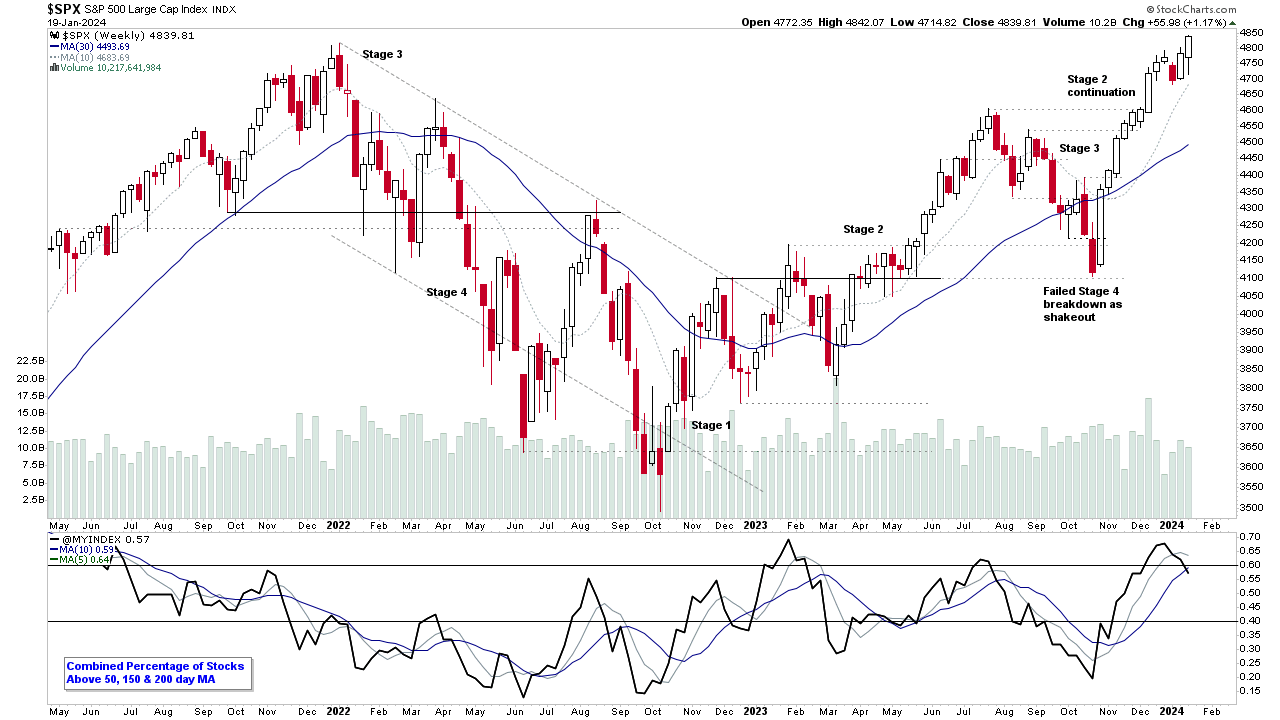

Stage Analysis Members Video – 21 January 2024 (1hr 26mins)

Stage Analysis members weekend video discussing the Major US Stock Market Indexes, the Futures charts, Industry Groups Relative Strength (RS) Rankings, IBD Industry Group Bell Curve – Bullish Percent, the key Market Breadth Charts to determine the Weight of Evidence, Significant Weekly Bars and the most recent US watchlist stocks in detail on multiple timeframes...

Read More

14 January, 2024

Stage Analysis Members Video – 14 January 2024 (59mins)

Stage Analysis members weekend video discussing the Major US Stock Market Indexes, and then in the members only content – the Futures charts, Industry Groups Relative Strength (RS) Rankings, IBD Industry Group Bell Curve – Bullish Percent, the key Market Breadth Charts to determine the Weight of Evidence, Significant Weekly Bars and the most recent US watchlist stocks in detail on multiple timeframes.

Read More

10 January, 2024

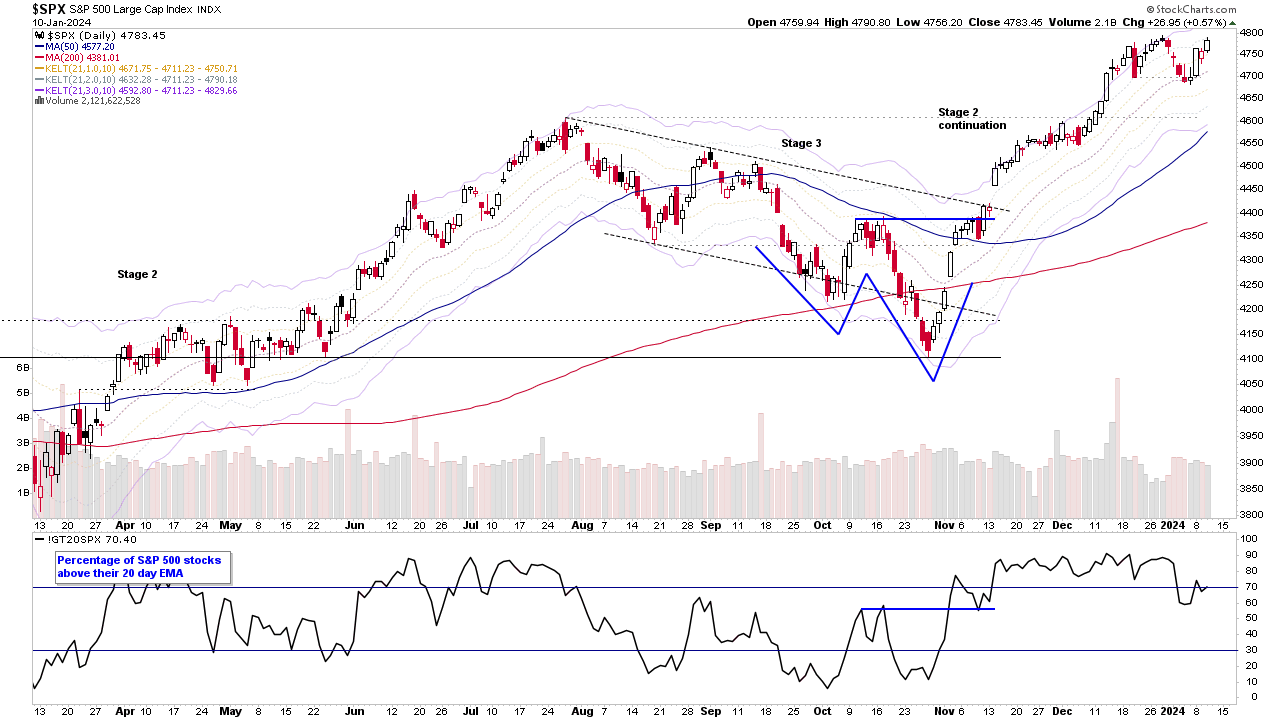

Stage Analysis Members Video – 10 January 2024 (49mins)

Stage Analysis midweek video discussing of the major US stock market indexes, short-term market breadth measures, plus a look at Bitcoin and some of the major Altcoins now that the spot Bitcoin ETFs have been approved, and finishing with discussion of the most recent watchlist stocks on multiple timeframes.

Read More

07 January, 2024

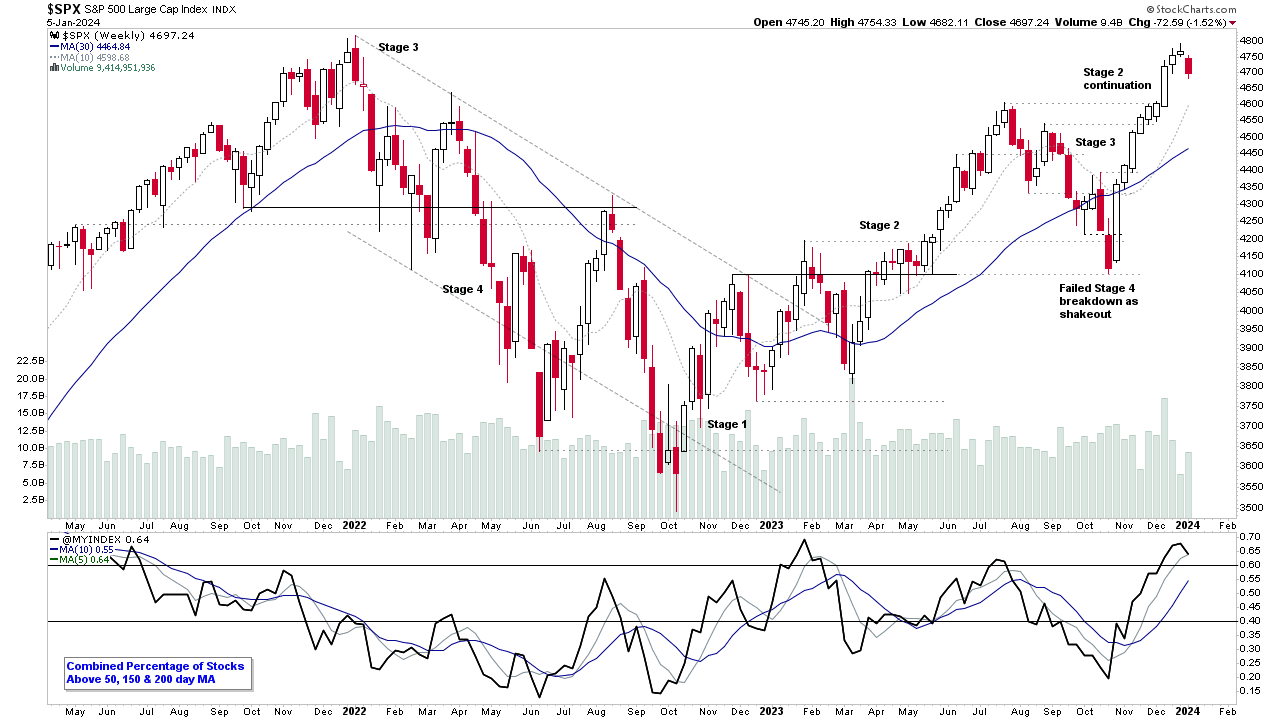

Stage Analysis Members Video – 7 January 2024 (1hr)

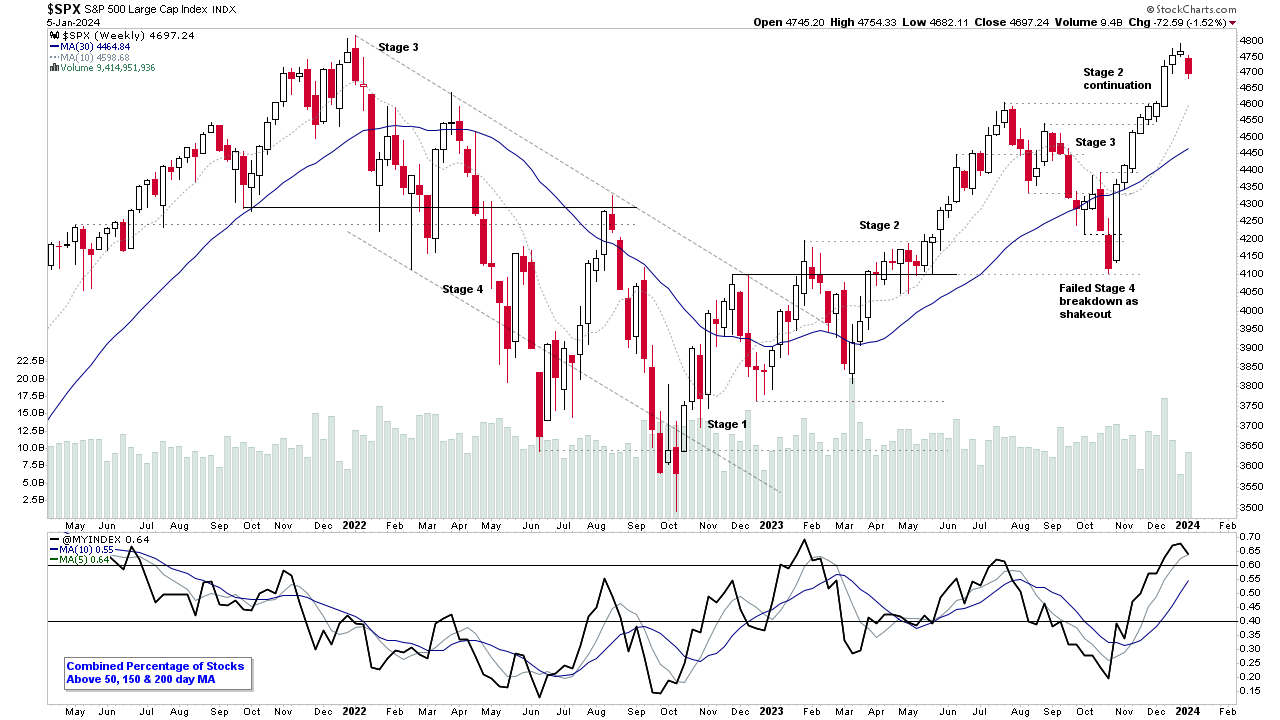

Stage Analysis members video discussing the Major US Stock Market Indexes, Futures charts, Industry Groups Relative Strength (RS) Rankings, IBD Industry Group Bell Curve – Bullish Percent, the key Market Breadth Charts to determine the Weight of Evidence, Significant Weekly Bars and the most recent US watchlist stocks in detail on multiple timeframes.

Read More

01 January, 2024

Stage Analysis Members Video – 1 January 2024 (1hr)

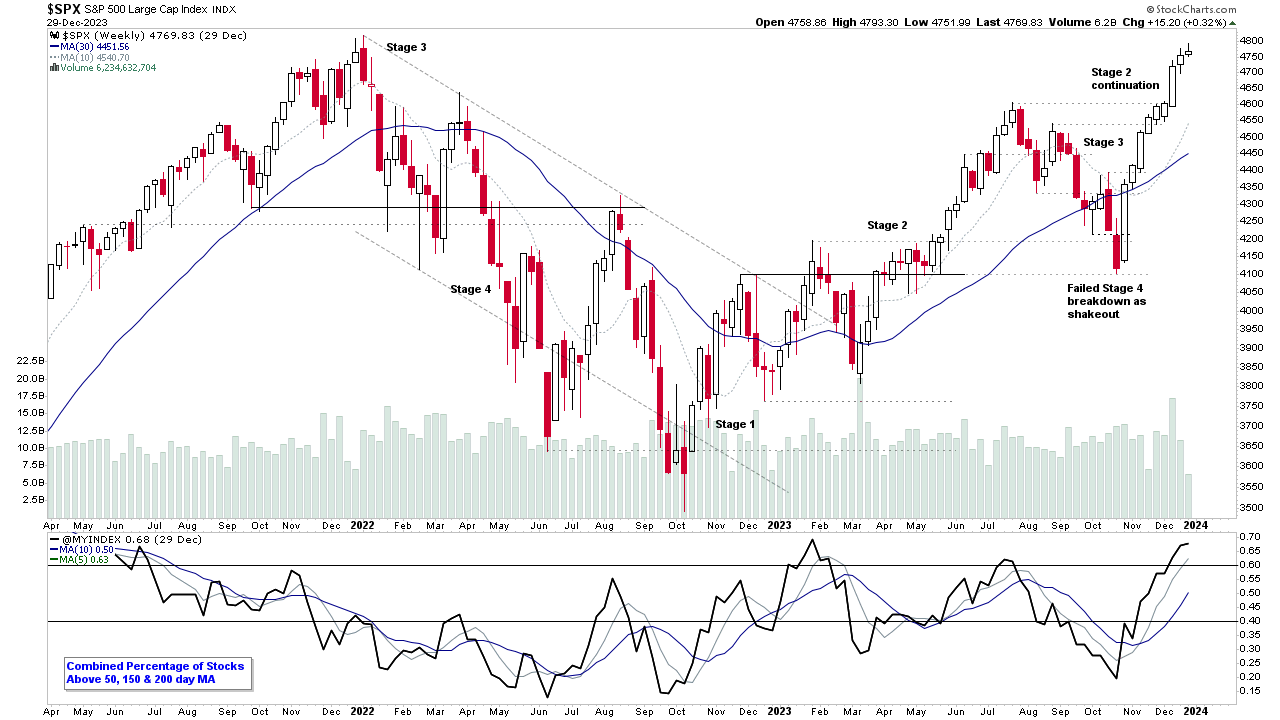

Stage Analysis members video discussing the Major US Stock Market Indexes, Futures charts, Industry Groups Relative Strength (RS) Rankings, IBD Industry Group Bell Curve – Bullish Percent, the key Market Breadth Charts to determine the Weight of Evidence, Bitcoin and Ethereum Stages and the most recent US watchlist stocks in detail on multiple timeframes.

Read More