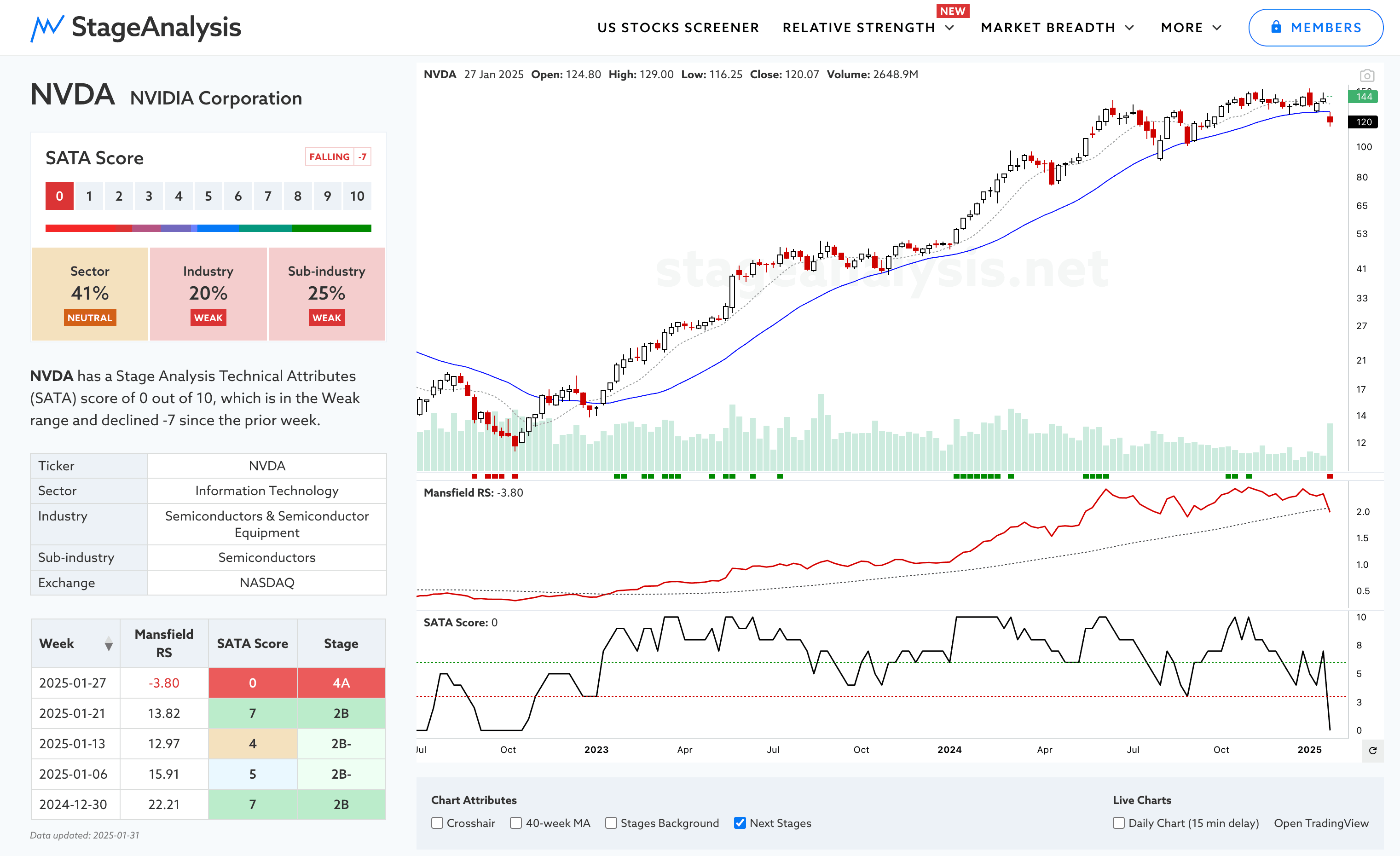

This weeks video starts with a discussion of NVDA, as it made its first Stage 4A breakdown attempt in multiple years. Followed by how to use the new screener filters to find stocks in similar positions to what I show in the US Watchlist Stocks posts each week...

Read More

Blog

02 February, 2025

Stage Analysis Members Video – 2 February 2025 (1hr 13mins)

05 January, 2025

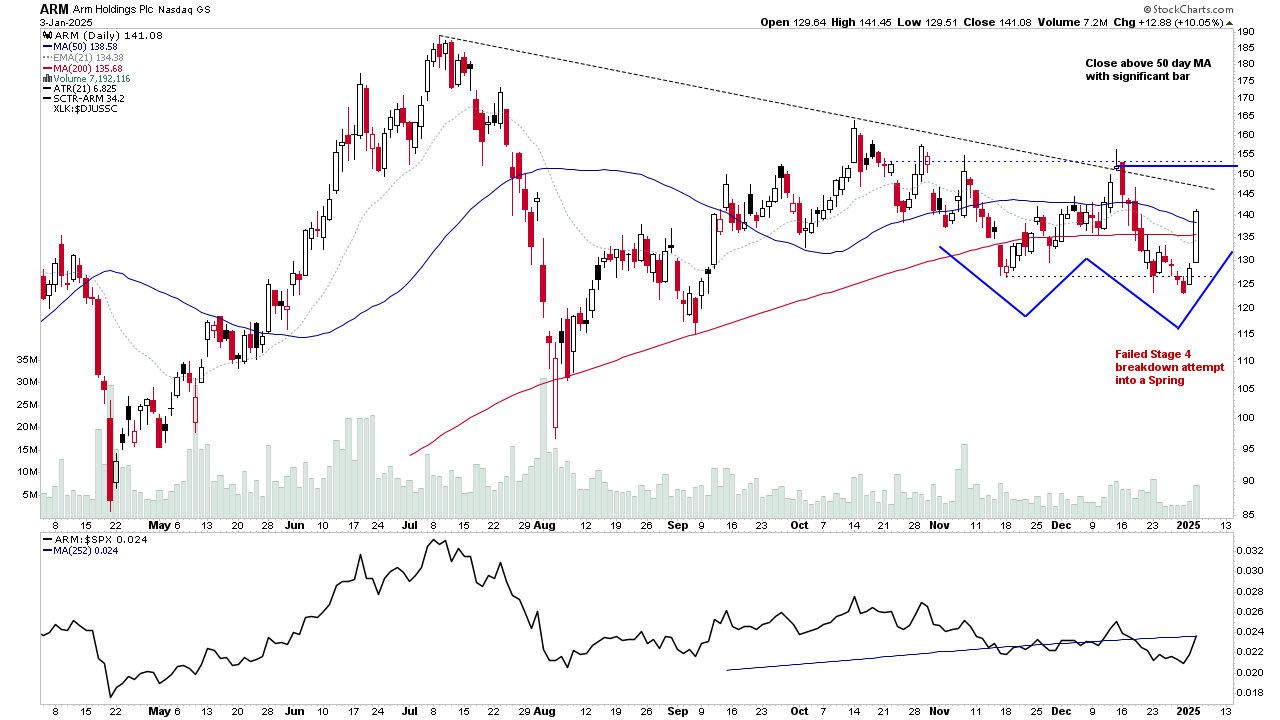

Stage Analysis Members Video – 5 January 2025 (57mins)

Stage Analysis members video starting with a look at the US Watchlist Stocks in detail on multiple timeframes, the Sector breadth and Sub-industries Bell Curves, the key Market Breadth Charts to determine the Weight of Evidence, Bitcoin & Ethereum and the Major US Stock Market Indexes Update.

Read More

29 December, 2024

Stage Analysis Members Video – 29 December 2024 (54mins)

Stage Analysis members video discussing the US Watchlist Stocks in detail on multiple timeframes, the Sector breadth and Sub-industries Bell Curves, the key Market Breadth Charts to determine the Weight of Evidence, Bitcoin & Ethereum and the Major US Stock Market Indexes Update.

Read More

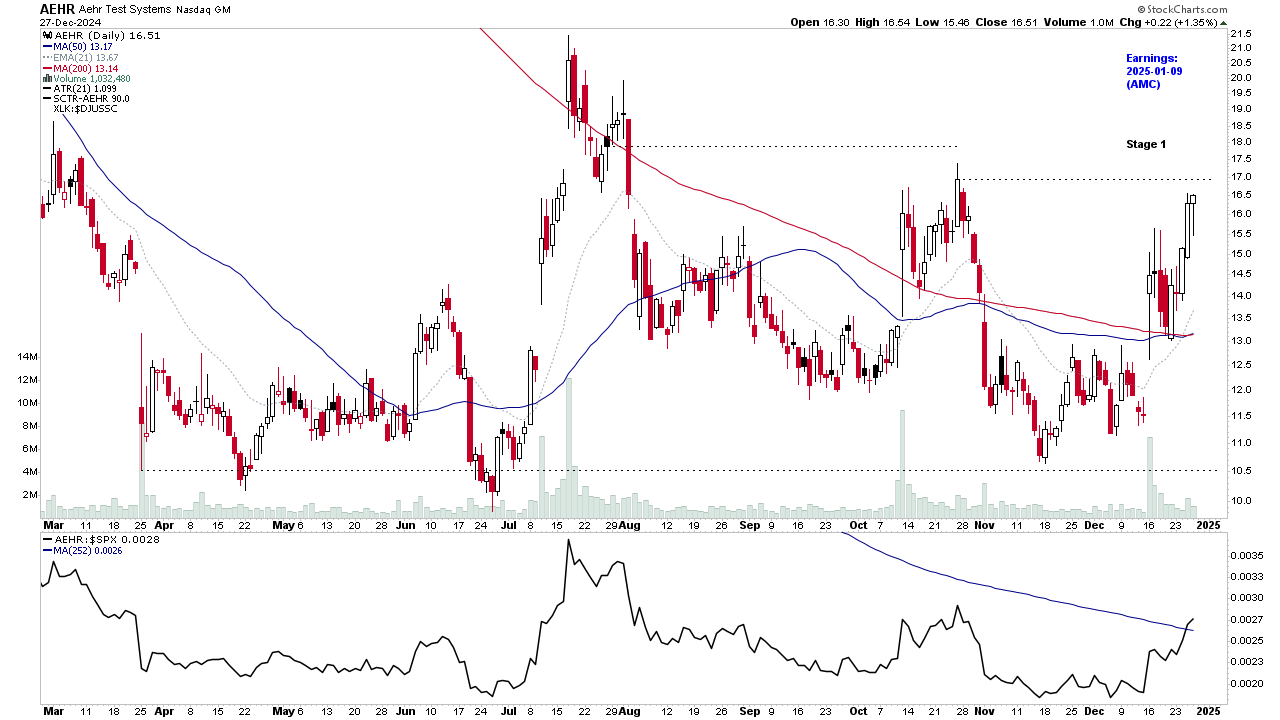

22 December, 2024

Stage Analysis Members Video – 22 December 2024 (1hr 11mins)

Stage Analysis members video discussing the US Watchlist Stocks in detail on multiple timeframes, the Sector breadth and Sub-industries Bell Curves, the key Market Breadth Charts to determine the Weight of Evidence, the Significant Bars, Bitcoin & Ethereum and the Major US Stock Market Indexes Update.

Read More

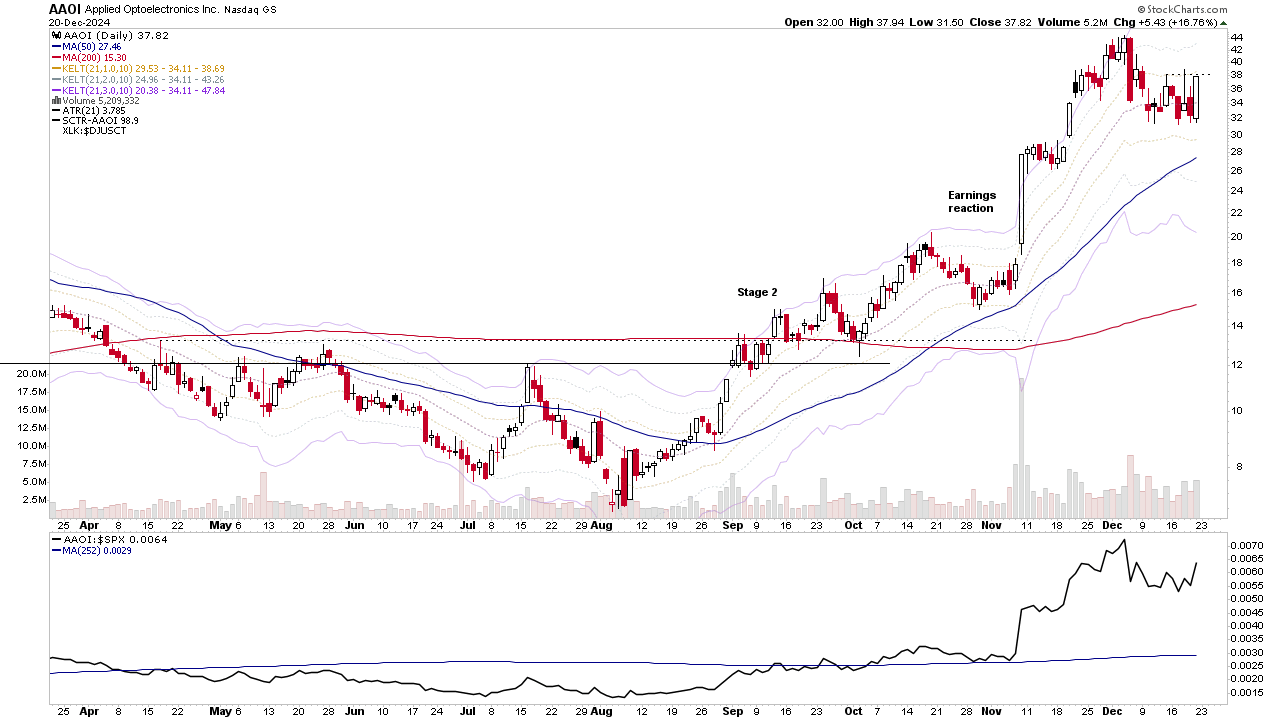

15 December, 2024

Stage Analysis Members Video – 15 December 2024 (59mins)

Stage Analysis members video discussing the Significant Bars, then the US Watchlist Stocks in detail on multiple timeframes, the Sector breadth and Sub-industries Bell Curves, the key Market Breadth Charts to determine the Weight of Evidence, Bitcoin & Ethereum and the Major US Stock Market Indexes Update.

Read More

08 December, 2024

Stage Analysis Members Video – 8 December 2024 (1hr 3mins)

Stage Analysis members video discussing the US Watchlist Stocks in detail on multiple timeframes, the Sector breadth and Sub-industries Bell Curves, the key Market Breadth Charts to determine the Weight of Evidence, the Significant Bars, Bitcoin & Ethereum and the Major US Stock Market Indexes Update.

Read More

01 December, 2024

Stage Analysis Members Video – 1 December 2024 (49mins)

Stage Analysis members video discussing the US Watchlist Stocks in detail on multiple timeframes, the Sector breadth and Sub-industries Bell Curves, the key Market Breadth Charts to determine the Weight of Evidence, the Significant Bars and the Major US Stock Market Indexes Update.

Read More

24 November, 2024

Stage Analysis Members Video – 24 November 2024 (58mins)

Stage Analysis members video beginning with a discussion of the weeks Significant Bars, the US Watchlist Stocks in detail on multiple timeframes, the Sector breadth and Sub-industries Bell Curves, the key Market Breadth Charts to determine the Weight of Evidence, the major Crypto Coins and the Major US Stock Market Indexes Update.

Read More

17 November, 2024

Stage Analysis Members Video – 17 November 2024 (1hr 1min)

Stage Analysis members video discussing the weeks Significant Bars, the US Watchlist Stocks in detail on multiple timeframes, the Sector breadth and Sub-industries Bell Curves, the key Market Breadth Charts to determine the Weight of Evidence, and the Major US Stock Market Indexes Update.

Read More

10 November, 2024

Stage Analysis Members Video – 10 November 2024 (1hr 12mins)

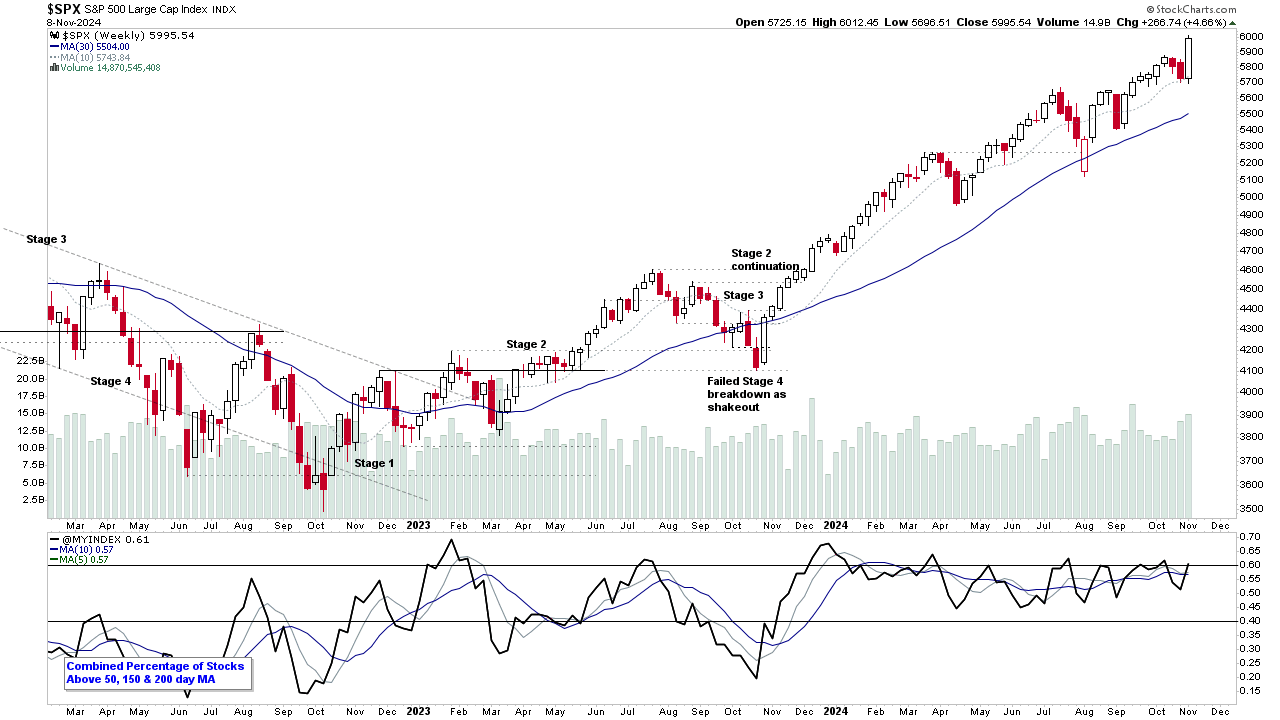

Stage Analysis members video discussing the large amount of Significant Bars this week, plus the US Watchlist Stocks in detail on multiple timeframes, the Sector breadth and Sub-industries Bell Curves, the key Market Breadth Charts to determine the Weight of Evidence, Bitcoin and Ethereum both Stage 2 again, and the Major US Stock Market Indexes Update.

Read More