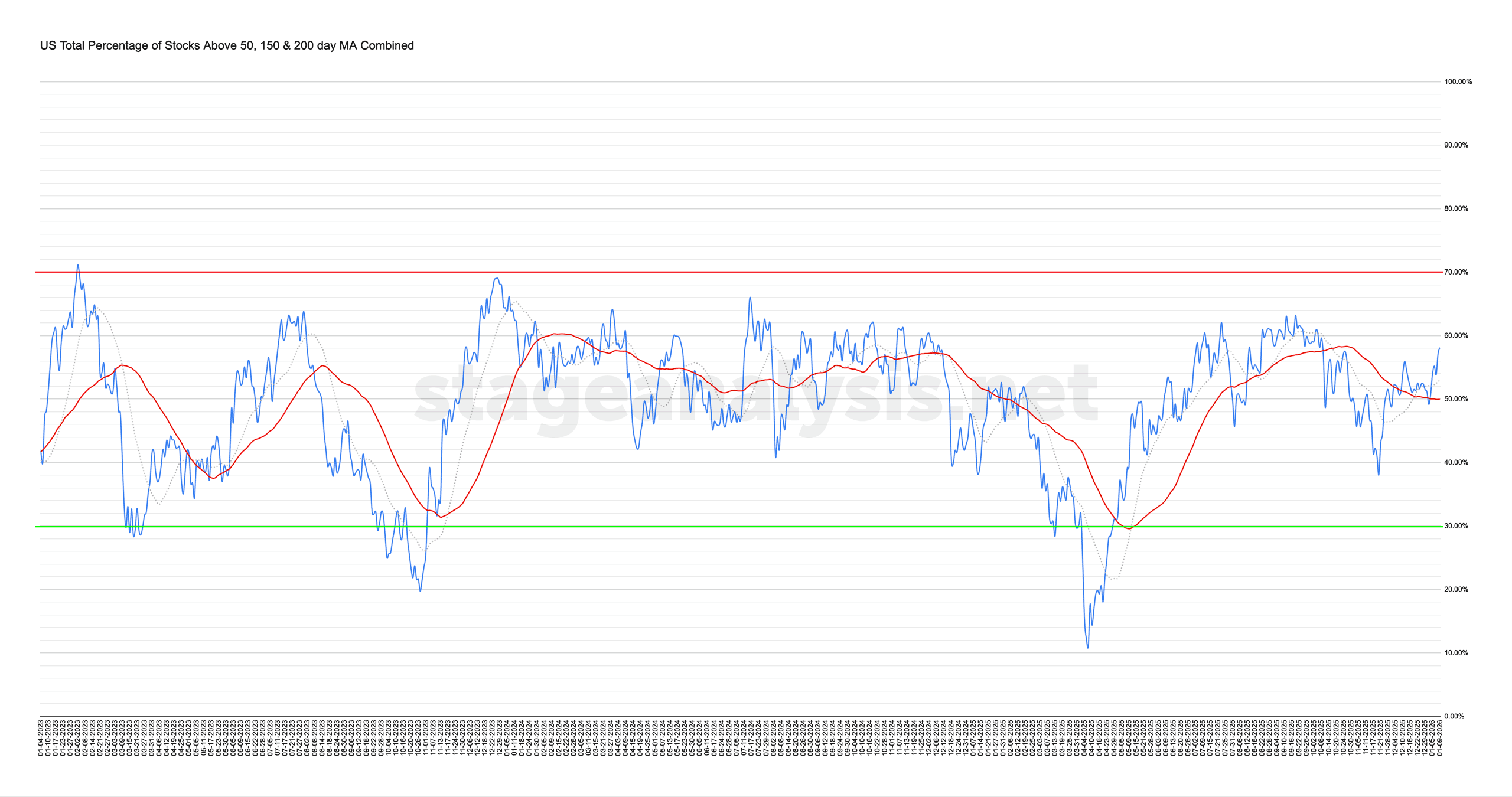

The US Total Percentage of Stocks above their 50 Day, 150 Day & 200 Day Moving Averages (shown above) increased by +7.39% this week. Therefore, the overall combined average is at 58.12% in the US market (NYSE and Nasdaq markets combined) above their short, medium and long term moving averages.

Read More

Blog

09 January, 2026

US Stocks Watchlist – 9 January 2026

There were 23 stocks highlighted from the US stocks watchlist scans today...

Read More

04 January, 2026

Stage Analysis Members Video – 4 January 2026 (58mins)

The Stage Analysis members video begins with a discussion of the latest US Watchlist Stocks in detail on multiple timeframes, Stage 2 Breakout attempts, Stages Summary, the Sector breadth and Sub-industries Bell Curves, Relative Strength Rankings, the key Market Breadth Charts to determine the Weight of Evidence, Bitcoin & Ethereum, the Major US Stock Market Indexes and ETF Summary.

Read More

02 January, 2026

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

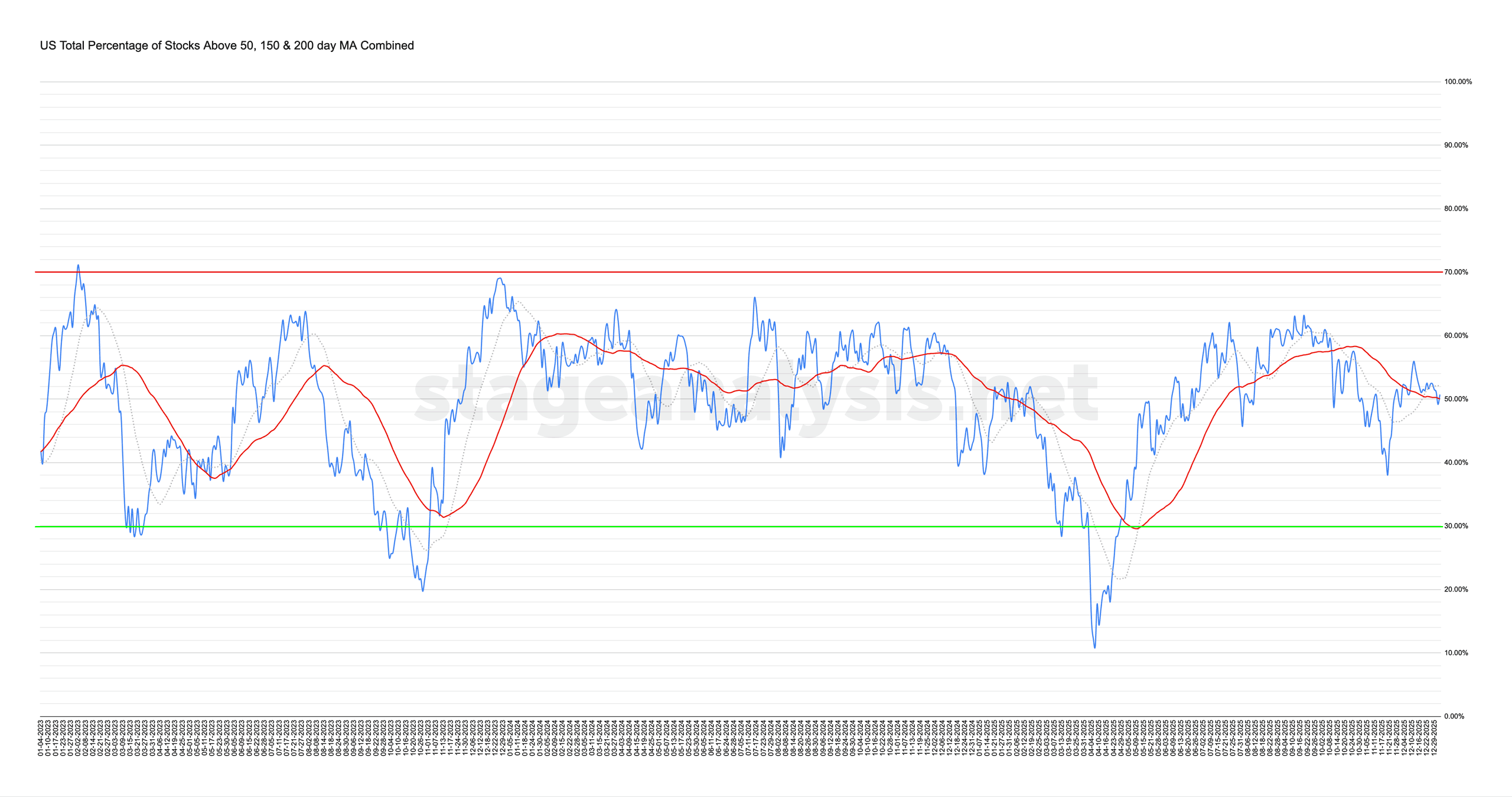

The US Total Percentage of Stocks above their 50 Day, 150 Day & 200 Day Moving Averages (shown above) decreased by -1.67% this week. Therefore, the overall combined average is at 50.72% in the US market (NYSE and Nasdaq markets combined) above their short, medium and long term moving averages.

Read More

28 December, 2025

Stage Analysis Members Video – 28 December 2025 (42mins)

The Stage Analysis members video discussing the latest US Watchlist Stocks in detail on multiple timeframes, Stage 2 Breakout attempts, Stages Summary, the Sector breadth and Sub-industries Bell Curves, Relative Strength Rankings, the key Market Breadth Charts to determine the Weight of Evidence, Bitcoin & Ethereum, the Major US Stock Market Indexes and ETF Summary.

Read More

21 December, 2025

Stage Analysis Members Video – 21 December 2025 (1hr 2mins)

The Stage Analysis members video starting with a discussion of the latest US Watchlist Stocks in detail on multiple timeframes, Stage 2 Breakout attempts, Stages Summary, the Sector breadth and Sub-industries Bell Curves, Relative Strength Rankings, the key Market Breadth Charts to determine the Weight of Evidence, Bitcoin & Ethereum, the Major US Stock Market Indexes and ETF Summary.

Read More

20 December, 2025

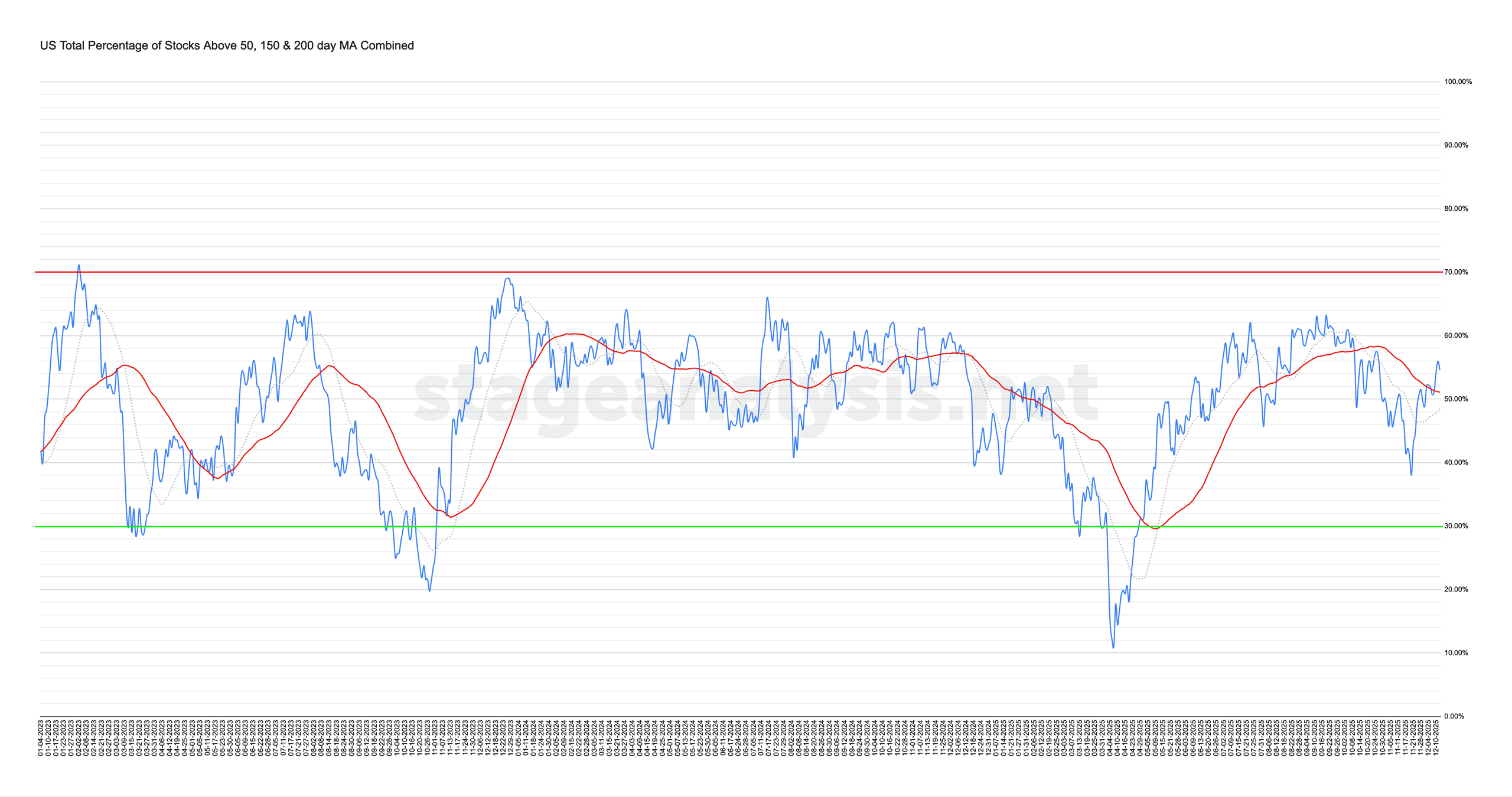

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

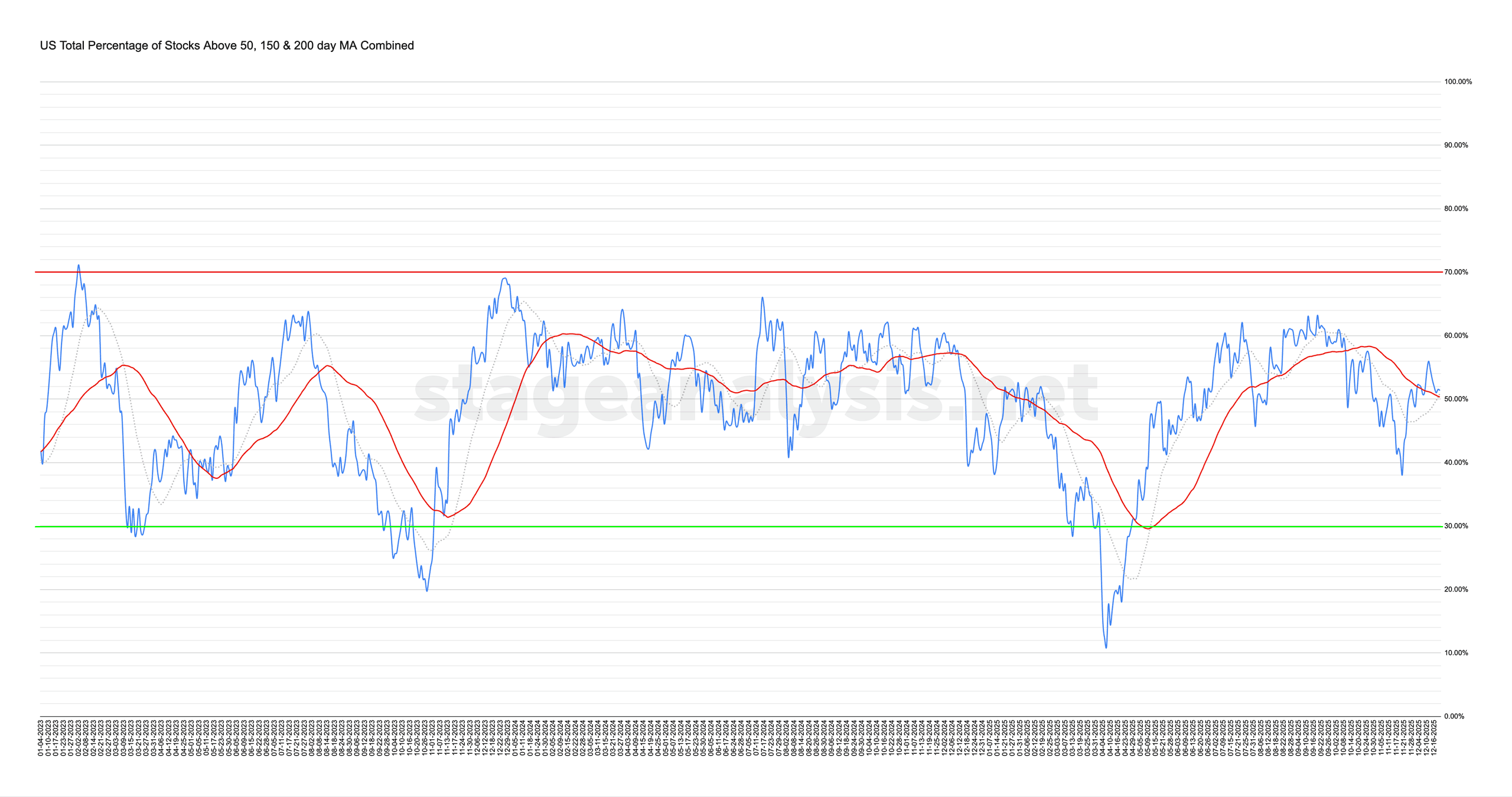

The US Total Percentage of Stocks above their 50 Day, 150 Day & 200 Day Moving Averages (shown above) decreased by -3.20% this week. Therefore, the overall combined average is at 51.35% in the US market (NYSE and Nasdaq markets combined) above their short, medium and long term moving averages.

Read More

19 December, 2025

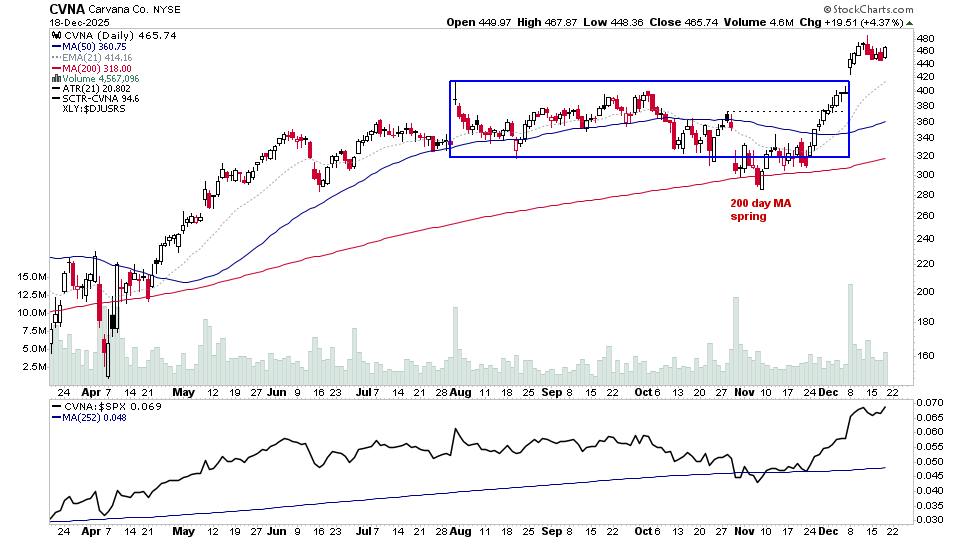

US Stocks Watchlist – 19 December 2025

There were 21 stocks highlighted from the US stocks watchlist scans today...

Read More

14 December, 2025

Stage Analysis Members Video – 14 December 2025 (59mins)

The Stage Analysis members video beginning with a discussion of the latest US Watchlist Stocks in detail on multiple timeframes, Stage 2 Breakout attempts, Stages Summary, the Sector breadth and Sub-industries Bell Curves, Relative Strength Rankings, the key Market Breadth Charts to determine the Weight of Evidence, Bitcoin & Ethereum, the Major US Stock Market Indexes and ETF Summary.

Read More

13 December, 2025

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

The US Total Percentage of Stocks above their 50 Day, 150 Day & 200 Day Moving Averages (shown above) increased by +2.70% this week. Therefore, the overall combined average is at 54.56% in the US market (NYSE and Nasdaq markets combined) above their short, medium and long term moving averages.

Read More