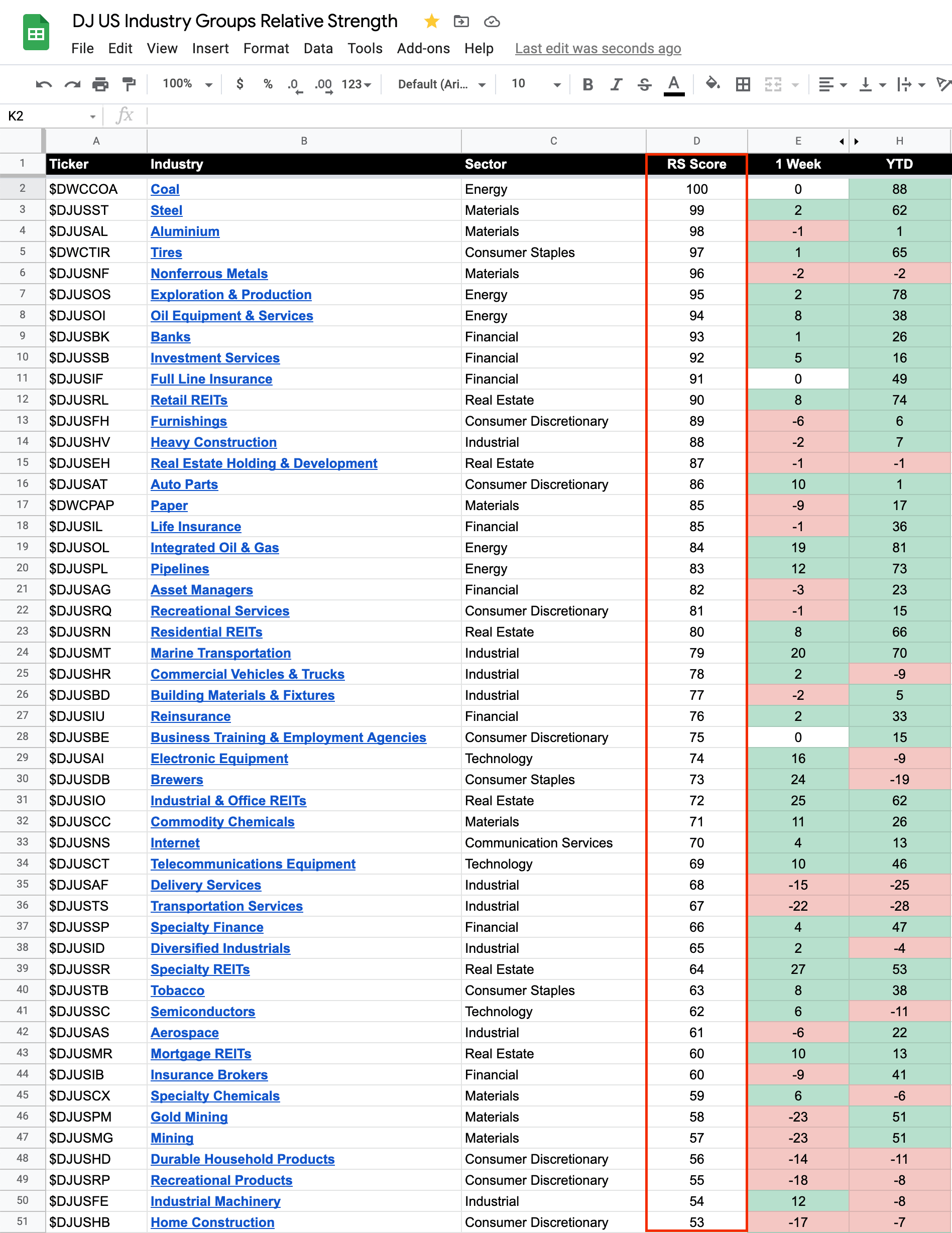

104 Dow Jones Sector Industry Groups sorted by Relative Strength

104 Dow Jones Sector Industry Groups sorted by Relative Strength. Purpose is to track RS changes across the groups each week using stockcharts SCTR rating.

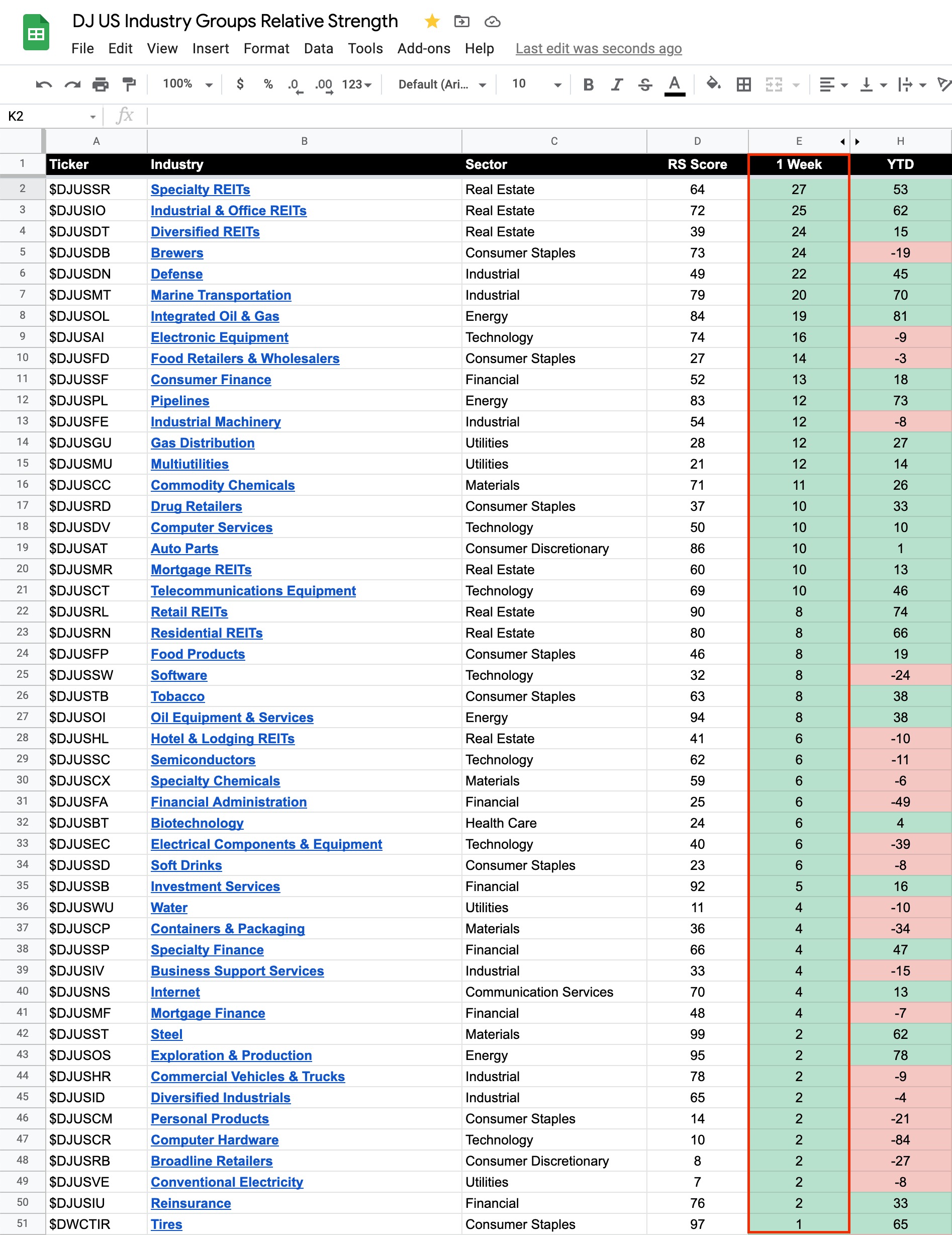

The top 10 risers this week were:

1. Specialty REITs

2. Industrial & Office REITs

3. Diversified REITs

4. Brewers

5. Defense

6. Marine Transportation

7. Integrated Oil & Gas

8. Electronic Equipment

9. Food Retailers & Wholesalers

10. Consumer Finance

So top 3 were in Real Estate

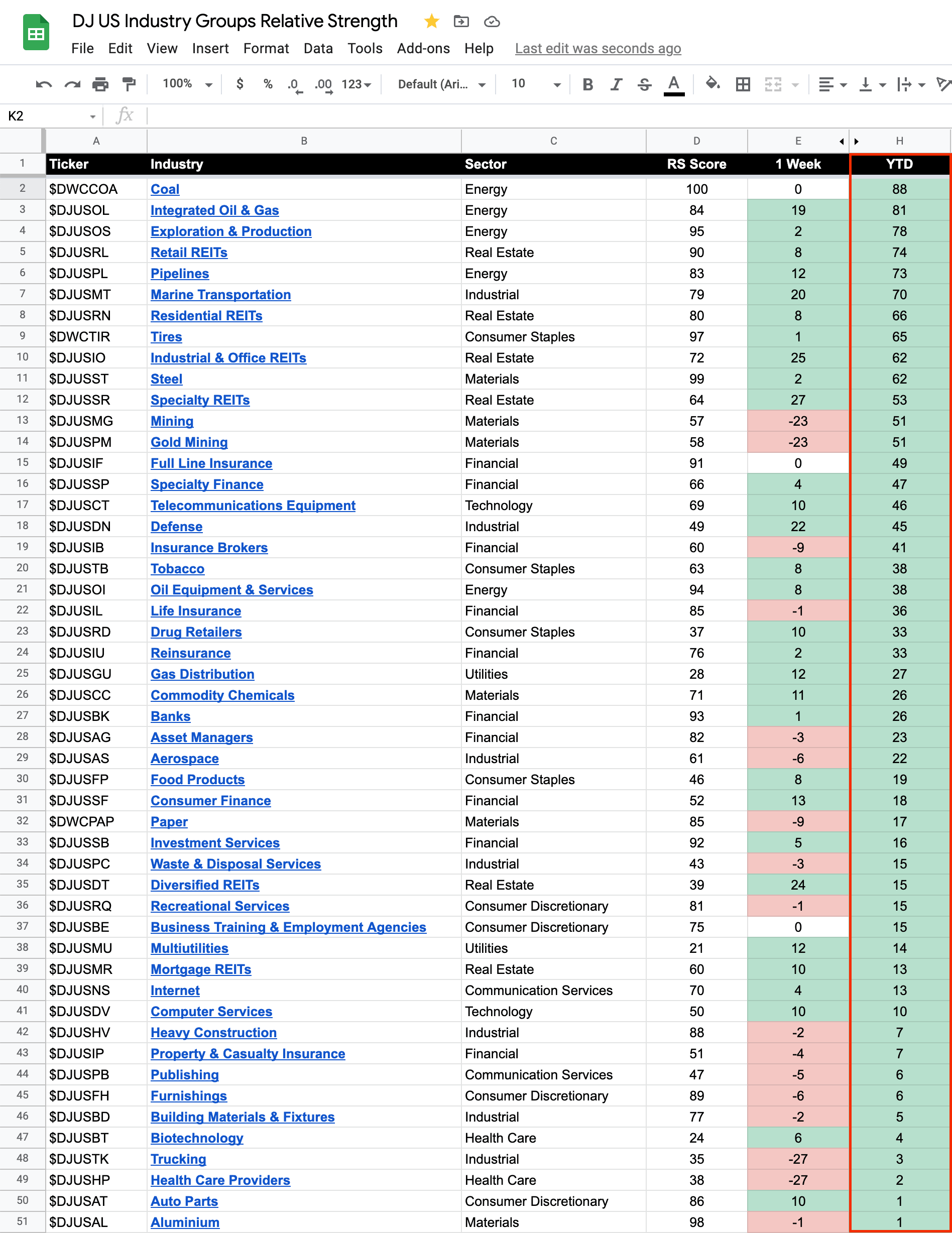

Attached current top 50 sectors plus sectors with the strongest moves this week and YTD

You can find out which stocks are in each industry group by going to https://stockcharts.com/freech... and clicking on the name of the group

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.