US Stocks Watchlist - 2 May 2021

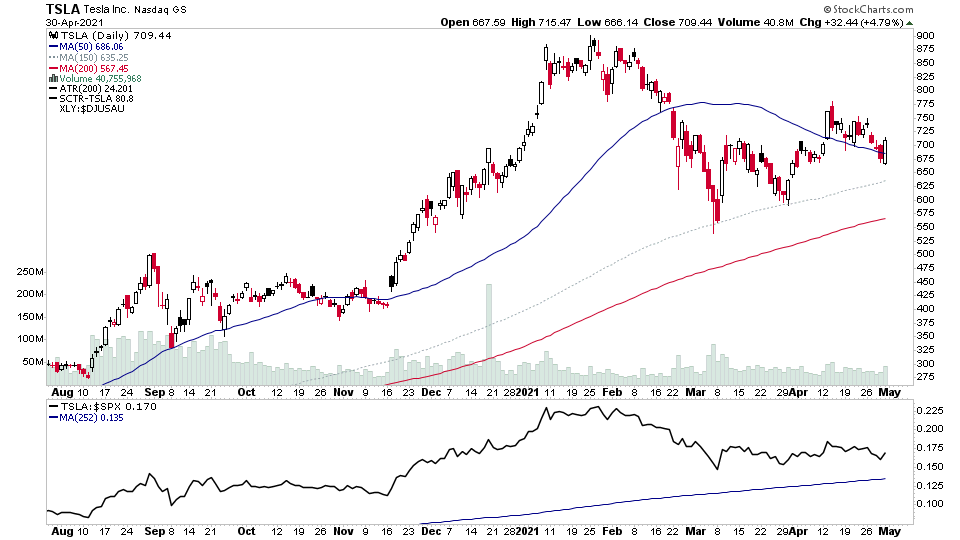

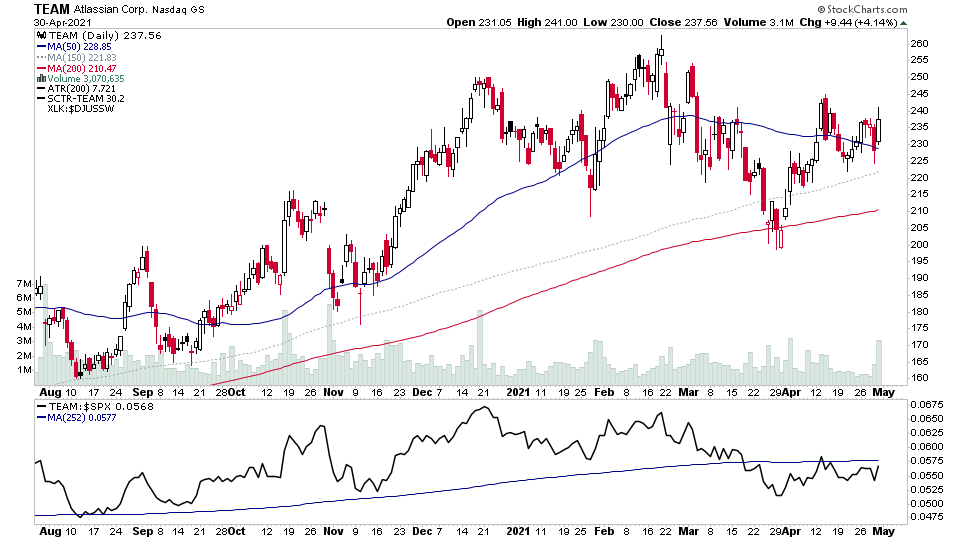

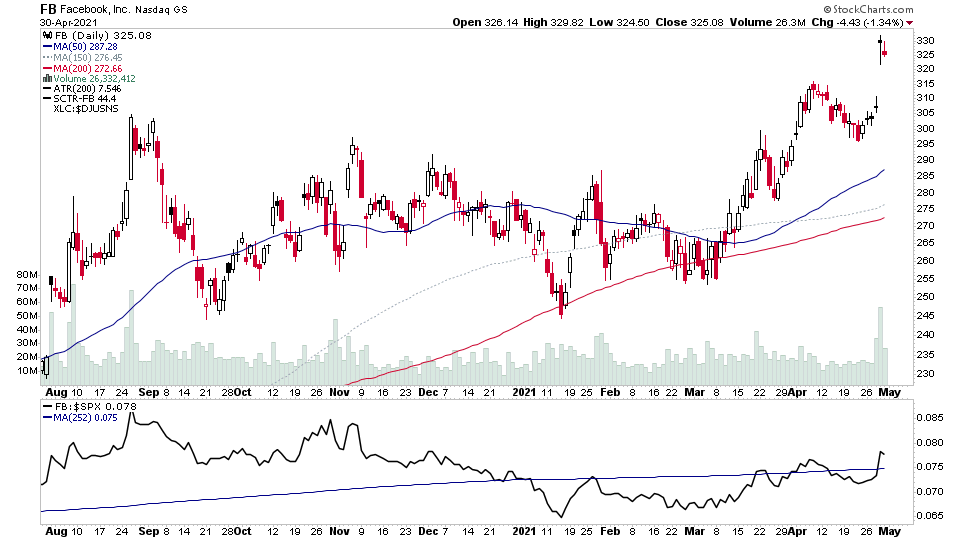

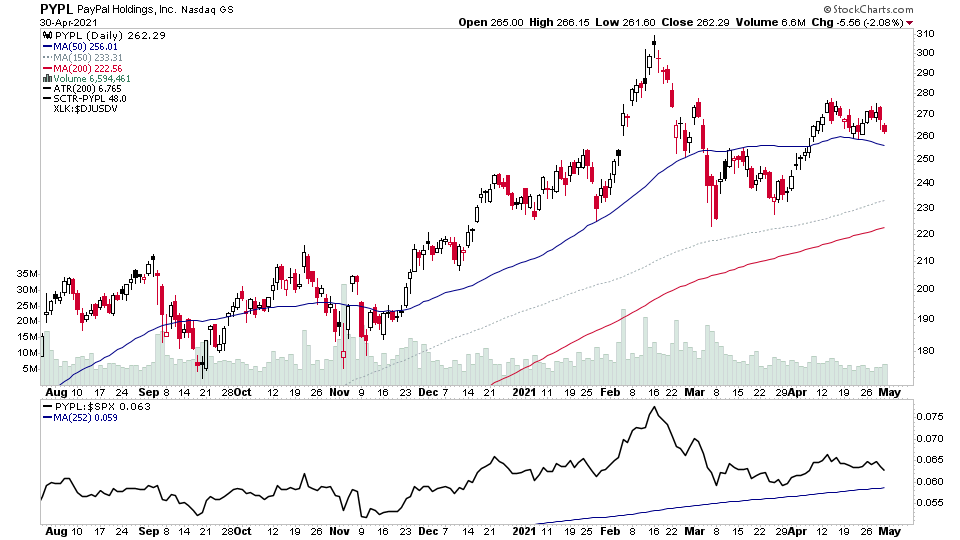

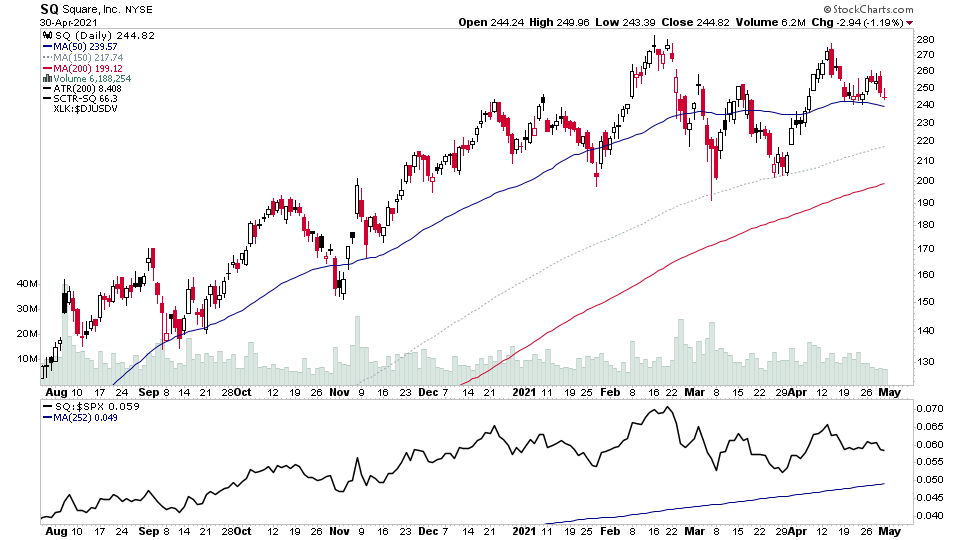

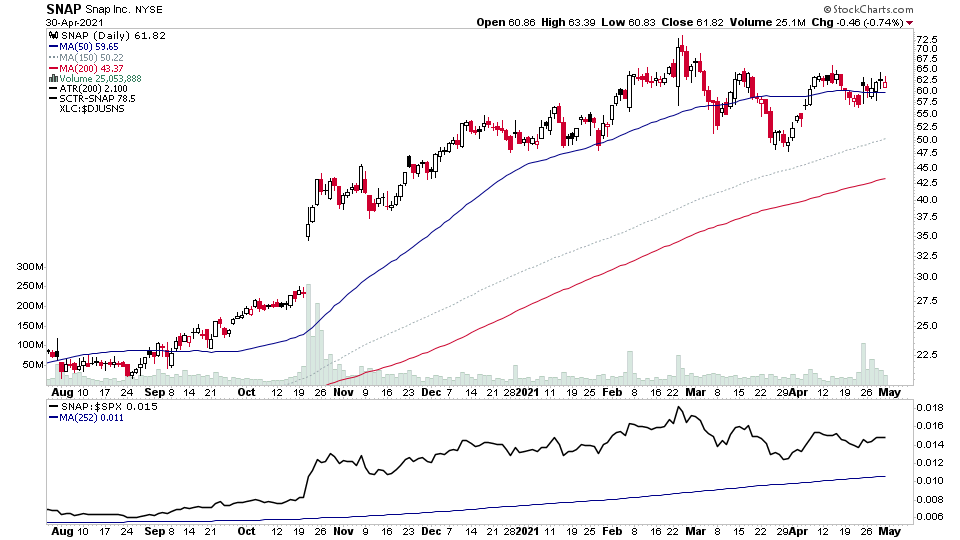

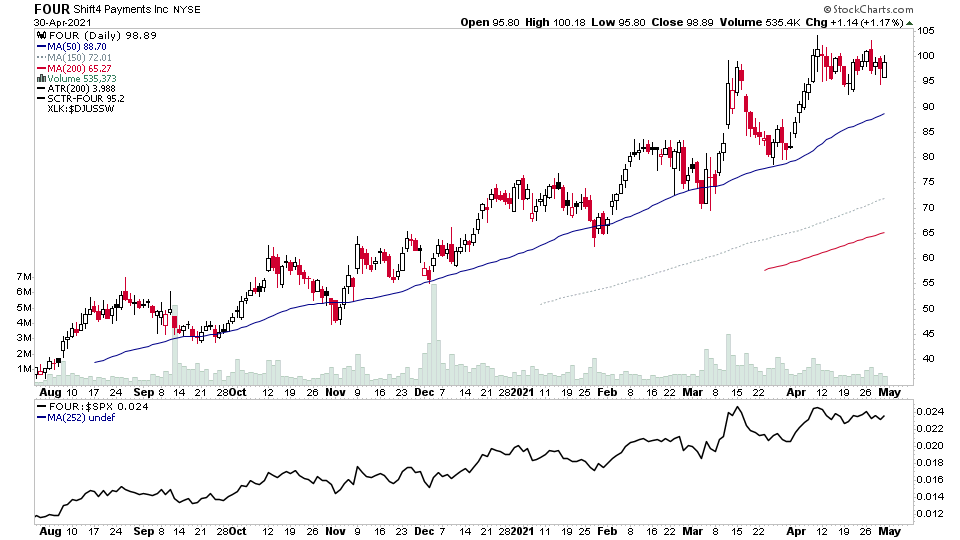

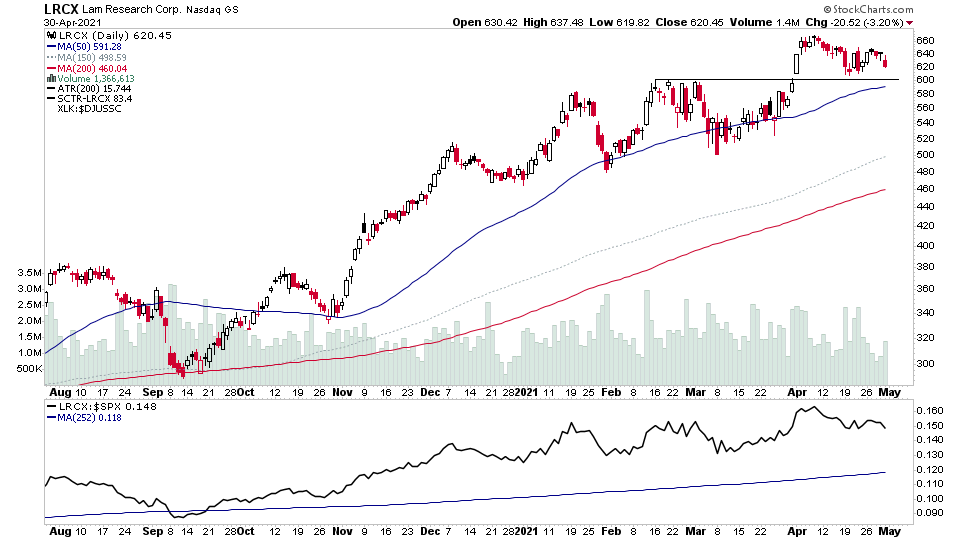

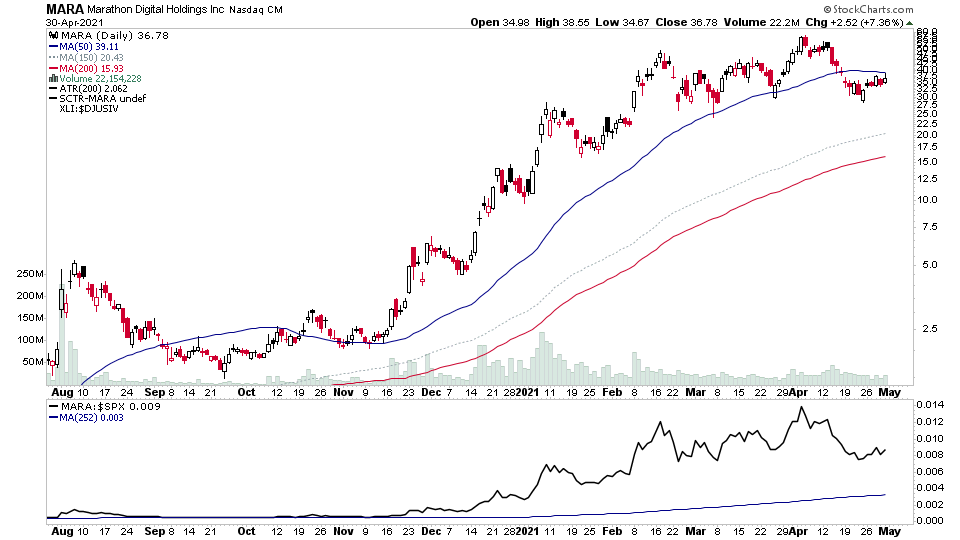

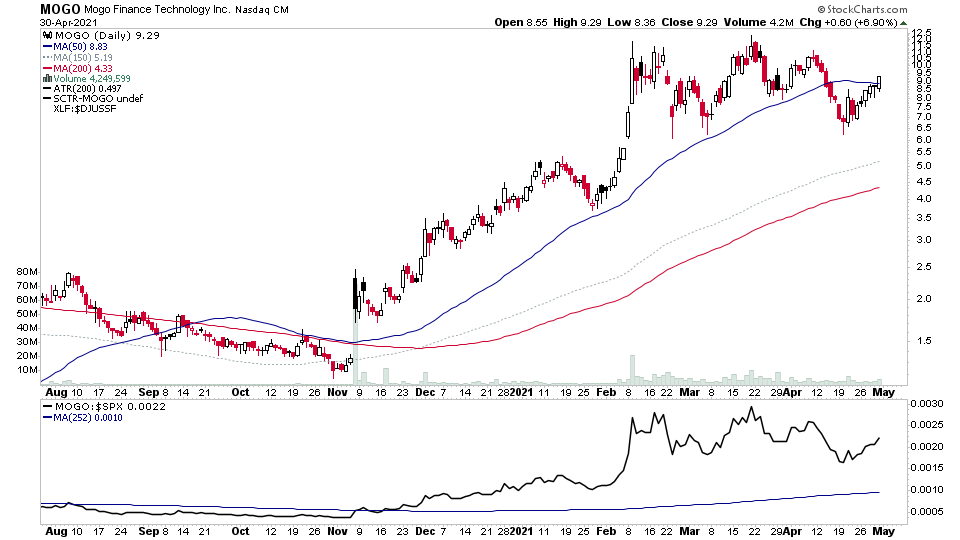

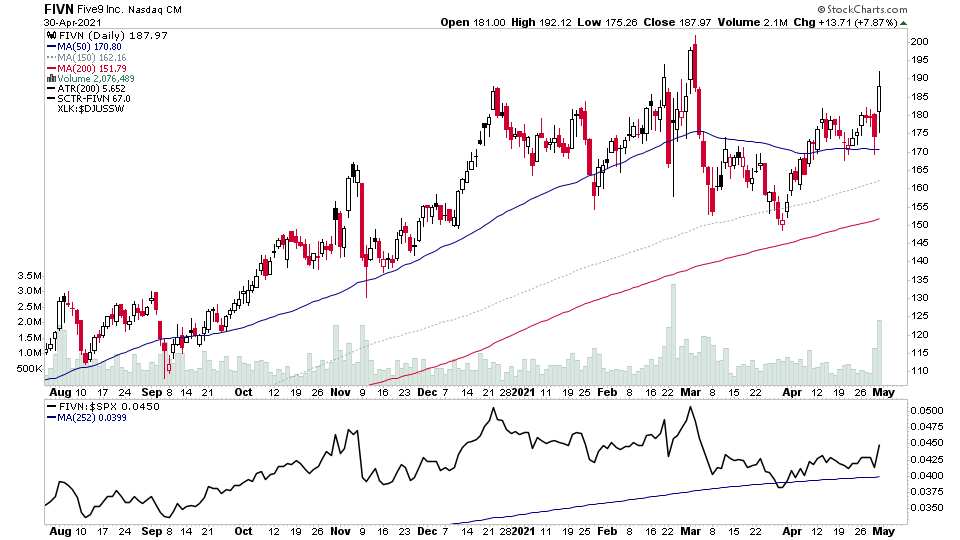

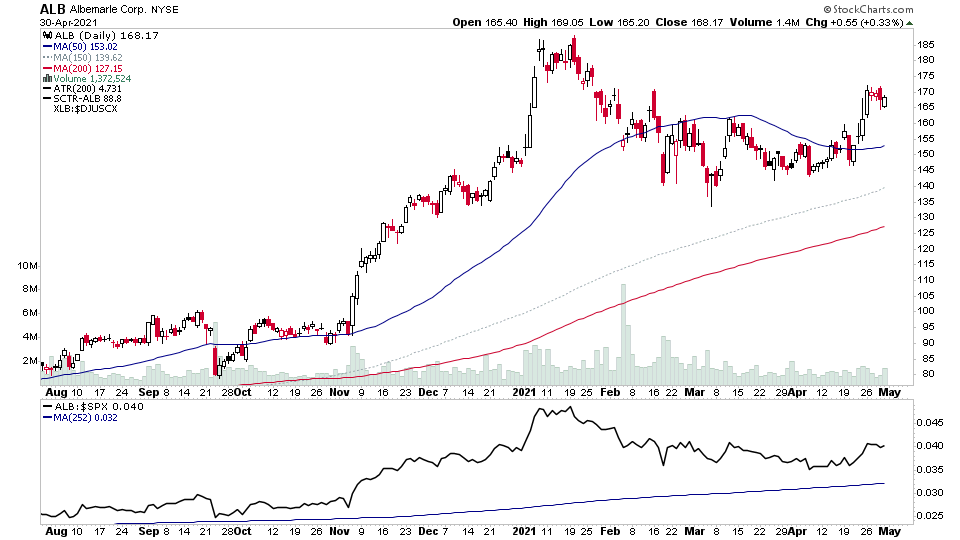

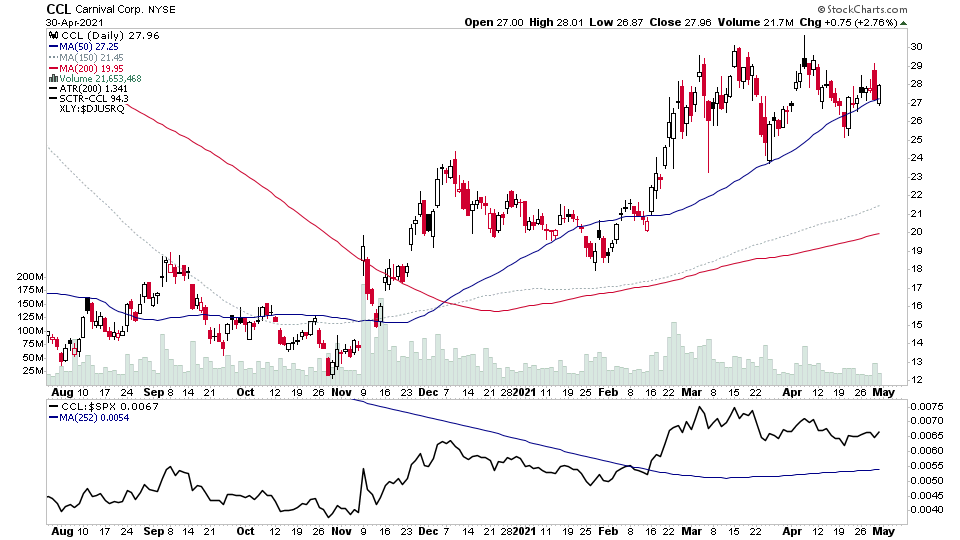

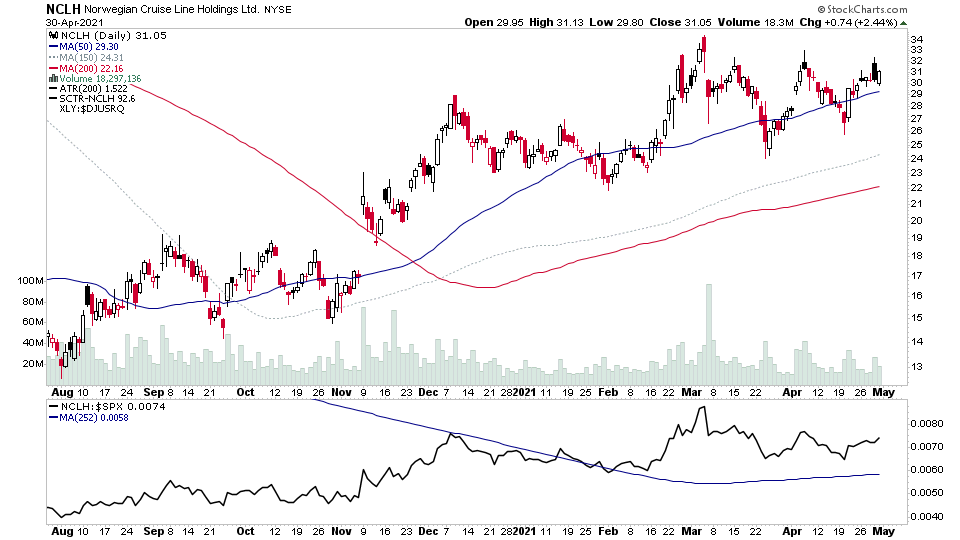

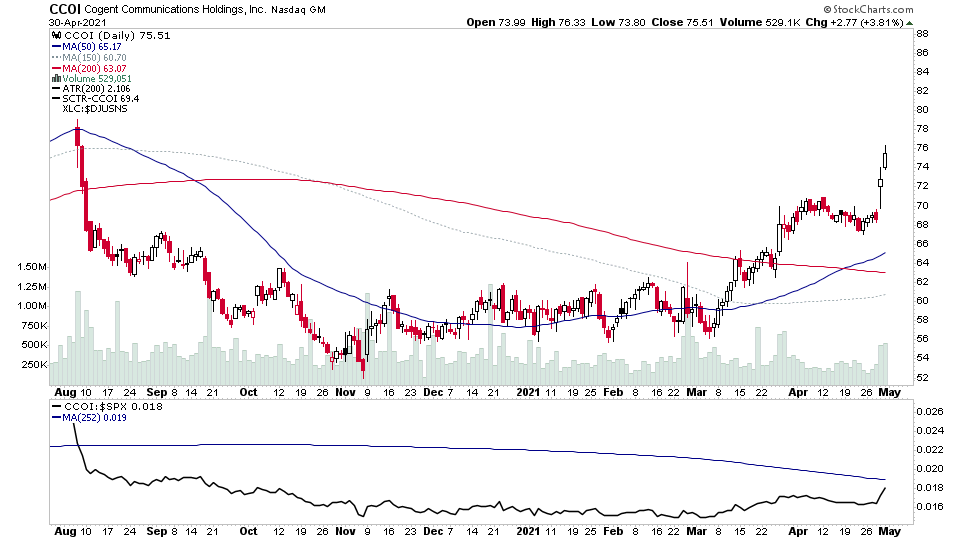

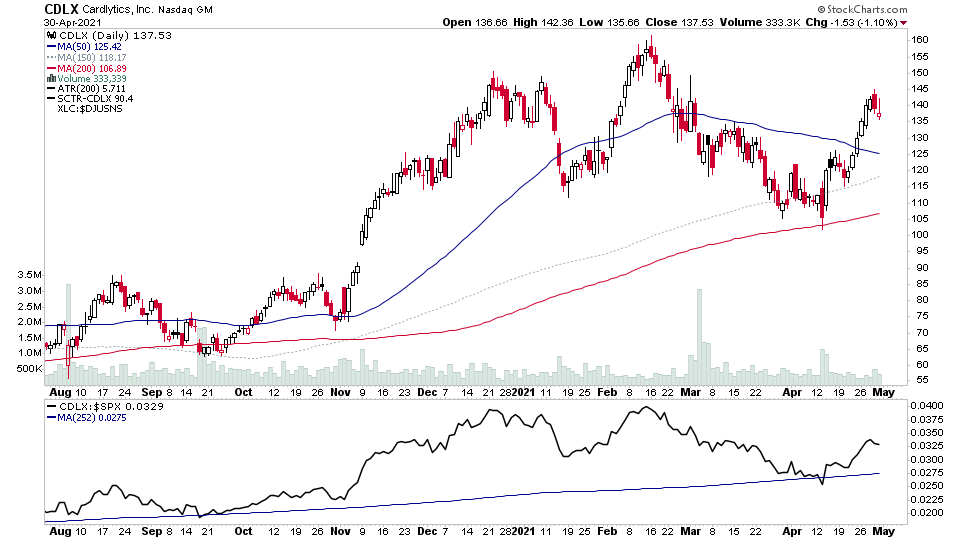

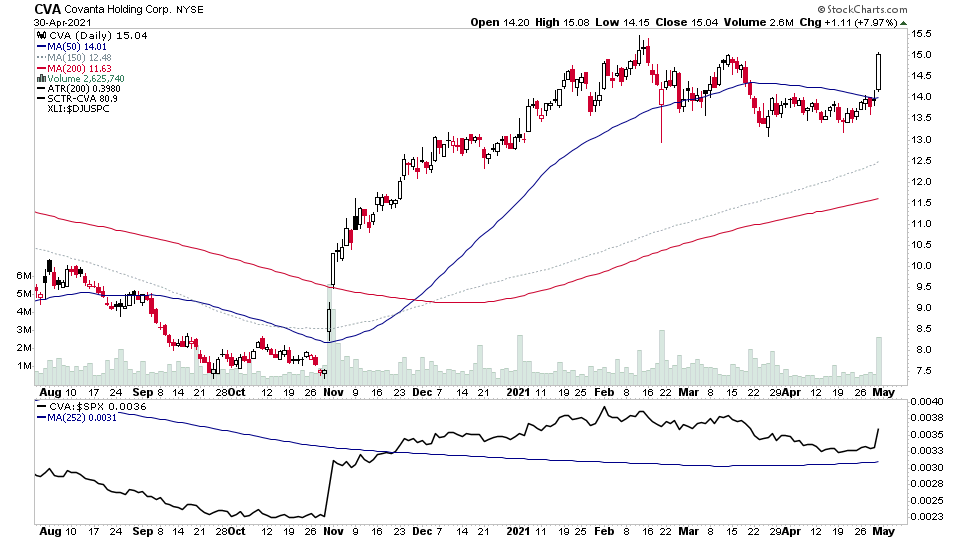

For the watchlist from the weekend scans - ALB, CCL, CCOI, CDLX, CVA, FB, FIVN, FOUR, LRCX, MARA, MOGO, NCLH, PYPL, SNAP, SQ, TEAM, TSLA, UNFI

Note: Multiple stocks in the watchlist have earnings this week. So make sure you know the dates of any stocks you hold.

Stage Analysis - Members

Become a Stage Analysis premium member to:

- Access to our Private Twitter channel* (once you've paid go to @Stage_Analysis and request to follow)

- Evening & Weekend Videos looking at the market action and key stocks in focus with detailed analysis

- US stocks and Crypto currencies

- Detailed chart analysis and commentary

- Swing & position trades that I'm trading in my accounts and how I'm managing the positions

- Sector Focus: Finding the industry groups with the strongest relative strength and charting the individual stocks in the group near to potential entry points on multiple time frames

- Risk management

- Learn advanced Stage Analysis techniques and how to use it alongside other methods such as CAN SLIM, Minervini, Wyckoff and more...

Sign up at: www.getrevue.co/profile/stageanalysis/members

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.