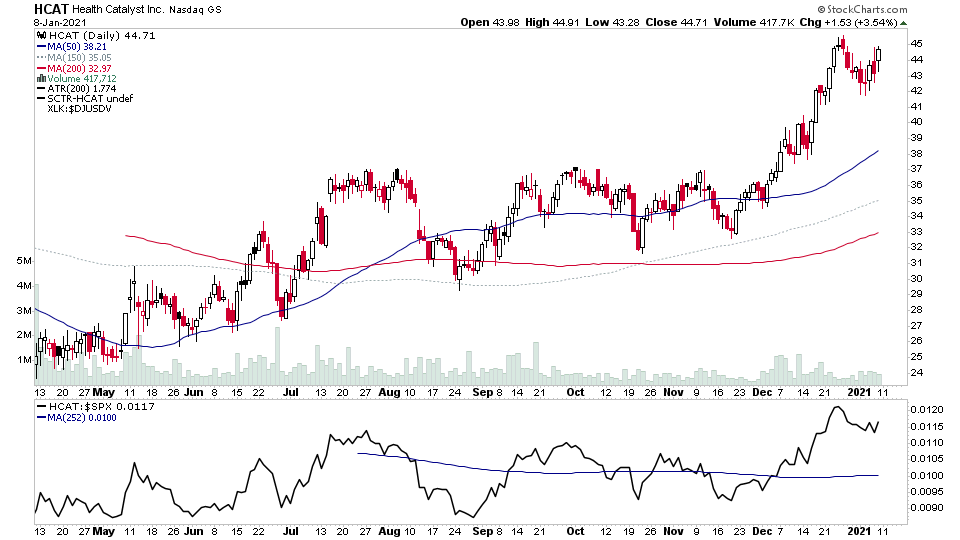

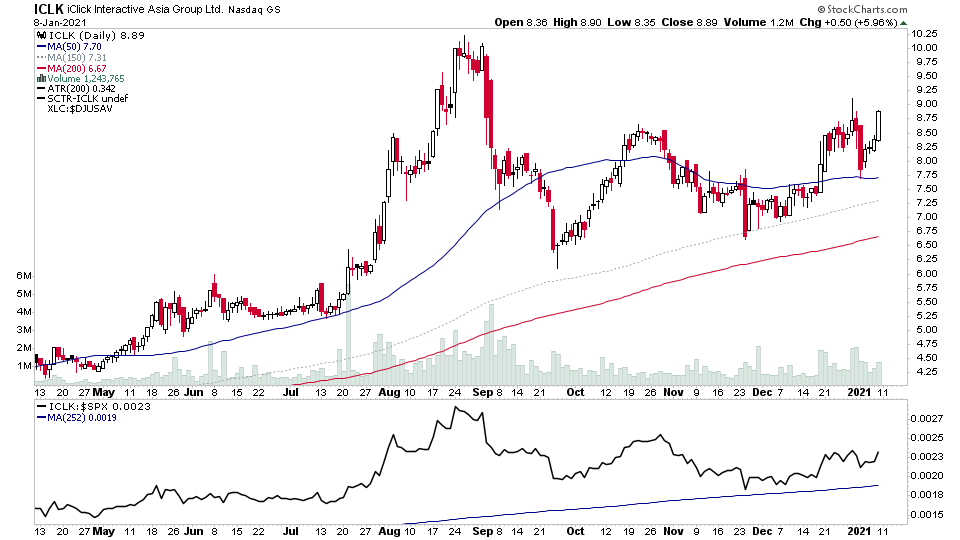

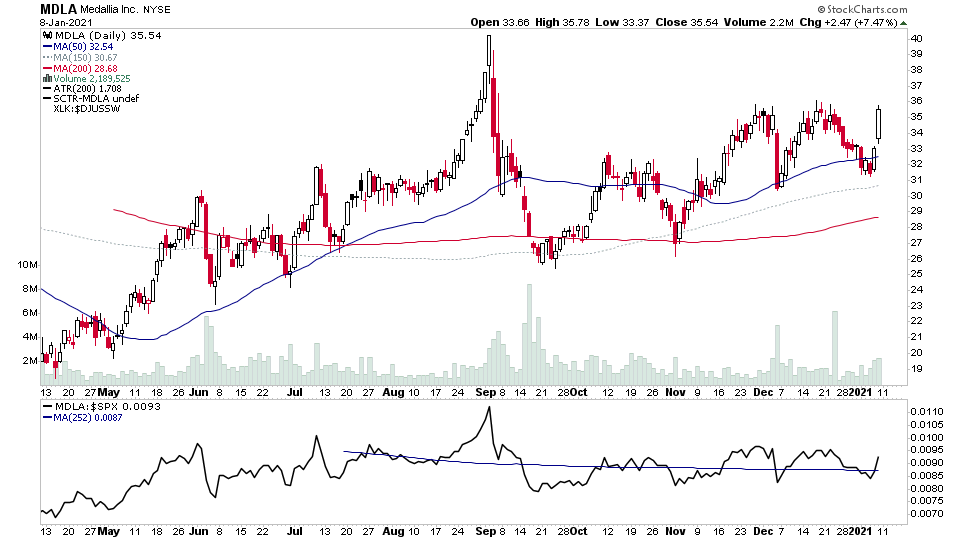

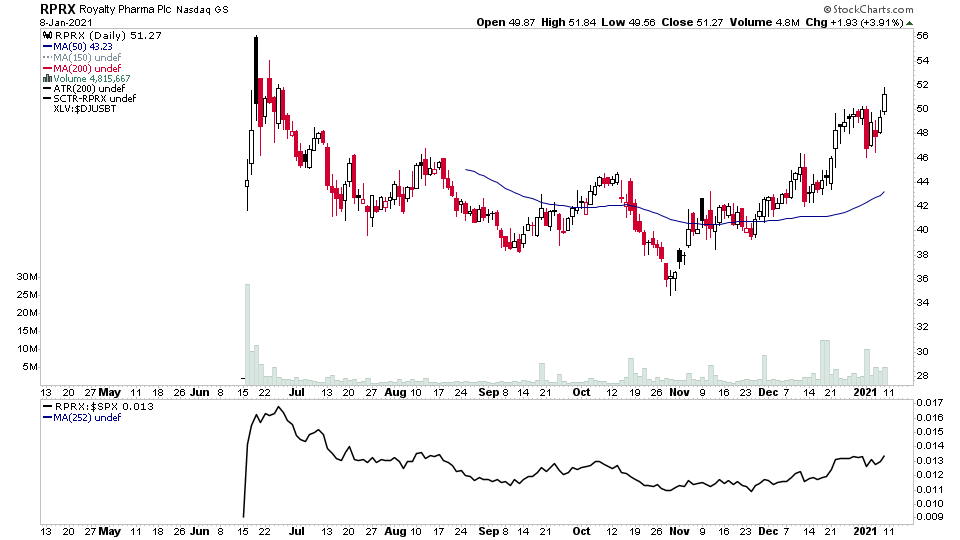

US Stocks Watchlist - 10 January 2021

For the watchlist from the weekend scans in addition to the other stocks that I mentioned in the previous blog post yesterday

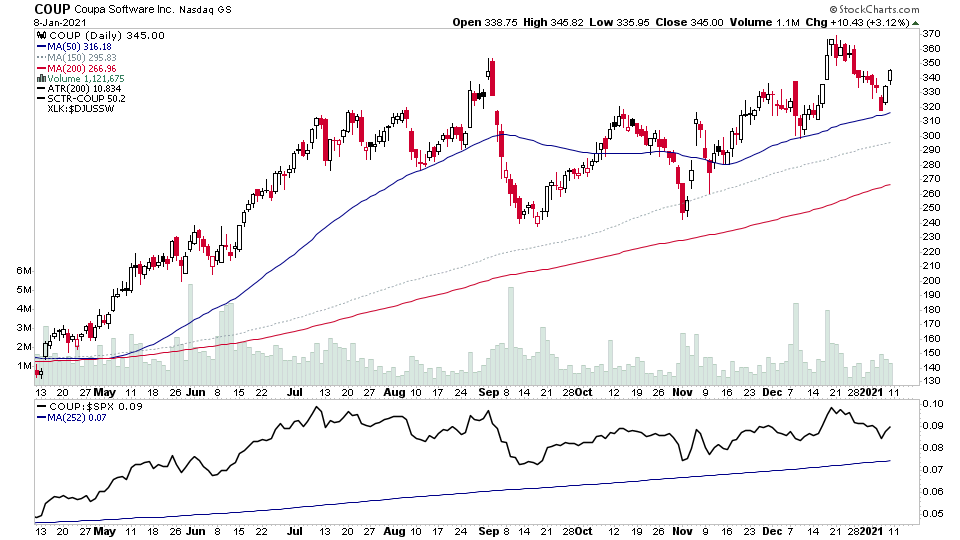

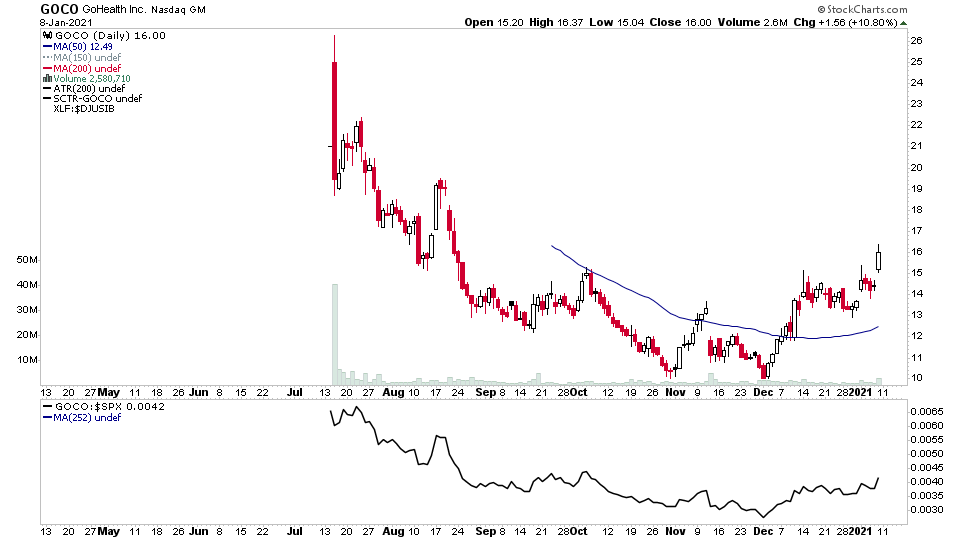

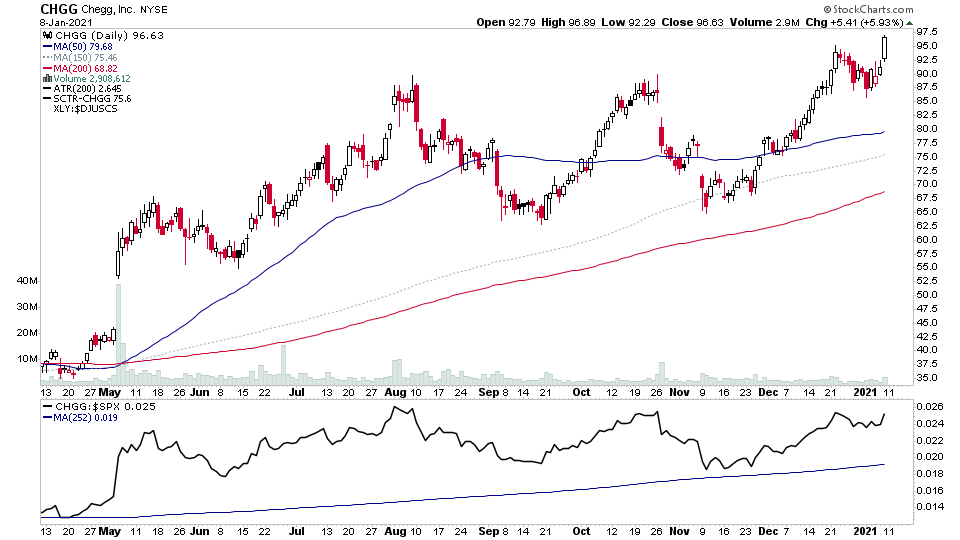

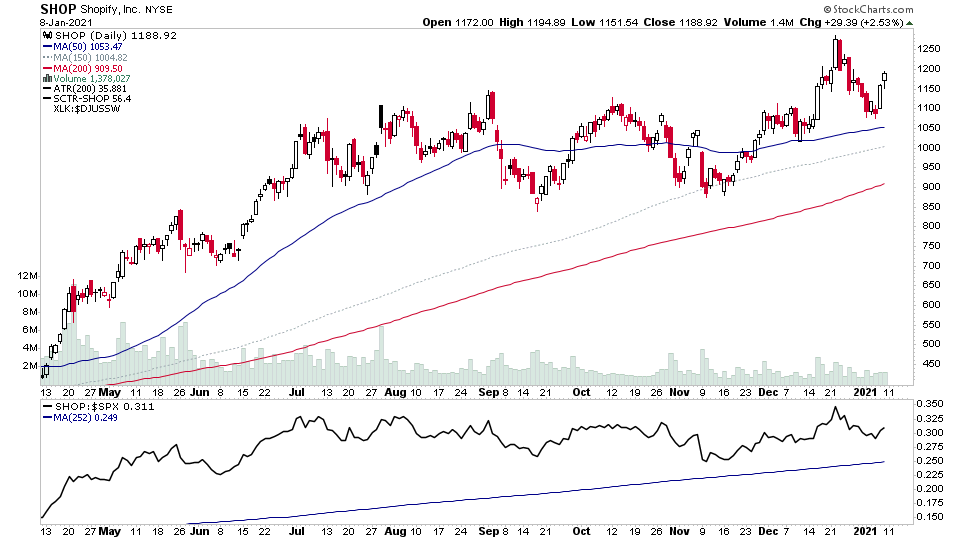

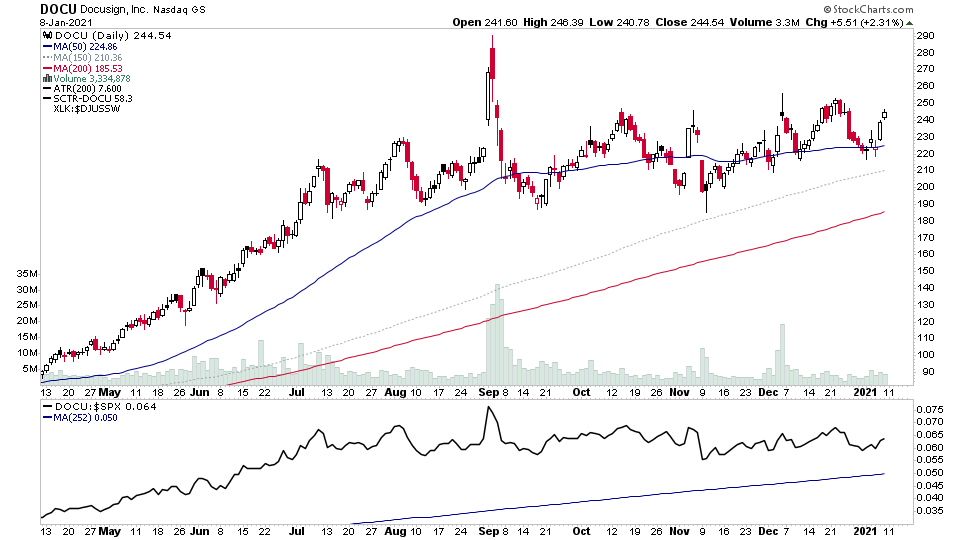

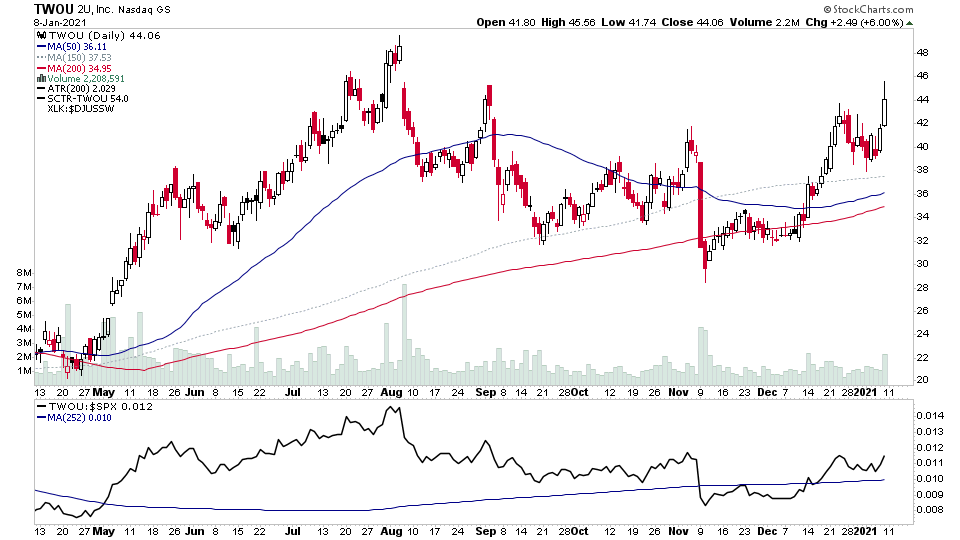

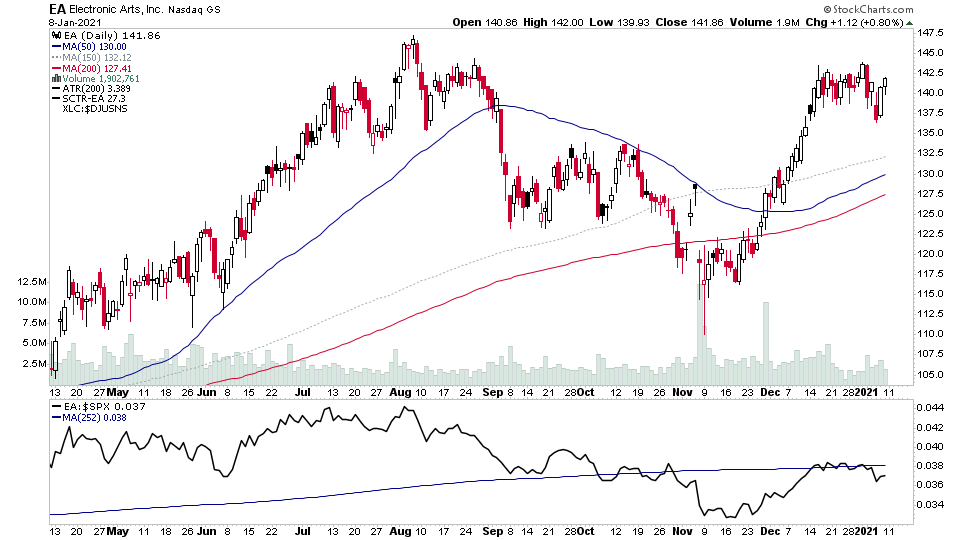

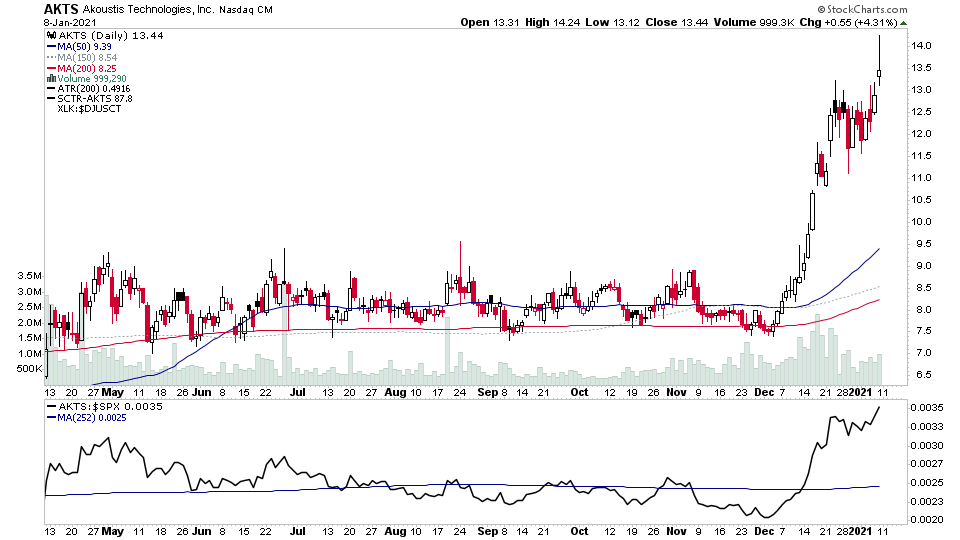

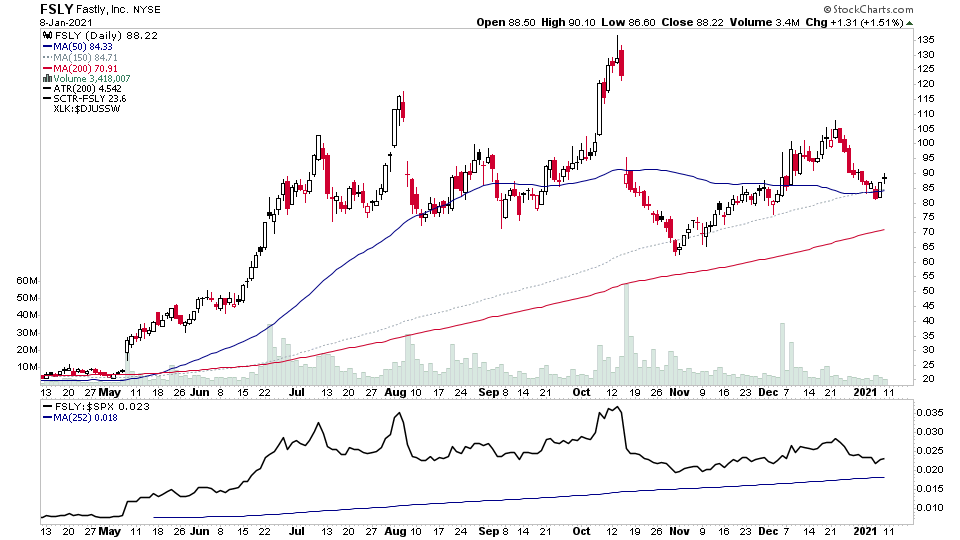

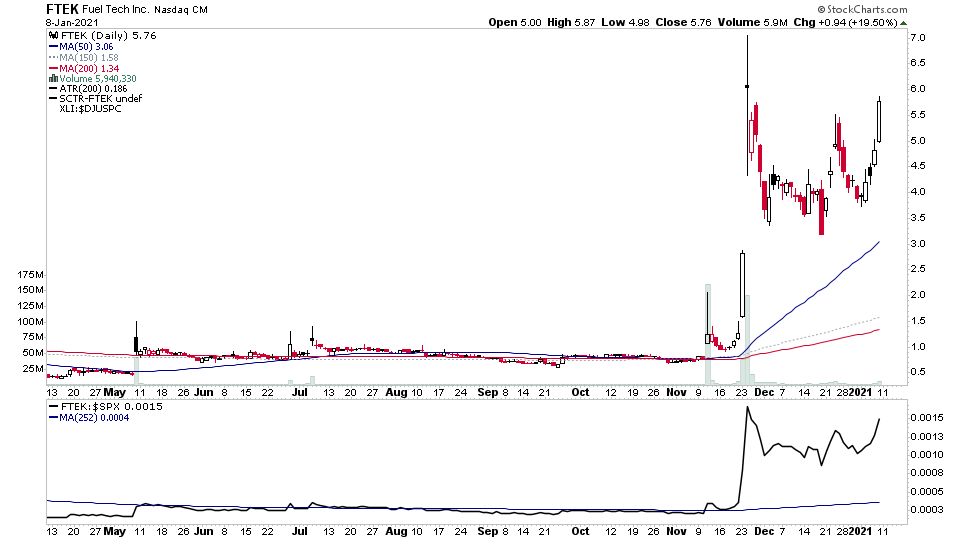

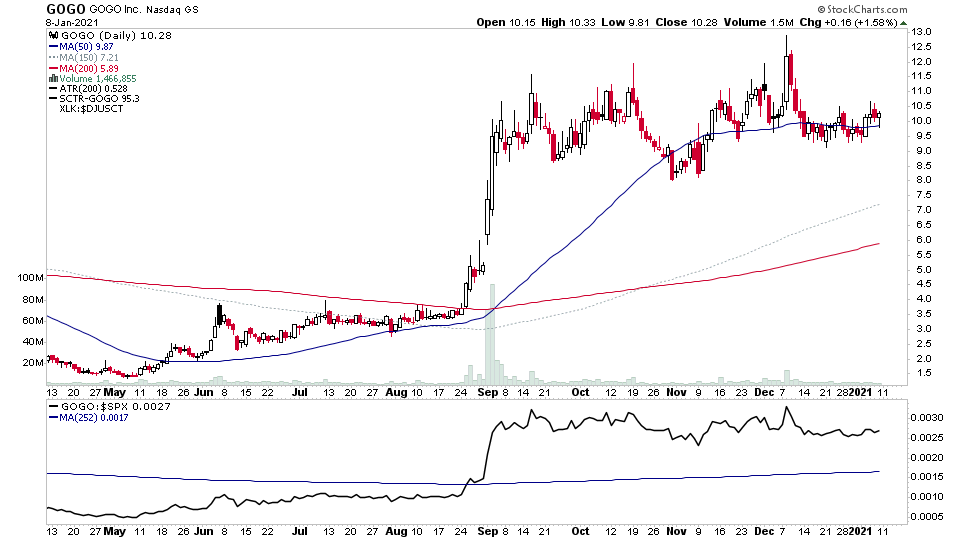

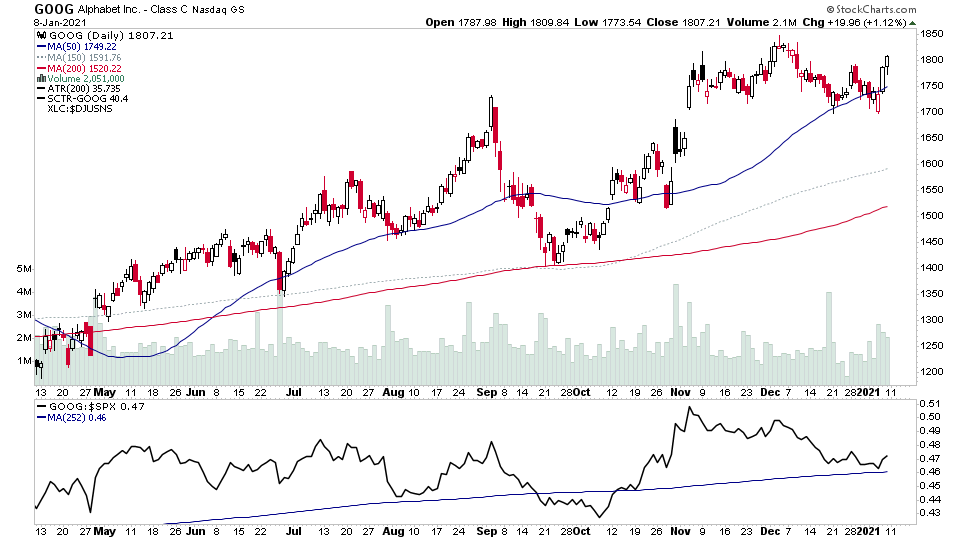

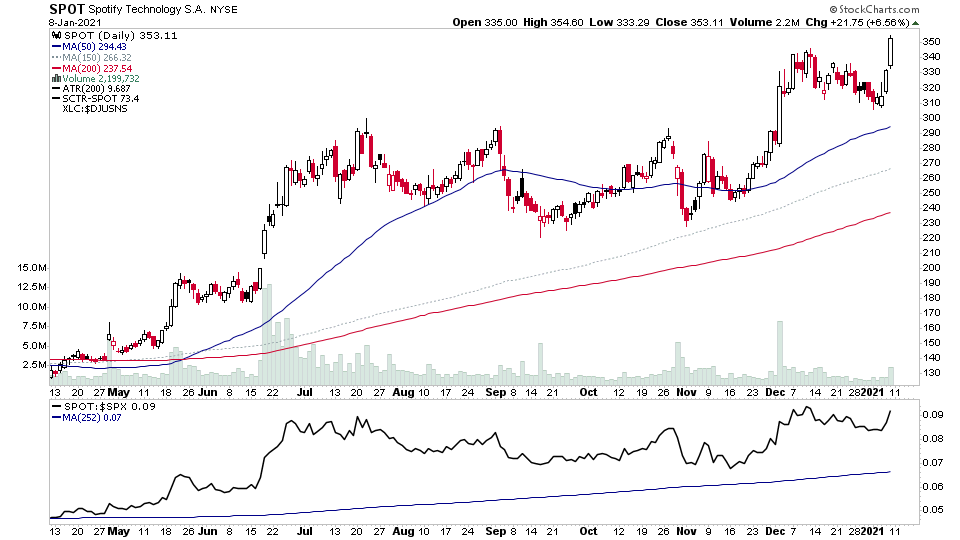

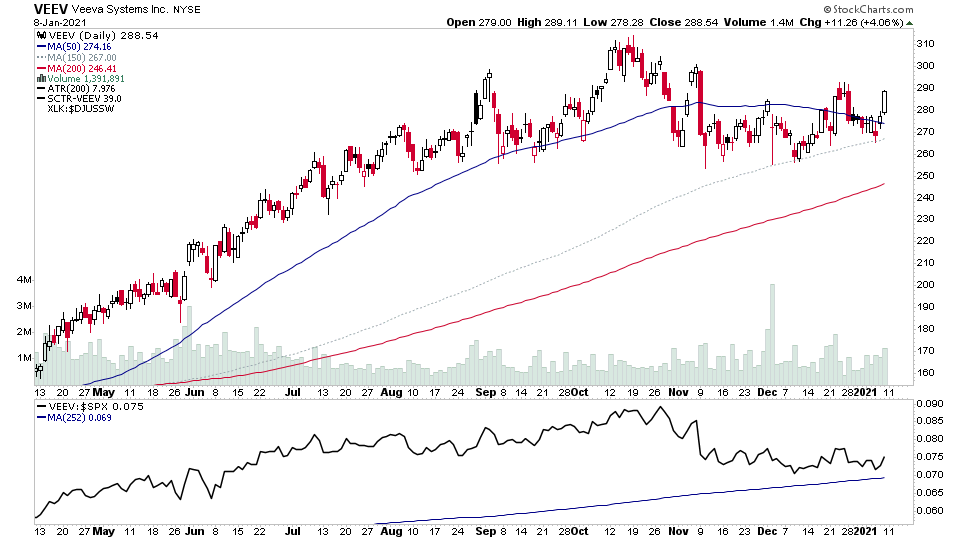

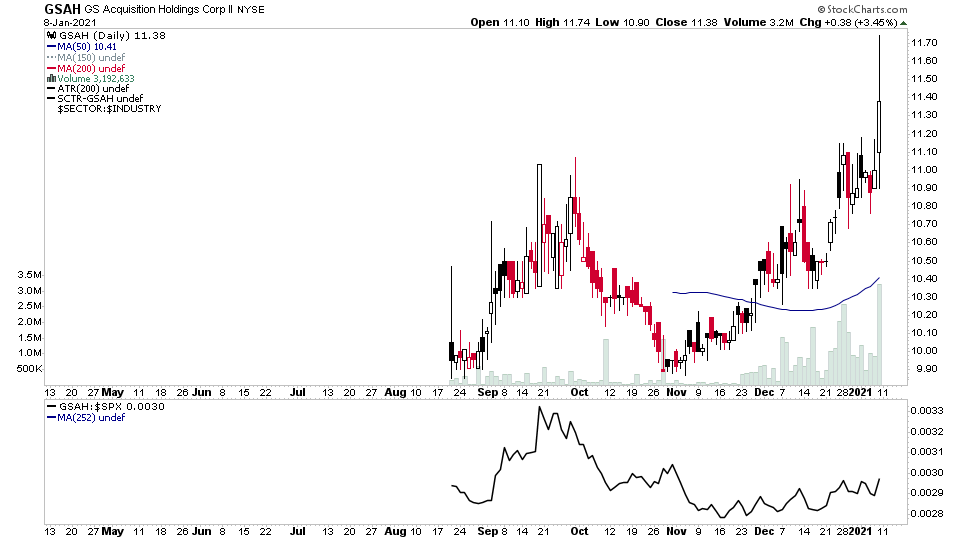

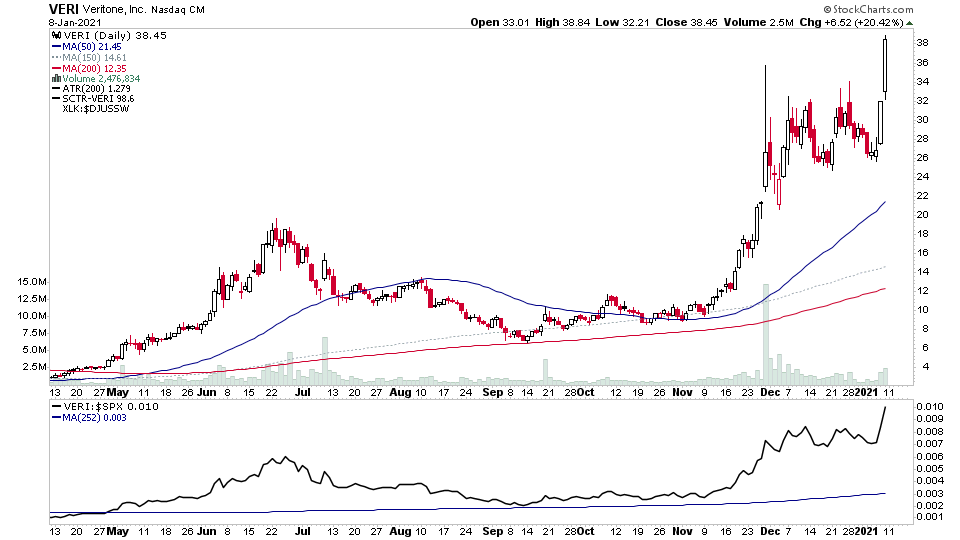

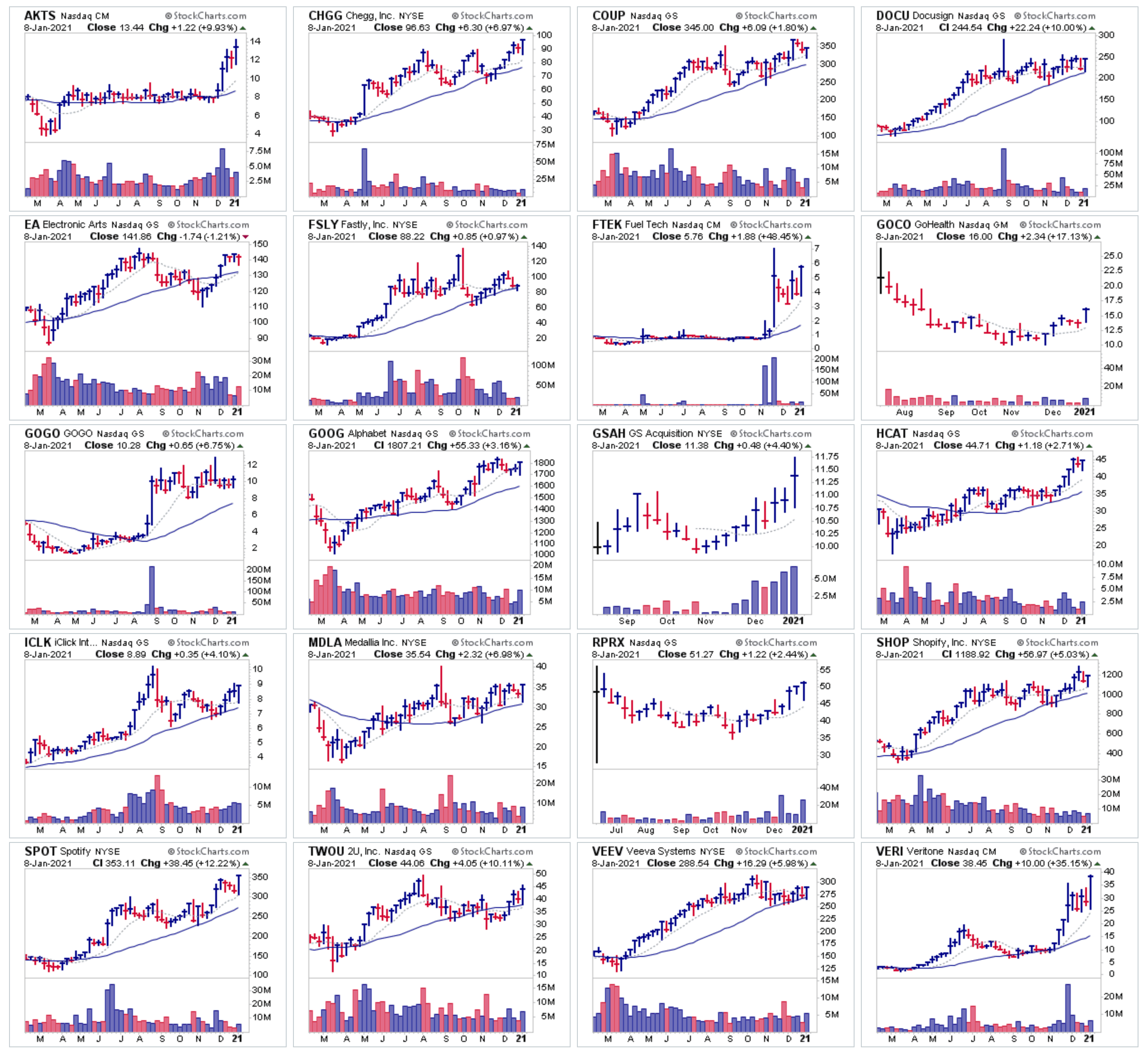

AKTS, CHGG, COUP, DOCU, EA, FSLY, FTEK, GOCO, GOGO, GOOG, GSAH, HCAT, ICLK, MDLA, RPRX, SHOP, SPOT, TWOU, VEEV, VERI

Daily Charts

Weekly Thumbnail Charts

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.