US Breakout Stocks Watchlist - 6 July 2020

I chose to just observe today as multiple stocks gapped up strongly on the open. So on days like this there's not much to do but sit back and let the portfolio work, and observe the price action of the leading stocks and how they close.

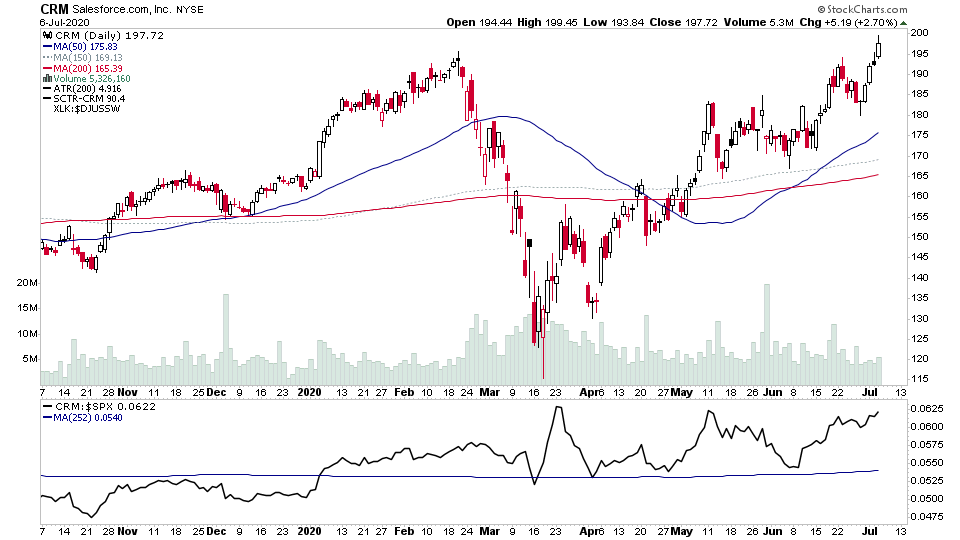

The S&P 500 closed above the first resistance level within the recent consolidation, which was evident in the sectors that were strongest today as Consumer Discretionary showed the most strength. Leading Tech stocks started the day very strongly, but faded for most of the day overall, with many forming spinning top type candles with low closing ranges. So signs of exhaustion maybe in the leaders, but we could be setting up for a bit rotation again as some of the lagging sectors that make up the S&P 500 may take the baton for a while.

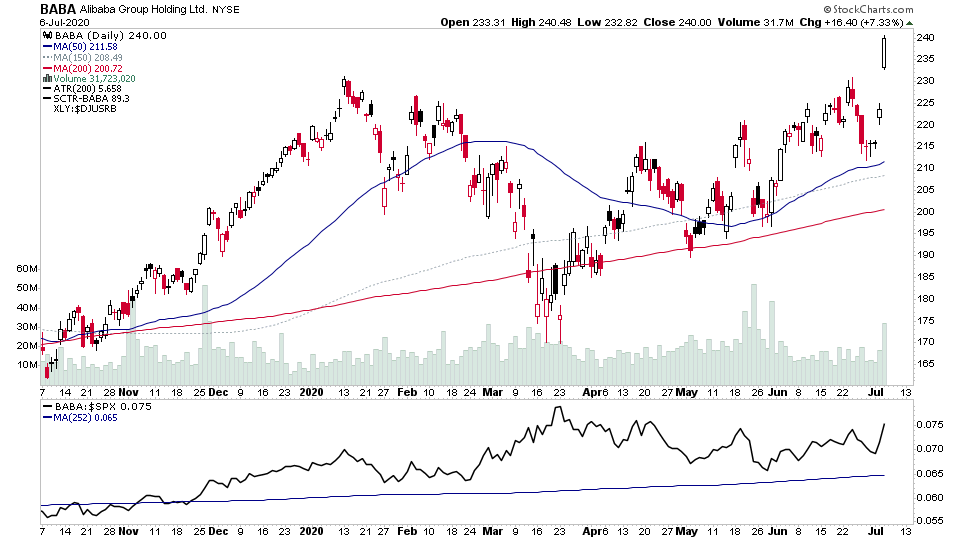

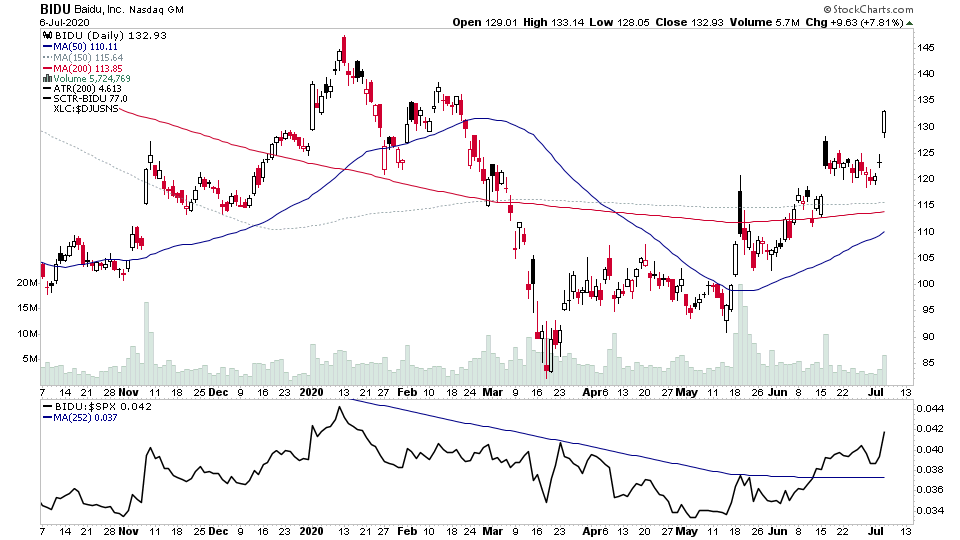

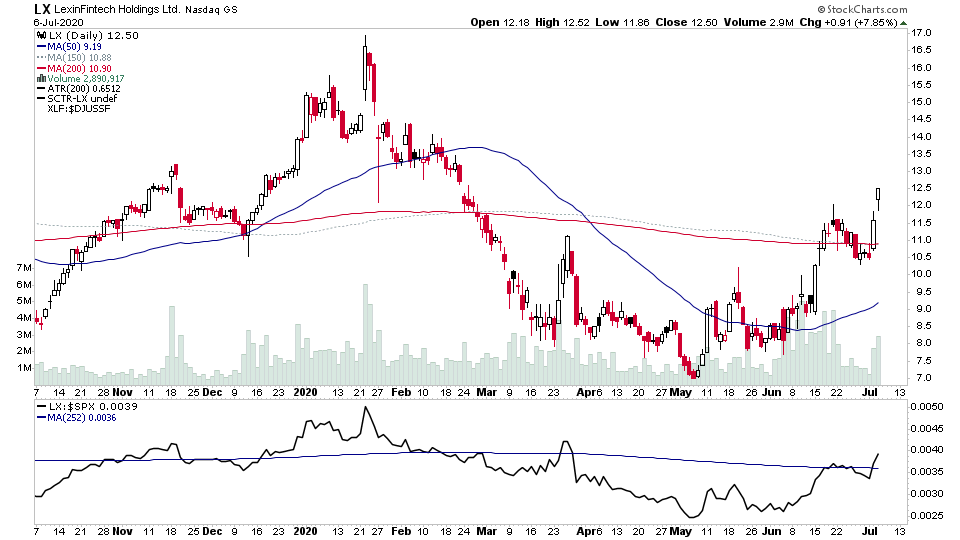

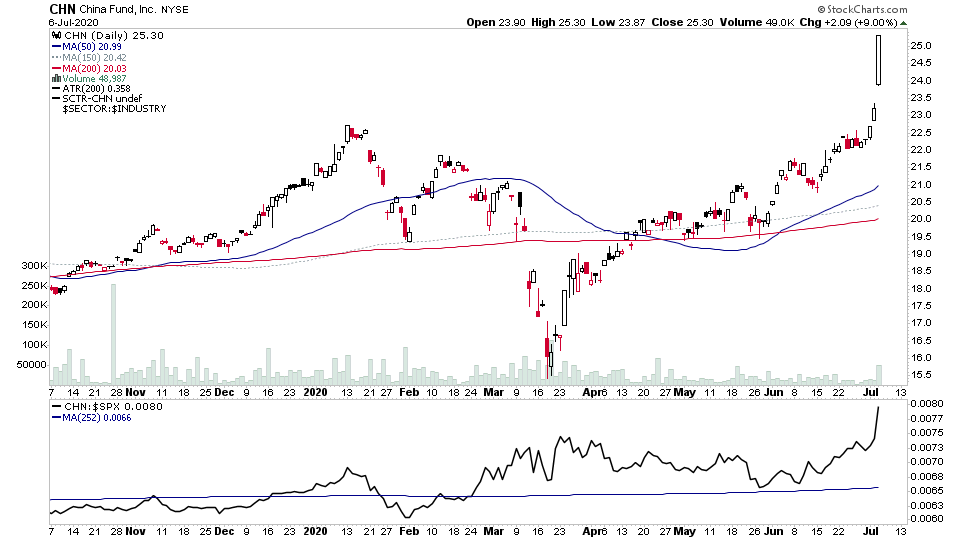

I also noticed a number of China related stocks in my scans tonight and a few made it into the watchlist below.

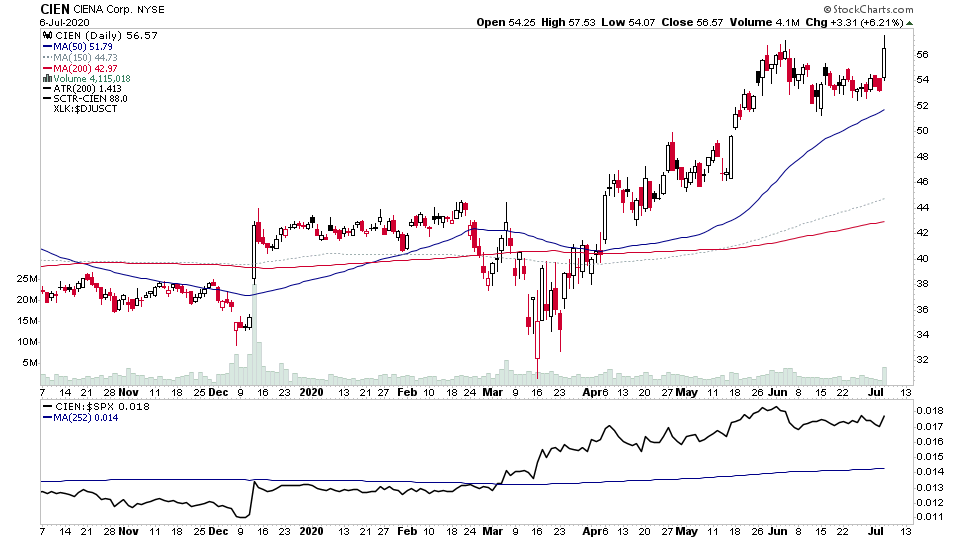

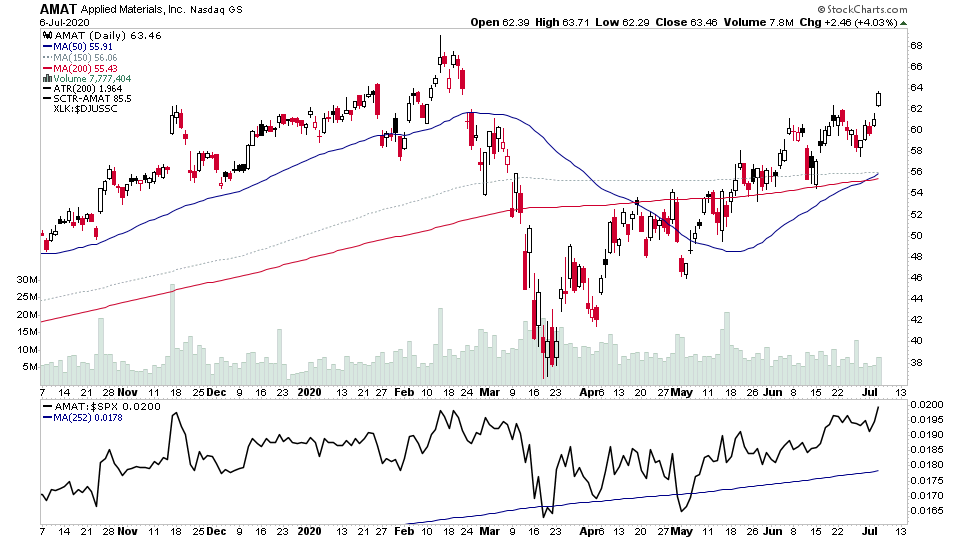

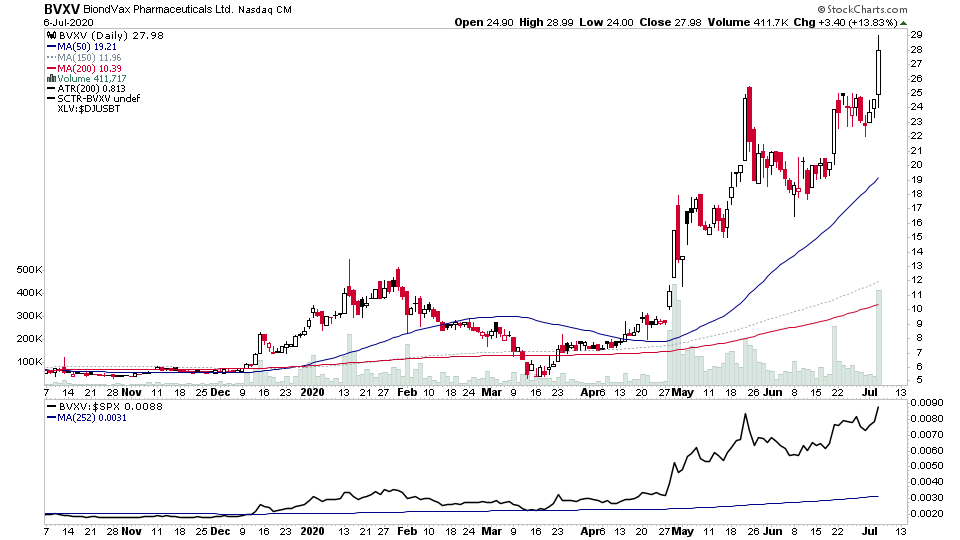

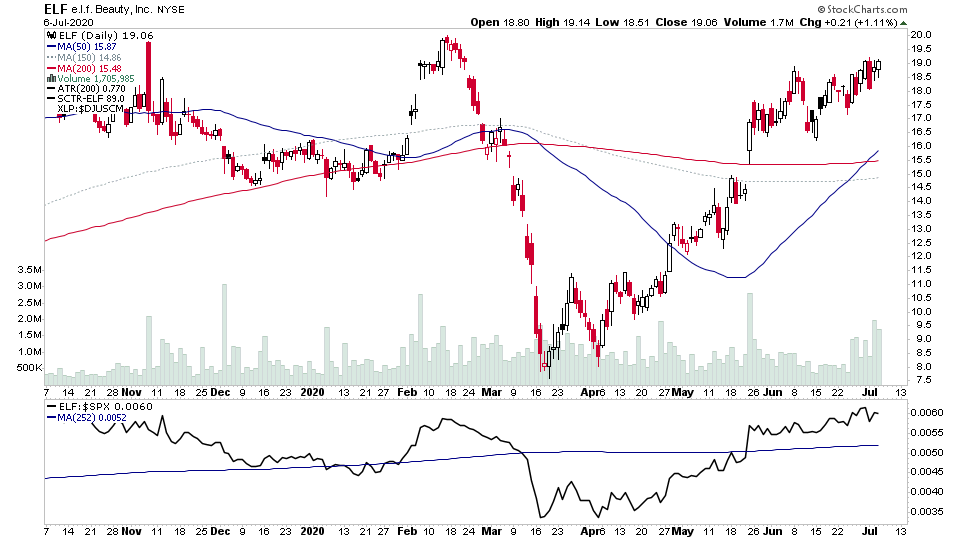

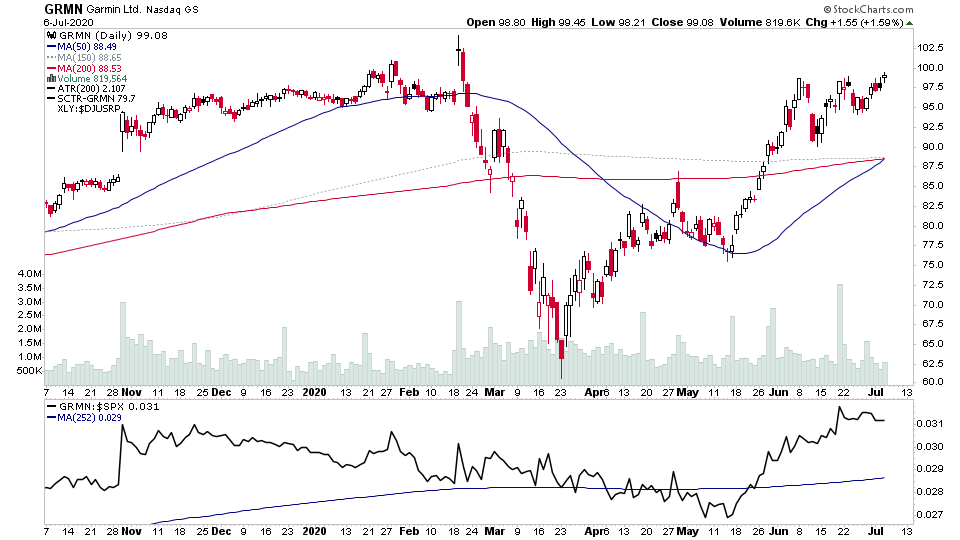

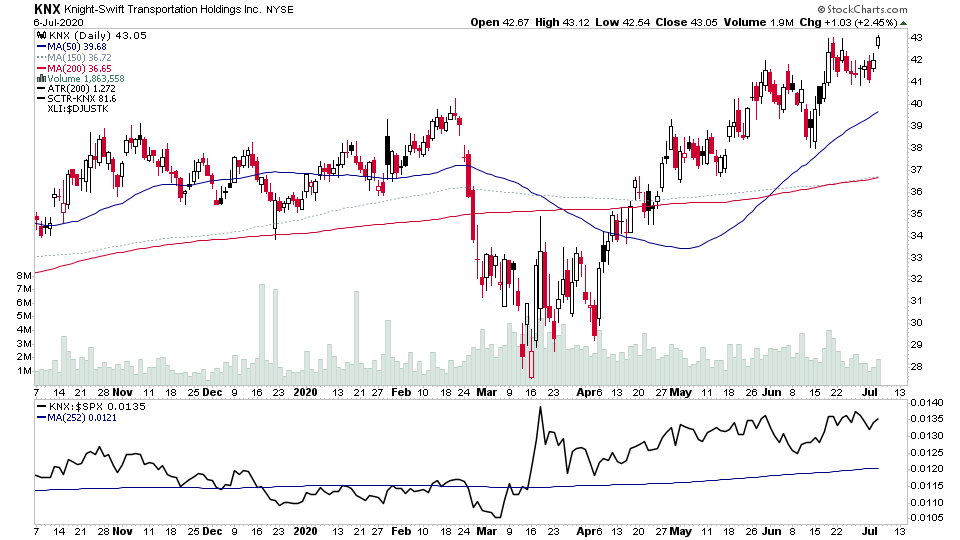

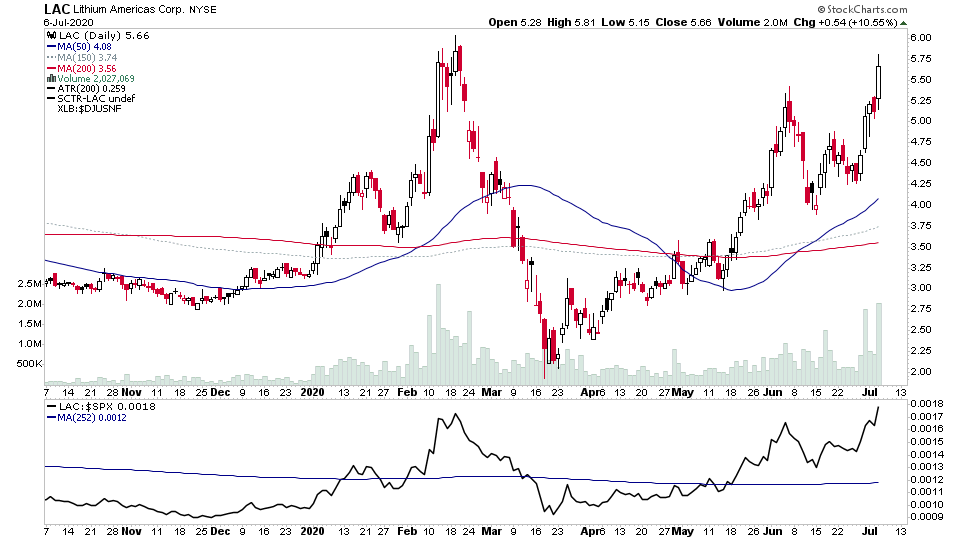

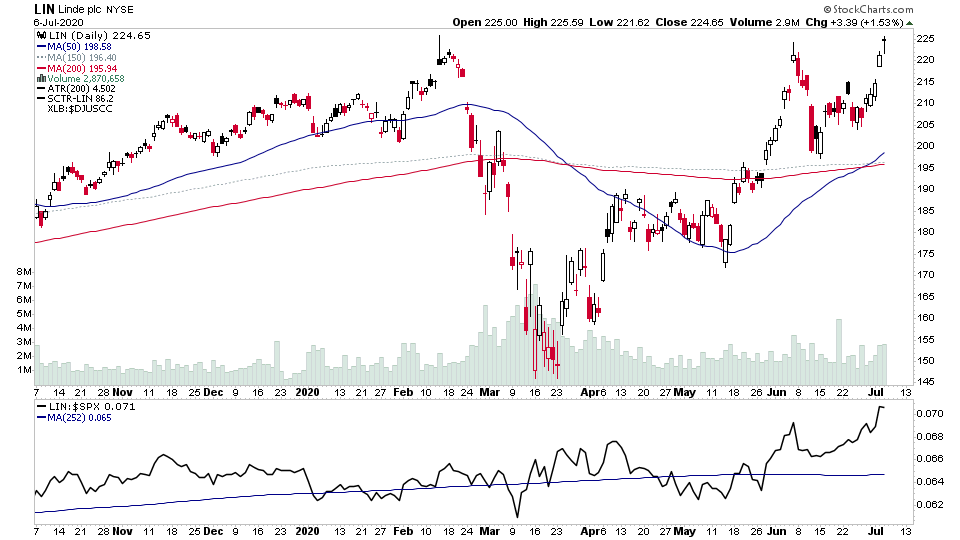

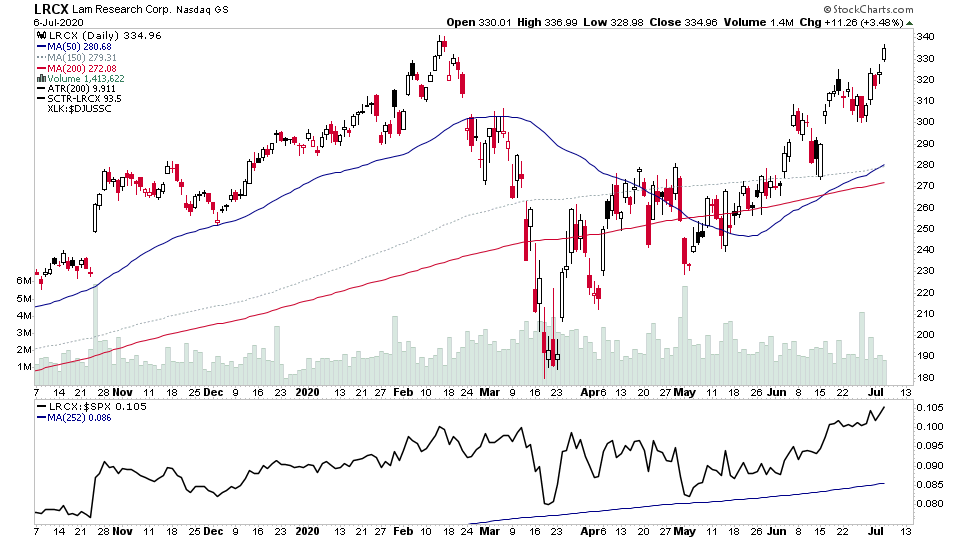

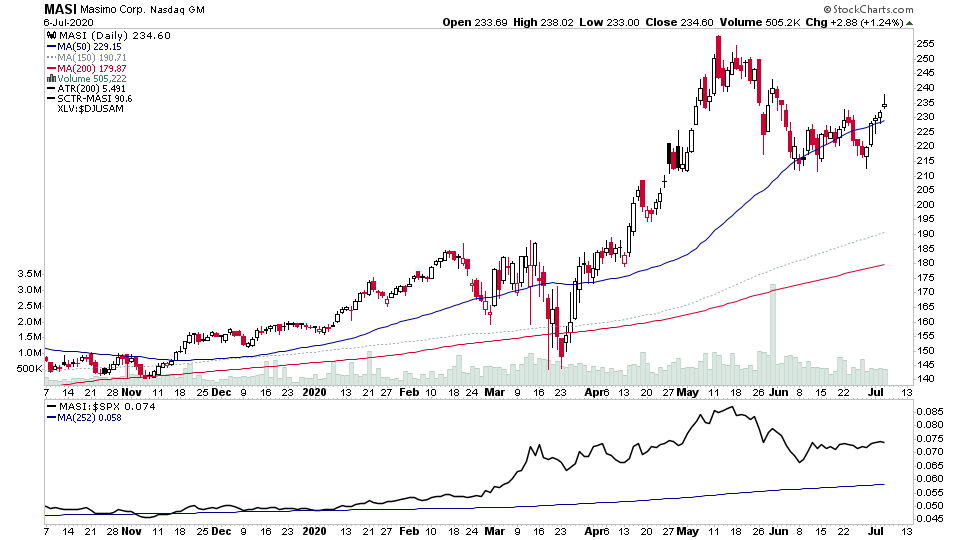

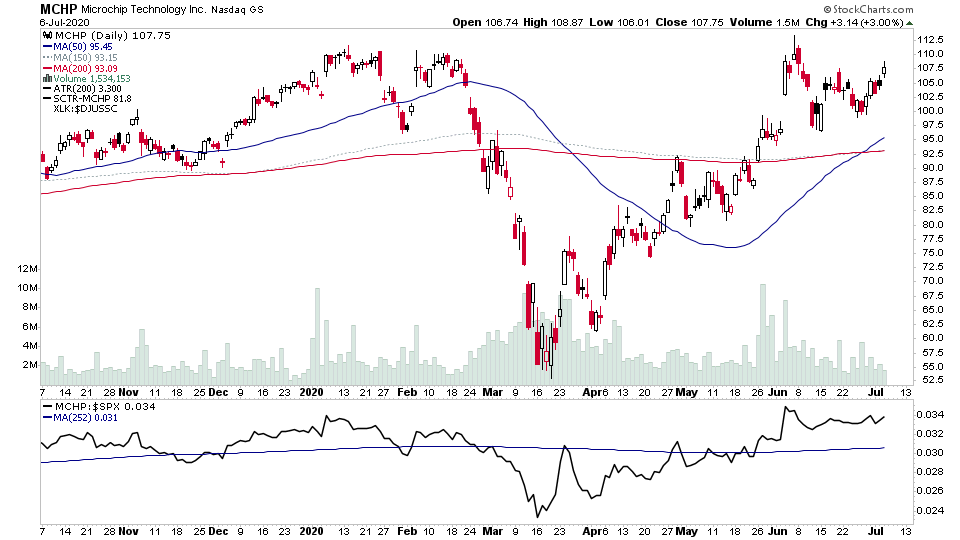

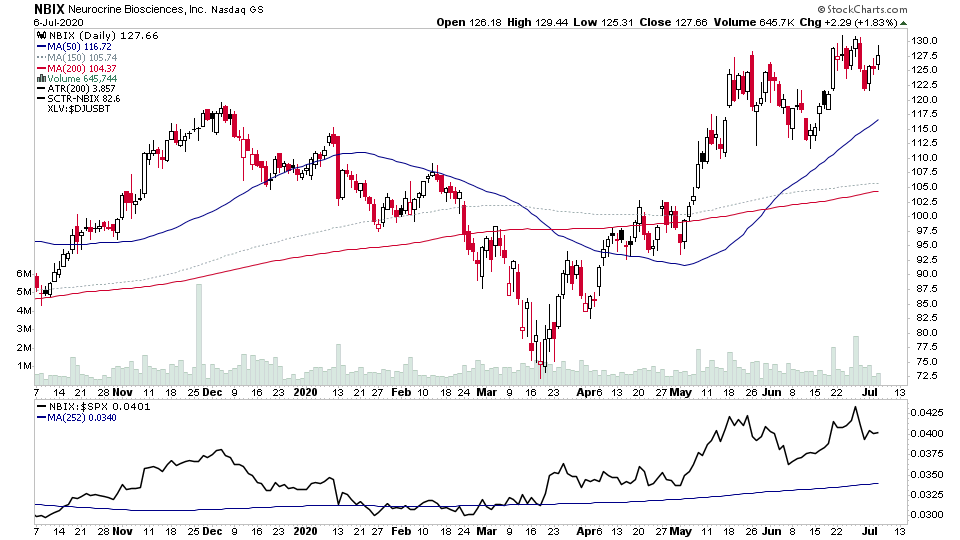

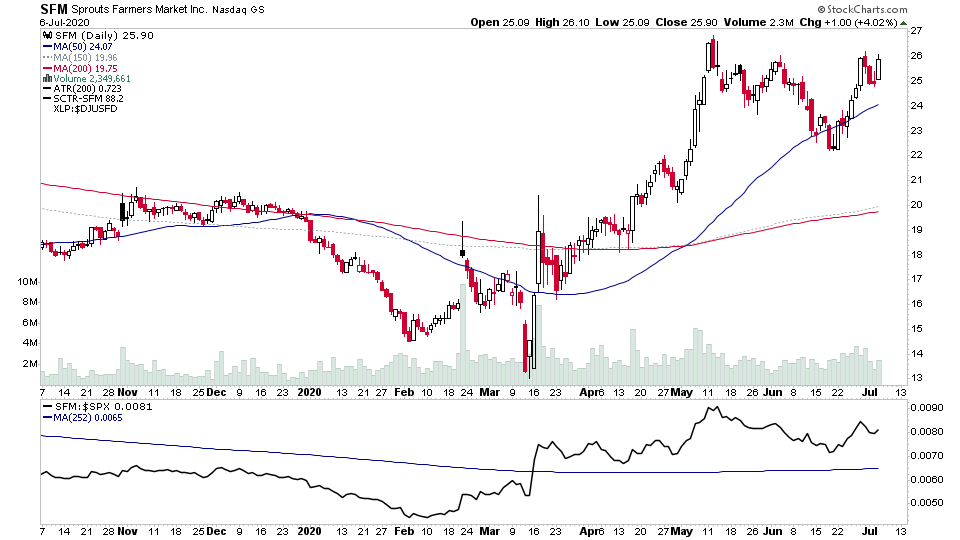

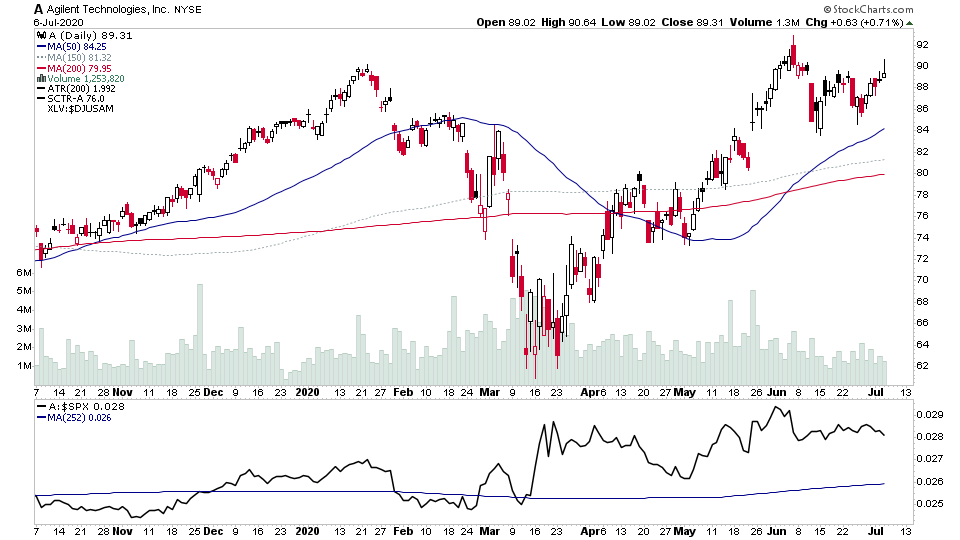

For the watchlist from Mondays scans - A, AMAT, BABA, BIDU, BVXV, CHN, CIEN, CRM, ELF, GRMN, KNX, LAC, LIN, LRCX, LX, MASI, MCHP, NBIX, SFM

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.