US Breakout Stocks Watchlist - 7 June 2020

There was another big list of stocks to go through after Fridays strong day across the whole US market. However, I made some further tweaks to my scans to filter out all stocks with a negative EPS, which basically halved the results. But I still had over 400 charts to go through manually and whittled it down to the list below.

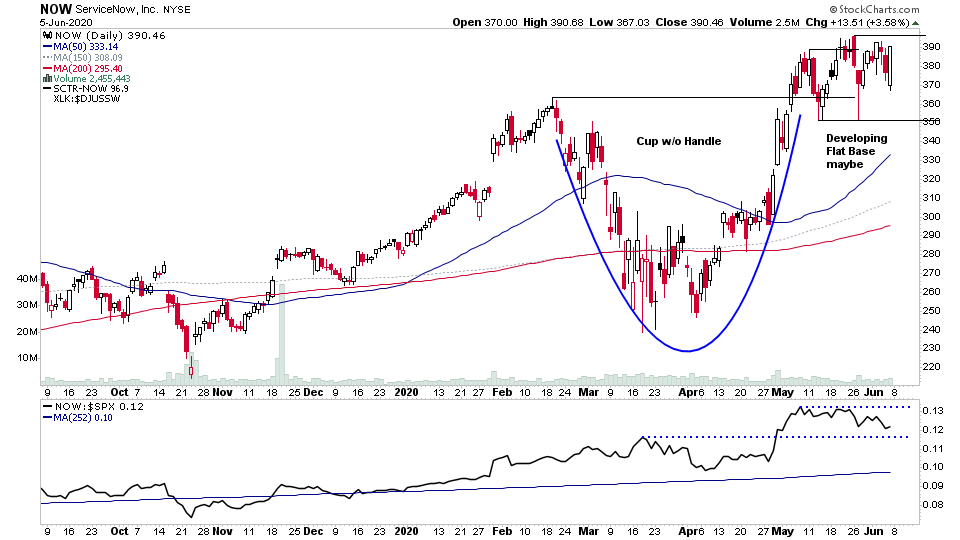

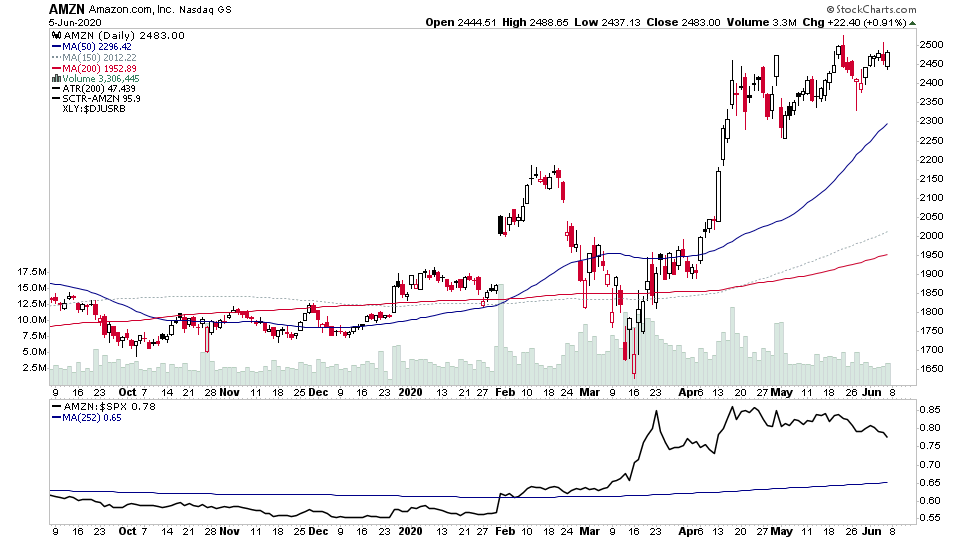

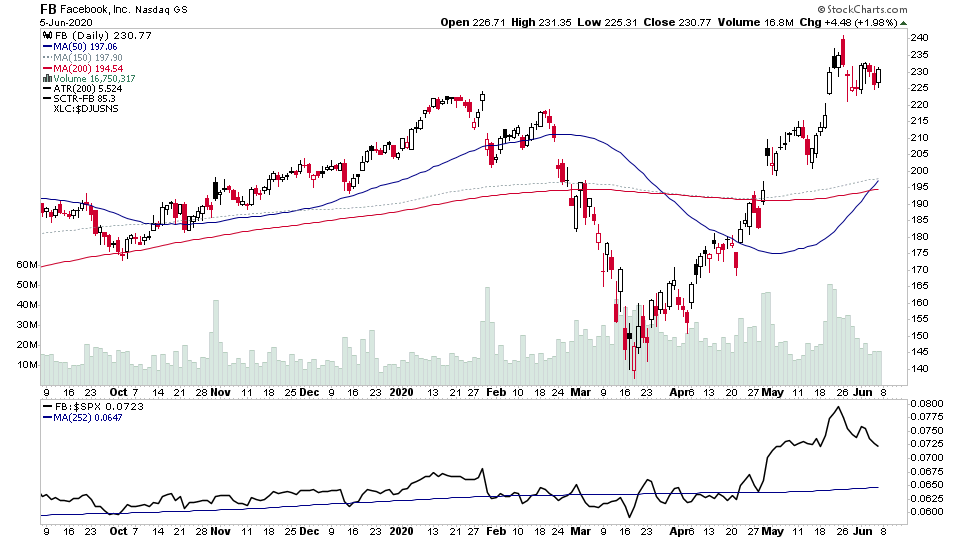

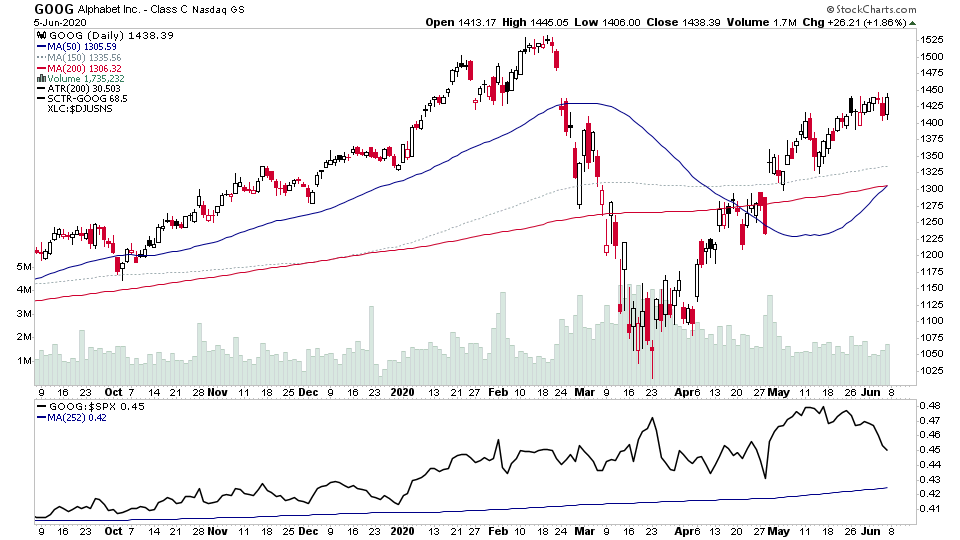

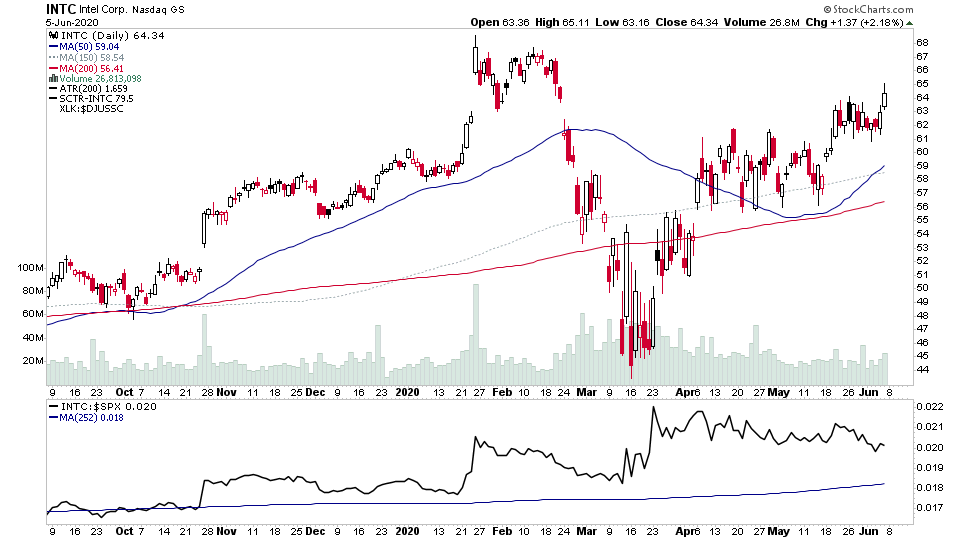

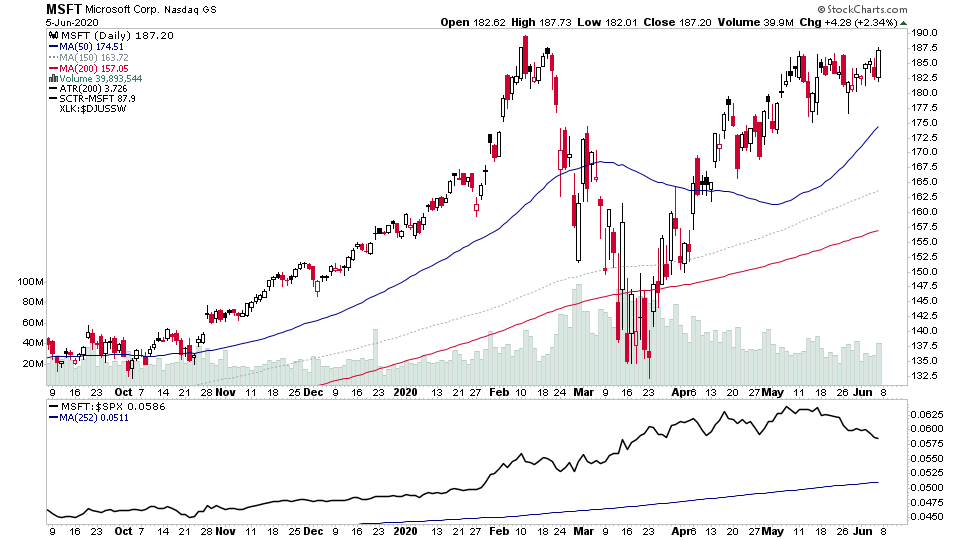

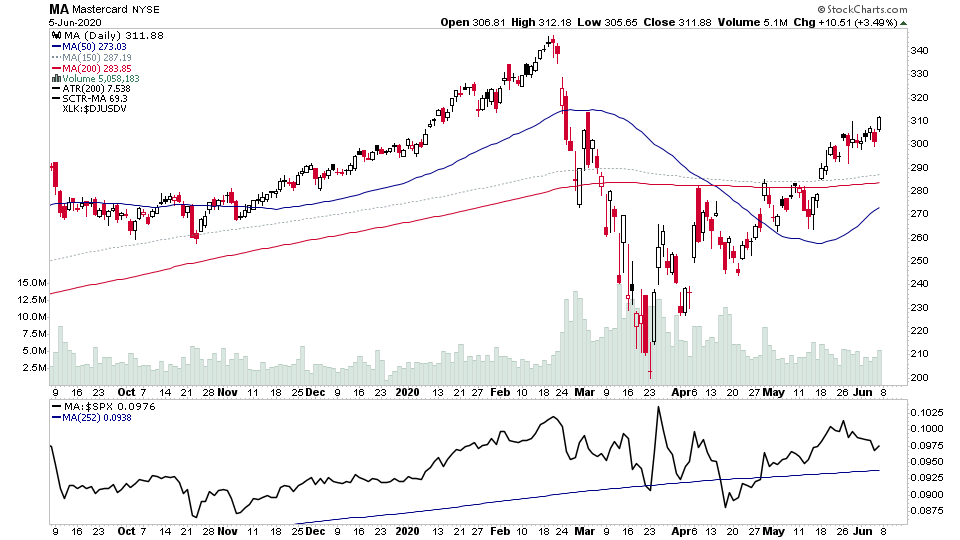

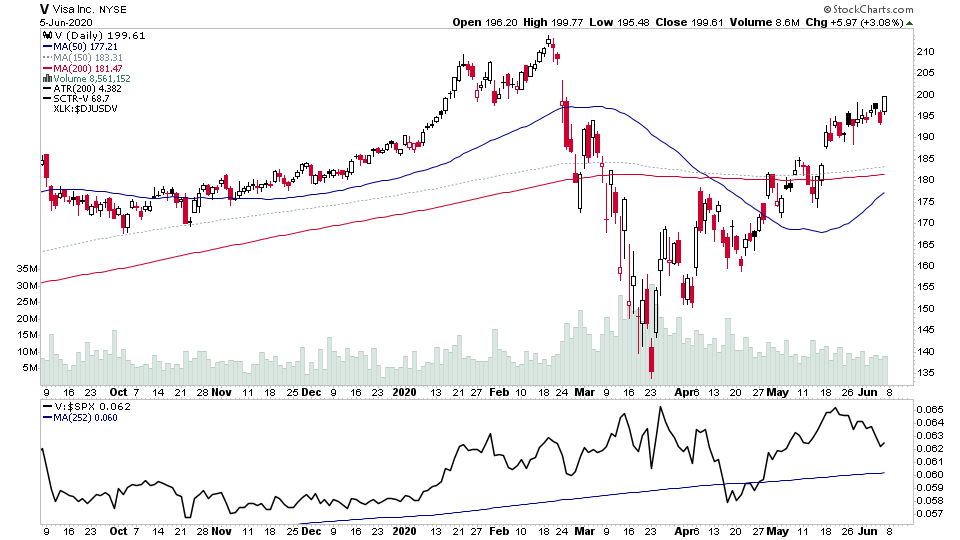

You'll notice this weekend a number of big name stocks in the watchlist (AMZN, FB, GOOG, INTC, MA, MSFT, V) which is interesting as each are making constructive patterns and are near to, or have already broken out of those patterns. So it is a positive breadth signal imo, as these widely held stocks by institutions and funds.

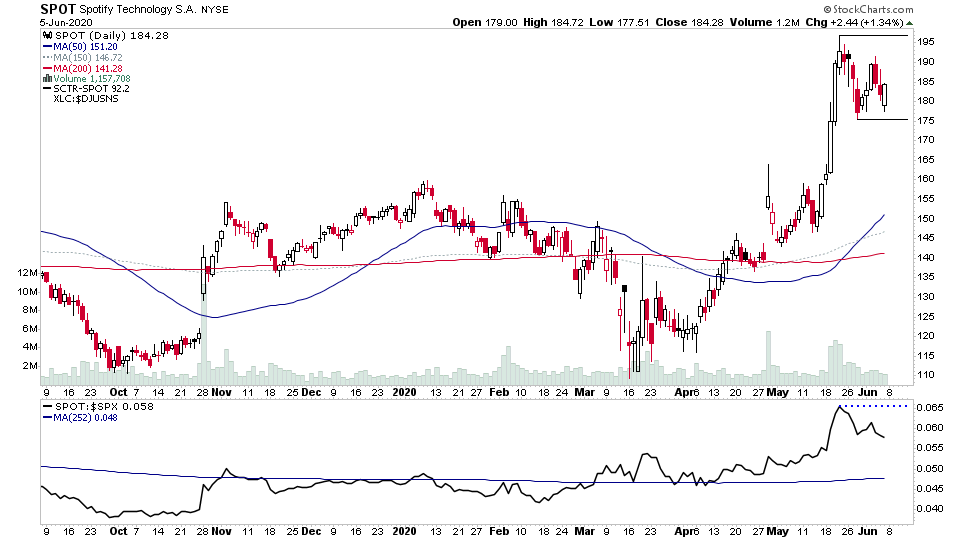

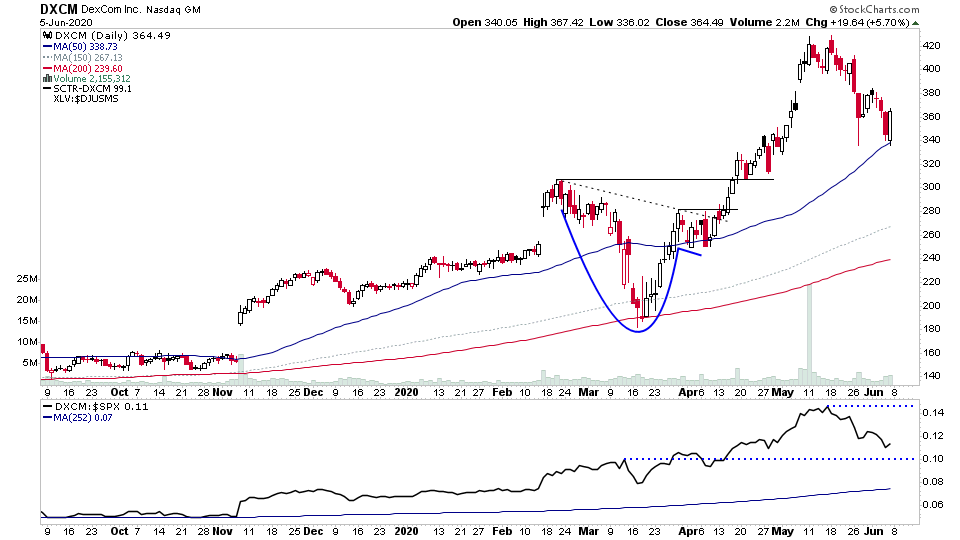

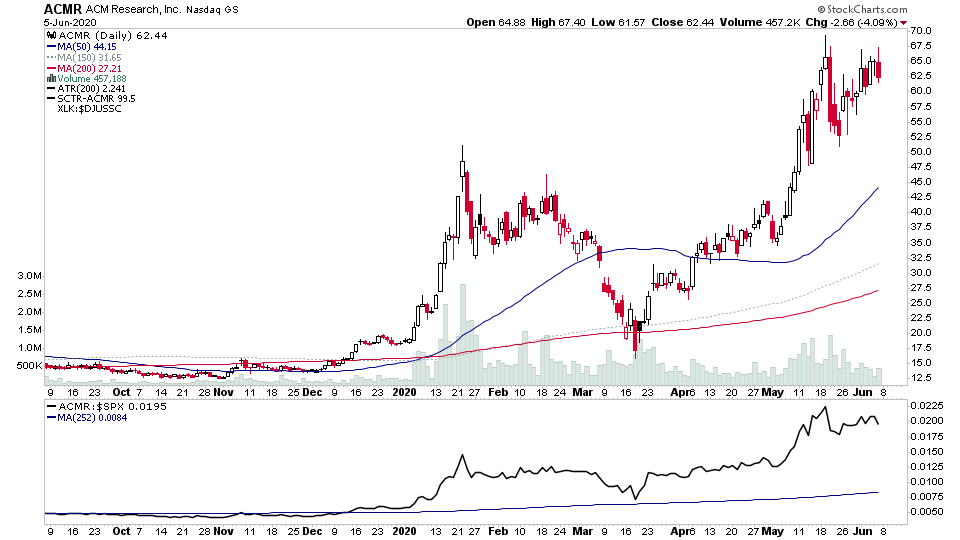

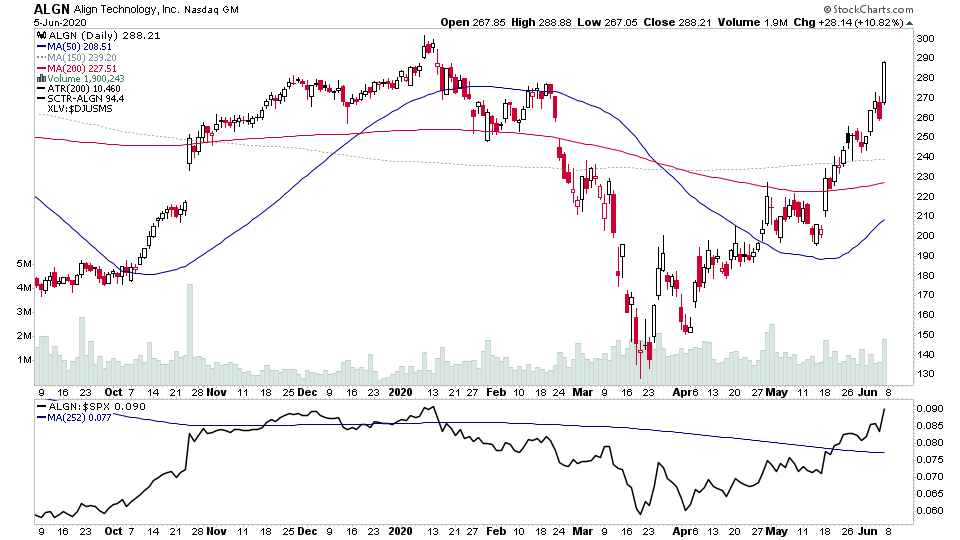

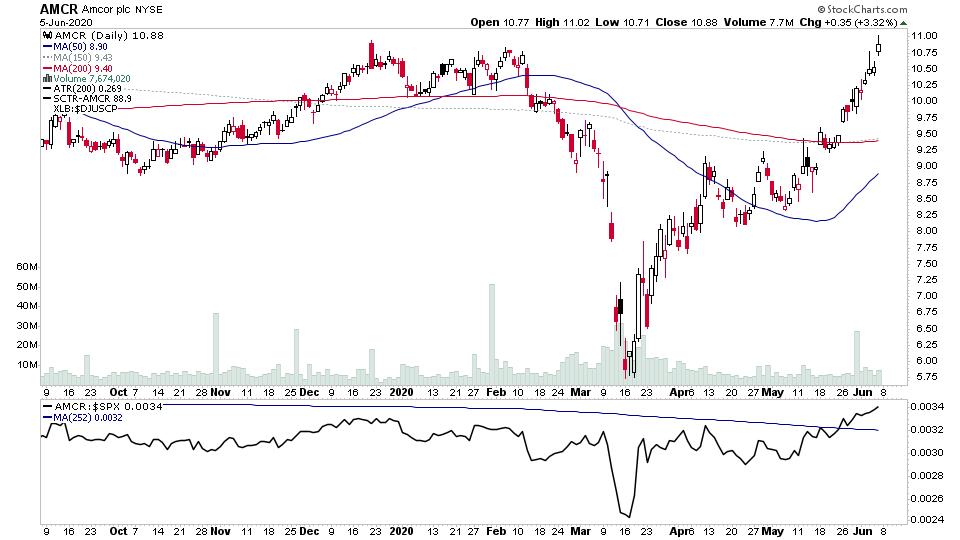

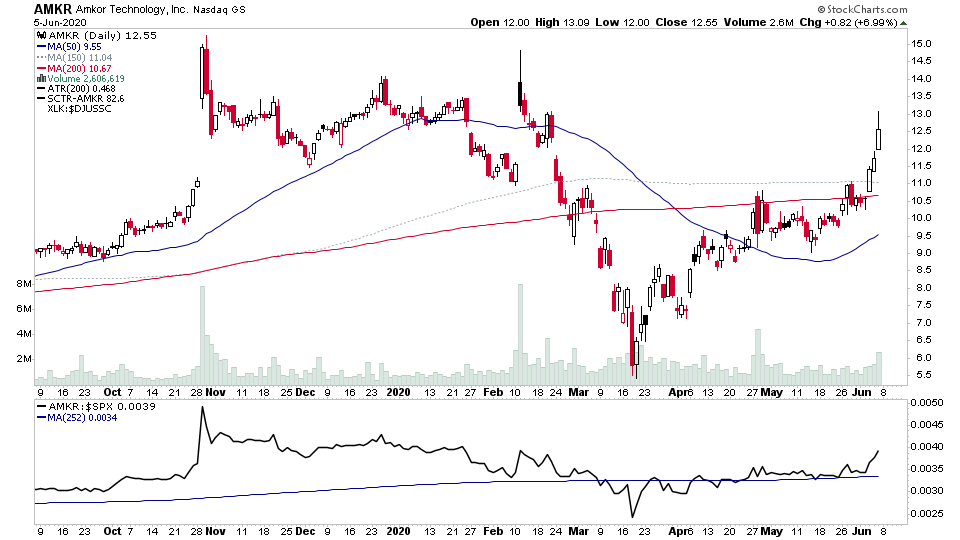

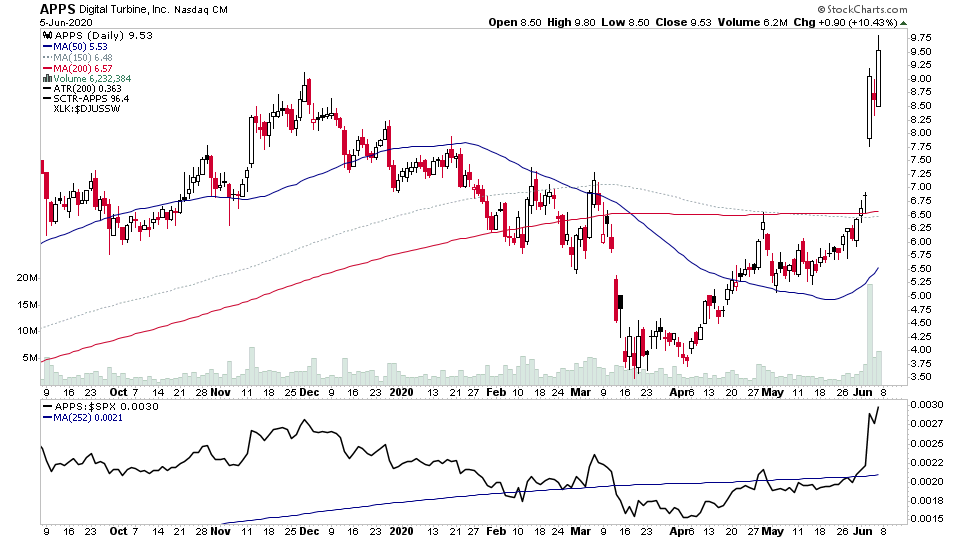

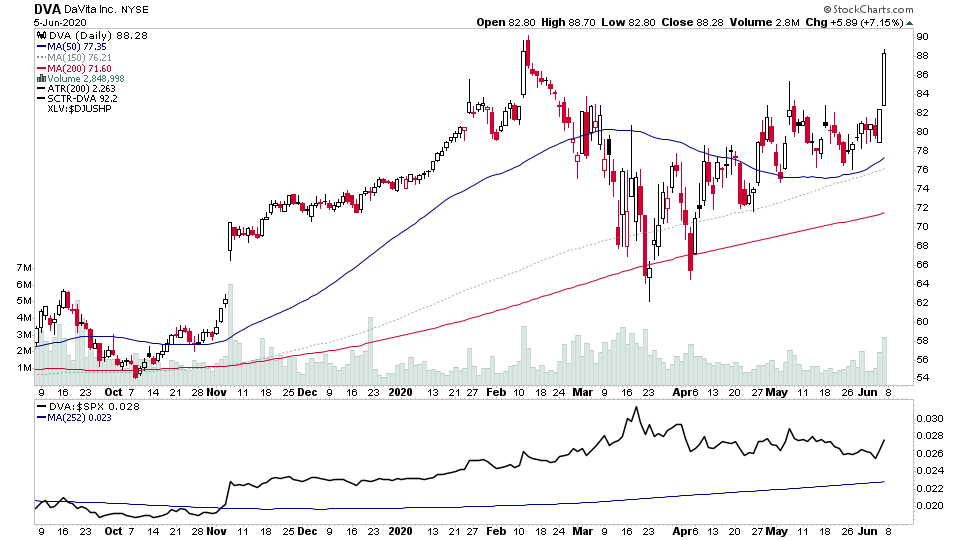

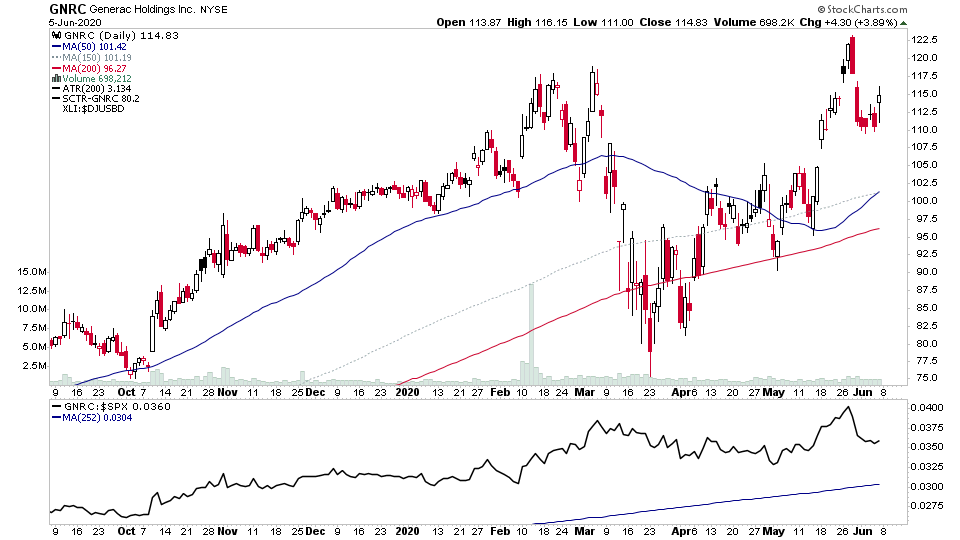

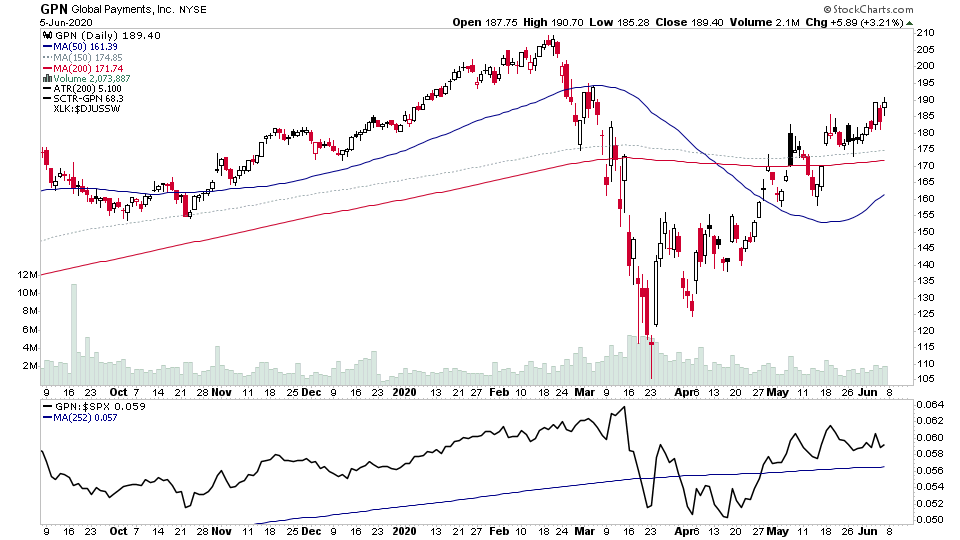

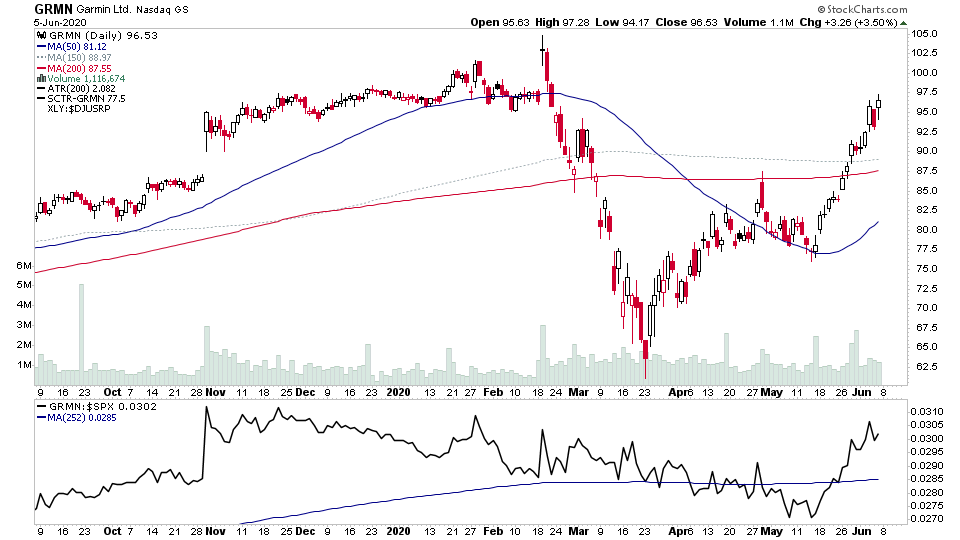

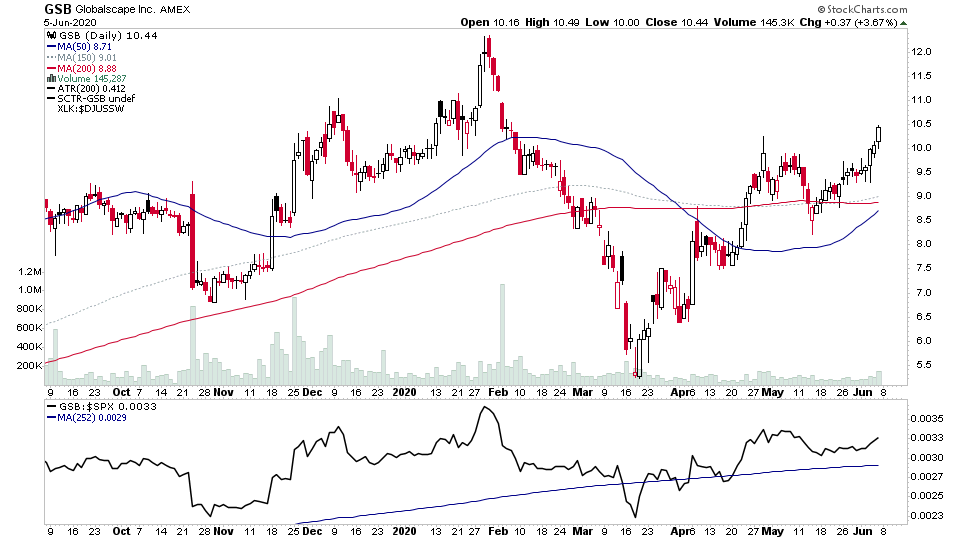

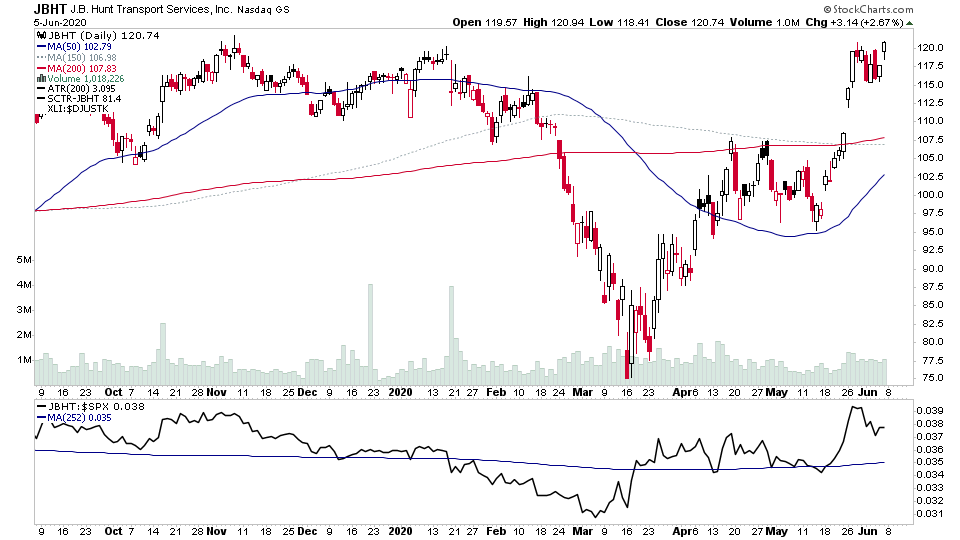

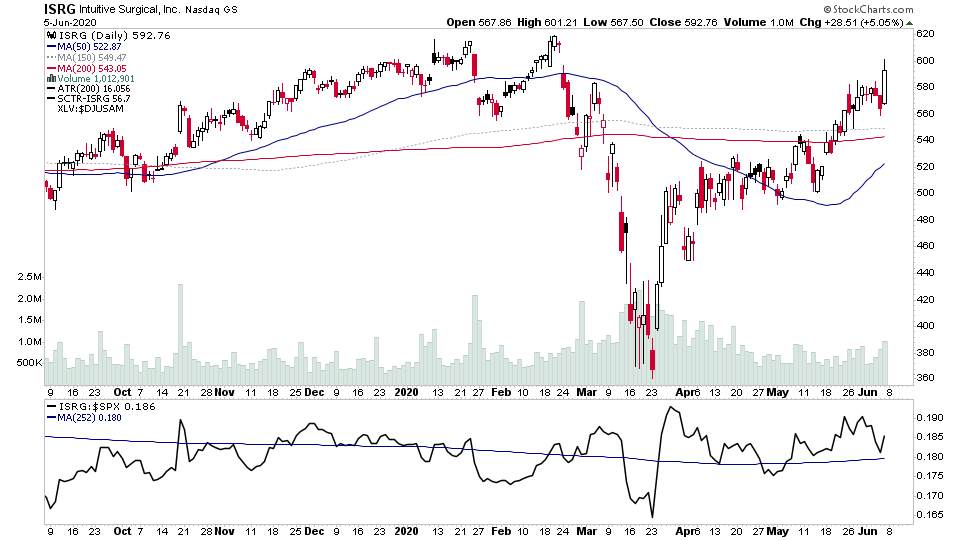

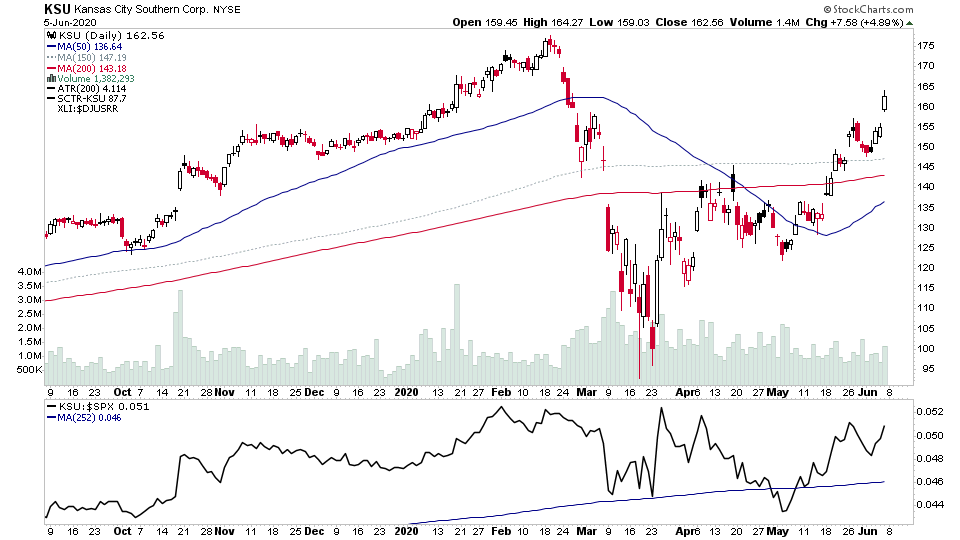

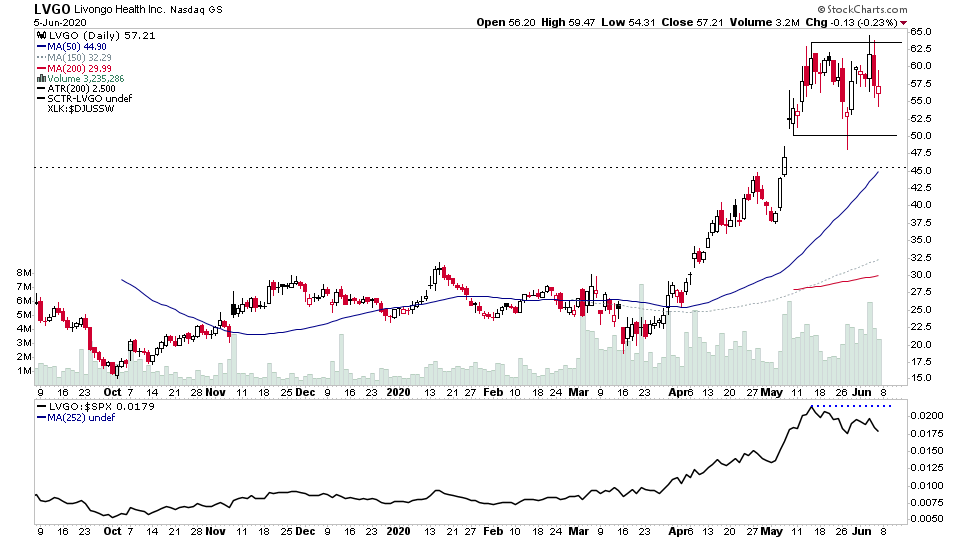

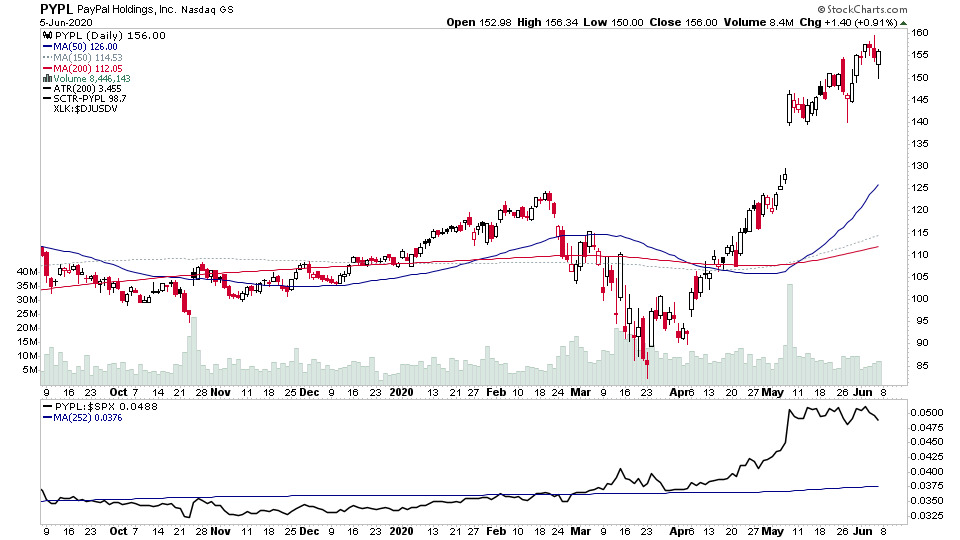

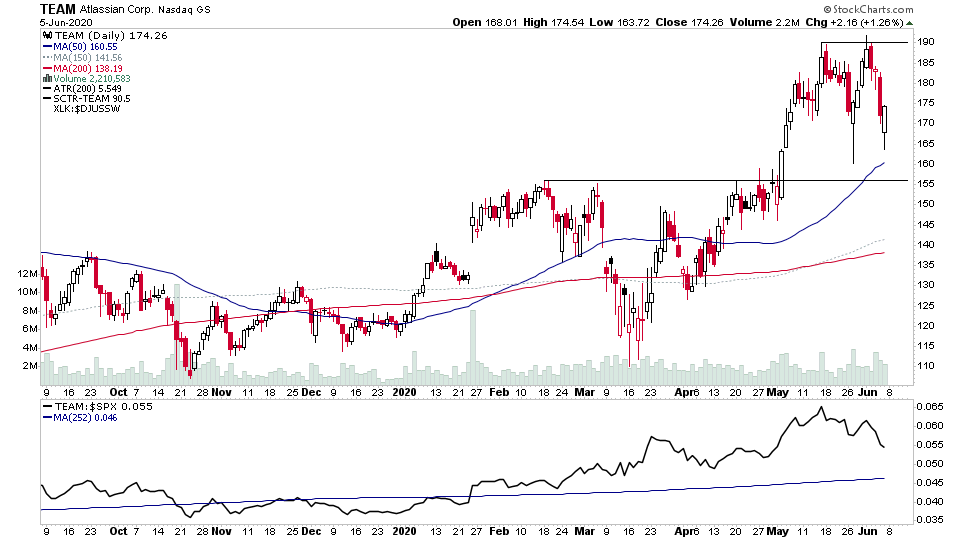

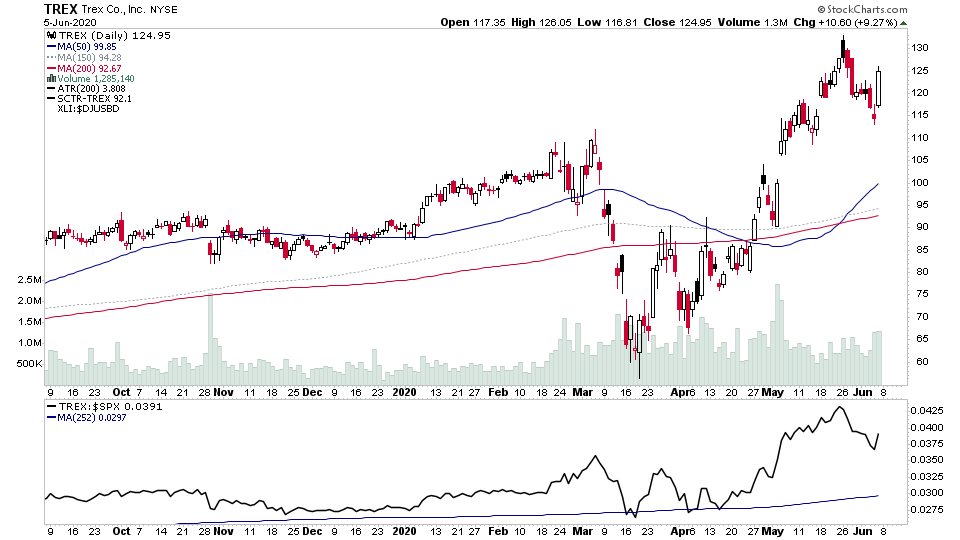

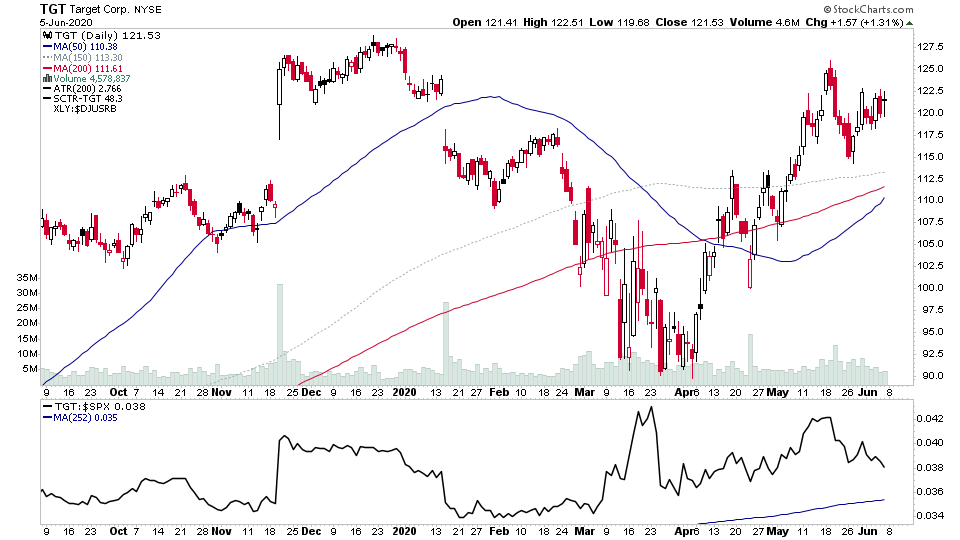

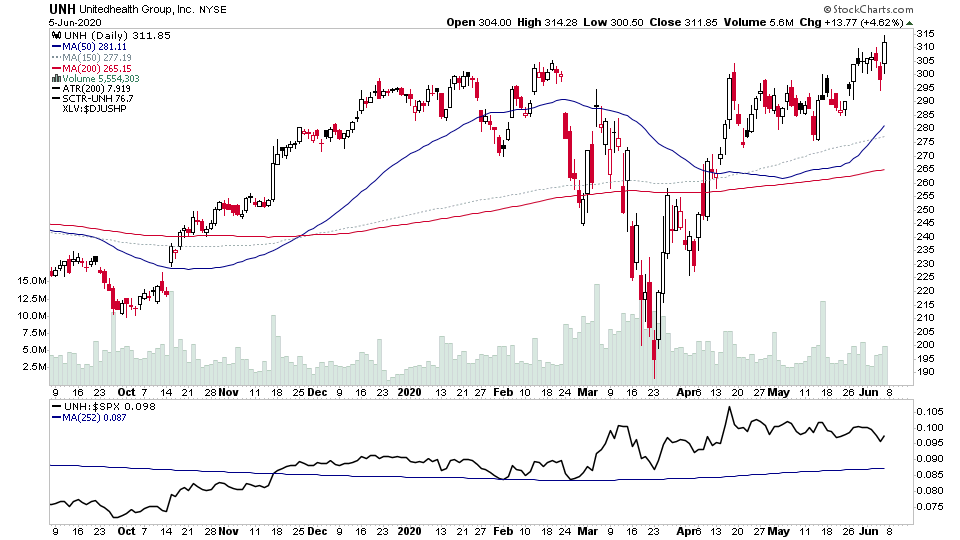

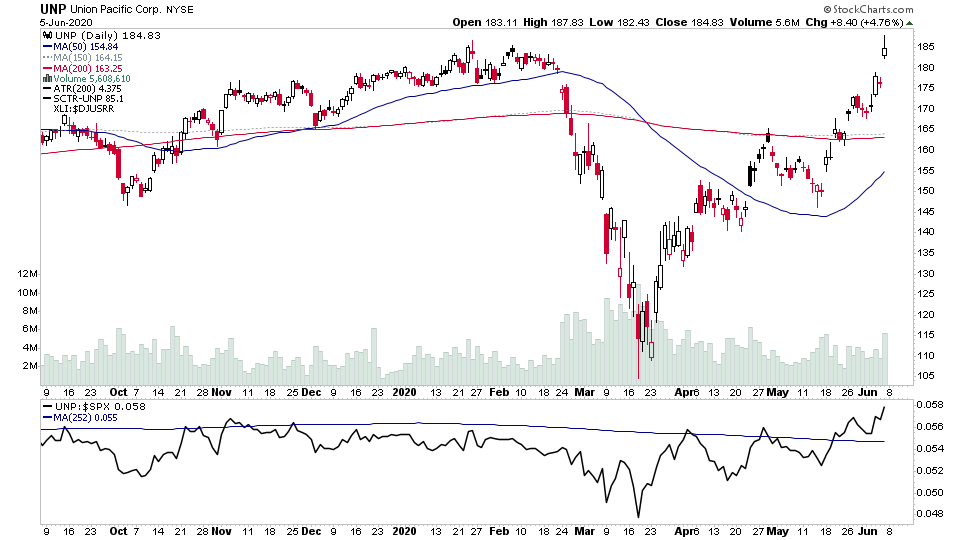

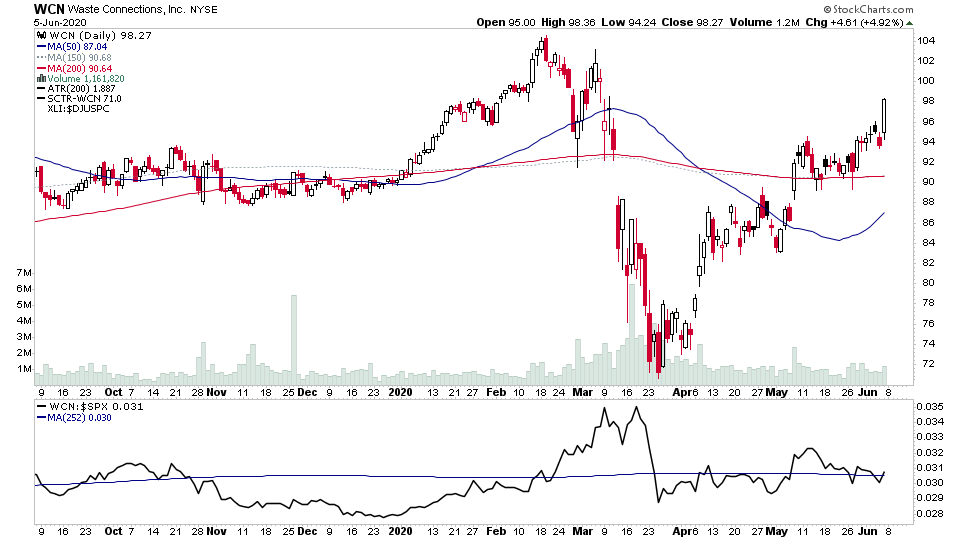

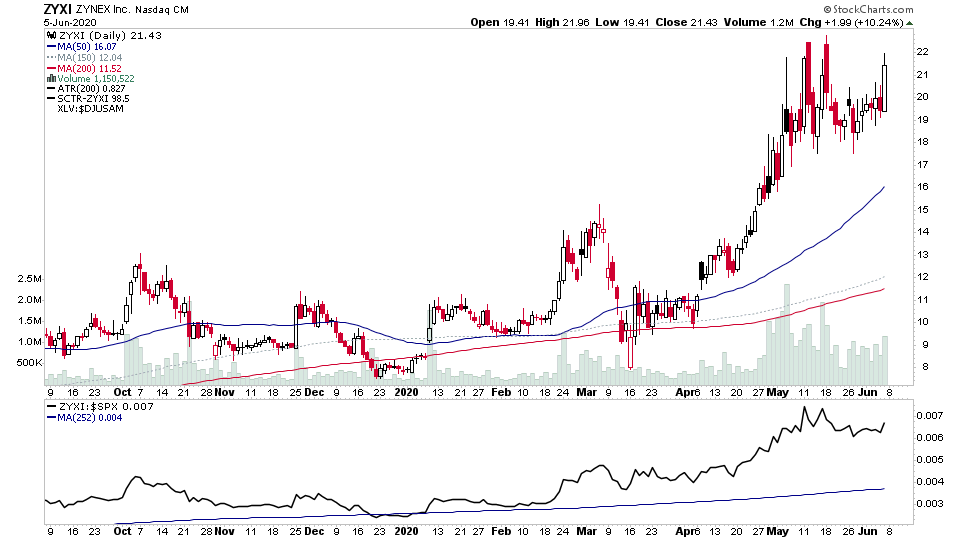

For the watchlist from the weekend scans - ACMR, ALGN, AMCR, AMKR, AMZN, APPS, DVA, DXCM, FB, GNRC, GOOG, GPN, GRMN, GSB, INTC, ISRG, JBHT, KSU, LVGO, MA, MSFT, NOW, SPOT, TEAM, TGT, TREX, UNH, UNP, V, WCN, ZYXI

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.