Stage Analysis Study Guide - Questions and Answers

The purpose of this Study Guide will be to help people learn to identify the Stages and to emphasise the importance of a full analysis taking into account the various technical attributes that we look to for guidance in determining the Stages i.e. price action in relation to the 10 and 30 week moving averages, volume, relative performance versus the market and the sector, support and resistance zones etc.

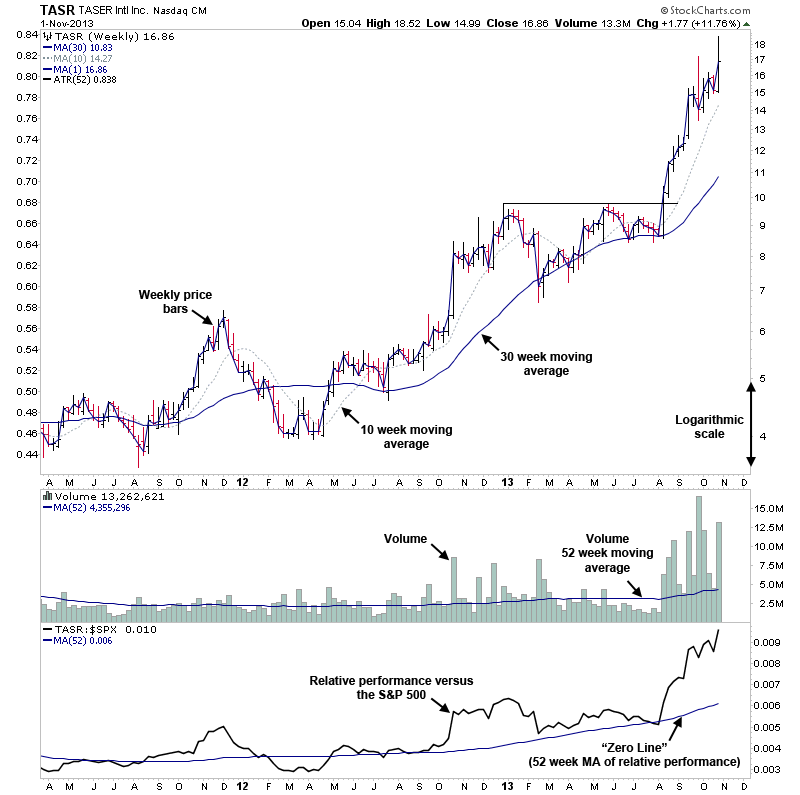

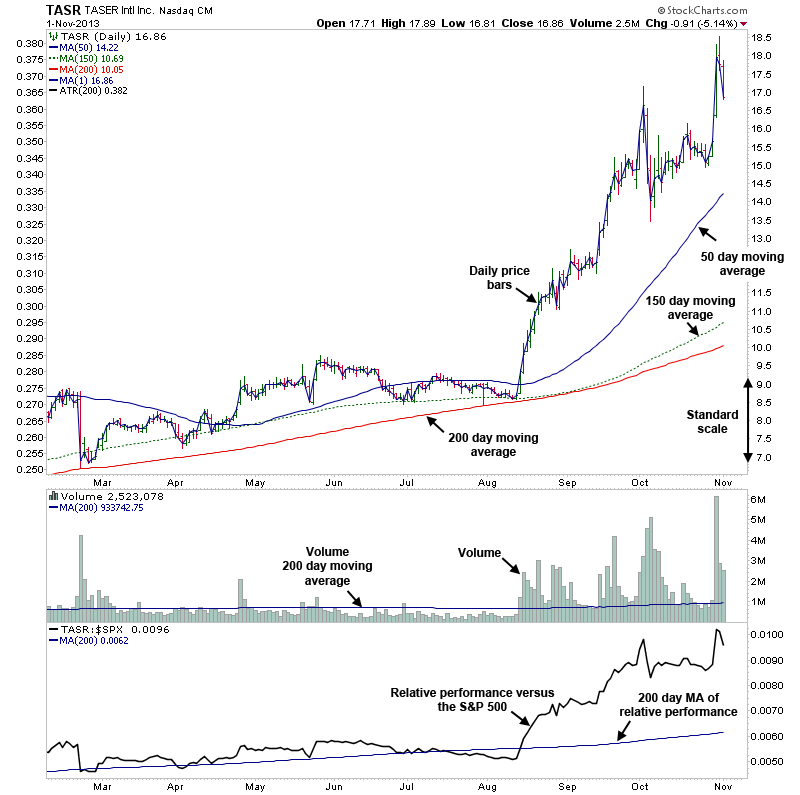

So before we start with the questions, lets have a look at the standard weekly and daily charts that I show and define all the various parts so that we are all speaking the same language.

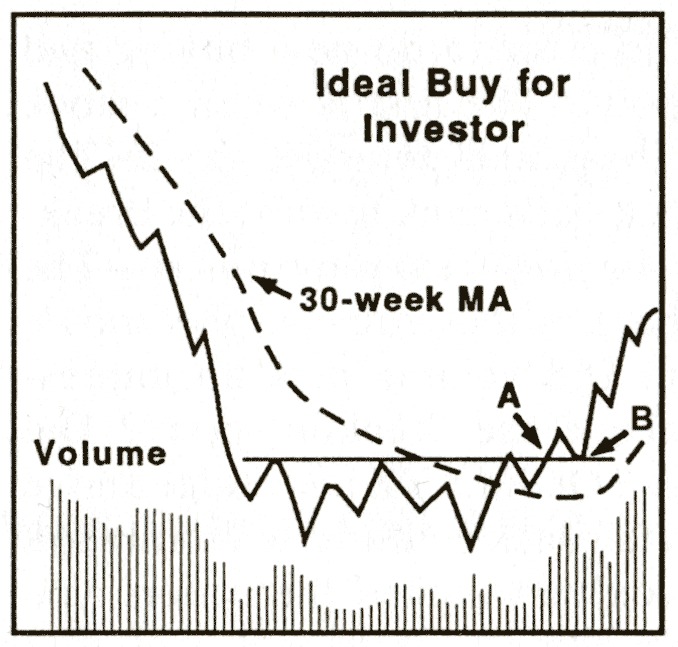

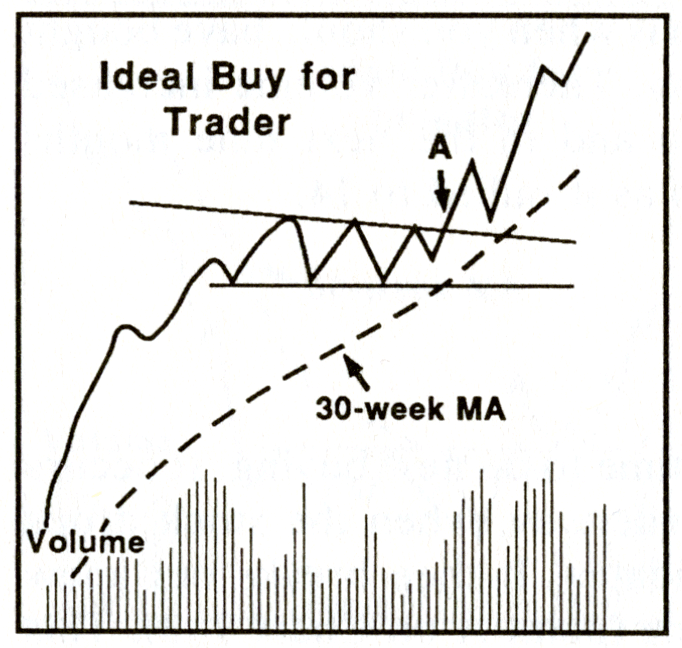

Now that you understand what everything is on the weekly and daily charts, the next thing is to recap what the ideal entry points are for the two major parts of the method:

Key requirements of the investor method for Stage 2A breakouts

- Price Action - price above a flattening or rising 30 week moving average

- Relative Performance - strengthening and ideally above the Mansfield Zero Line (Relative Performance 52 week MA)

- Volume - ideally two times the average volume or greater on the Stage 2A breakout week. The book specifies two times the four week average, but I prefer a smoother and longer term average, and so use the 52 week average on my charts, as it tends to be a bit stricter than the four week average and is cleaner on the chart.

- Support / Resistance - little or no heavy near term resistance.

For Stage 4A breakdowns the reverse of the above conditions should be true, but volume is less important.

The above chart is an edited example from Chart 3-1 on page 60 of the book and shows the ideal entry points for the investor method. The entry point marked with an "A" shows the breakout into early Stage 2A, and the entry point marked with an "B" shows the secondary lower risk entry point on the initial pullback within Stage 2A. To learn more about the investor method start by reading Chapter 3 in the book, and the various resources on the Stage Analysis forum.

Key requirements of the trader method for Stage 2 continuation breakouts

- Price Action - price above a rising 30 week moving average

- Relative Performance - above the Mansfield Zero Line (Relative Performance 52 week MA)

- Volume - ideally at least three times the average daily volume on the breakout day and also two times the four week average or greater on the Stage 2 continuation breakout week

- Support / Resistance - little or no heavy near term resistance.

For Stage 4 continuation breakdowns the reverse of the above conditions should be true.

The above chart is Chart 3-3 from page 62 of the book and shows the ideal entry point for the trader method. The entry point marked with an "A" shows a Stage 2 continuation move. To learn more about the trader method start by reading Chapter 3 in the book, and the various resources on the Stage Analysis forum.

Let's begin the Q&A...

Quiz Question#1

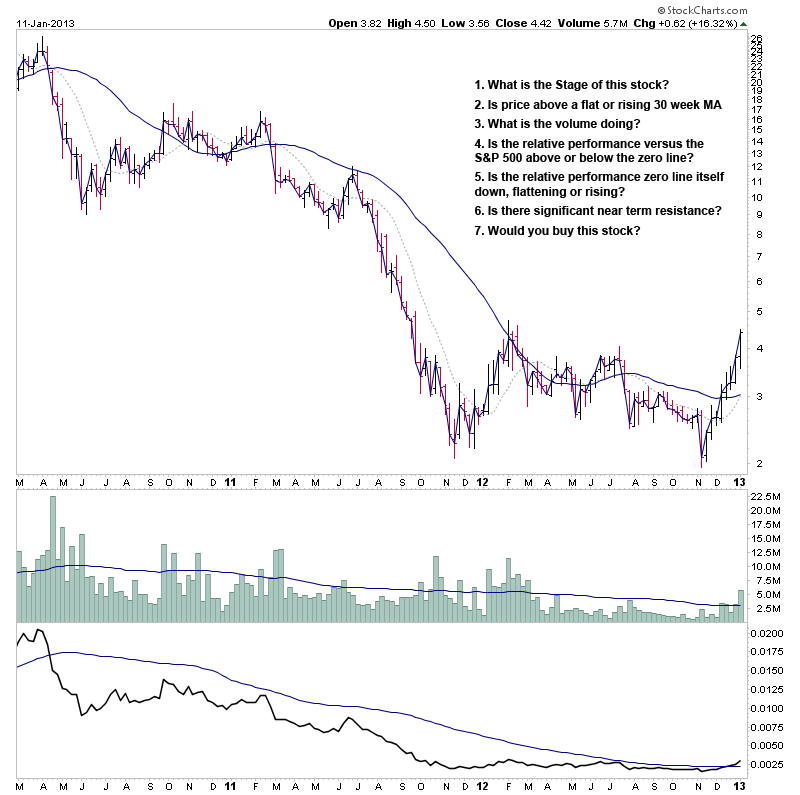

Attached is the first mystery chart with a set of questions for you to answer.

- What is the Stage of this stock?

- Is price above a flat or rising 30 week MA?

- What is the volume doing?

- Is the relative performance versus the S&P 500 above or below the zero line?

- Is the relative performance zero line itself down, flattening or rising?

- Is there significant near term resistance?

- Would you buy this stock?

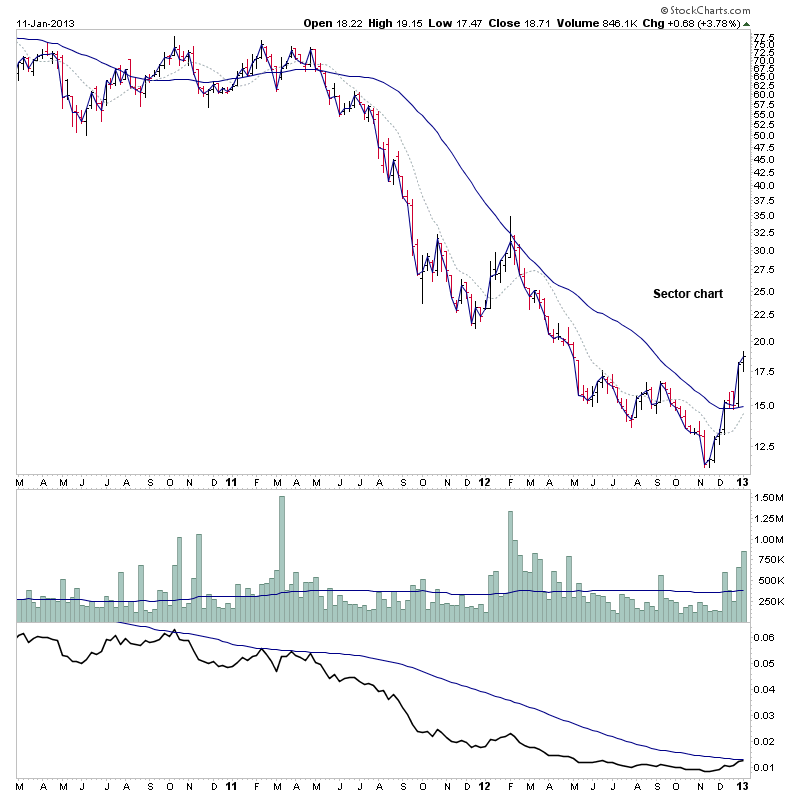

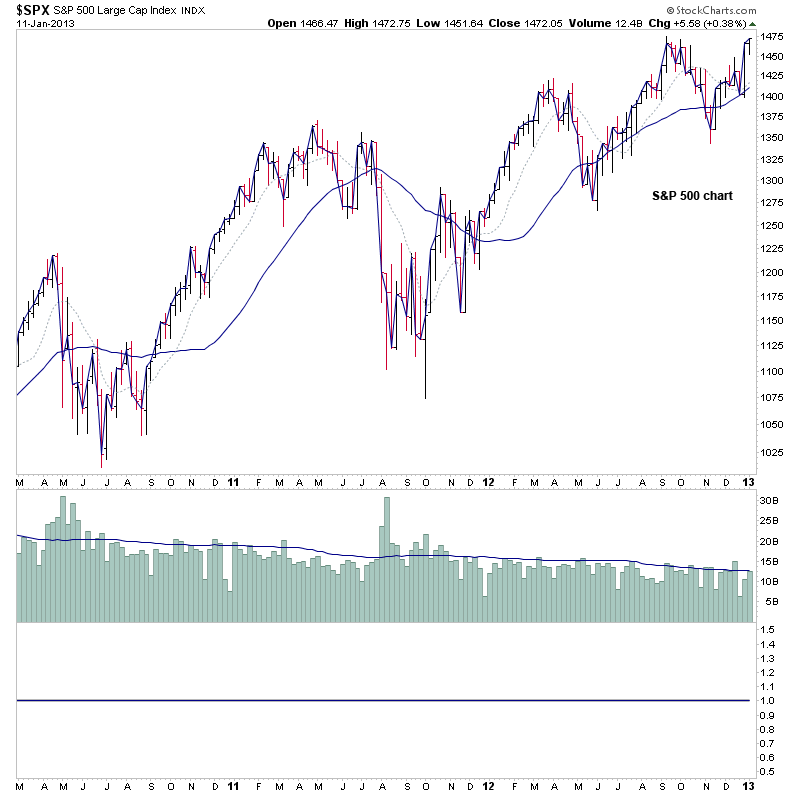

- I've also included the Sector chart and the S&P 500 at the time, so that you can evaluate their Stages also to complete the analysis.

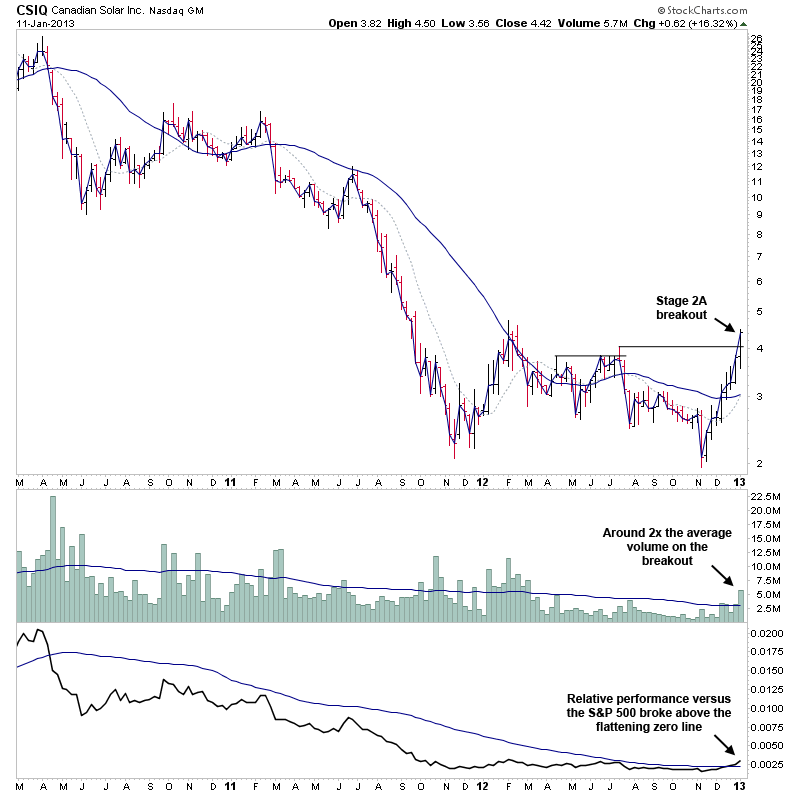

Quiz Answer#1

I've attached the marked up chart, which shows it was at the Stage 2A breakout point and the 30 week MA had just started rising. Volume picked up to around 2x the average on the breakout week and was trading above a flattening zero line. Most of the near term resistance had been cleared on the breakout with only the early 2012 high to clear, but it had rallied directly off the bottom to make the Stage 2A breakout and so was quite extended short term. The sector chart had only just moved into Stage 1A, and was recovering, and meant that CSIQ was one of the leaders in the sector as it had already formed a large Stage 1 base and was breaking out, and so more research on other members of the sector would have been necessary to see if it was the best candidate in the group. The S&P 500 too was recovering after a failed Stage 4 breakdown attempt in November 2012 and was attempting to make a Stage 2 continuation move to new highs. And so it would have been a potential investor buy imo, but wasn't yet an A+ candidate, more like a B+ prospect due to the few issues I highlighted, and how extended it was in the short term.

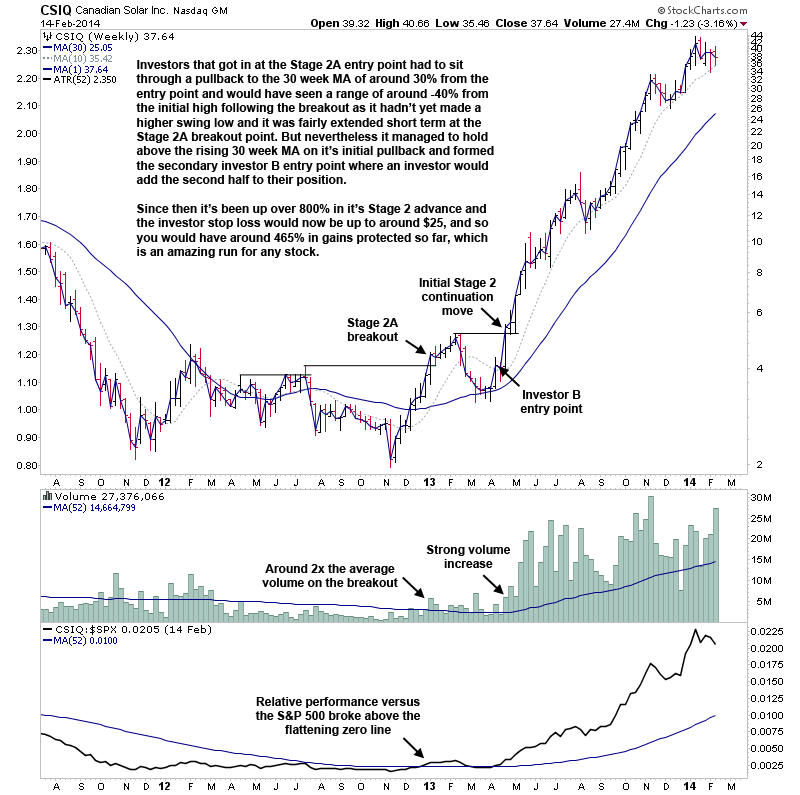

I've also attached the chart a year later, which shows that investors that got in at the Stage 2A entry point had to sit through a pullback to the 30 week MA of around 30% from the entry point after it's initial breakout and would have seen a range of around -40% from the initial high following the breakout as it hadn't yet made a higher swing low and it was fairly extended short term at the Stage 2A breakout point. But nevertheless it managed to hold above the rising 30 week MA on it's initial pullback and formed the secondary investor B entry point where an investor would add the second half to their position.

Since then it's been up over 800% in it's Stage 2 advance and the investor stop loss would now be up to around $25 just over a year later, and so you would have around 465% in gains protected so far, which is an amazing run for any stock. But I imagine a lot of people would have exited the stock on the first pullback as it had gone from a 15% profit following the initial breakout to -30% on the first pullback, and is why position sizing is an important consideration, as the pullback from the entry point was only 1.5x the 52 week average true range, which is quite normal.

I think this is a good example to show, as the initial Stage 2A breakout lacked decent relative volume on the the weeks following the breakout and could only manage to close one week above the 2012 high before rolling over and pulling back. But it then formed the secondary entry point and volume started to increase as it made the first continuation move into Stage 2. So it shows that it can take a while after the Stage 2A breakout point to get going and a lot of people got shaken out on that first pullback before it started it's dramatic Stage 2 advance with the all important heavy volume that so many mediocre Stage 2 runs are lacking.

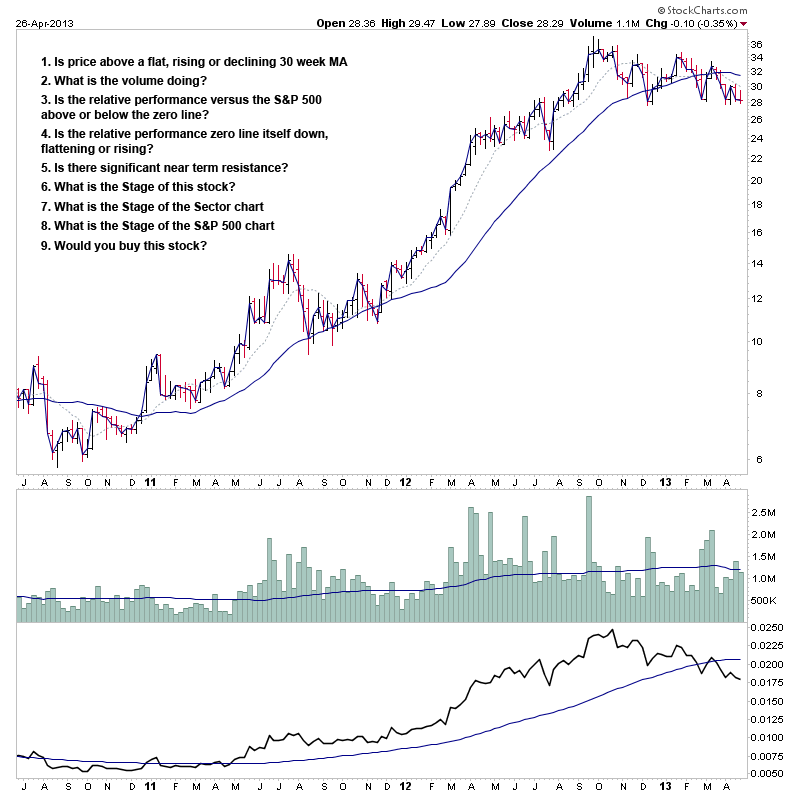

Quiz Question#2

Attached is a mystery chart with a set of questions for you to answer, and I'd encourage you to elaborate if you can as it helps in analyzing the Stage.

- Is price above a flat, rising or declining 30 week MA?

- What is the volume doing?

- Is the relative performance versus the S&P 500 above or below the zero line?

- Is the relative performance zero line itself down, flattening or rising?

- Is there significant near term resistance?

- What is the Stage of this stock?

- What is the Stage of the Sector chart?

- What is the Stage of the S&P 500 chart?

- Would you buy this stock? Explain your reasons of what you would do.

Attached is the weekly and daily charts of the mystery stock, and also weekly charts of it's sub sector and the S&P 500, and I'll post the answers later on once a few people have had a go at answering the questions.

Quiz Answer#2

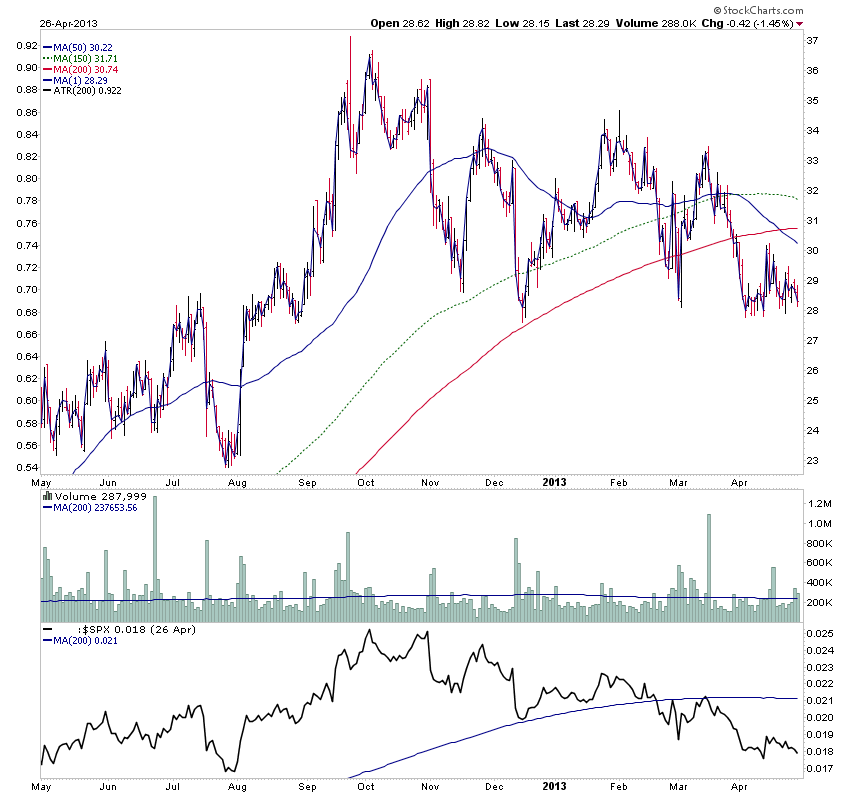

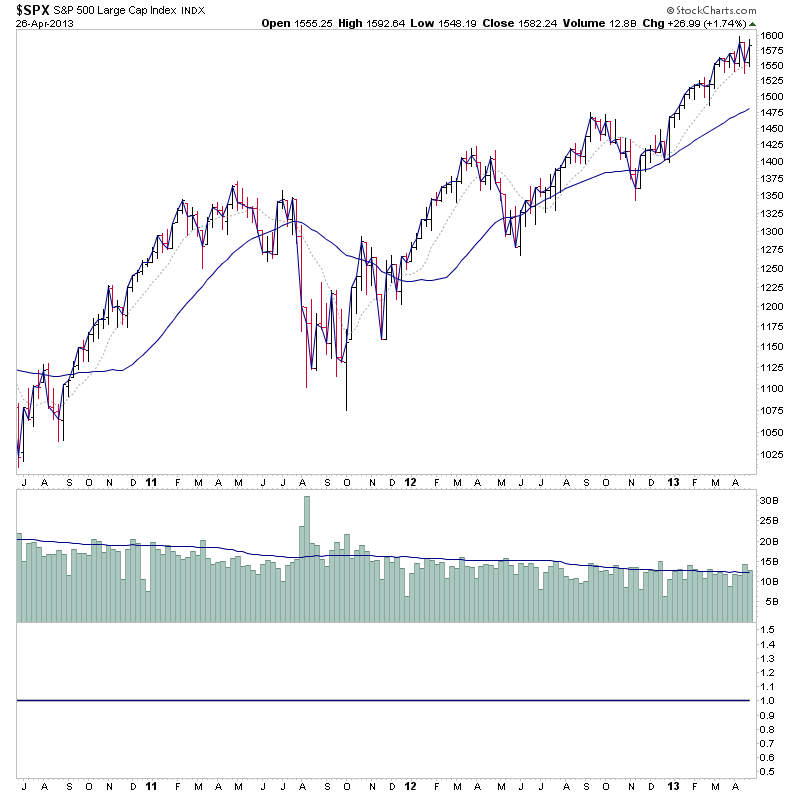

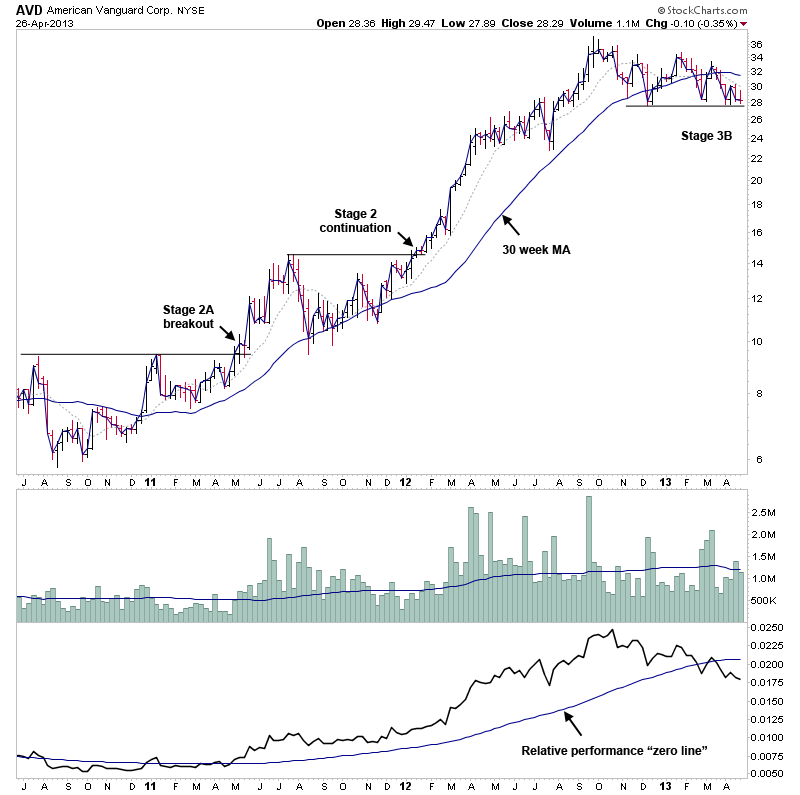

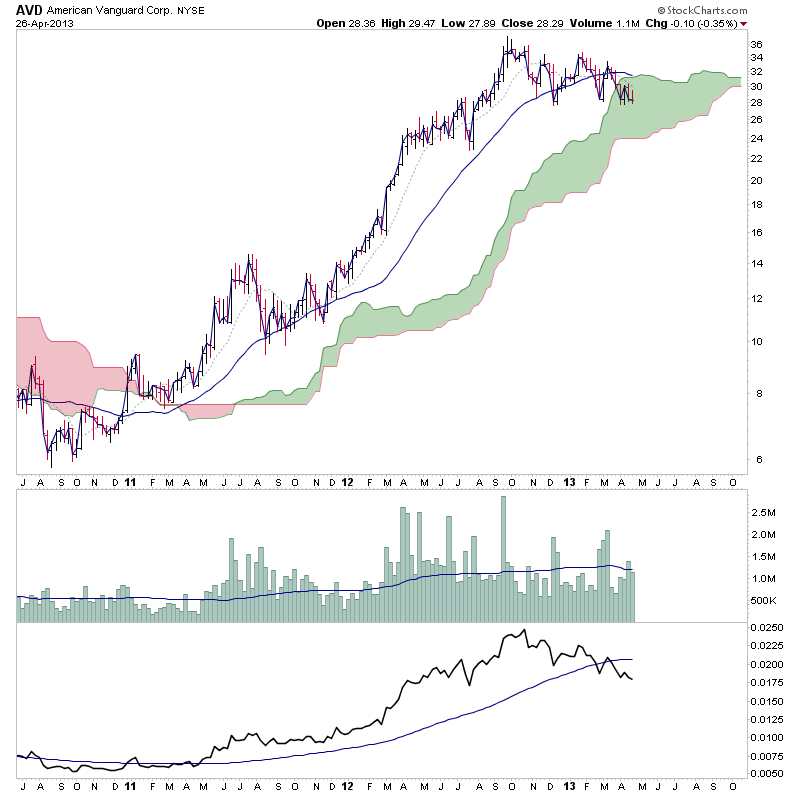

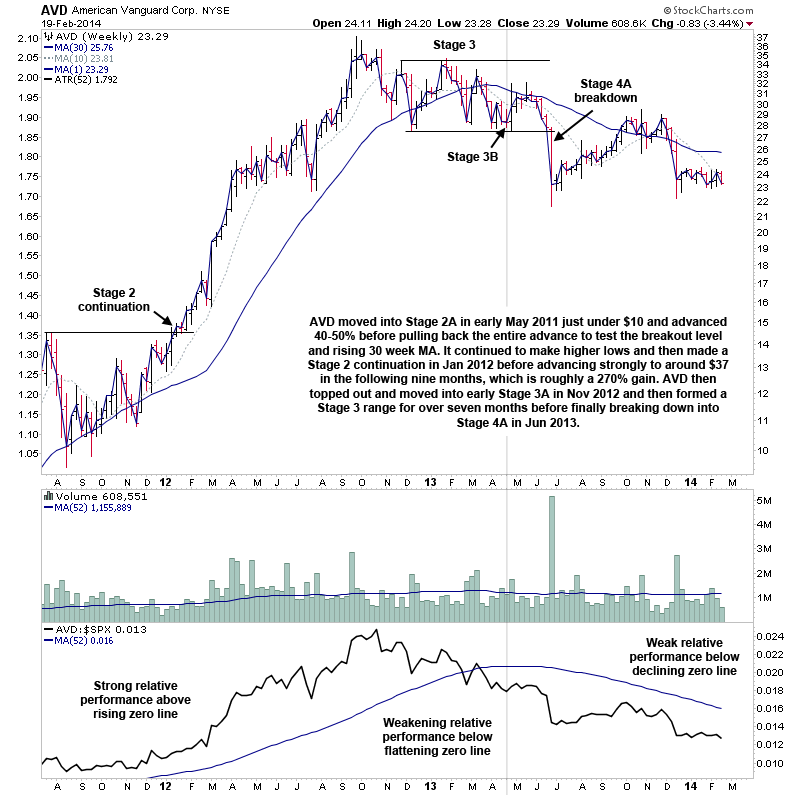

I've marked up an up to date chart of the stock, which was AVD (American Vanguard) which is in the $DJUSCX (Specialty Chemicals) sector, and I've highlighted the point that it was at on the previous chart I showed for you to analyze with a vertical grey line, so you can see what happened next to the price and the relative performance and volume.

AVD was below a declining 30 week MA with around average volume for it. The relative performance was weakening below a flattening zero line, and it had formed some near term resistance with a number of lower highs and was testing the lows of the Stage 3 range which had been forming for six months. And hence it would be given a Stage 3B rating, which means late in Stage 3 as it had become increasingly toppy, and so if you were still in it then you should use rallies for at least partial selling at that Stage.

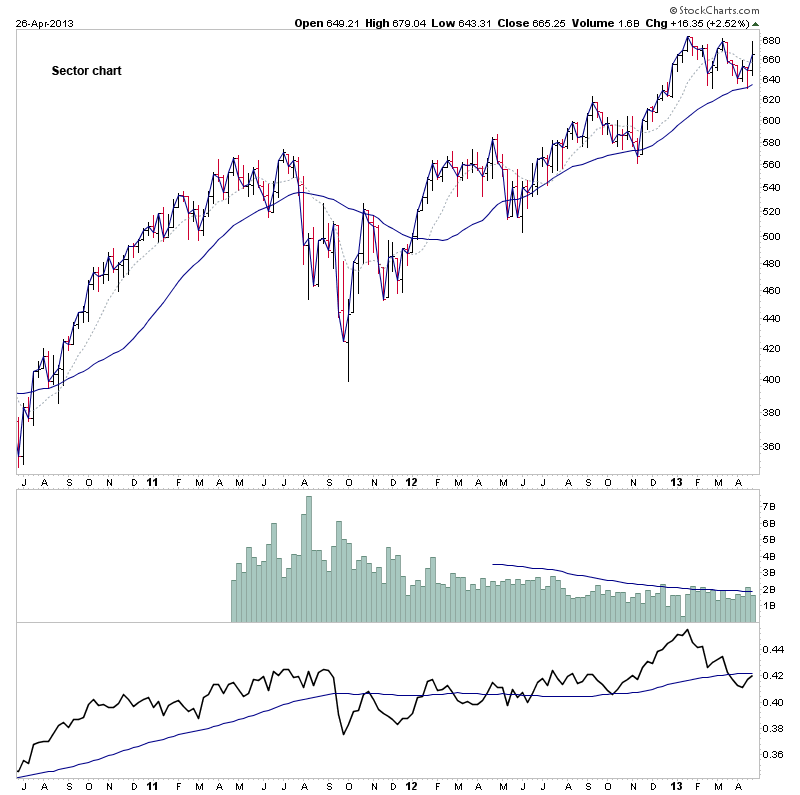

The sector chart was in Stage 2B- / Stage 3A, as it was still above a rising 30 week MA, although it had made a lower high, but had managed to hold from breaking down on a test of the swing low and had recovered back above the 10 week MA. Relative performance was rising, but below the zero line, and so whether a Stage 2 consolidation or the beginnings of Stage 3 it was in a neutral position until it either broke out to new highs or broke down below the swing low.

The S&P 500 chart was much more clear cut in Stage 2B, near to it's highs and still above strongly rising 10 and 30 weeks MAs.

So the final question was would you buy this stock? And so the answer is no, as the time to buy stocks for an investor is at the Stage 2A breakout point in May 2011 and on the initial Stage 2A pullback to test the breakout in August 2011. And for a trader the ideal time to buy is on the Stage 2 continuation breakout, and so as AVD was in late Stage 3B with deteriorating technicals; you wouldn't consider buying it at that Stage, as it breaks numerous items of Stan's Don't Commandments and most of all the fundamental rule of the method that you shouldn't buy stocks in Stages 3 or 4. Also, if you already held it you would be looking for an opportunity to sell your remaining holding on any rally before a potential breakdown into Stage 4.

Another perspective you would consider once you'd determined that the stock was in Stage 3B, is whether you should short it. And initially, it looks to have potential with it's deteriorating technicals, but one piece of the puzzle isn't quite there yet, as the support from the previous consolidation is still fairly recent and so becomes a source of resistance to any down move until it's cleared. This can be seen more clearly on the chart with the ichimoku cloud overlaid (which is a great way of highlighting the dynamic support and resistance zone), that shows that it's still trading in the resistance zone, and so would likely need more time for the resistance to weaken or a heavy volume sell off in order to break through early.

So lets look at the final up to date chart which shows that nine weeks later AVD broke down into Stage 4A, after first rallying back up to the declining 30 week MA and rolling over. Now almost a year later it's still in Stage 4 and has formed a much larger head and shoulders top, which if it makes a further Stage 4 continuation breakdown below the major support that's formed, it would move into a more serious Stage 4 decline with no support until around the mid teens, although that's quite old now.

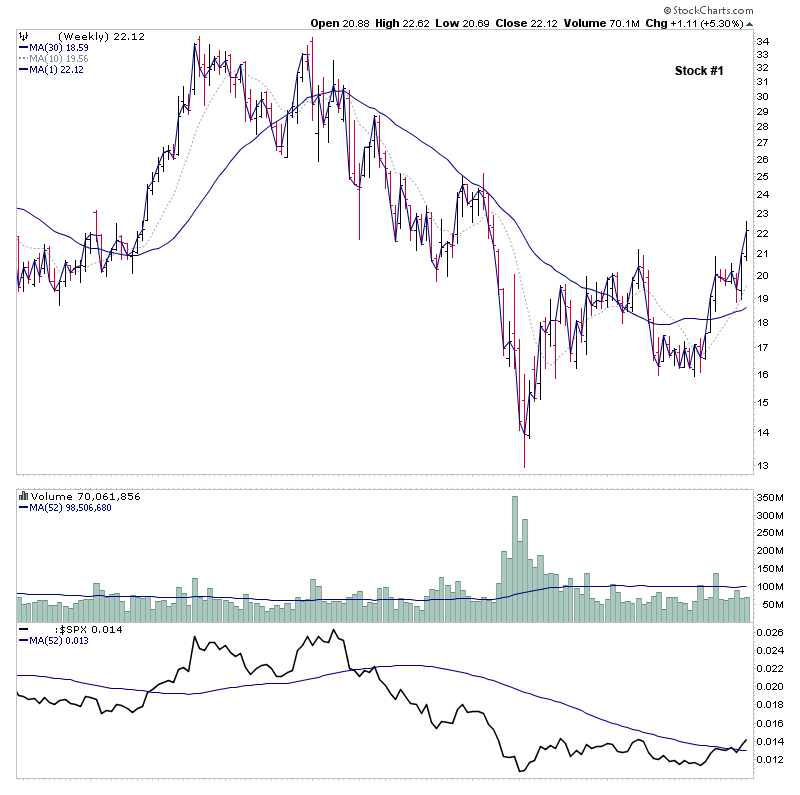

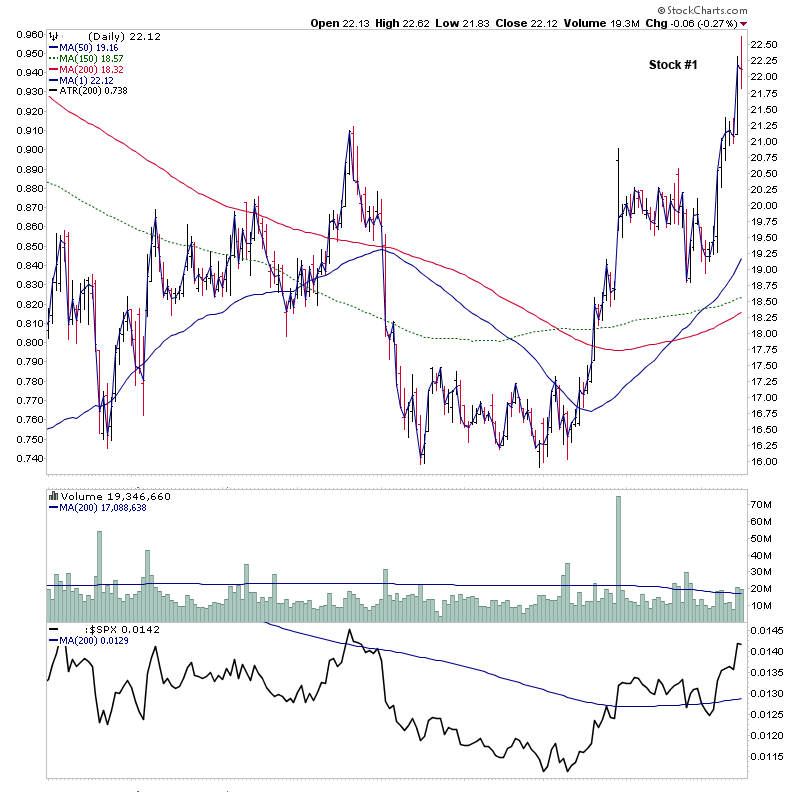

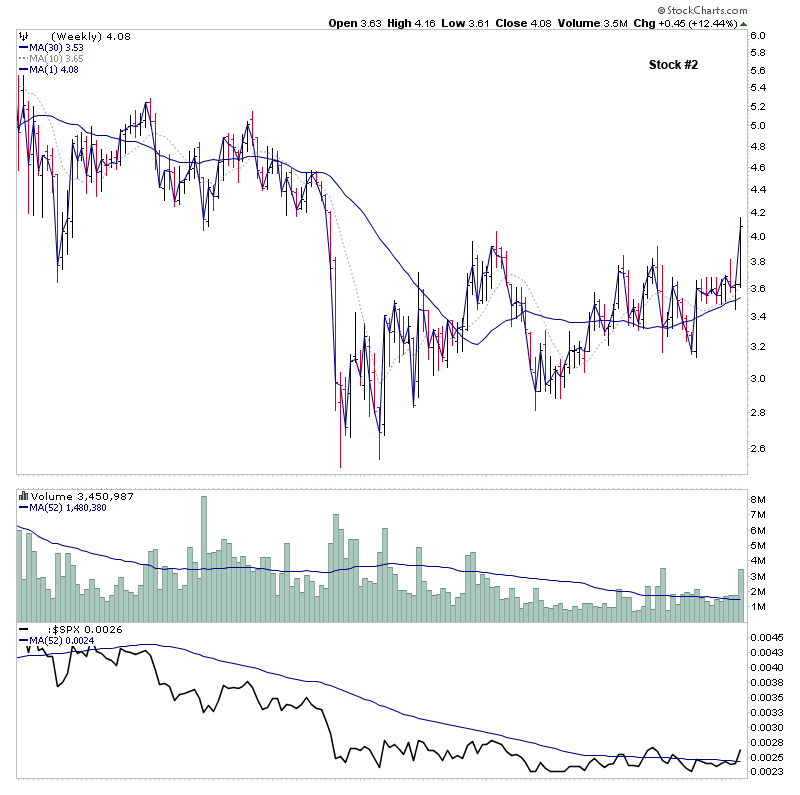

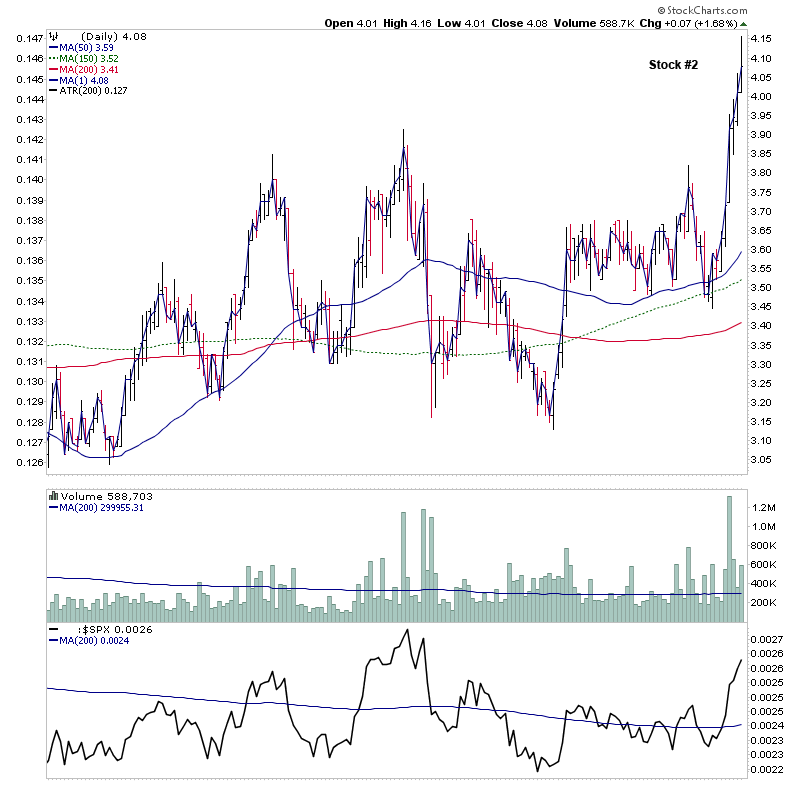

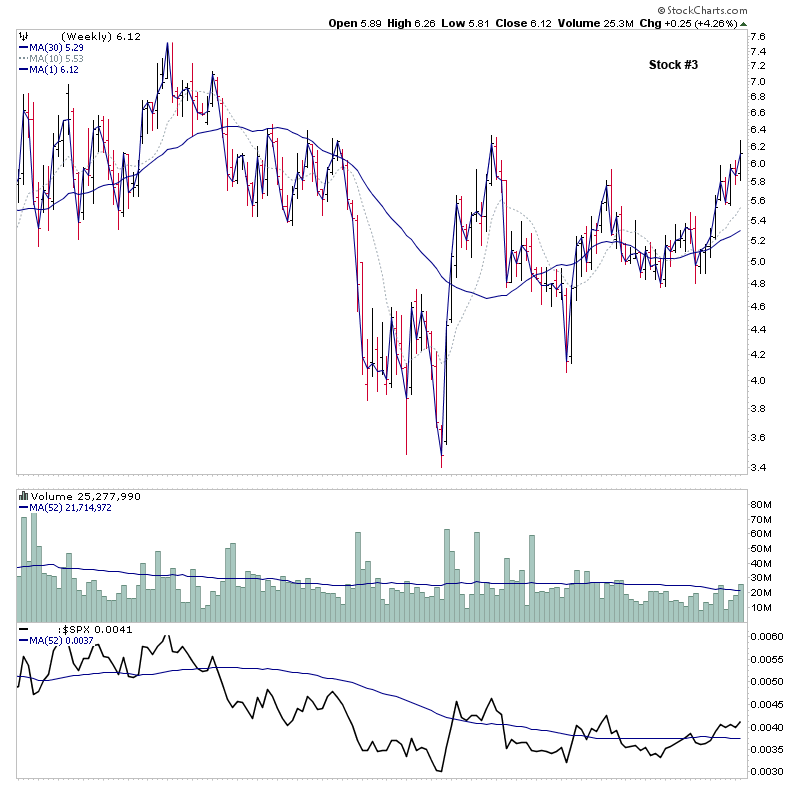

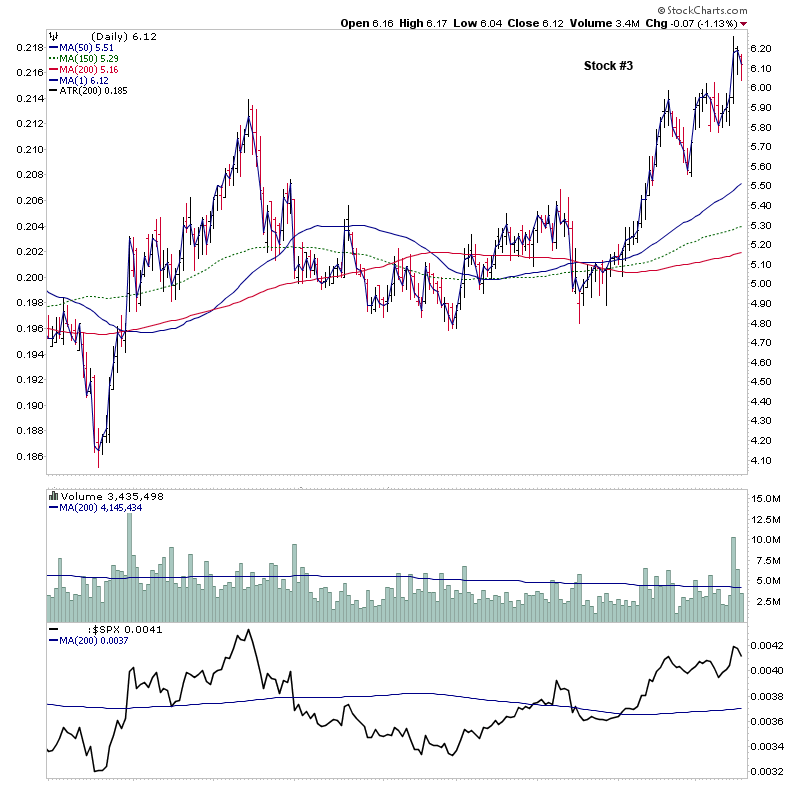

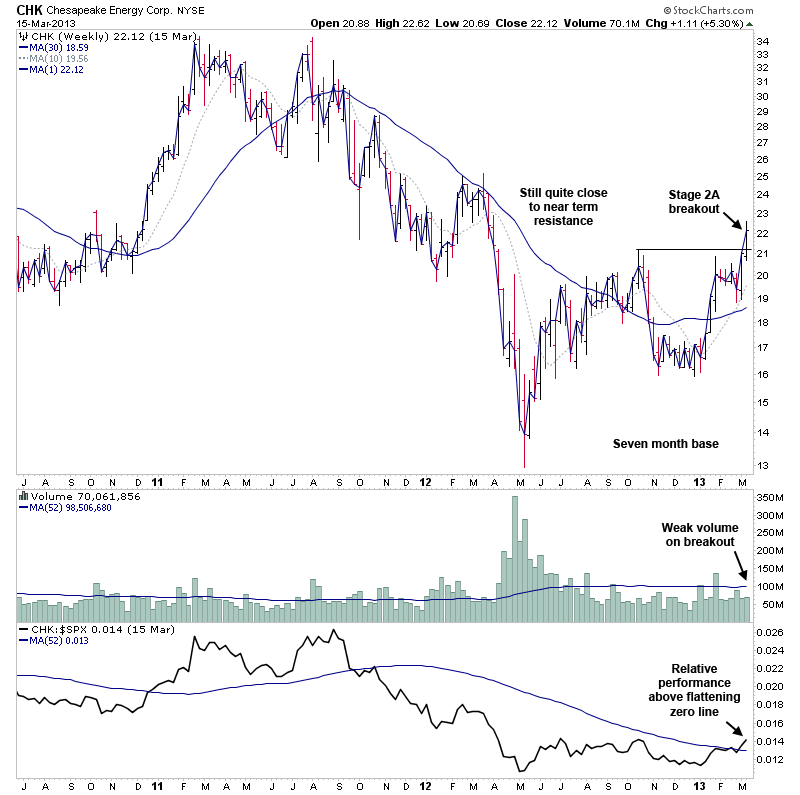

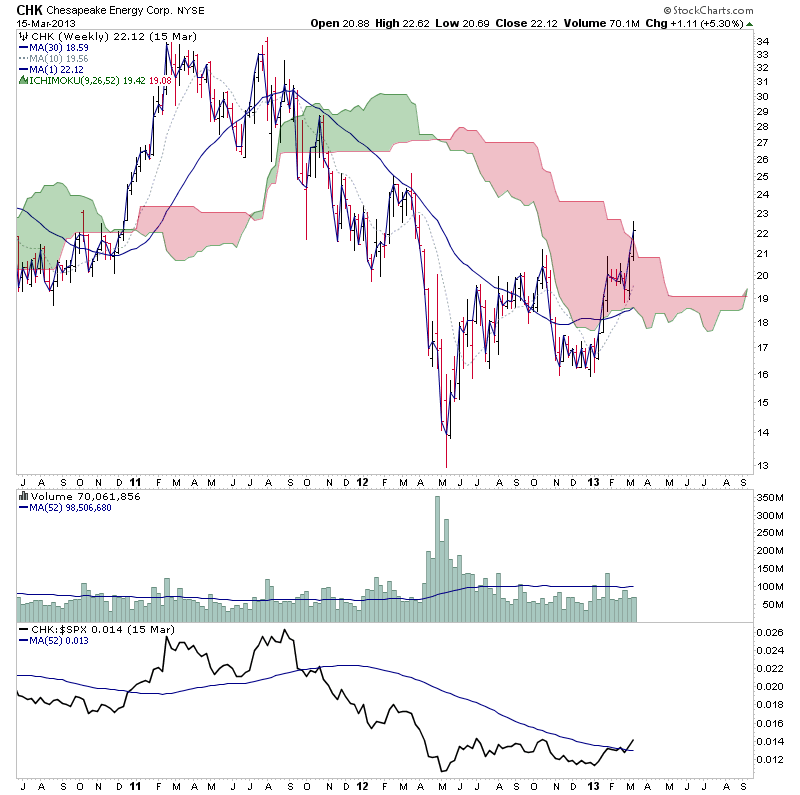

Quiz Question#3

Attached is three stocks making Stage 2A breakouts. The charts are weekly and daily, and each is at the close of the week. So assuming that the overall market and group action of the stocks was positive:

- Which of the following stocks would you buy? Give reasons concerning the various technical attributes that we look for. i.e. Price action, Moving averages, Volume, Relative performance, near term Resistance etc.

- Rank the stocks in order of best to worst? Give reasons.

Mystery stock#1

Mystery stock#2

Mystery stock#3

Quiz Answer#3

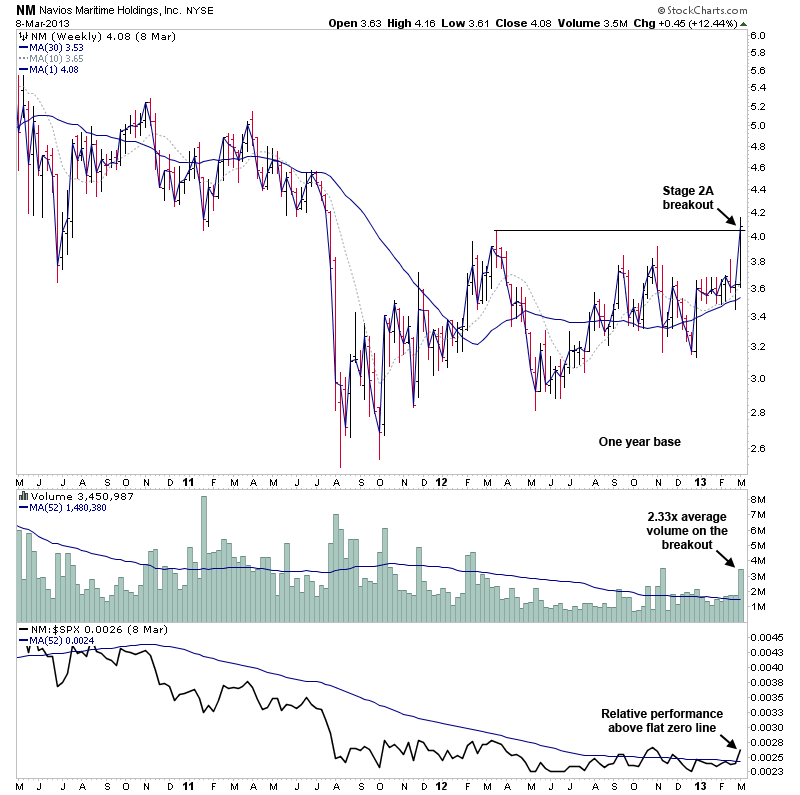

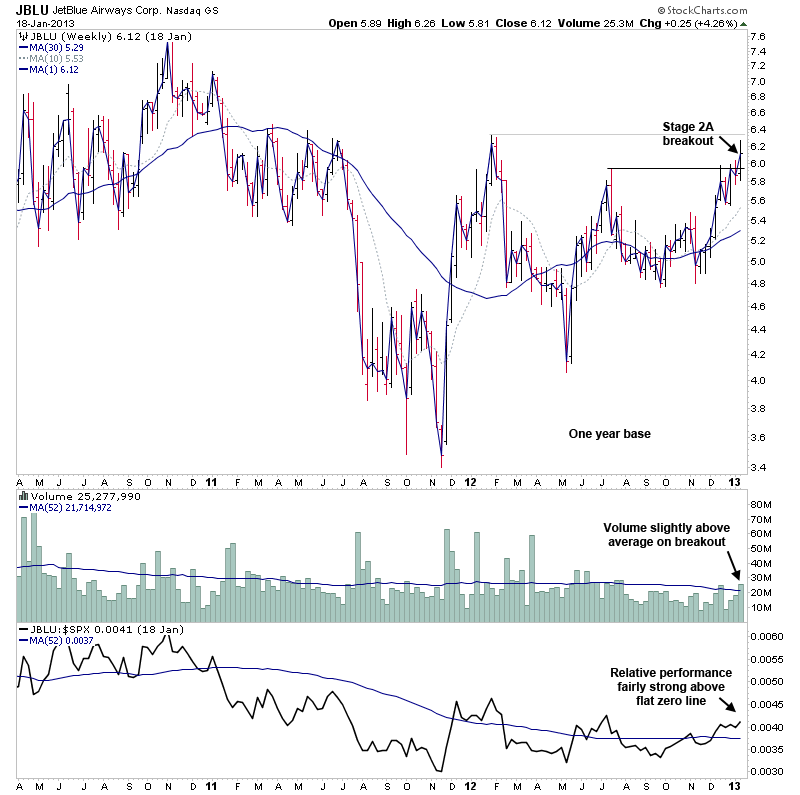

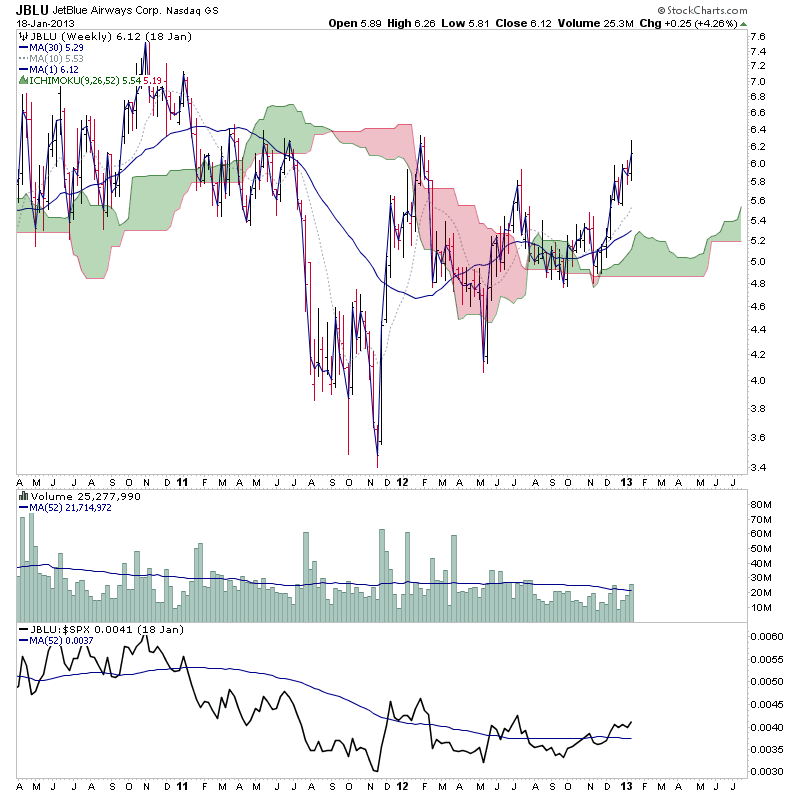

Attached is the marked up charts for the three mystery charts for Quiz Question#3.

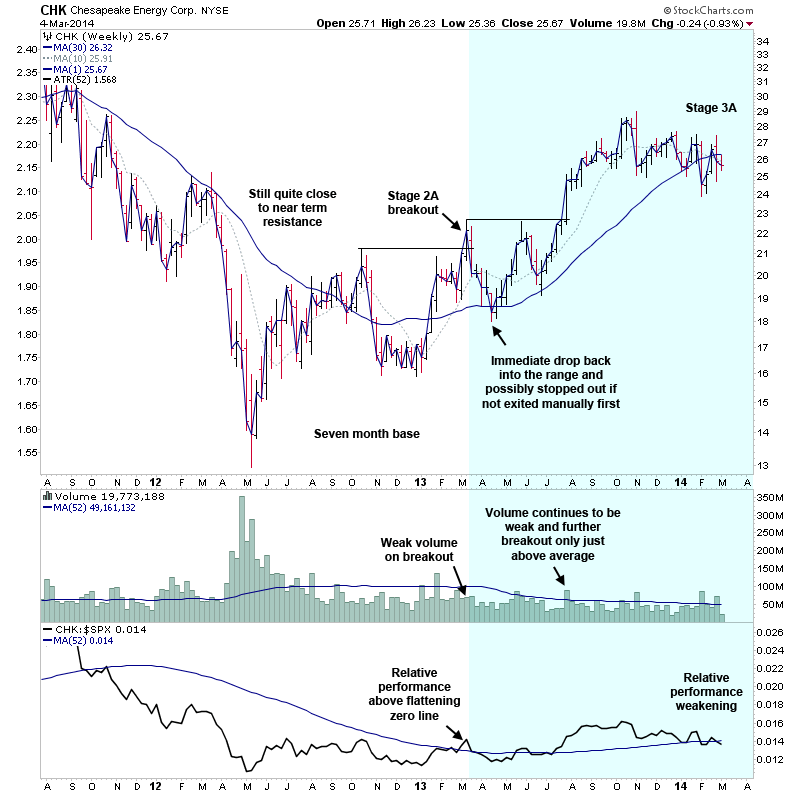

Chart #1 was Chesapeake Energy (CHK) in March 2013, which was making a Stage 2A breakout. However, there were a few problems to note in that firstly the most important attribute was missing - an expansion of volume on the breakout week - which was well below average and hence would have been a big negative against it.

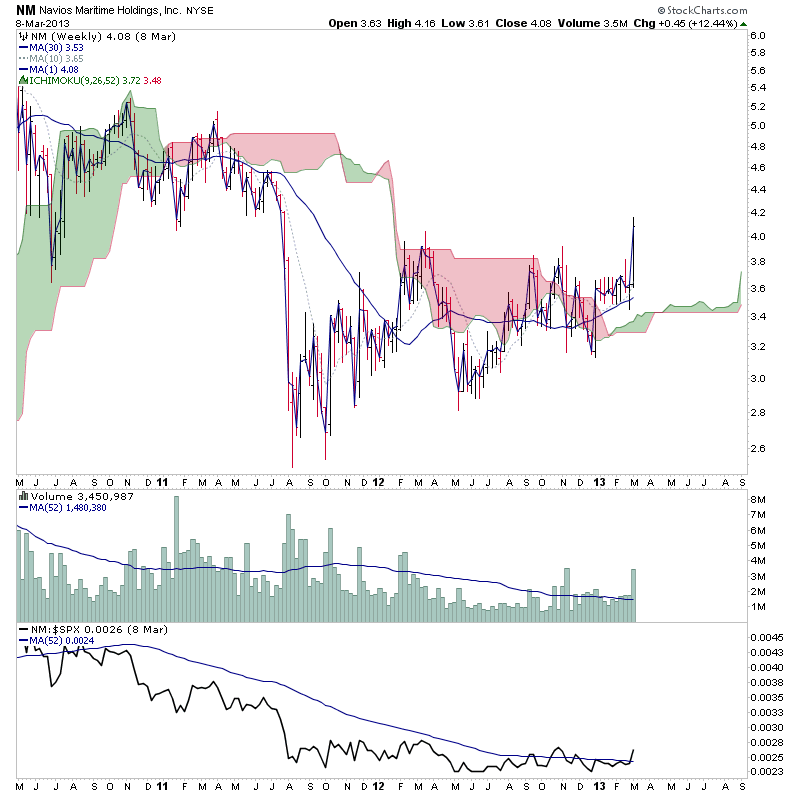

The second problem visible is that it was still quite close to near term resistance which was around one year old, and so it had not yet had sufficient time for it to be significantly less important yet, as can be seen better if you view the attached chart below with the ichimuko cloud overlaid on the price, as it was only just clearing the resistance cloud.

The final issue of note is that the Stage 1 base was still relatively small at only roughly seven months or so. Which wouldn't have been a problem if the breakout had had very strong volume, as it's bigger than some Stage 1 bases that are successful, but remember that the bigger the base, the bigger the eventual move in most cases when a stock breaks out of it to new highs on exceptional volume.

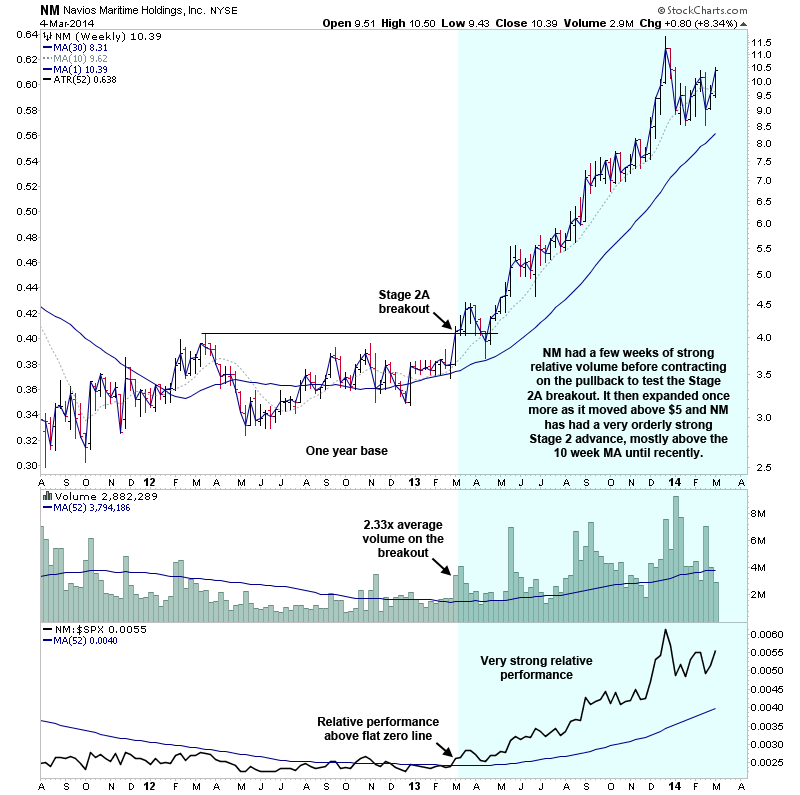

Chart #2 was Navios Maritime (NM) in March 2013, which was making a solid Stage 2A breakout, with more than 2x the average volume and relative performance moving above a flat zero line which it had hugged for a while.

The base was well developed at just over a year, and it was clear of significant resistance which can be seen on the ichimoku chart below, and also the volatility had contracted during the base especially in the last 8 weeks or so before the Stage 2A breakout, where it got into a very tight range. So it was a strong candidate for a Stage 2A buy with all the key technical attributes in place.

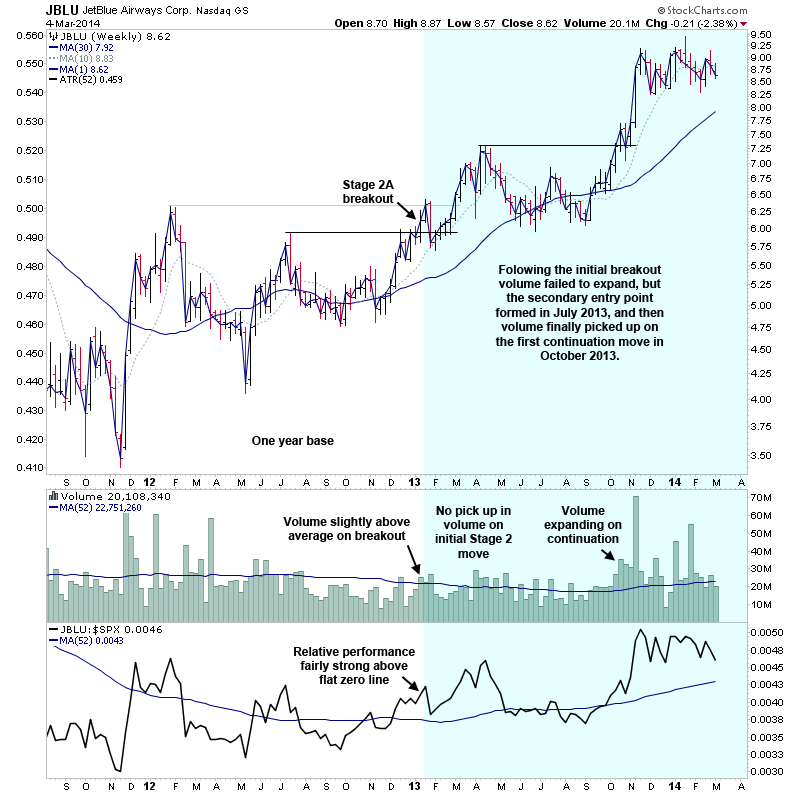

Chart #3 was Jet Blue Airways (JBLU) had a similar chart to NM, but with a few slight differences. Firstly the key ingredient was once again missing, as volume was only slightly above average on the breakout - which is not enough. Relative performance was fairly strong above a flat zero line and it was also clear of most of it's resistance, except for it hadn't yet closed above 2012 high, which it was quite close to. And it had a good one year base which had also seen a contraction of volatility. So it was a reasonable candidate, but needed an expansion of volume.

So going back to the original questions of what would you buy and in what order would you rank them. NM would be the correct choice to buy, as it was the only one with all the key attributes that we look for, and imo you should never compromise, as good candidates with all the key attributes come along all the time, you just have to find them. And the order would have been 1. NM, 2. JBLU, and 3. CHK.

Below is the charts as they are now, with some notes of how their Stage 2 advances have progressed over the last year so that you can compare them in detail.

Quiz Question#4

Attached is the weekly and daily charts of a mystery stock with a set of questions below for you to answer, and I'd encourage you to elaborate if you can as it helps in analyzing the Stage.

- Is price above a flat, rising or declining 30 week MA?

- Is price above the 10 week MA?

- Is the 10 week MA rising or falling?

- What is the volume doing?

- Is the relative performance versus the S&P 500 strengthening or weakening?

- Is the relative performance versus the S&P 500 above or below the zero line?

- Is the relative performance zero line itself down, flattening or rising?

- Is there significant near term resistance? If yes, then where?

- What is the Stage of this stock?

- Should an investor buy the stock? Elaborate.

Quiz Answer#4

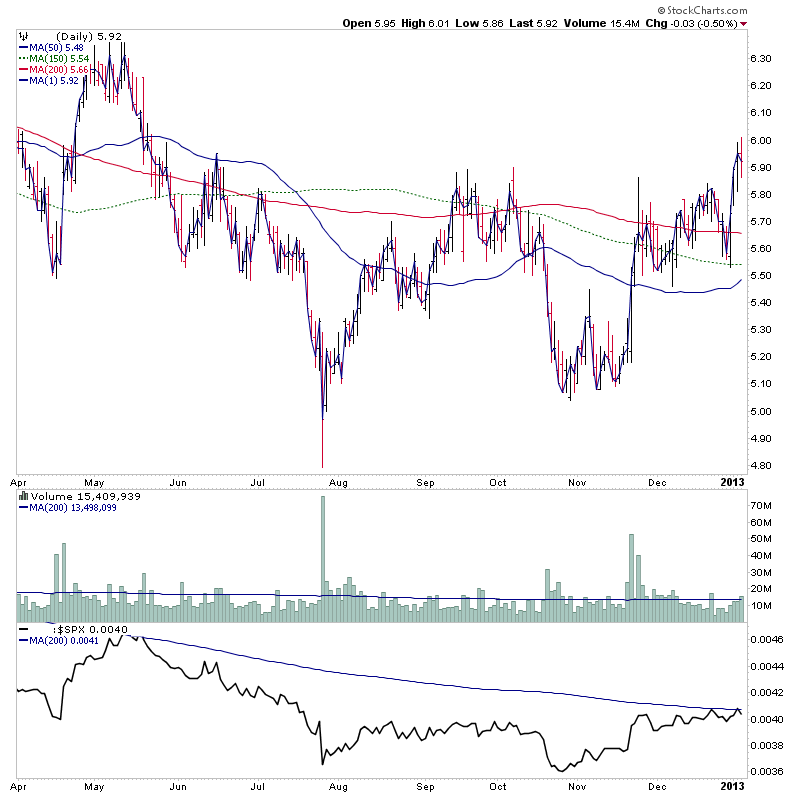

The mystery chart this time was BSX (Boston Scientific) which was attempting to make a Stage 2A breakout, and had closed the week just above the breakout level. The price was above a flat to slightly rising 30 week MA, and the shorter term 10 week MA had turned up a number of weeks before and was close to crossing the 30 week MA.

However, volume was poor on the breakout week, below average and the relative performance versus the S&P 500 was strengthening, but it was still below a flattening relative performance zero line. But the biggest issue was that there was still significant near term resistance up to around the 6.4 area, which it had failed to clear twice earlier in the 2012 and so although it was technically in Stage 2A, the other technical attributes that we look for in an A+ candidate weren't all present, and so imo it would stay on the watchlist until it cleared the near term resistance and there was improvement in the volume and relative performance versus the S&P 500 as the risk of a failed breakout is increased otherwise.

Below is the marked up weekly chart.

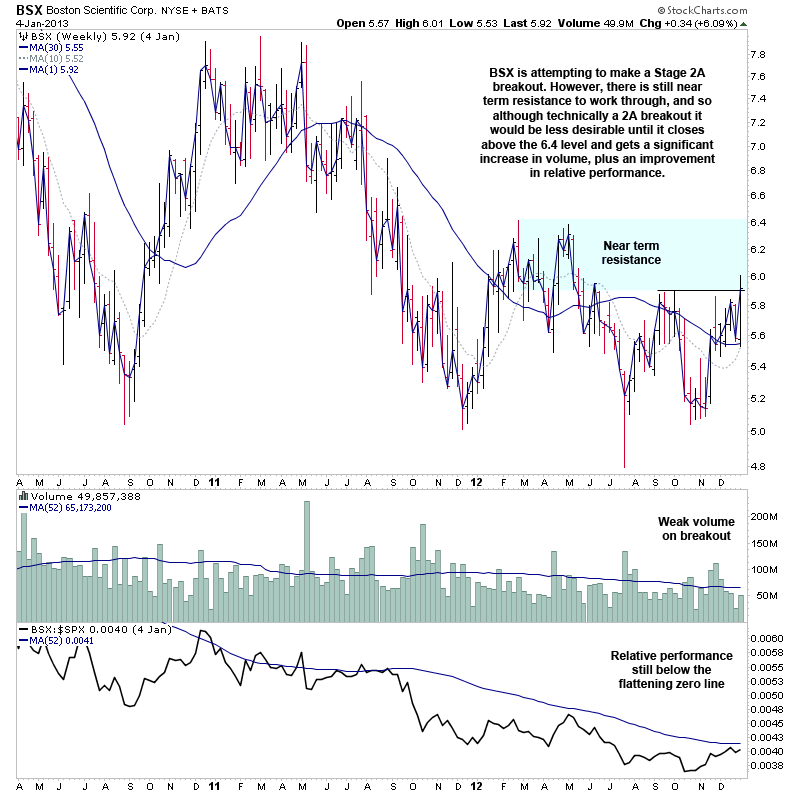

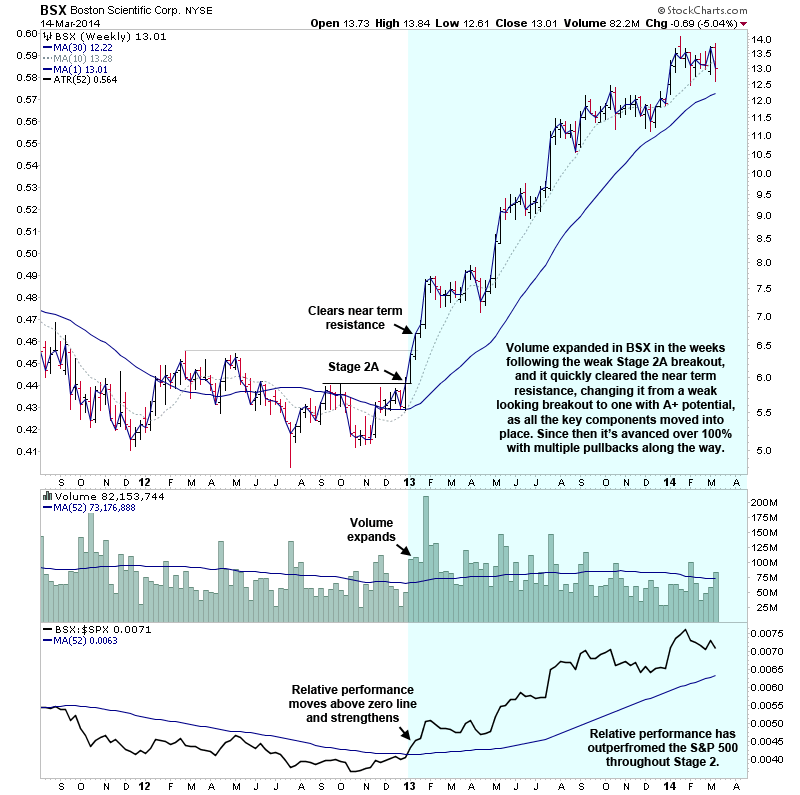

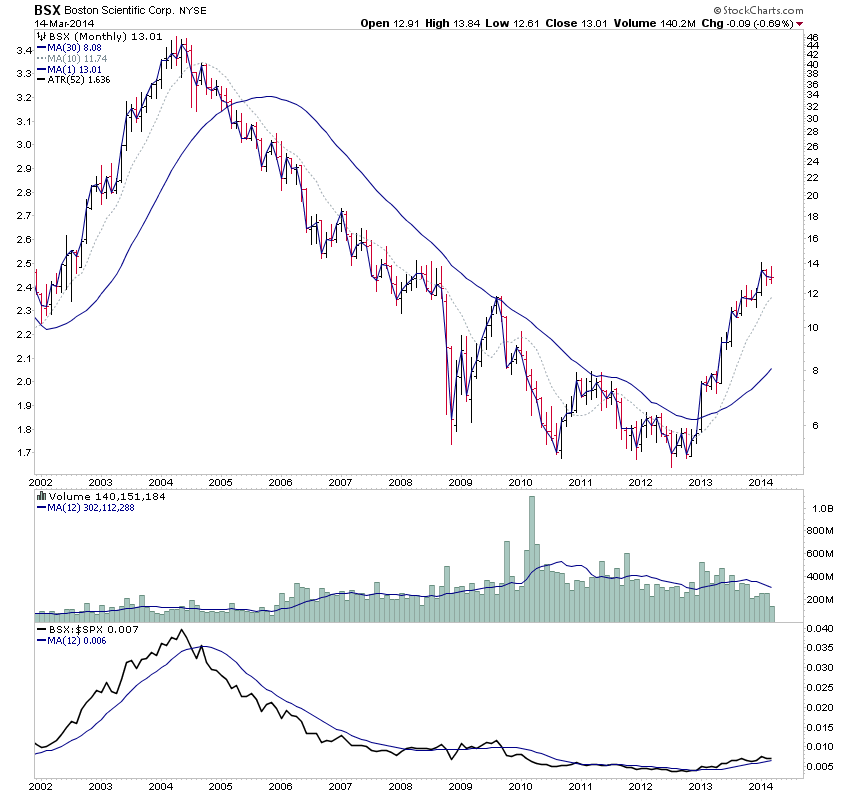

So what happened next? Well, in this case the following two weeks saw a decent increase in volume, which helped BSX to sail through it's near term resistance and the relative performance versus the S&P 500 broke above it's zero line strongly, and so BSX now had A+ potential, and hence would have been a strong buy candidate, especially as it also had a strong monthly close above it's 30 month MA for the first time in many years with a strong volume increase as well, which added extra conviction to it.

As you can see in the below chart, it's had a strong Stage 2 advance with numerous consolidations/pullbacks towards the 10 and 30 week MA, and has advanced over 100% so far in just over a year and three months. Currently the 30 week MA momentum is slowing and price is in another consolidation phase and so I'd give it a Stage 2B rating now, as it's late in Stage 2 advance. Below is the weekly and monthly charts.

Become a Stage Analysis Member:

To see more like this – US Stocks watchlist posts, detailed videos each weekend, use our unique Stage Analysis tools, such as the US Stocks & ETFs Screener, Charts, Market Breadth, Group Relative Strength and more...

Join Today

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.