US Breakout Stocks Watchlist - 23rd January 2020

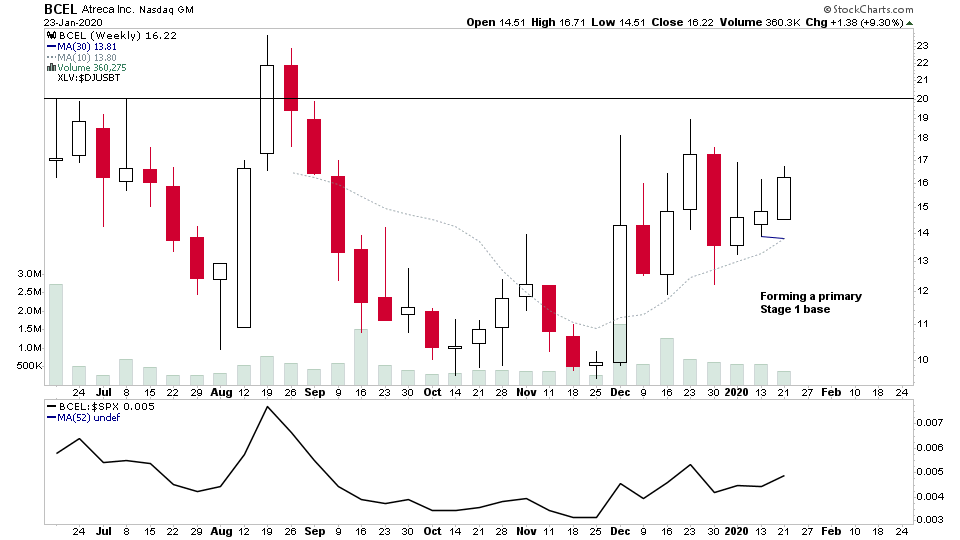

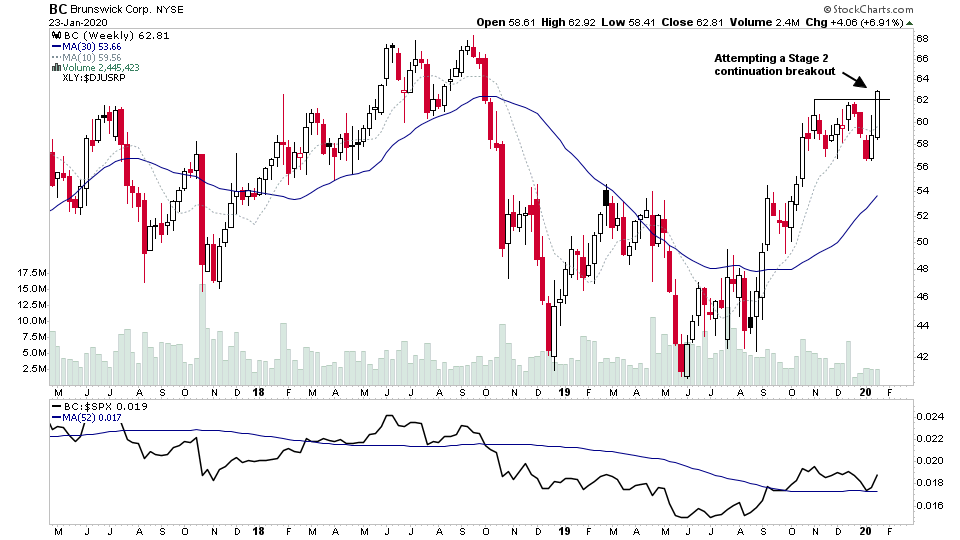

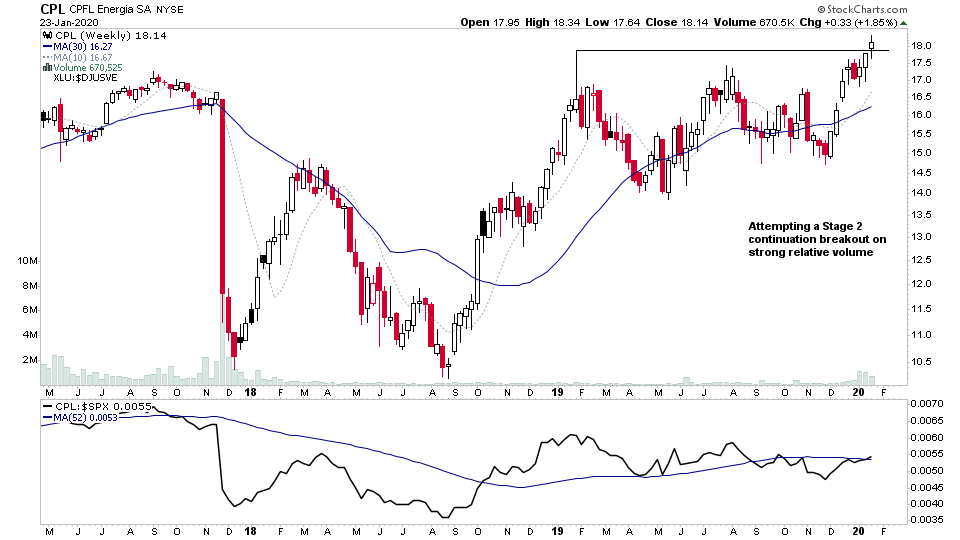

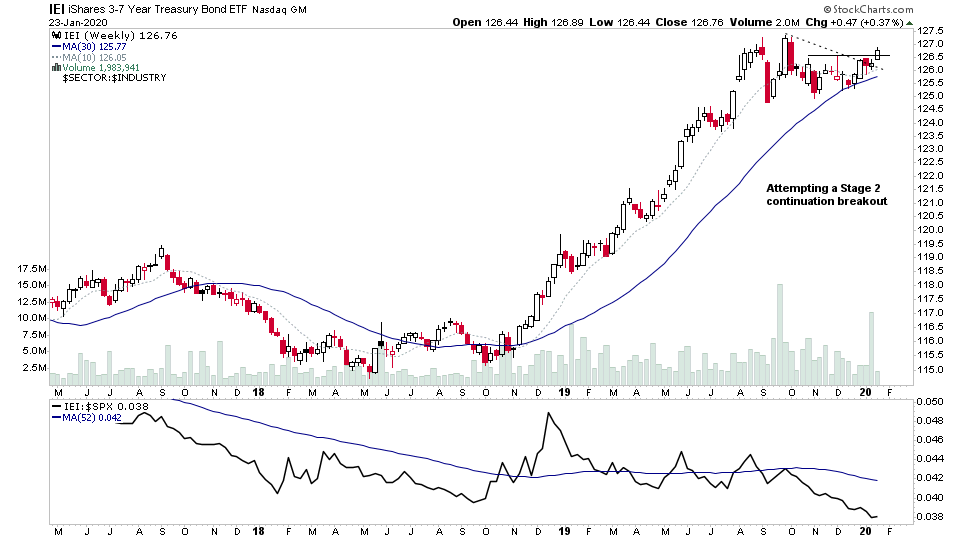

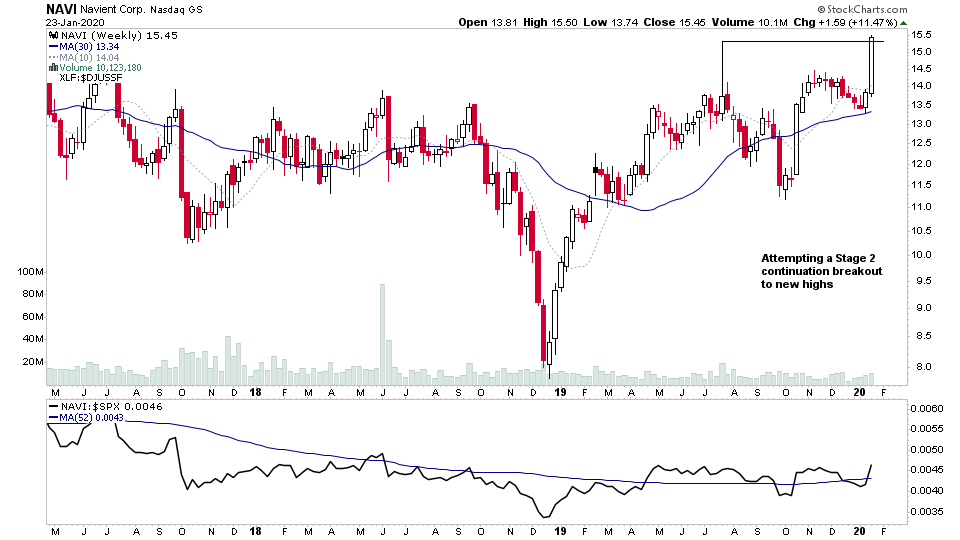

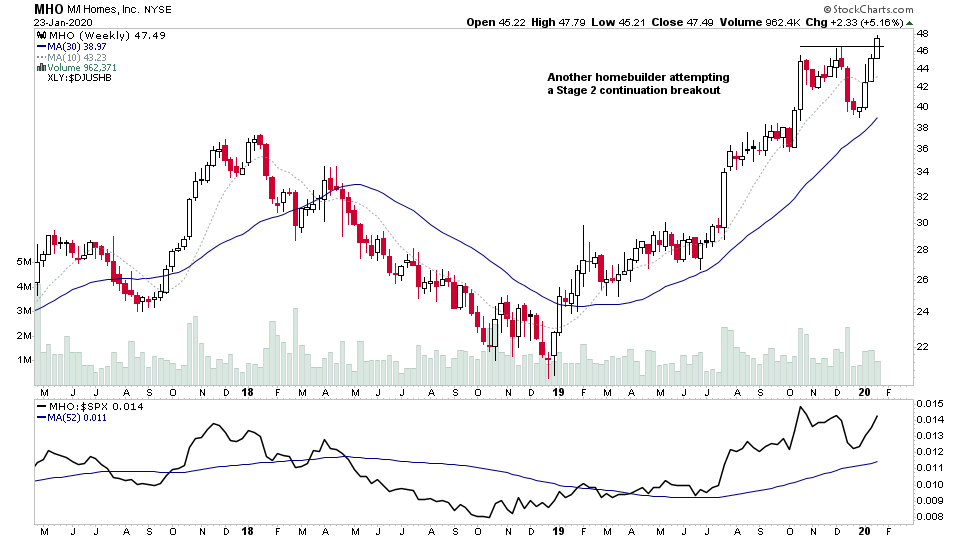

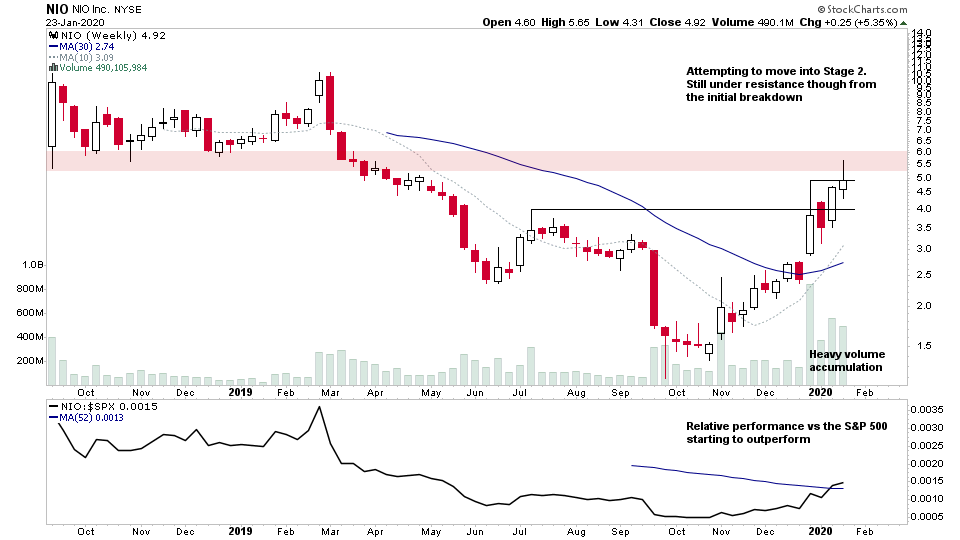

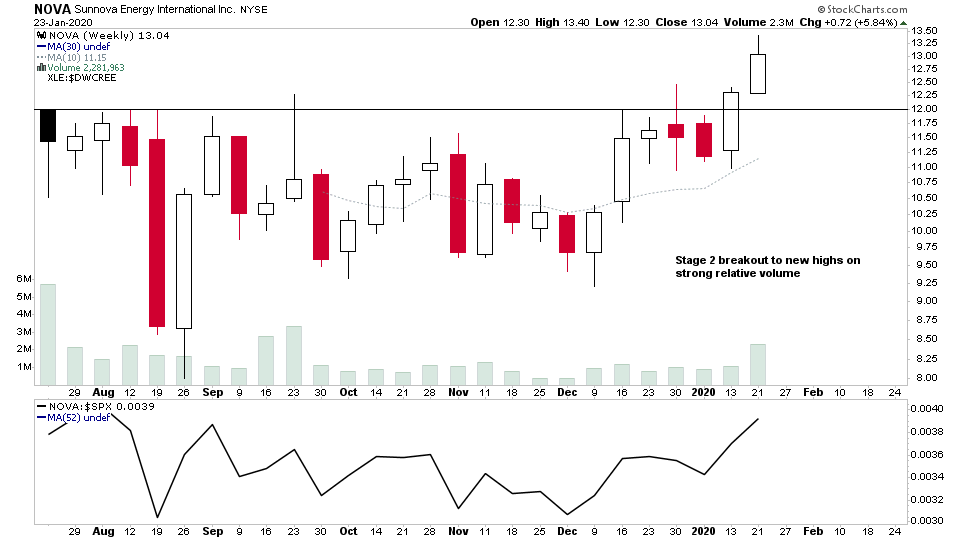

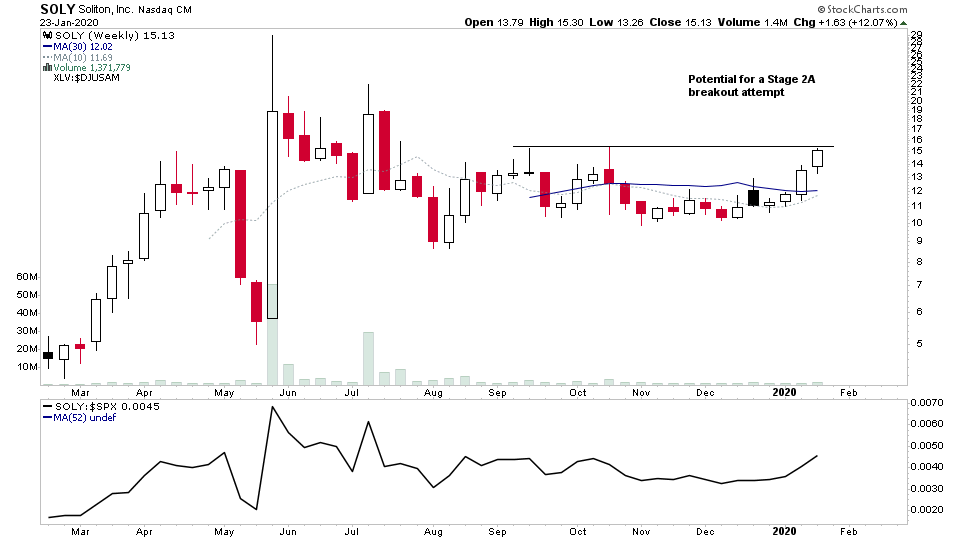

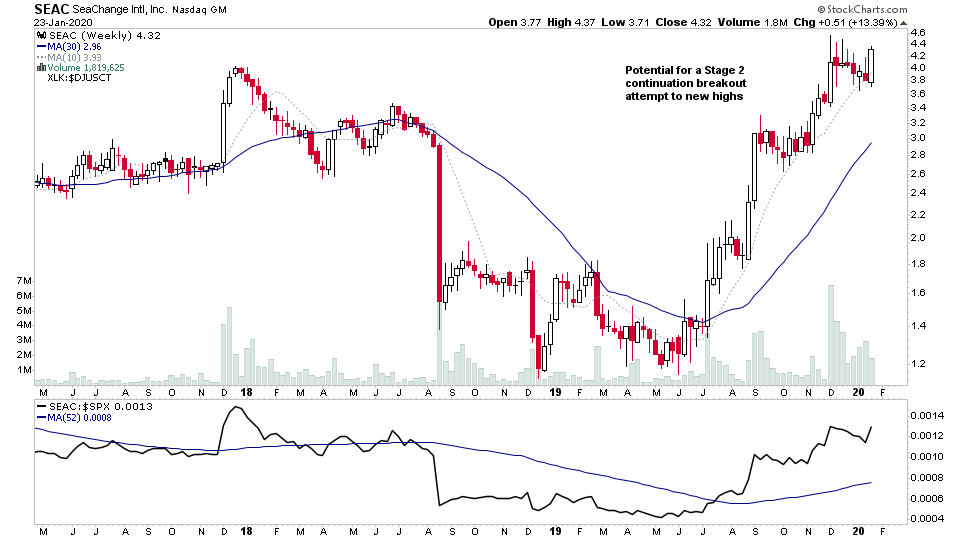

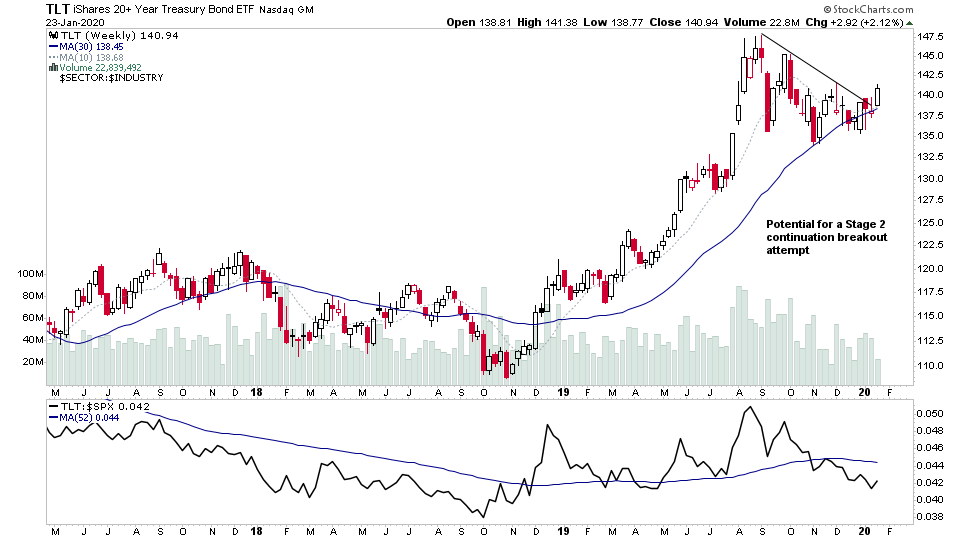

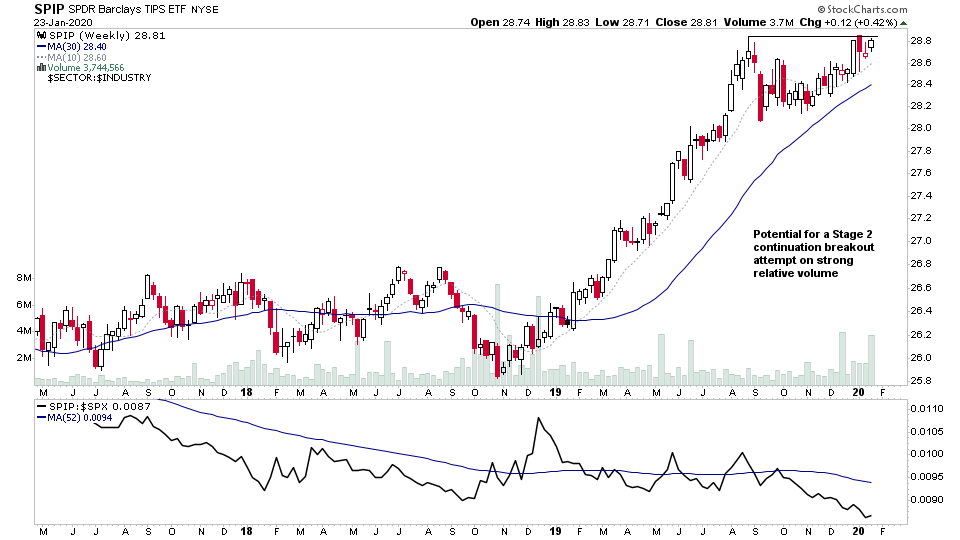

For the watchlist from the Thursdays scans of the US stockmarket - AUY, BC, BCEL, CPL, IEF, IEI, MHO, NAVI, NIO, NLOK, NOVA, SEAC, SOLY, SPIP, TLT

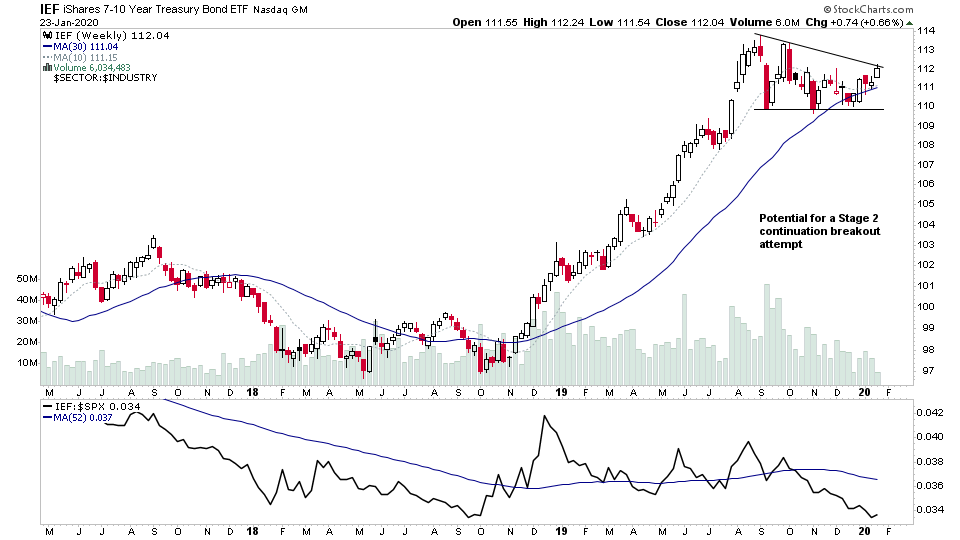

I've been noticing multiple bonds charts breaking out of their consolidation patterns that have formed since September time, and tonight I'm highlighting multiple US Treasury charts in the watchlist as they are all showing potential to make a Stage 2 continuation attempt to new highs too. So could be some rotation occurring as stocks have been running hot for while.

Note: there's no watchlist video tonight. So the next videos will be the Weekend Stocks Watchlist and the Market Breadth videos, which will come out over the weekend.

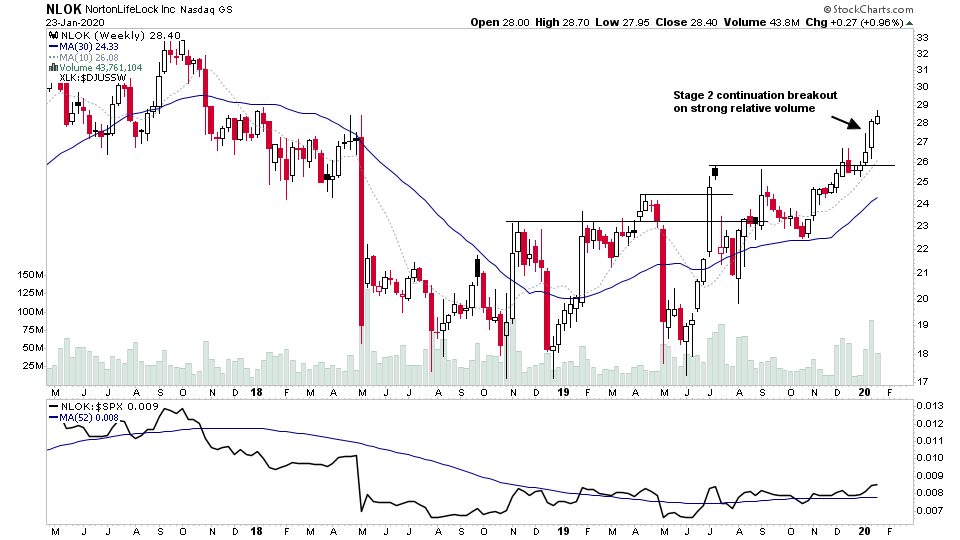

And thanks to Ian Worley who highlighted NLOK to me on yesterdays Stage Analysis YouTube channel video comments, which I've included in tonights watchlist, as it's one to watch for a pullback or consolidation to form after a strong volume continuation breakout last week. See: Breakout Stocks and Shares Watchlist - Technical Analysis of the US Stock Market 2020-01-22

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.