US Sectors - Percent of Stocks Above their 150 Day Moving Average

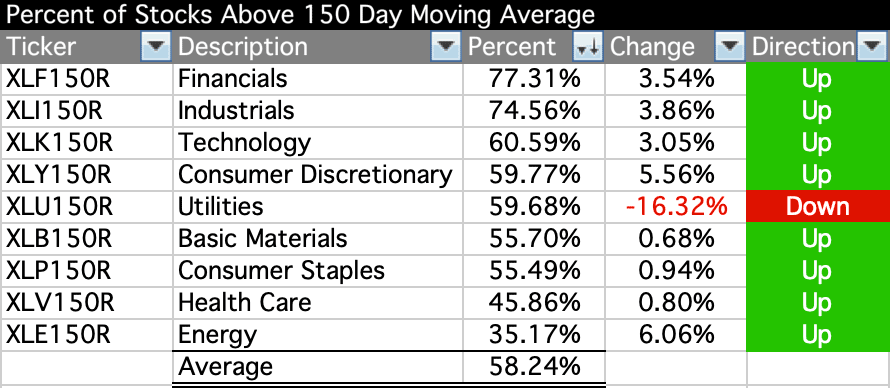

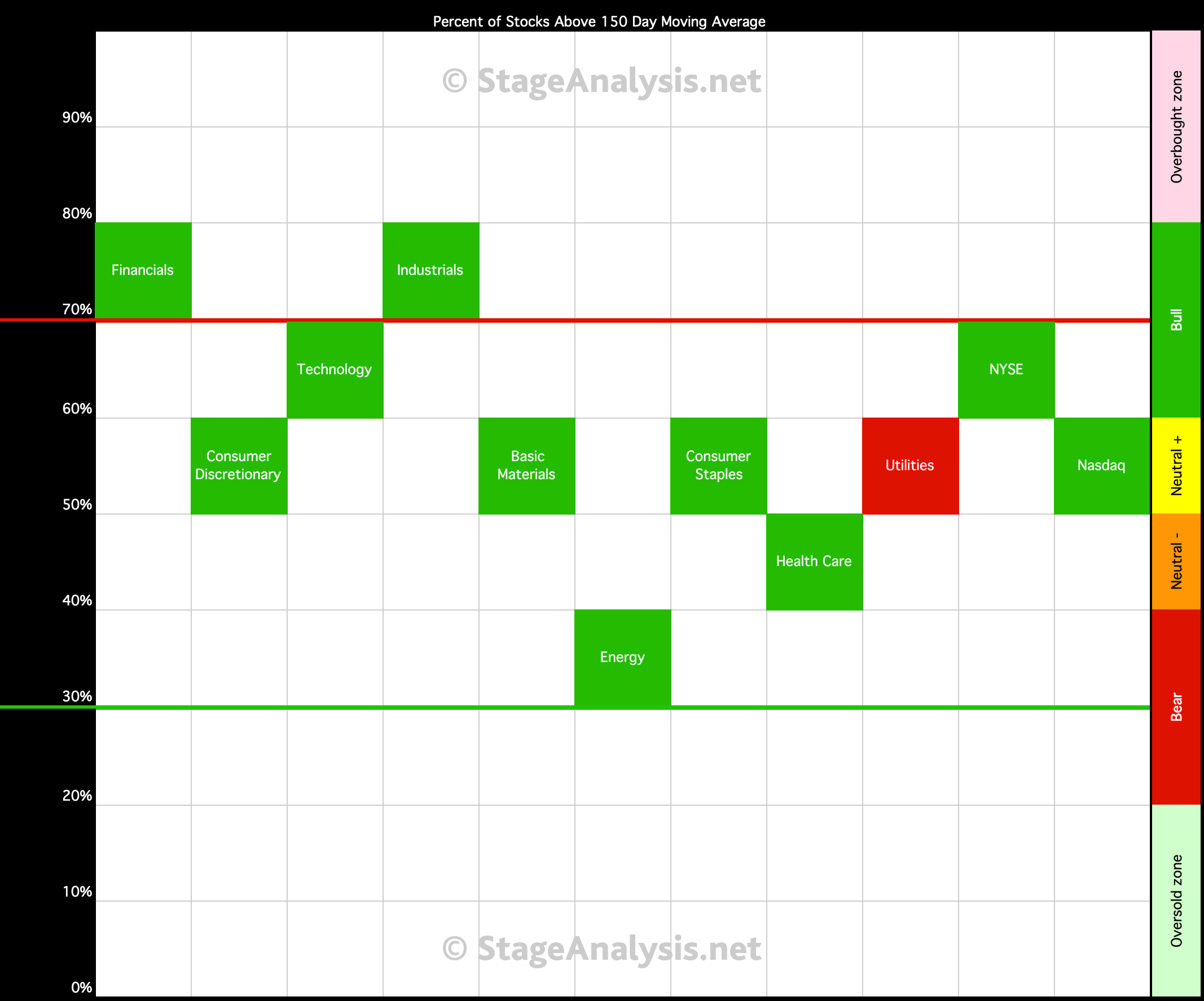

Below is the Percent of Stocks Above their 150 Day Moving Average table in each sector, which is ordered by overall health.

Note: Sector Average is 58.24% currently and gained +0.91% since last week with Energy and Consumer Discretionary having the largest gains this week.

The biggest move this week though was in Utilities which declined a massive -16.32% since last week to take it back below the 60% level for the first time this year, after leading the percentage of stocks for the entire year. This in my opinion may be a positive sign, as people favour utilities during times of uncertainty due to their lower average volatility and high dividends, and so a rotation of money out of them as the broad market breaks out could mean that this is finally a breakout that can become a Stage 2 advance – as money moves into more higher risk sectors instead. As during a Stage 2 advance you tend to see sectors like Technology, Financials, Industrials and Consumer Discretionary leading. So I think it's positive for the weight of evidence that these sectors are finally back at the top of the table again, and the broad NYSE and Nasdaq indexes are in the upper middle range. As that means that there is plenty of potential for movement higher still.

Disclaimer: For educational purpose only. Not investment advice. Seek professional advice from a financial advisor before making any investing decisions.