RE: Beginners Questions

(2014-02-21, 12:23 AM)malaguti Wrote: On another topic, this is in relation to page 16/17 where he says that the MOST bullish scenario is where a long term trend has been breached to the upside followed within days of breaking the MA

Here is Gold, would this classify as an example? trend line has been going for a year, with numerous touches and MA (weighted) broken immediately

and does anyone actually use this method, or rather wait for a more "classic" basing pattern? Interestingly the MA on the breakout turns up immediately.

There is of course the added benefit of a large double bottom playing out after 1400 of course

Hi malaguti, I think you've misinterpreted what it was saying in the book:

Quote:From the last line of page 15 onwards in the Trendline section of text...

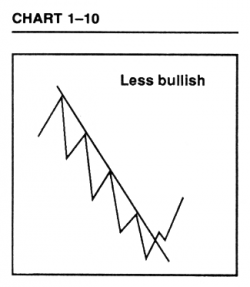

Conversely, the steeper the angle of descent of a declining trendline (Chart 1-10) the less bullish it's implications are when it's overcome. All it may mean (especially if the stock is below it's long term MA) is that the stock is now going to decline at a slower rate of descent.

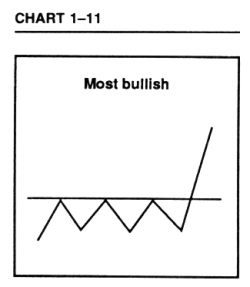

However, the closer to horizontal the trendline is when it's broken to the upside (Chart 1-11), the more bullish the implications are. The most bullish signals are given when a very important trendline is broken on the upside, and within a matter of days the long term MA is also overcome on the upside.

So as you can see your Gold example looks more like the less bullish example in Chart 1-10, as the descent of a declining trendline is quite steep on it. So I'll repeat what it said in the book quote above: "The most bullish signals are given when a very important trendline is broken on the upside, and within a matter of days the long term MA is also overcome on the upside". So lets say that in a different way. The most bullish signals are given when a horizontal trendline is broken that has been tested multiple times and then it breaks above it's 30 week MA as well or is already above it on the breakout. i.e. the bigger the base, the more bullish the breakout.

This in my opinion is one of the most important things to learn, as it will stop you bottom fishing and getting into stocks in early Stage 1 when they have not yet gone through a proper basing process, and hence have a much higher failure rate. You will get the odd winner, but you are increasing your risk of failure and can also tie up your capital for months or even a year or more in some cases while the Stage 1 base develops. Re-read the text on "Opportunity Costs" at the bottom of page 97, as it will help you understand the point of maximizing your resources into only the very best candidates with A+ potential.

I hope that helps

isatrader

Fate does not always let you fix the tuition fee. She delivers the educational wallop and presents her own bill - Reminiscences of a Stock Operator.

Fate does not always let you fix the tuition fee. She delivers the educational wallop and presents her own bill - Reminiscences of a Stock Operator.